Back to basics: Defining ESG investing, ESG fund regulations and greenwashing in Asia

Amidst economic and geopolitical developments in 2022, ESG investing has continued as a theme of interest in Asia in the year so far. This past quarter has seen increasing market and regulatory interest in defining what ESG investing means and having greater clarity from investment process to disclosures. This piece goes back to basics by examining key trends and clarifying approaches in thinking about ESG investing in Asia.

Market demand for greater clarity in defining ESG investing

ESG AUM in Asia is forecasted to grow to more than $500B by 20251 and in tandem with this growth, increasing alignment and clarity on the definitions of ESG investing would be critical. Recent developments include:

- Government and policy makers attention: Many policy makers have called for better clarity on sustainable investing- PBOC Governor Yi Gang has commented on “moral hazards of greenwashing” and need for better disclosures2, SFC CEO Ashley Alder shared on urgent need to “improve comparability and reliability of sustainable investing”3 and Singapore Deputy Prime Minister Heng Swee Keat described the need for “legal frameworks” given “concerning magnitude of greenwashing”4. Increased government attention has translated into regulatory action in the form of investigations and fines, further increasing investors’ demand for better clarity.

- Reflections on the future of ESG investing: Economic and geopolitical impact on financial markets in 2022 has also shifted ESG discourse from simple exclusionary investment processes to a broader focus on ESG integration alongside other more sophisticated ESG investment approaches. The design of future ESG investment strategies have to start with an understanding and evaluation of current spectrum of ESG investing approaches.

- Regulatory developments: Finally, this year has also seen new ESG regulations focused on bringing greater clarity to sustainable investing markets including EU’s regulations on sustainability preferences and sustainable investments and US SEC’s ESG Fund Name and ESG Fund Disclosures.

These developments have driven market interest for greater clarity and transparency on ESG approaches.

Regulatory developments defining ESG Investing in Asia

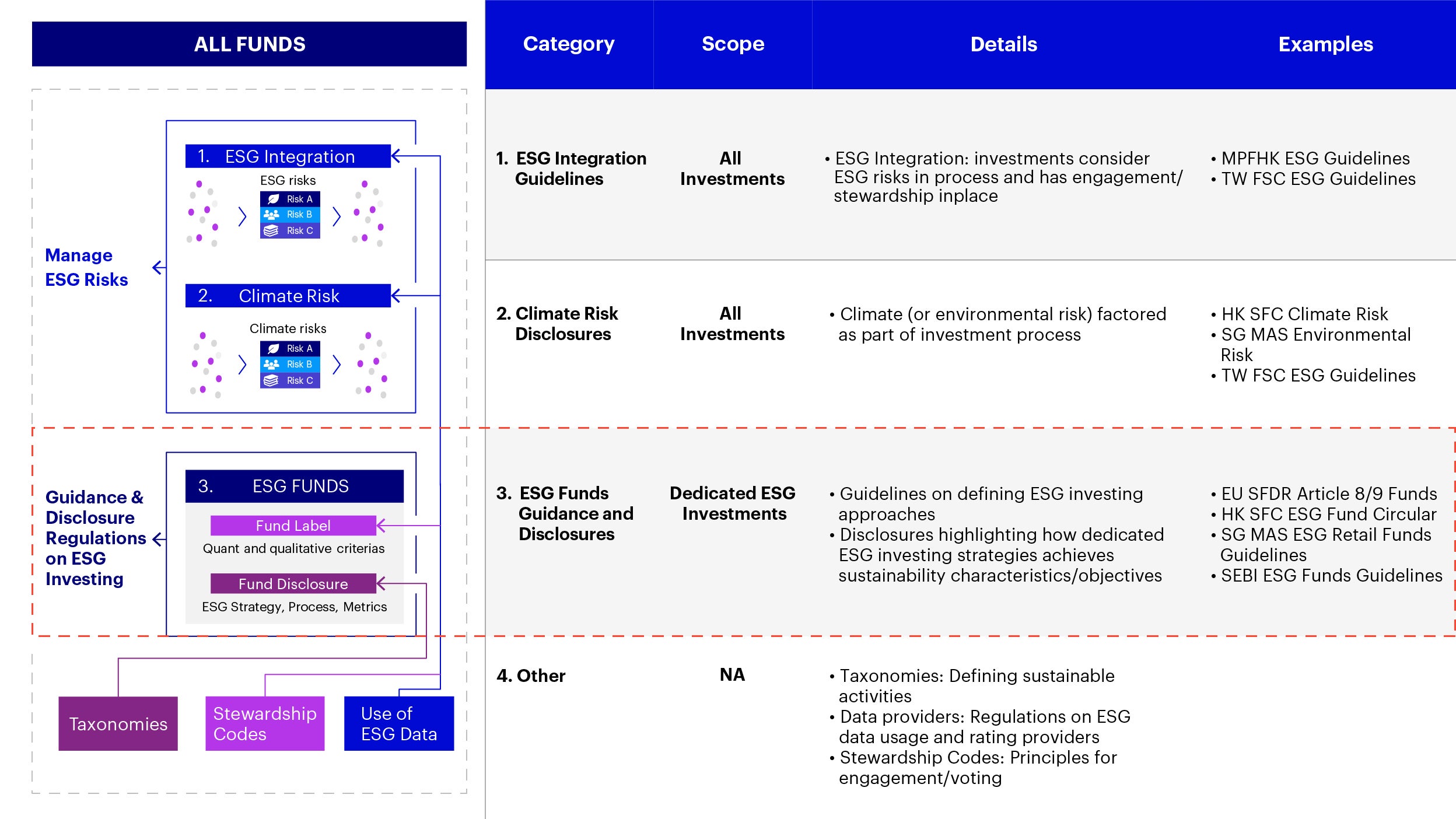

While some ESG regulations in Asia has focused on ensuring investors consider material ESG and climate risks in their investment process, recent developments have also included increasing transparency in the adoption and disclosures of ESG investing strategies.

Source: Invesco Analysis. Note: Mandatory Provident Fund Hong Kong (MPF HK), Taiwan Financial Supervisory Commission (TW FSC), Hong Kong Securities and Futures Commission (HK SFC), Singapore Monetary Authority of Singapore (SG MAS), Securities and Exchange Board of India (SEBI).

Two notable regulatory developments in Asia are:

Greenwashing guide: Australia Regulator ASIC has published a “Guide to Greenwashing” defining greenwashing as misrepresentation of the extent of how sustainable an actual investment strategy is. In particular, the guide gives examples of greenwashing including

- Misleading marketing content: such as misaligned fund labels, use of vague unsubstantiated jargons or terminologies or misleading headline claims inconsistent with investment strategy

- Unclear investment process: such as lack of details on how sustainability factors are incorporated into investments or in screening

- Lack of transparency in disclosures: Inadequate disclosures on investment’s sustainability targets, metrics, and data methodologies

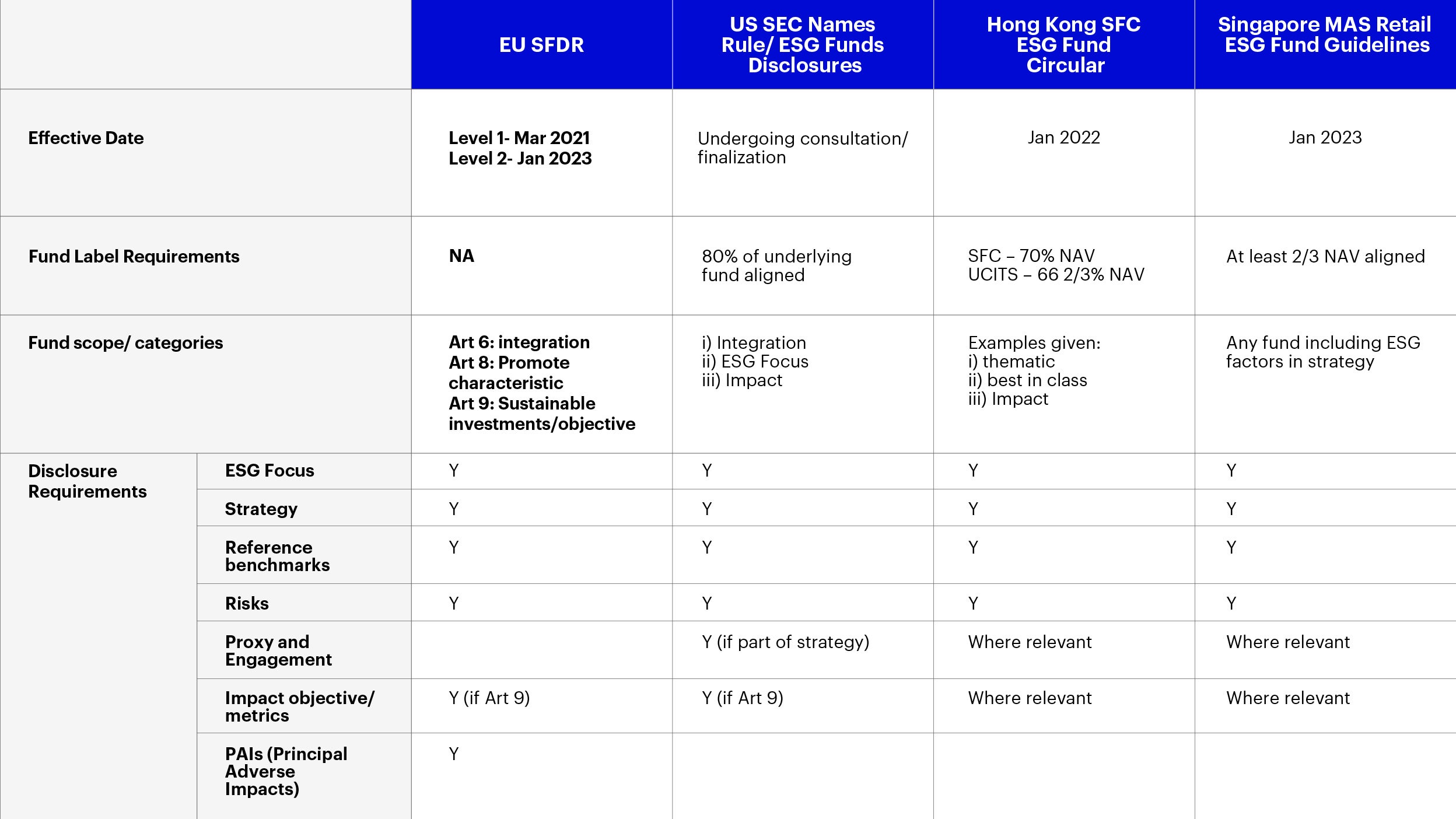

ESG Fund Regulations: Regulators have also issued guidance and disclosure requirements for dedicated ESG investment strategies. These typically includes i] fund labelling requirements including minimal percentage of holdings aligned with ESG objectives or features and ii] disclosure requirements such as on ESG investment strategy and portfolio construction process. Some regulations will also define the different types of ESG investment approaches (e.g. US SEC ESG Fund Disclosures define 3 categories of ESG strategies- integration, ESG focused and impact). In Asia, Hong Kong (SFC ESG Fund Circular)5 and Singapore (MAS Retail ESG Fund Guidelines)6 both have ESG Funds’ requirements going live in the coming year with broad alignment to global requirements. Other regions like India (SEBI)7 and Japan (FSA)8 have also publicly announced consultations or plans focused on regulating ESG investments.

Source: Invesco Analysis, ASIFMA, Bernstein

Invesco’s approach to defining ESG Investing

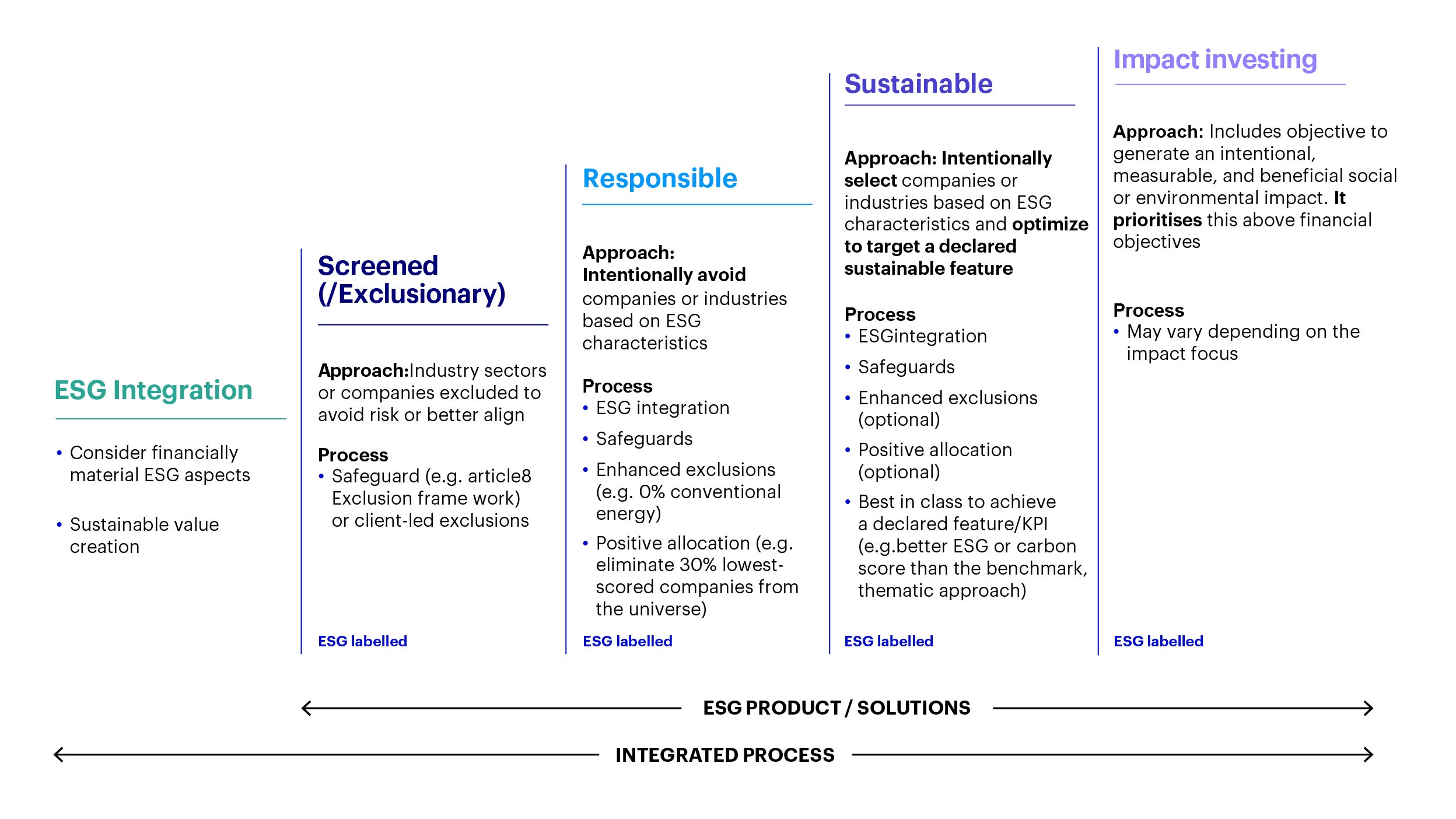

In our recently released Stewardship Report, we set out our client-driven approach in defining a spectrum of ESG investing strategies. This is in recognition that different clients might have different ESG investing objectives and investment needs.

Source: Invesco Stewardship Report 2021; for more details see Section 2 and 3 of 2021 ESG Investment Stewardship Report (invesco.com)

Specifically, the spectrum includes basic and minimal ESG integrated strategies which considers financially material ESG risks as well as dedicated ESG strategies with specific ESG or impact objectives and investment processes aligned to those targets. Our investment teams are focused on strategically developing client-centered investment solutions that align with ESG market opportunities, identifying potential strategies for ESG conversion or new launches, and introducing innovative ESG investment strategies based on Invesco resources and capabilities.

By having a clear spectrum of ESG investing approaches, we hope to better enhance transparency and to customize effective ESG solutions for sustainable value creation and risk mitigation. For more information about Invesco’s approach to ESG investing, kindly refer to our latest ESG Investment Stewardship Report.

Footnotes

-

1

Invesco ESG Opportunities and Challenges in Asia (invesco.com)

-

2

PBC Governor Yi Gang CGTN Interview http://www.pbc.gov.cn/en/3688110/3688172/4437084/4587509/index.html

-

3

SFC Ashley Alder PRI Speech https://www.sfc.hk/-/media/files/ER/PDF/Speeches/Speech-27-May-2022.pdf

-

4

MAS Heng Swee Keat Speech https://www.mas.gov.sg/news/speeches/2022/speech-by-mr-heng-swee-keat-deputy-prime-minister-and-coordinating-minister-for-economic-policies-at-the-opening-of-point-zero-forum-on-22-june-2022

- 5

-

6

MAS CFC 02/2022 Disclosure and Reporting Guidelines for Retail ESG Funds (mas.gov.sg)

-

7

SEBI SEBI | Consultation Paper on introducing disclosure norms for ESG Mutual Fund Schemes

-

8

Bloomberg Japan to get tough on greenwashing (businesslive.co.za)