ESG Asia Playbook: Engagement and Stewardship in Asia

As more investors consider different ESG investing approaches in their strategies, we believe stewardship and engagement will increasingly play a critical role in managing investment risks and driving returns. Whether it’s as a way of understanding an issuer’s responses and actions on ESG risks or as part of an investment strategy focused on ESG momentum or climate transition, engagement provides an additional investment tool to complement investment analysis and research. Asia in particular provide unique opportunities and growth areas on stewardship. The following ESG Asia Playbook piece deep-dives into why engagement matters along with suggested best practices and approaches for investors.

Why engagement matters in Asia

Source: ASIFMA, ACSI (https://acsi.org.au/members/australian-asset-owner-stewardship-code/); Stewardship Asia (https://stewardshipasia.com.sg/what-we-do/singapore-stewardship-principles-for-responsible-investors); PRI Annual Reports; Morningstar & GS Analysis; Bloomberg & Bernstein

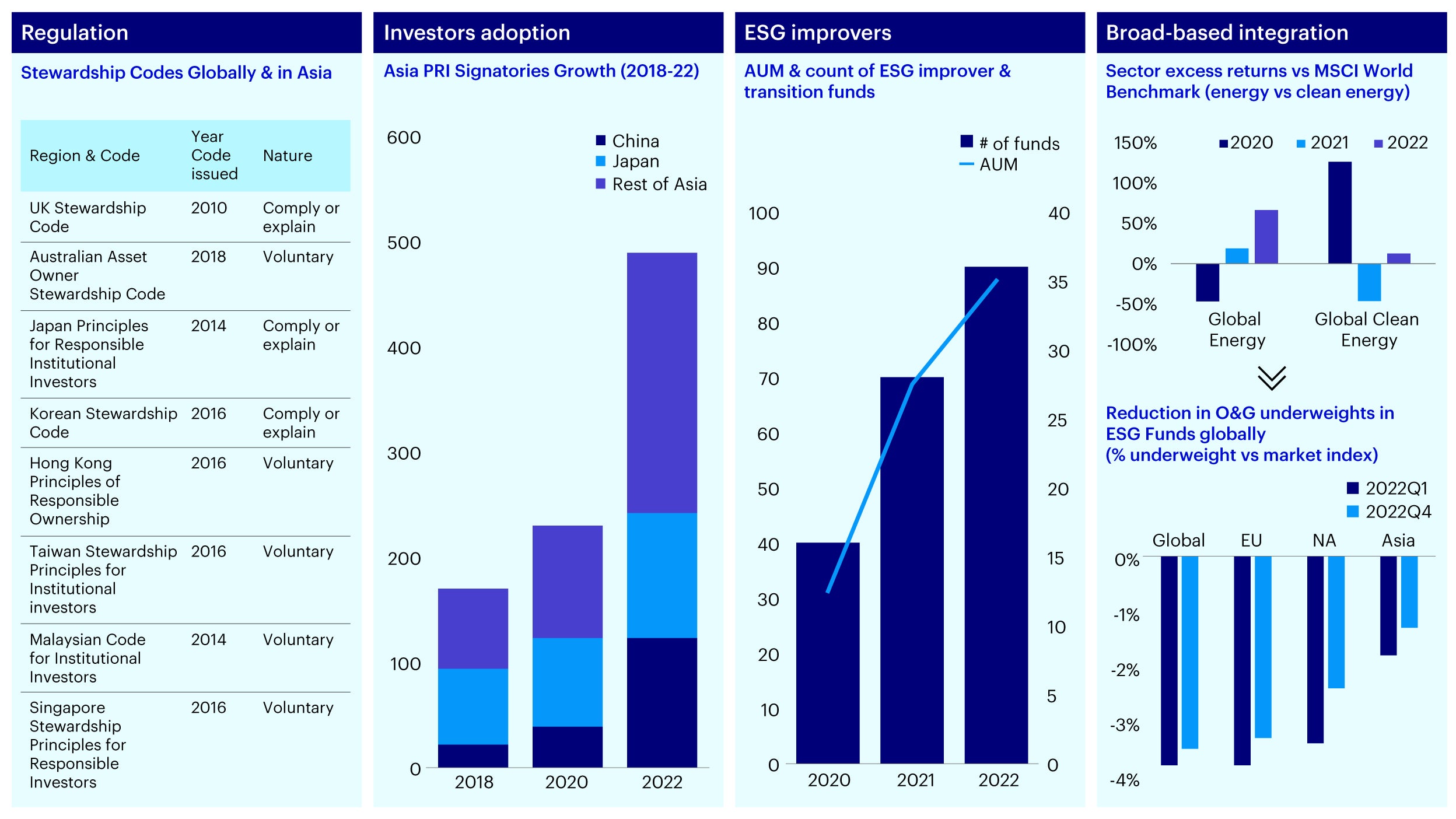

- Regulation: As highlighted in our ESG Outlook, ESG regulations continue to drive adoption of sustainable investing in Asia. Notably, many regions have set in place stewardship codes for investors as guiding reference for investors on stewardship and engagement. This has also been supplemented by ESG regulations focused on ESG integration and climate risk management in the region that encourages engagement with portfolio companies with regards to material financial risks in those areas. The EU Sustainable Finance Disclosure Regulation’s (SFDR) requirements on consideration on Principal Adverse Impacts could also entail a degree of engagement where required. We expect the finalization of the International Sustainability Standards Board (ISSB) standards and subsequent adoption will also play a key role in improving ESG data disclosures.

- Investor adoption: Growth in ESG AUM in the region has partly been driven by growth in Principles for Responsible Investment (PRI) and net zero signatories in Asia. As part of becoming a signatory, investors might report on how they integrate ESG considerations in their investment processes for better risk management and value creation including on their engagement and proxy approaches and policies.

- Improver/ transition opportunity: As shared in our research with Tsinghua’s Center for Green Finance Research (CGFR), there has been a steady increase in investment strategies focused on transition and ESG momentum. The investment thesis is centered on capturing longer-term alpha and upside from issuers who are making early progress in transition or are actively working to improve ESG risk management today. These strategies often involve a degree of engagement by investors to both support issuers on improving risk management while also assessing if issuers are making satisfactory progress.

- Broad-based integration: The macroeconomic environment in 2022 has resulted in energy shortages and commodity hikes while also seeing a market shift from growth to value. This has also led to investors moving from exclusions to more broad-based integration approaches. Similar to ESG improver or transition strategies, taking a broad-based integration approach also entails a greater degree of investor stewardship to better understand how well issuers are considering and mitigating against longer-term ESG or climate risks.

Developments and growth areas in Asia

Note: Engagements are considered successful based on the commitments made and measures adopted by companies to address investor concerns. Source: GS analysis (https://www.goldmansachs.com/intelligence/pages/gs-research/gs-sustain-our-analysis-of-apac-esg-regulation/report-new-era.pdf); Bloomberg (https://www.bloomberg.com/professional/blog/esg-disclosures-gain-traction-in-apac/); SCMP/ Net Zero Tracker (https://www.scmp.com/business/article/3181695/climate-change-chinas-firms-lag-behind-asia-north-america-europe-net-zero); SBTi; CFA (https://www.cfainstitute.org/-/media/documents/article/position-paper/stewardship.pdf); ISS (https://www.issgovernance.com/file/publications/iss-esg-sustainability-engagement-in-the-asia_pacific.pdf)

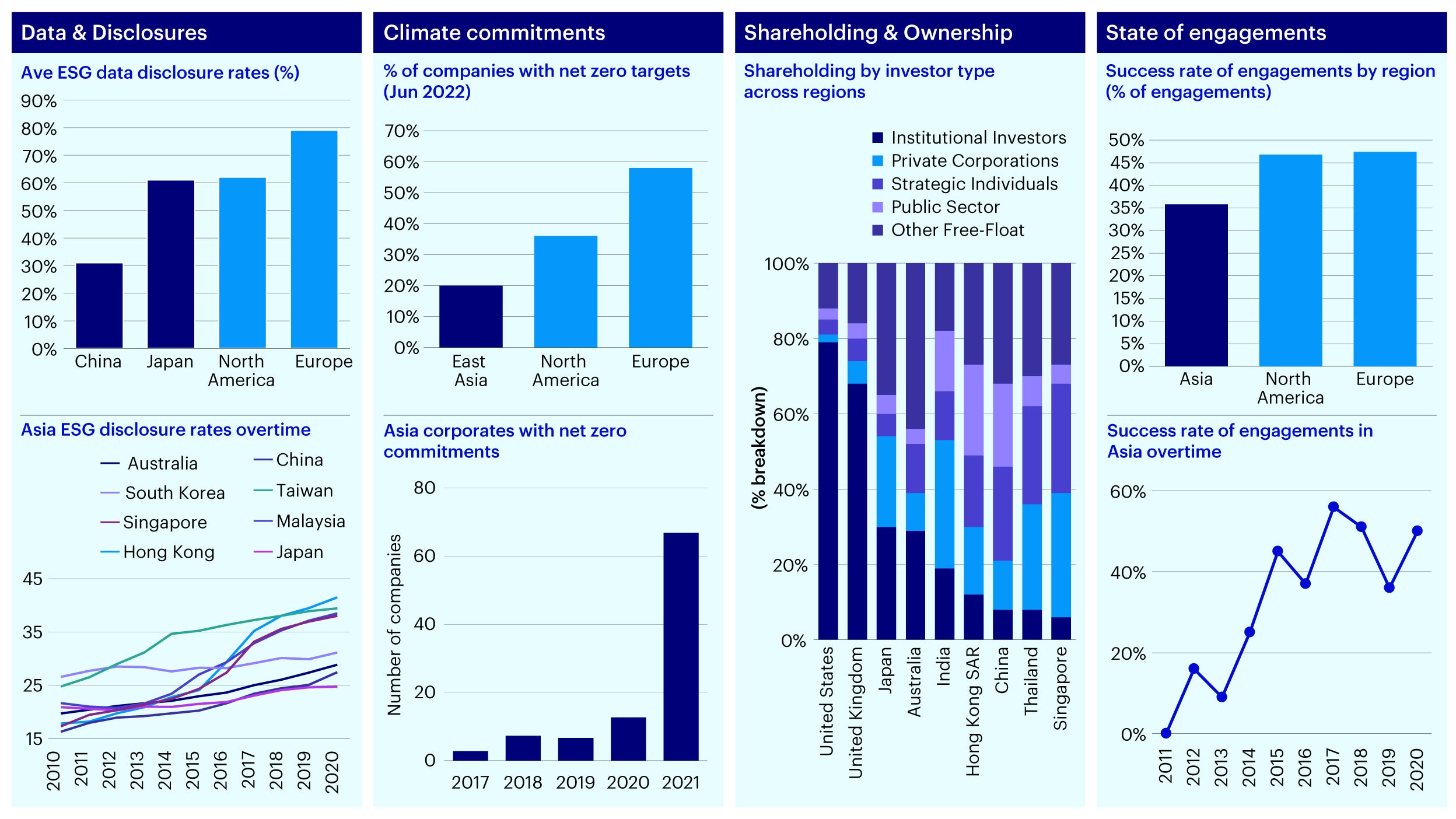

- ESG disclosures: Current ESG disclosure rates still have room to grow (versus the EU) though this has been helped by rapidly increasing disclosure requirements across regions (climate risks by Hong Kong Exchange and Singapore Exchange, China Ministry of Ecology and Environment’s environmental information disclosures, the Australian Treasury’s climate-related financial disclosures). The current state of disclosures also creates further opportunities for engagement.

- Climate commitments: While most Asian governments have put in place net zero commitments; net zero commitments of Asian corporates are still nascent but growing quickly. In 2017, only a handful of Asian corporates committed to net zero but in 2021 this increased to more than 60 corporates1. This also signifies that target setting, disclosures and transition plans are all potential engagement topics.

- Shareholding: Asia as a region has less institutional investors shareholding, with greater state-owned/ public-owned or retail investors owning shares. Greater capacity building is required for asset owners (both institutional and state owned) as stewardship becomes more important. We anticipate that increases in stewardship code adoption and a growth in signatories to the PRI will also help.

- Engagement: The shareholding structure also impacts current levels of engagement and corresponding engagement outcomes in the region. Controlled companies tend to be less responsive compared to non-controlled companies. However, as an increasing number of investors become more active in engagement to drive shareholder returns, companies are also becoming more open to engaging with investors and addressing their concerns. Investors can play a role to engage with corporates about the value in shareholder stewardship and also to support corporates’ capacity building on the topic.

Engagement best practices in Asia

Source: Invesco Analysis. For illustrative purposes only.

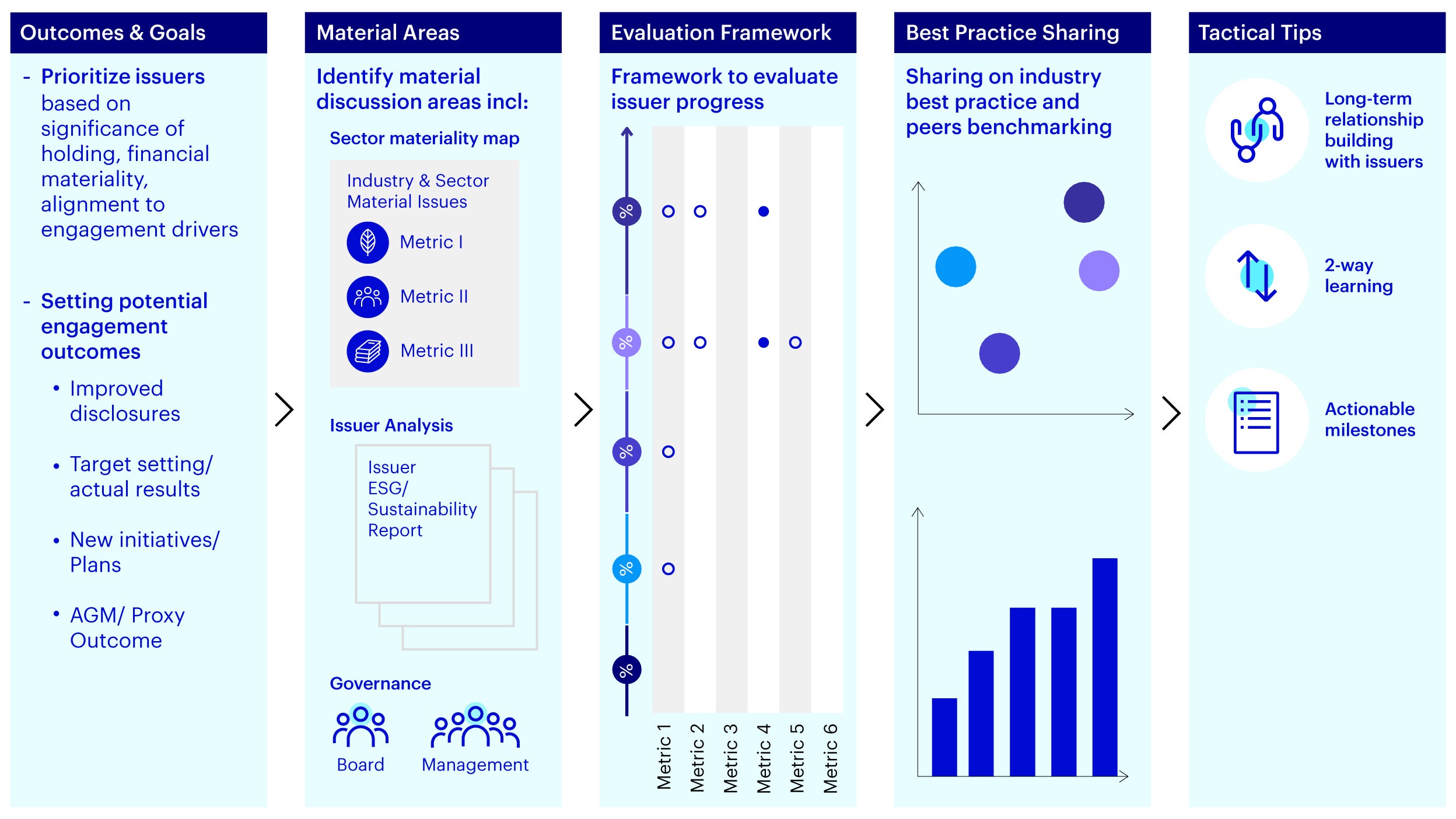

As engagement comes into the focus of investors looking to engage on financially material topics, greater emphasis would be on having more targeted and outcomes-based engagement. Areas of best practices include:

- Starting with outcomes in mind: This includes prioritizing issuers based on significance of holdings, financial materiality, and alignment to drivers of engagement. Once issuers have been identified, investors can also think about potential engagement outcomes. Common areas include improving ESG disclosures, setting targets and progress made on key metrics, launching new initiatives and plans or actual proxy voting or AGM-related outcomes.

- Identifying material areas: In the preparation for engagement, investors can consider the most common financially material issues relevant to the sector, analyze strengths and gaps in issuers’ existing ESG and sustainability reports (and comparisons over time) and evaluate the quality of their governance and processes on ESG risk management (including relevant board oversight and remuneration-linked KPIs).

- Framework to evaluate progress: On certain specific issues, such as climate transition, it is also helpful to have a relevant framework to measure and assess issuer progress on material financial risks and opportunities. These frameworks also serve as a way to set milestones; for instance, on transition, the Institutional Investors Group on Climate Change’s (IIGCC) framework on net zero alignment offers such a frame of reference.

- Best practice sharing: Engagement is also a helpful channel for investors to set expectations, share insights on what investors are looking for (such as on relevant disclosures aligned with international standards like Task Force on Climate-Related Financial Disclosures (TCFD) or metrics for investment analysis and screening) as well as share global best practices in similar or adjacent industries and sectors.

Additionally, some other tactical tips include:

- Longer-term relationship building with issuers: Especially in Asia, corporate issuers do value continuous dialogue to build trust and understanding and often initiate engagement with discussions or meetings rather than formal letters. The sharing of questions ahead of time also helps in building that longer-term relationship.

- Two-way learning: Relatedly, corporates also value engagement as a way for them to learn from investors about market trends and global developments and the corresponding implications for Asia. As mentioned, the sharing of best practices helps issuers to better understand what is “top-of-mind” for investors as well as obtain feedback on potential areas they can prioritize in the future.

- Actionable milestones: Finally, it’s also helpful to focus conversations on near-term or medium-term targets and initiatives (rather than just focusing on longer-term commitments) as these are more practical, actionable, and trackable.

Case studies and future trends

Stewardship is the responsible allocation, management, and oversight of capital to create long-term value for investors and engagement with issuers play a key role in that process. We expect engagement to continue to grow in importance in Asia.

At Invesco, active ownership is a key element of the investment process. Engagement with company management plays a fundamental role in our efforts to help manage, protect, and enhance the value of investors. In exercising our responsibilities, the Asia ex-Japan Equity Investment Team considers a wide variety of factors and concentrates on each company’s ability to create sustainable value and, in the process, may inquire or question the company regarding ESG issues that could have an impact on future value. We believe that investors are increasingly results focused when engaging with companies on ESG issues.

The Investment Team conducts engagement through various formats including meetings together with the Global ESG Team as well as part of a group with other investors. Below we introduce a case where we engaged with a company mainly on climate-related risks and opportunities.

Case study of engagement with an Asian electronics company

The investee company announced in November 2020 that it aims to achieve net zero greenhouse gas (GHG) emissions by 2050. We initiated engagement with the company in June 2021 to better understand its decarbonization strategy as well as encourage it to set short-to-mid-term milestones in considering potential climate-related risks and opportunities ahead.

In our initial call the company stated that it was committed to improving its climate-related disclosure and was also working on setting milestones for the next few years. In terms of decarbonization efforts, the company stated that clean energy accounted for around 10% of its total energy usage and that it was installing rooftop and ground-mounted solar stations at factory sites.

In late 2021, the company stated that it was working to disclose its scope 1-3 CO2 emission levels and finalize its short, medium, and long- term emission targets by the end of 2021. These were expected to be submitted to and approved by senior management in early 2022, and later submitted to the Science Based Target initiative (SBTi) by the end of 1Q22 with a target to receive SBTi validation in 1Q23. The company also became a supporter of TCFD in December 2021.

The company also gave an update on its investments in solar power stations and stated that purchasing green energy from third parties was more costly and therefore would likely increase investments in its existing solar/renewable energy plants.

In a call with the company in early 2022, the management reiterated the company’s 2050 net zero target and stated that improving power efficiency and increasing usage of renewable energy were two key pillars to achieving this target. The company also confirmed that that it was preparing to submit scope 3 applications together with scope 1 and 2 to SBTi and expected to receive validation in about a year. The company stated that in order to submit a scope 3 application it had been working closely with its suppliers and enrolled approximately 100 of its top suppliers to disclose carbon emissions.

In April 2023, the company made a public announcement that its GHG emission reduction targets were validated by SBTi, meaning that its committed targets are in line with the 1.5C trajectory. The company also affirmed that its climate migration strategy was on the right track and committed to reduce absolute GHG emissions by 42% by 2030, from a 2020 base year.