COP28 implications for China and the Middle East

Key themes from COP28

COP28, the 28th Conference of the Parties to the UN Framework Convention on Climate Change will be held from Nov 30 to Dec 12 in the United Arab Emirates. Some of the key themes we expect the conference to feature include:

- Transition: Global stocktake of results that can help to assess current progress on climate transition and define policy tailwinds (or headwinds) ahead. This will have implications on various aspects of transition such as potentially tripling renewable energy capacity by 2030 and doubling the rate of energy efficiency improvements.1Supporting the development of climate technologies will be critical, including scaling grid investments and accelerating storage technologies. We also expect increased focus on guidance and regulations that ensure the credibility of transition plans.

- Adaptation: We expect to see a more detailed framework on the Global Goal on Adaptation and more emphasis on national adaptation plans. These tie into plans to catalyze greater financing in this area to achieve a previous goal of doubling adaptation finance by 2025.

- Climate financing: Early discussions on a new collective quantified goal for climate finance (NCQG) as the previous 2009 commitment of $100 billion USD per year expires in 2025.2

- Other areas of focus:

- Private sector role: Increased private sector participation is expected at COP28 as investment opportunities are developing in the public and private markets. The COP28 presidency has also launched a private sector charter for transition and accountability mobilization.

- Health: We expect climate impact on health systems to be discussed for the first time, covering areas such as heat stroke and the impact on food systems.

- Nature: There’s a growing focus on nature-related opportunities with links to climate and decarbonization that support Paris Agreement objectives and generate investible opportunities across markets.

Deep dive on China and the Middle East

China

- Quality growth from transition: There is an increasing emphasis on “quality growth” when thinking about China’s economic outlook. Green sectors and broader transition themes are expected to feed into this story.

- Green sectors: We see strong existing market share across key green sectors like solar, wind and electric vehicles. We anticipate a continued focus on innovations in technologies and business models whether it’s in cells, batteries, or end-of-life recycling. China’s export thesis will continue given the cost advantages, economies of scale and transition demands. The country’s share of EVs sold in Europe has grown significantly to 8% in 2023 and could reach 15% by 2025.3

- Transition: Our previous piece on China’s transition story emphasizes the country’s existing economic share of high-emitting sectors and we maintain our thesis on transition upside opportunities. We also expect potential developments in transition taxonomy4 to supporting transition financing.

- Carbon pricing: All eyes are on future developments building from the launch of the emissions trading scheme (ETS) in 2021 including awaiting the relaunch of voluntary carbon markets (China Certified Emission Reduction (CCER) scheme) and the potential inclusion of additional sectors.

- Green financing: Carbon financing policy tools (like preferential rates) and standards and frameworks such as the Green Bond Principles have supported the growth of green financing, particularly in green lending.

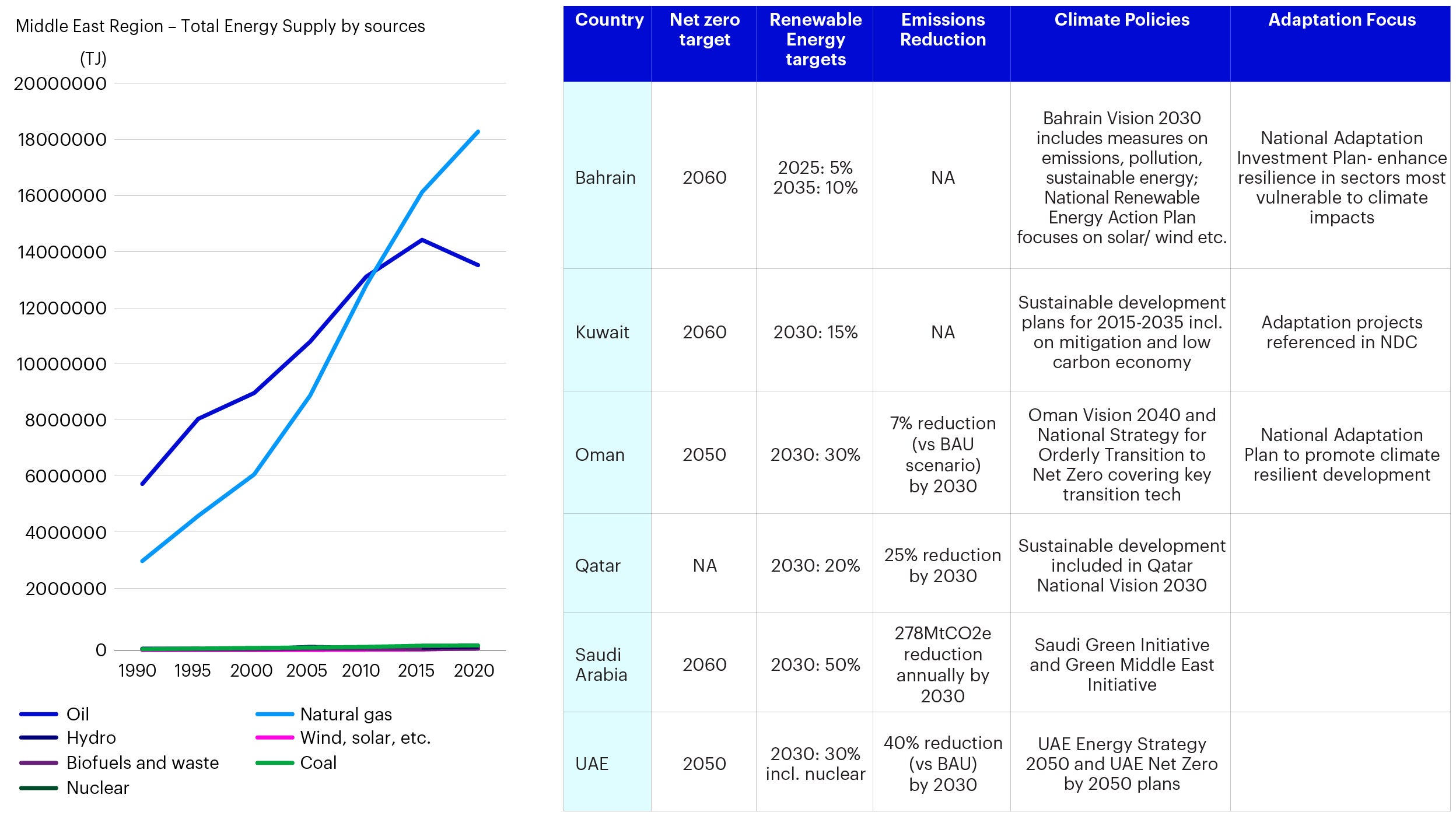

Middle East

Data as of October, 2023. Source: IEA (World Energy Statistics and Balances); Middle East Institute, The GCC and the road to net zero | Middle East Institute (mei.edu) ; Oman (Oman's Second Nationally Determined Contribution – Policies – IEA ); SGI (Saudi & Middle East Green Initiatives); Qatar (Qatar targets 25% cut in greenhouse gas emissions by 2030 under climate plan | Reuters); UAE (UAE says it's committed to meet CO2 emissions targets after criticism | Reuters).

With the UAE hosting COP28, the Middle East region is getting special attention. Many of the Gulf Cooperation Council (GCC) countries have also reaffirmed their support for transition in the lead up to the COP. We believe interesting trends for the region include:

- Energy sector in focus: Given the relevance of energy sectors to the region’s economy, COP28’s focus may include halving oil and gas scope 1-2 emissions by 2030 and achieving “near-zero” methane emissions. These measures will have material implications on traditional energy sectors. Countries in the region will be prioritizing energy security and economic growth alongside transition pathways. Part of the transition would be reliant on usual pathways such as renewables and energy efficiency while the development of newer technologies like hydrogen and carbon capture may also feature. Regionally, nations have been focusing their efforts on the development of carbon capture and in some cases doubling efforts to combat climate emissions. Oman, for example, is working on a framework for carbon capture, utilisation, storage (CCUS) and blue hydrogen development, expecting CCUS to contribute to reducing 15% of the countries emissions as part of its Net Zero target.5

- Adaptation: The Middle East region is anticipated to continue to experience vulnerability to the effects of climate change, particularly with stressors affecting regional water supply and negative impacts to food production systems. Continued heat waves and temperature spikes will have an impact and according to the World Resource Institute, 83% of the population of the MENA region is already exposed to extremely high levels of water stress.6 Countries like Bahrain have put in place a national adaptation investment plan to enhance in sectors with high climate risks.

- Climate financing: The region’s climate financing market is valued at around $2 to 3 billion USD annually7 and there is room to grow financing through policies and standards for both mitigation and adaptation solutions. The Abu Dhabi market for instance announced one of the first sustainable finance frameworks in the region.8 As more investible opportunities develop in new technologies, we may see increased climate financing from the Middle East.

Investment implications and opportunities

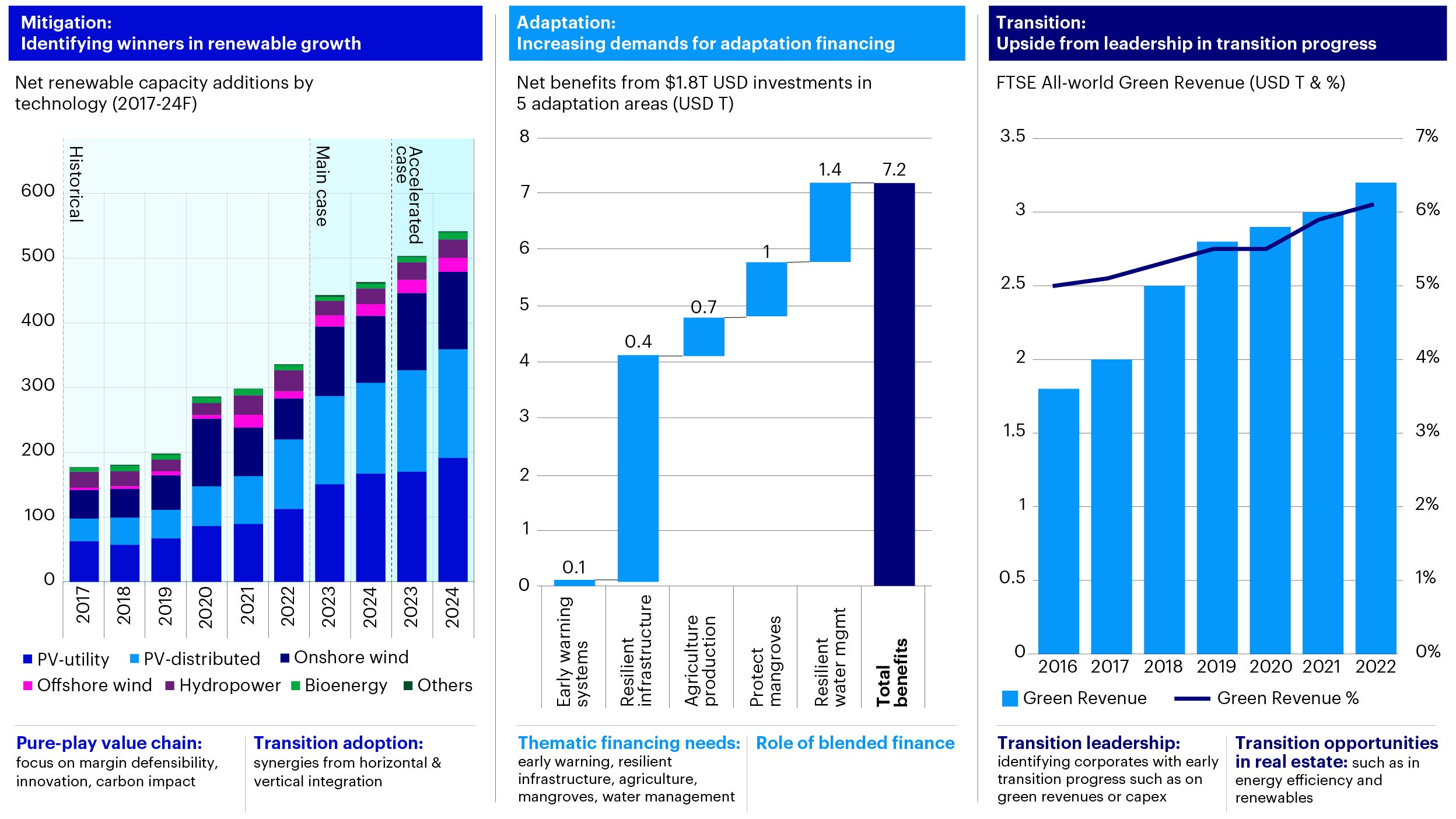

We maintain our previous climate investment thesis of looking at climate mitigation, adaptation, and transition.

Source: IEA (https://www.iea.org/data-and-statistics/charts/net-renewable-electricity-capacity-additions-by-technology-2017-2024 ); Global Commission on Adaptation https://gca.org/about-us/the-global-commission-on-adaptation/; GIC/ FTSE GIC-ThinkSpace-Weighted-Average-Green-Revenue.pdf

Mitigation: Picking winners as renewables continue to grow

- As per the G20’s declaration on tripling renewable capacity, continued growth in renewable installation capacity is expected as underlying costs continue to decline and demand is driven by energy security concerns and downstream dependency on renewables. Bottlenecks relating to grid infrastructure, underlying margin concerns and global supply chain-related regulatory risks remain. Investment upside is highly dependent on picking winners in an increasingly competitive space.

- Pure-play value chain: Identifying pockets of defensible margin, innovation and carbon impact

- Solar: We see selective opportunities across components (cells, modules, polysilicon), equipment manufacturers and utility names. There is a need to evaluate price and margin stabilization following the polysilicon downturn. For Asian names, export opportunities are dependent on a company’s carbon emissions profile, affected by the manufacturing location and innovation such as n-type modules. There are also related opportunities in energy storage systems to address intermittency.

- Wind: To-date installation growth and cost declines have lagged behind solar. We are seeing continuous margin pressure on component manufacturers as end prices decrease. Longer-term margins are dependent on upstream component costs.

- Underlying technologies: Underlying technologies to support renewable energy are becoming increasingly critical including grid, storage, and batteries.

Adaptation: Mainstreaming of climate adaptation

- Mainstreaming of adaptation is expected to be a key focus of COP28 to strengthen climate resilience. The COP28 presidency publicly called for an urgent need to strengthen global adaptation action in August.9 The presence of El Nino this year has further exacerbated physical climate risks, with many regions already experiencing record heat and flooding10 over this past summer. Secondary effects are being seen in the insurance and reinsurance markets and the impacts they have across sectors with increasing national catastrophe events across the globe.

- The Global Commission on Adaptation identifies five key investment areas where $1.8 trillion USD of investments could generate up to $7.1 trillion USD in net benefits11 for the economy, cities, and communities:

- Strengthening early warning systems allows for better disaster preparedness. Spending $800 million on this could avoid $ 3 to 16 billion USD per year in losses, cutting ensuing damage by 30%.12

- Making new infrastructure resilient increases downside protection through avoided losses. Typical investments in climate resilient infrastructure have benefit-cost ratios of about 4:1.13

- Improving dryland agriculture crop production helps both with reducing losses in flooding but also boosting farm yields.

- Protecting mangroves: helps with both flood protection and providing habitat to sustain local fisheries.

- Making water resources management more resilient safeguards the supply of water alongside providing public health benefits from wastewater treatment and sanitation.

- Blended finance instruments allow for risk-sharing and catalyzation of private finance, especially towards regions most affected by climate impacts.

Transition: Identifying transition leaders with transition upside

- Transition names capturing share of renewables growth have potential valuation upside especially in traditional power generation, utilities, and oil and gas sectors.

- Benefits to vertical integration as renewables can feed into other businesses like hydrogen, EV charging, industrial production while also leveraging on the existing distribution and channel synergies of these sectors.

- Transition leadership seeks to identify upside opportunities from corporates making early initial progress on decarbonization that benefits from the mispricing of non-green assets and pricing-in of carbon over time. This can be done by assessing on emissions targets and progress, green revenue and capex deployment

Footnotes

-

1

COP28 Presidency Letter COP28_Publish_Letter_October_2023_EN (unfccc.int)

-

2

UNFCCC New Collective Quantified Goal on Climate Finance | UNFCCC

-

3

Reuters What is driving Chinese EV exports and their price competitiveness? | Reuters

-

4

Regulation Asia China Eyes Transition and Nature Taxonomies (regulationasia.com)

-

5

Carbon Capture World Oman signs MOC for carbon capture & storage plus blue hydrogen development - carboncaptureworld.com

-

6

World Resource Institute 25 Countries Face Extremely High Water Stress wri.org/insights/highest-water-stressed-countries

-

7

Resource Governance The Road to COP28: Fueling a Green Revolution in the Middle East and North Africa by Bridging the Climate Finance Gap | Natural Resource Governance Institute

-

8

Morgan Lewis Sustainable Finance: A Strategic Priority for the UAE – Publications (morganlewis.com)

-

9

Yahoo Finance, COP28 Presidency urges adaptation efforts https://finance.yahoo.com/news/cop28-presidency-urges-adaptation-efforts-125600277.html

-

10

CNBC When El Niño exacerbates global warming: Record heat, record flooding, record wildfires https://www.cnbc.com/2023/07/15/el-nio-exacerbates-global-warming-record-heat-flooding-wildfires.html

-

11

Global Commission On Adaptation https://gca.org/about-us/the-global-commission-on-adaptation/

-

12

Global Commission On Adaptation https://gca.org/about-us/the-global-commission-on-adaptation/

-

13

Global Commission On Adaptation https://gca.org/about-us/the-global-commission-on-adaptation/