Climate investing in Asia: Opportunities in climate mitigation, adaptation, and transition

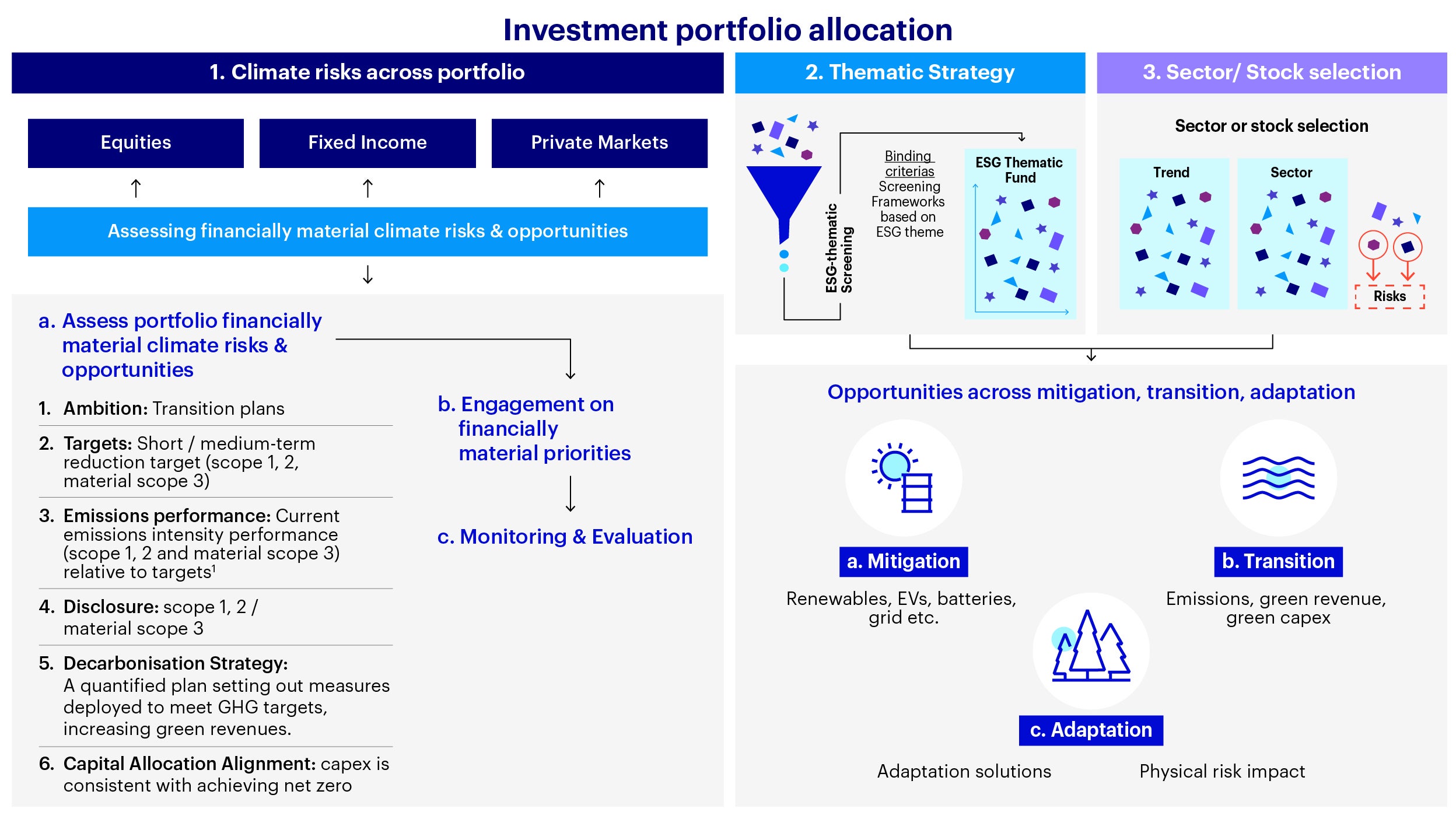

As highlighted in our recent piece on 5 Asia ESG investment ideas for 2024, we expect climate investing to continue to present interesting opportunities for investors be it in sector or stock allocation, thematic strategies, or broader asset allocation. Specifically, we believe opportunities exist across the themes of climate mitigation (solutions and technologies driving decarbonization), adaptation (increasing resiliency), and transition (adoption of green technologies and business models).

Recent developments at COP28 have highlighted potential investment opportunities in climate mitigation, adaptation, and transition:

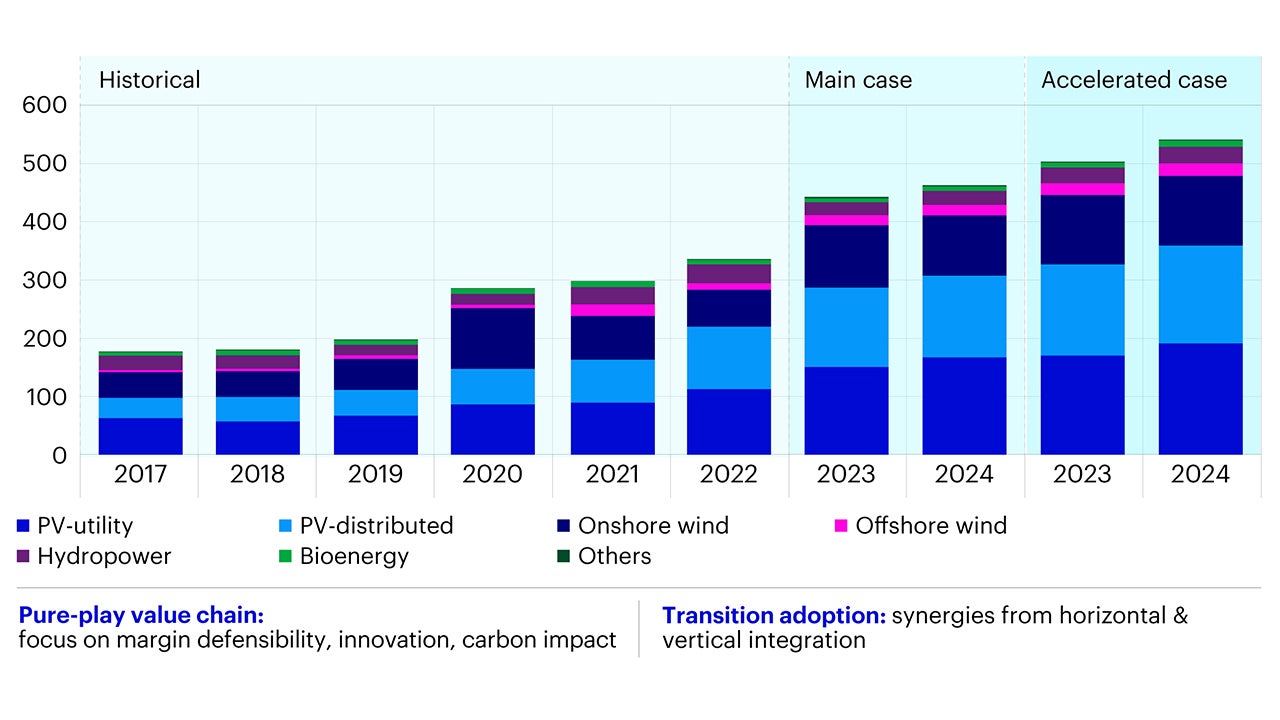

Mitigation: identifying winners in renewable growth

Decreased costs and increased penetration rates across solar, wind, electric vehicles (EVs), and batteries, higher interest rates, as well as shortages and increased costs for supplies and raw materials, weighed down green sector returns in 2023. Commitments at the G20 and COP28 to triple the capacity of renewables indicate continued penetration and growth in climate solutions in 2024, but it will be critical for investors to fully analyze fundamentals to identify the winners in each segment and identify attractive investment opportunities.

- Solar/ wind: Cost deflation amidst installation gains underscores the importance of identifying the right investments in these sectors. The key is to identify pockets of defensible margin, innovation, significant carbon impact and components and processes with lower emissions.

- Infrastructure technologies: Grid storage and batteries will be critical in supporting sector growth.

- EVs: Identifying attractive segments of the value chain will be critical given increasing competition, policy support and subsidies, and export potential.

- Broader technologies: We anticipate further developments in areas like hydrogen and carbon capture. Oman, for example, is working on a framework for carbon capture, utilization, storage (CCUS) and blue hydrogen development, and expects CCUS to contribute to a 15% reduction in the country’s emissions as part of its Net Zero target.1

- Real estate: COP28 saw the launch of the Buildings Breakthrough Initiative, with the goal of making near-zero emission and resilient buildings the standard by 2030. This is expected to accelerate the uptake of low-carbon technologies and solutions for energy efficiency in the sector.2

- Critical materials: Demand for raw materials like lithium, cobalt and nickel is expected to grow alongside penetration growth of climate solutions and clean technologies. We believe a potential demand-supply gap for critical materials should drive growth of circular economy solutions like materials recycling and processing.

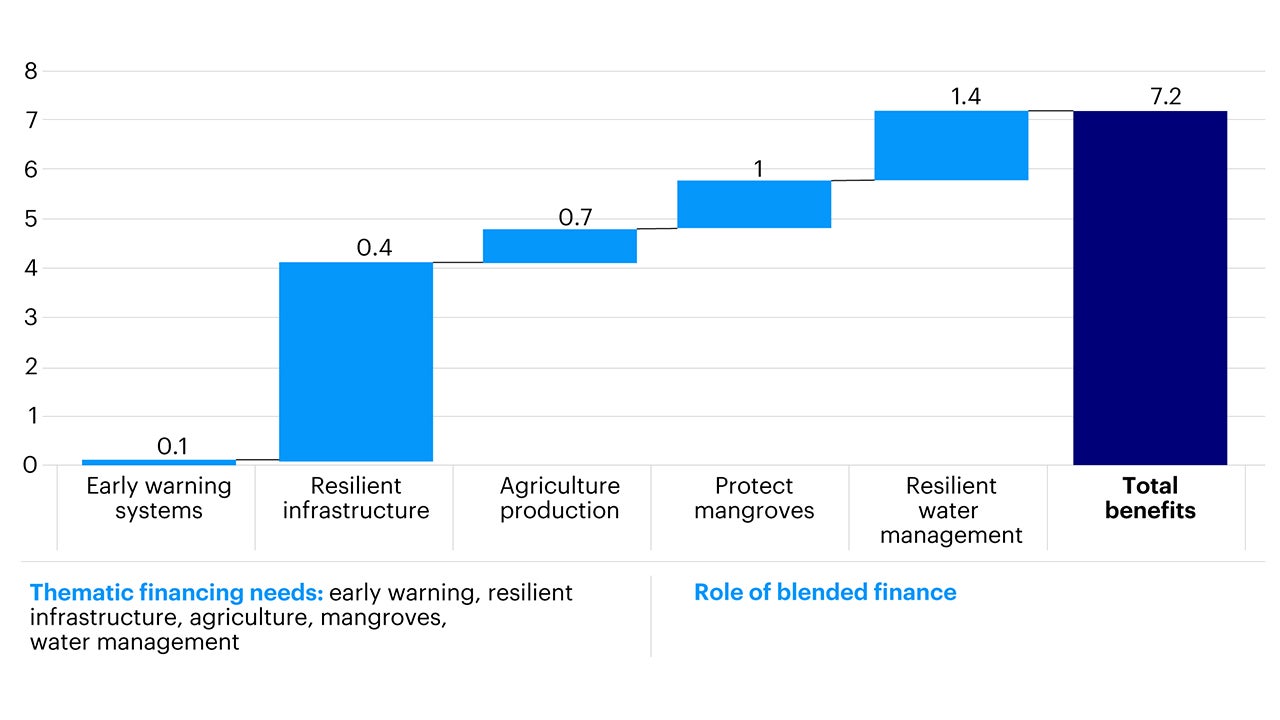

Adaptation: increasing demands for adaptation financing

Source: Global Commission on Adaptation, https://gca.org/about-us/the-global-commission-on-adaptation/; Invesco.

2023, an El Nino year, saw climate impacts materialize through record temperatures and heat, flooding, and droughts. This resulted in significant shocks on property and infrastructure, water, food and agriculture security, and longer-term maintenance and insurance costs globally. Estimates for annual projected insured losses from natural catastrophes in 2023 are likely to surpass $100B USD.3

- Regional impact: Asia is highly vulnerable to physical risks due to higher occurrences of weather disasters, while the Middle East and North Africa (MENA) have high levels of water stress. We expect countries will look to strengthen their national adaptation plans in 2024, with related regional financing needs.

- Financing gaps: Significant financing gaps will need to be addressed through blended finance instruments, where public finance can enable better risk-return profiles for private sector investments in adaptation. More rigorous frameworks to define and assess the quality of adaptation solutions will be critical to securing this funding.

- Themes & solutions: The Global Commission on Adaptation finds that investing $1.8T USD globally in five areas related to early warning systems- infrastructure resilience, agriculture security, water resilience, and mangroves/ biodiversity protection - could generate $7.1T USD in total net benefits to vulnerable areas.4

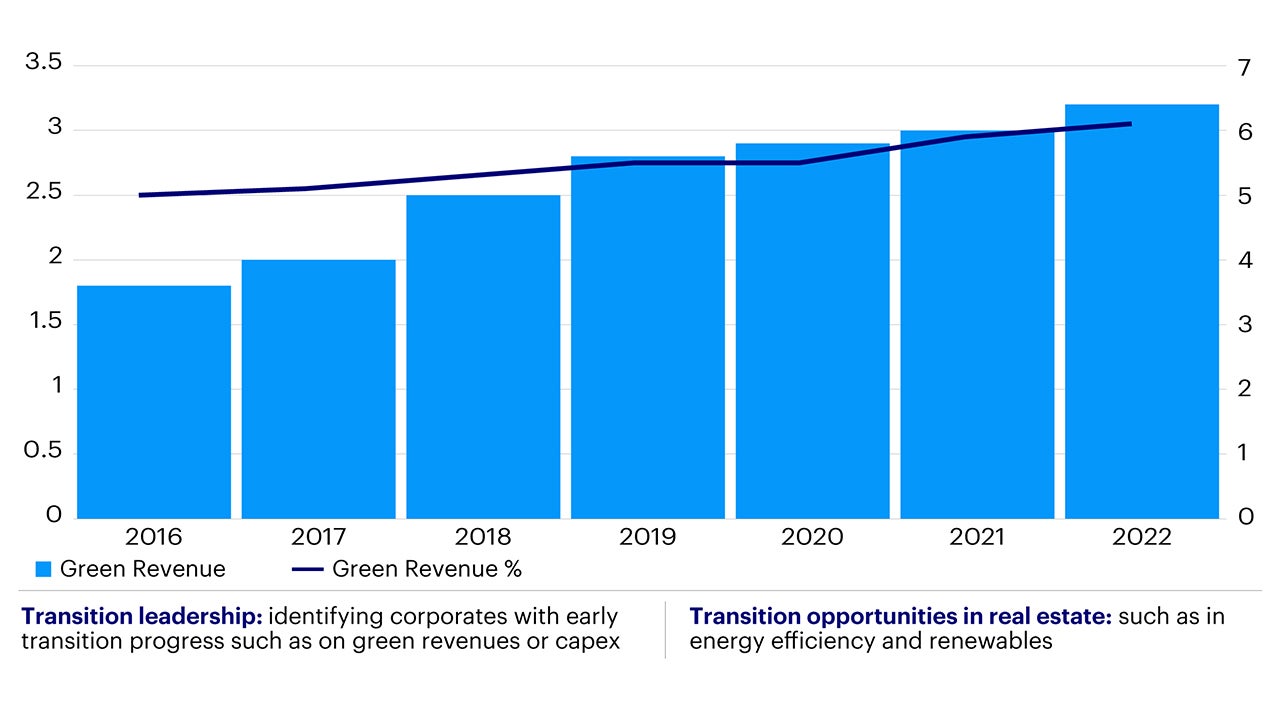

Transition: Upside from leadership in transition progress

Source: GIC and FTSE Russell, https://www.gic.com.sg/thinkspace/long-term-investing/weighted-average-green-revenue/; Invesco.

- Transition leaders: Regions adopting carbon pricing policies through compliance markets, taxes, and carbon-border adjustments could incur cost implications for high-emitting sectors. EU markets have previously favored low carbon and green technology names with price discounts on high emitters. This could favor corporates making early progress on transition with cheaper valuations and better management of potential taxation and costs. This investment approach seeks to identify signals and metrics that demonstrate progress, including emissions and targets, green revenue and capex, board and management alignment, as well as cashflow availability to fund transition.

- Climate risks: In contrast, certain sectors and issuers face increasing headwinds as physical and transition risks begin to materialize. Incorporating these financially material considerations into investment risk management and due diligence processes will be increasingly important. The built environment for instance may encounter high transition risks in regions like the EU, where minimum energy performance standards and fines from the recent “Energy Performance of Buildings Directive”5 could impose material costs for real estate.

Asia in focus: mitigation, adaptation, transition opportunities

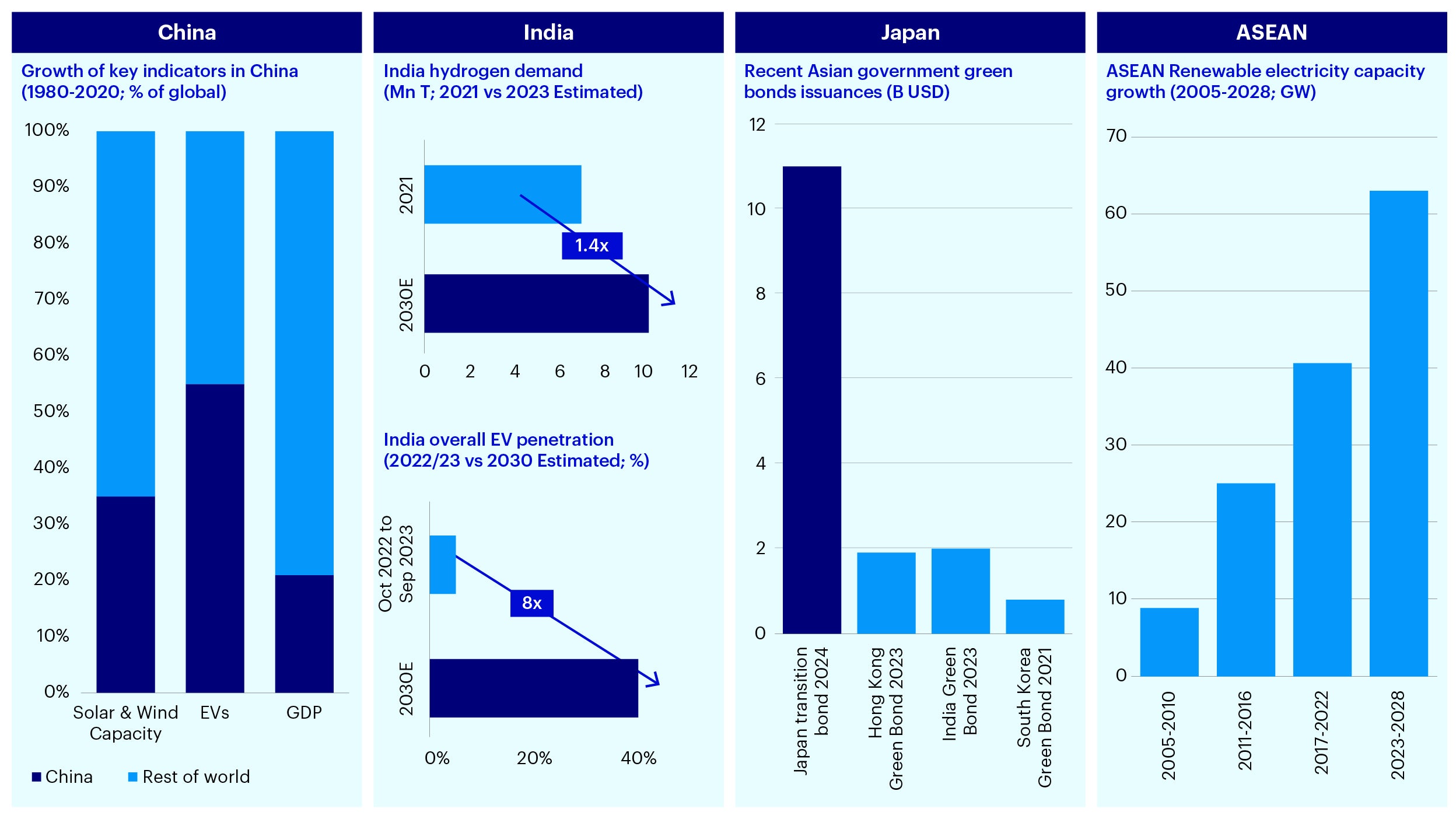

Source: IEA Energy Sector Roadmap to carbon neutrality in China (Executive summary – An energy sector roadmap to carbon neutrality in China – Analysis – IEA ); IEA/ Bernstein Analysis; Bain (India Electric Vehicle Report 2023 | Bain & Company); CBI (Japan will issue $11bn Climate Transition Bond, Certified under the Climate Bonds Standard | Climate Bonds Initiative ); SCMP (https://www.scmp.com/business/banking-finance/article/3233476/hong-kong-issue-second-batch-retail-green-bonds-valued-us191-billion-available-residents-september ); CBI (https://www.climatebonds.net/2023/03/india%E2%80%99s-debut-sovereign-green-bond-market-first-deal-landed-greenium ); LSEG https://www.londonstockexchange.com/discover/news-and-insights/london-stock-exchange-welcomes-republic-koreas-sovereign-green-bond-sustainable-bond-market ; IEA New Energy (https://www.iea.org/reports/renewables-2023/executive-summary);

- China: Green sectors that support mitigation will be a driver of quality growth for the economy while broader developments in carbon pricing and energy transition will drive opportunities for identifying transition leaders.

- India: India ranks fourth globally in terms of total renewable power capacity additions.6 We believe that this alongside having a focus on hydrogen development through the National Green Hydrogen Mission will drive opportunities in mitigation. High vulnerability to physical risks like floods and rainfall will also drive demand for adaptation financing particularly for agriculture, food and water security.

- Japan: The Japanese government’s Green Transformation plan can lead to nearly $1T USD in investments for whole economy transition including in green technologies like nuclear, hydrogen as well as transition leadership with the development of the emissions trading scheme (ETS). The Japan government also recently announced plans for a $11B USD issuance of a climate transition bond to fund the government’s green transformation program.7

- ASEAN: The ASEAN region has seen development in taxonomies alongside national transition plans and targets. Renewable capacity has been on the rise alongside investments into areas like hydrogen (Singapore plans to be hydrogen hub) and smart grids (national policy priority in Thailand).

Source: Invesco Analysis. For illustrative purposes only.

- Climate risk considerations in portfolio be it assessing the impact of transition risks such as carbon pricing on EBITDA impact or the magnitude of physical risks on portfolio valuation.

- Thematic strategies such as investing in clean energy thematic or funds focused on transition or supporting the growth of adaptation financing.

- Sector or stock allocation and increasing allocation and weight to the three themes in question (mitigation, transition and adaptation) in existing funds and strategies, such as seeing green sectors as a driver of returns in Chinese equities especially given the export opportunities.