Climate investing: Transition opportunities from Europe to Asia

Transition continues to grow in interest both as a thematic opportunity and an investment risk to consider. This piece examines opportunities and approaches in transition investing, from Europe to Asia.

Climate investing: Transition opportunities and challenges

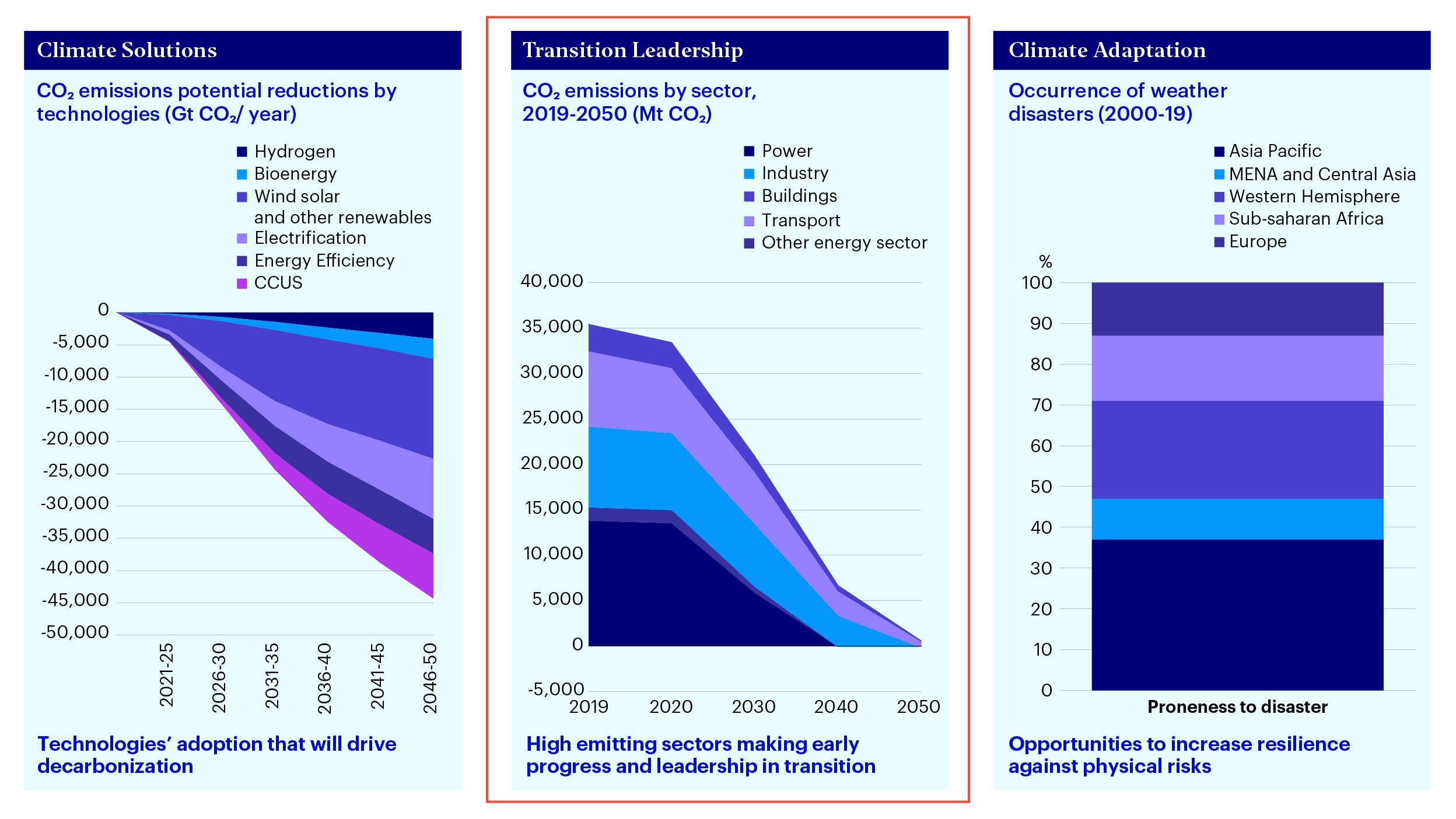

As with our midyear ESG outlook, we increasingly see climate investing as comprising of three opportunities- mitigation, transition and adaptation:

Source: IEA Analysis; Bloomberg; World Bank. Note: CCUS - Carbon Capture, Usage and Storage.

- Mitigation: Climate solutions such as EVs that will grow in adoption and scale as other sectors to decarbonize.

- Transition: Decarbonization of non-green sectors creating potential risks and upside opportunities.

- Adaptation: Impact of physical risks driving demand for adaptation financing globally; further highlighted by El Nino this year.

Focusing specifically on transition, the investment thesis is to identify transition names that are mispriced assets today and have the potential to grow as they are transition leaders and are making early progress on decarbonization:

- Why mispricing? In the last decade, the macroeconomic backdrop has created an equity market that favors quality compounding businesses. This market skew has created pockets of mispriced assets. High emitting sectors, which are a key hunting ground for transition investors, are typically cyclical stocks which have not been in favor.

- What has intensified this? The growth in sustainable investing has meant that this trend is more pronounced. High-emitting sectors have been considered ESG laggards and faced de-rating pressures relative to low carbon sector stocks. Traditional sustainable investing approaches that focus on exclusions rather than engagements, alongside the historic focus on growth, has also further exacerbated valuation differences.

- What will create value? Longer-term valuation adjustment will come as the impact of carbon pricing policies continue to increase and transitioning companies could also capture productivity gains from green technology adoption. Our job is to identify businesses that can thrive, not just survive, on the journey towards a low carbon society.

That said, in our previous piece on ESG investing: from exclusions to transition, we covered the challenges to investing in transition opportunities; namely:

- Data: Assessing transition progress requires evaluating forward-looking emissions data rather than just historical backward-looking information. Scope 3 also plays a critical role for selected sectors. This requires bottom-up emissions projections and understanding the relevant valuation impact.

- Transition performance: Investors also need to be able to monitor like-for-like changes in emissions from structural adjustments, abstracted from the impact of economic cycles or divestments.

- Varying transition speed: In our view, investors should also recognize that transition pathways vary by sector and are often not linear paths. Any cross-sectoral comparison requires adjustments and analysis which looks at the equivalence of emissions.

Investing approaches: risk consideration versus transition thematic

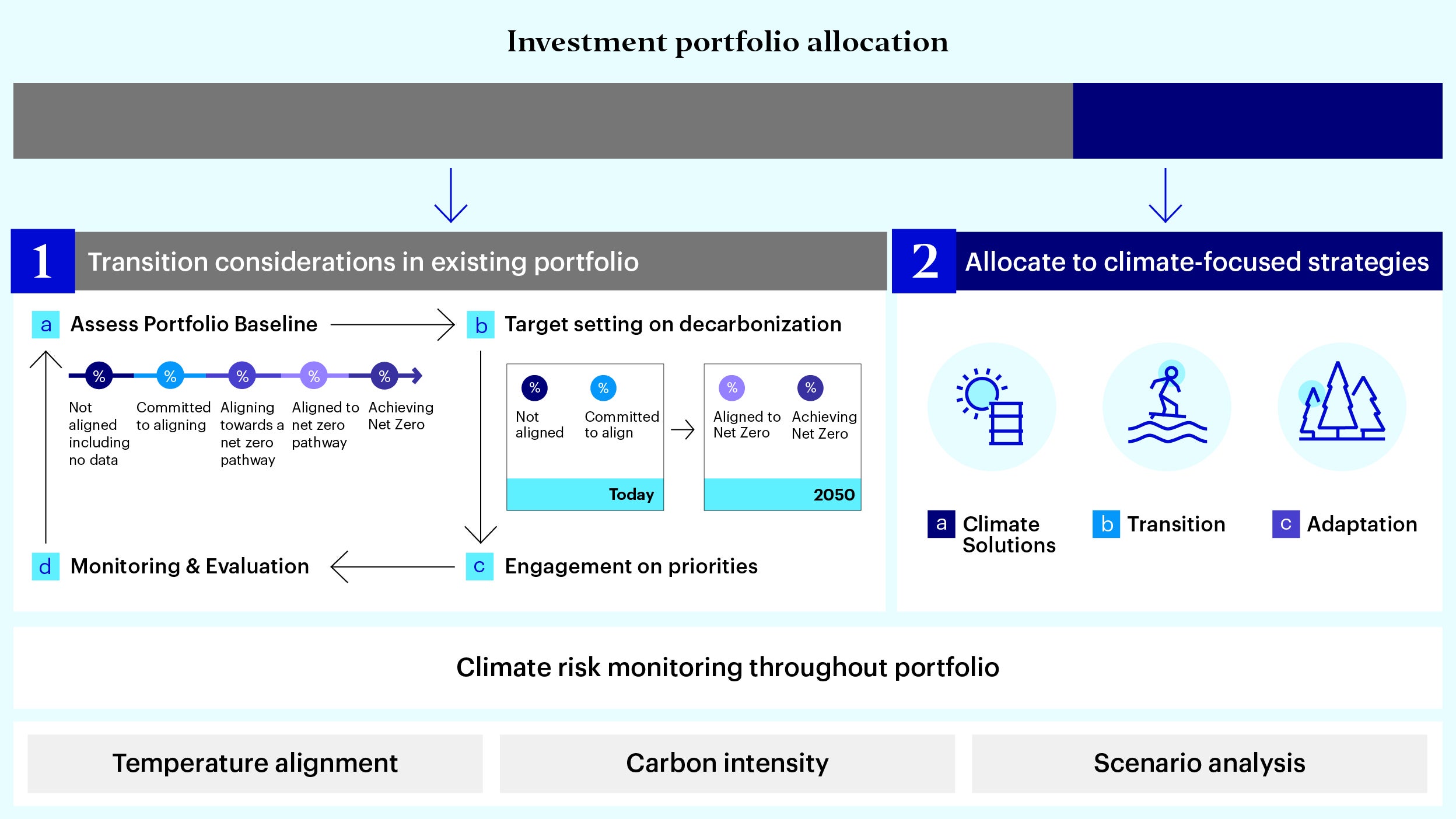

We believe an investor thinking about transition investing today should consider two aspects - consideration of transition risks across the portfolio and alpha opportunities in transition leadership.

Source: Invesco Analysis; for illustrative purposes only.

Transition considerations in the investment process

Investors come at transition considerations from multiple angles. For some it’s about better assessing investment risks that arises as economies and sectors transition, while for other investors it might also be to align with their climate targets or commitments. Often these are further balanced against other investment objectives and constraints like liquidity, tracking error and returns, not to mention the bigger question of how to adopt such considerations across the broader portfolio.

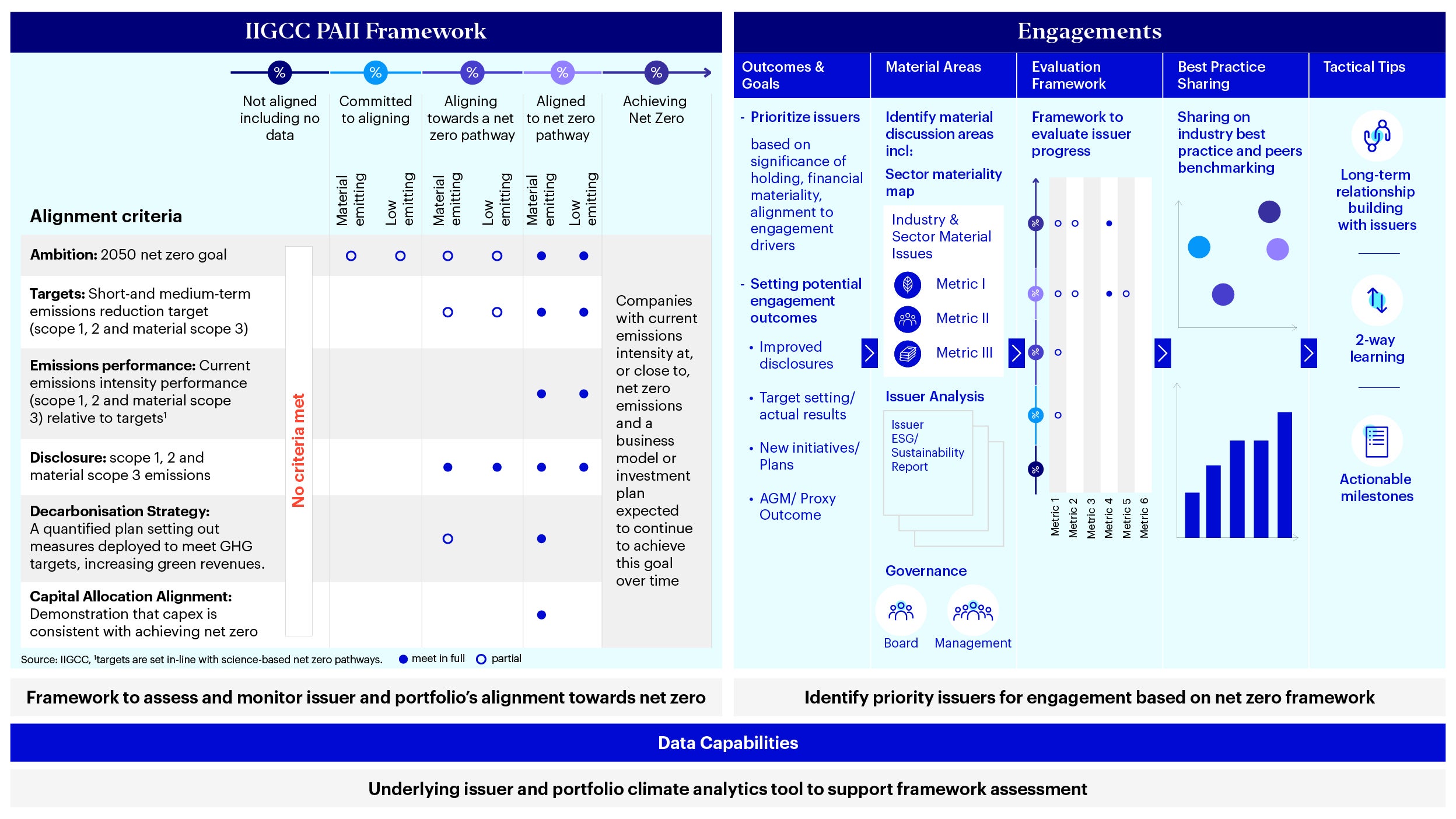

Source: IIGCC. Note: IGCC PAII Framework - Institutional Investors Group on Climate Change’s Paris Aligned Investment Initiative Framework.

In such instances, having a transition framework (such as Institutional Investors Group on Climate Change’s Paris Aligned Investment Initiative Framework or the IGCC PAII Framework) provides a starting point to understand where portfolios are at today and allows investors to then target set. Specifically, the IIGCC’s framework looks at 6 factors – long-term ambition, targets, emissions performance, disclosures, decarbonizations strategy and capital allocation alignment. The framework can also be helpful in setting engagement priorities and measuring engagement progress. These would all need to be supplemented by underlying data capabilities.

For investors that are interested in including transition considerations across their equities and corporate fixed income portfolios, going down this route gives a good starting point to assess portfolio baselines and prioritize material risks in a portfolio. There might also be investors who are interested in going one-step further to capture upside from transition as a strategy- that of looking for transition leaders.

Investing in transition leadership: Approaches in Europe and Asia

Europe versus Asia

A common question from investors is often on how we compare transition opportunities in Europe versus those of Asia.

Source: GS analysis (GS SUSTAIN APAC ESG Regulation A new era for ESG in Asia Pacific (goldmansachs.com)); Bloomberg (ESG disclosures gain traction in APAC | Insights | Bloomberg Professional Services); SCMP/ Net Zero Tracker (Climate Change: China’s firms lag behind Asia, North America, Europe in net-zero targets with only 4 per cent adherence, study finds | South China Morning Post (scmp.com)).

A couple of differences stand out:

- Data and disclosures: Climate-related data and disclosures in Europe are ahead of Asia though Asia has been fast catching up. The underlying drivers for this relate to regulations on mandatory sustainability disclosures. The emergence and adoption of the International Sustainability Standards Board (ISSB) would likely be a game-changer particularly the initial priority of climate disclosures in some regions.

- Climate targets and planning: Like disclosures, a larger proportion of companies in Europe have net zero targets and commitments and the focus has shifted to developing credible transition plans. That said, there has been a rapid growth in Asian companies having climate targets and commitments as well.

- Carbon markets and policies: Finally, Europe has had a longer history of carbon markets and pricing with better developed carbon pricing signals.

Given this backdrop, assessing transition progress in European markets requires more in-depth analysis on the credibility of transition implementation whereas in Asia it’s more about identifying early forward-looking signals (such as companies making earlier progress on disclosures or plans).

Europe: Credibility of transition

As European companies increasingly develop transition plans, the credibility of transition planning become key. Carbon Disclosure Project research previously showed that only 0.4% of companies in their database were assessed as having credible transition plans.1

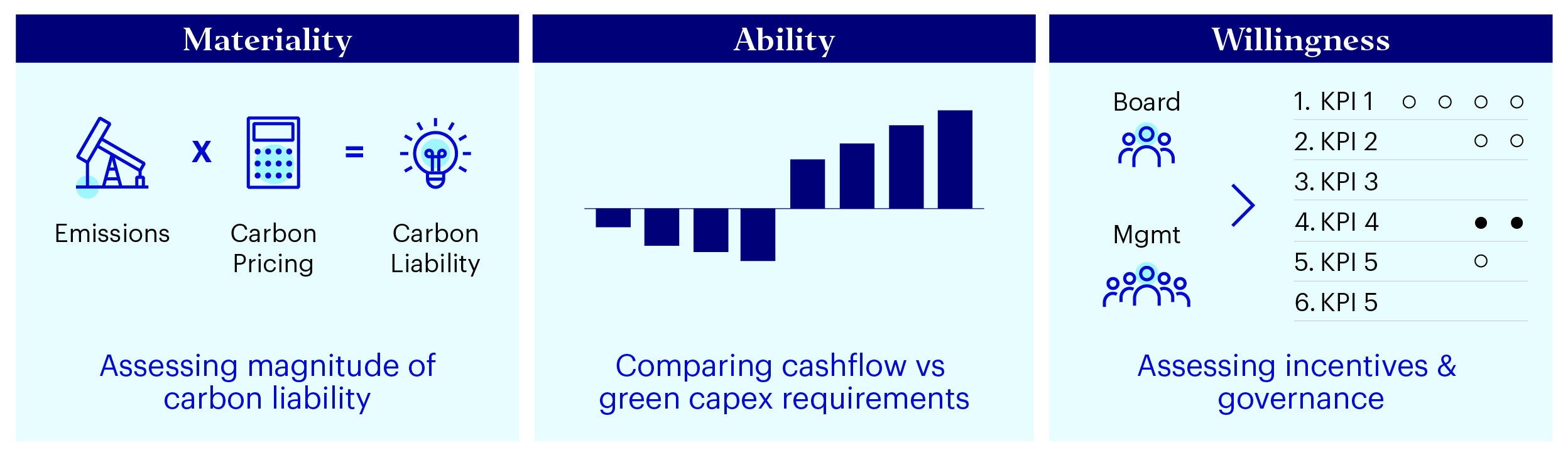

We believe investors would benefit from assessing three key areas:

Source: Invesco, for illustrative purposes only.

- Materiality: Magnitude of the impact of carbon liability on companies by evaluating the carbon costs on a company over time.

- Ability: Analyzing if a company has the resources and cashflow to fund its transition journey within a constrained time period.

- Willingness: Looking at whether the incentives and governance of a company are aligned to its transition plan and objectives.

The thesis again lies in the fact that winners in transition would be the ones with the biggest pricing upside (materiality) supported by its cash generation to fund green capex (ability) and supportive management (willingness). Implementing this strategy requires strong fundamental active research, including evaluating forward-looking emissions projections and green revenues uptake alongside engagement with companies to assess the plans, progress, and governance alignment.

Asia: Forward looking signals

Given the state of the market, early forward-looking signals would be key differentiators for identifying potential transition leaders in Asia. As shared in our research piece, Tsinghua CGFR-Invesco Research: Investing in transition leadership in China, assessing winners could include looking at:

- Transparency progress: by early alignment analysis to ISSB standards.

- Emissions analysis: through estimations using the emission factor method.

- Sectoral pathways: both in terms of policy tailwinds and technology roadmaps.

- Green revenue: as an additional proxy for the transition progress.

Much of the above again requires active fundamental research and analysis alongside engagement with companies.

The tailwind of transition: Investing to future-proof portfolios

Just as the impact of physical risks have led to greater interest in building climate resilience across sectors and supply chains, transition presents material risks and opportunities for investors to build more resilient portfolios. We believe investors should develop approaches to incorporate transition risks in the investment process while also capturing investment opportunities from transition champions.