APAC asset owner approaches to ESG and climate investing

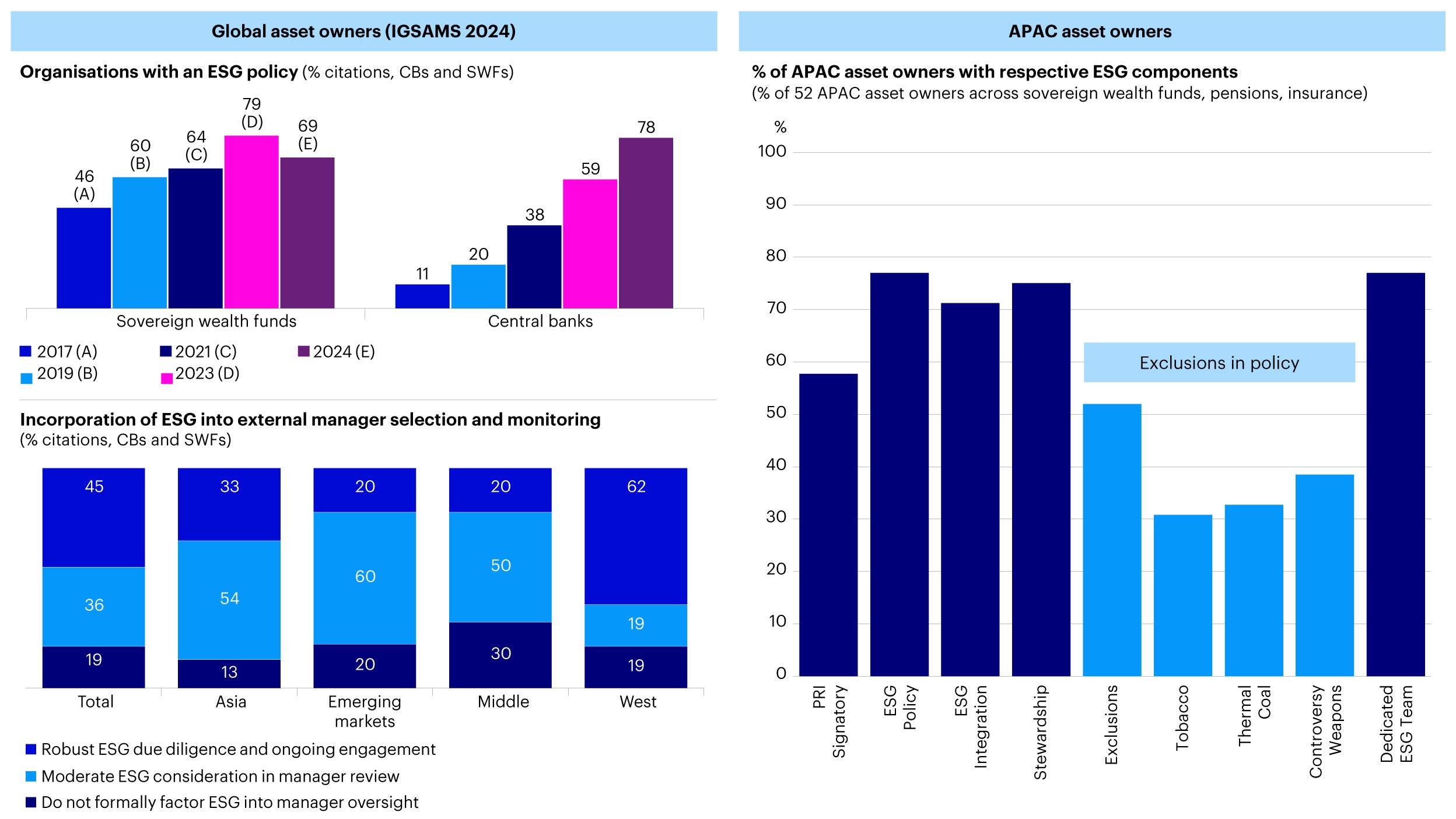

Invesco’s latest Global Sovereign Asset Management Study 2024 (IGSAMS 2024) highlights increasing sophistication amongst asset owners in applying ESG in their investment approaches. Indeed, understanding how asset owners are approaching sustainable investing provides a lens to learn ESG best practices, discover emerging trends and priorities, and identify potential investment opportunities. In this piece, we look at how 52 APAC asset owners across sovereign wealth funds, pensions and insurance companies with over US $15 trillion in assets under management (which we refer to as APAC asset owners) approach ESG and climate investing based on publicly available policies and sustainability reports. The APAC asset owners are based in Greater China (including Hong Kong), Japan, South Korea, Singapore, Malaysia, Indonesia, Australia and New Zealand.

ESG approach: Foundations are in place among most APAC asset owners

Our Global Sovereign Asset Management Study 2024 shows that the number of global asset owners with ESG policies has increased since 2017. The study also shows that the number of investors globally that have had ESG policies in place for more than five years has reached a critical mass.1 We are seeing similar trends in this region, where more than 75% of APAC asset owners have adopted ESG policies and have a dedicated in-house ESG team.2 Many of these policies help the asset owners articulate the role of ESG in their investment process and the key approaches they are using.

Source: Global – IGSAMS 2024; APAC asset owners – Invesco analysis of 52 APAC asset owners based on publicly available policies and sustainability reports. Data as of August 2024.

The key aspects that are captured in these ESG investment policies and strategies include:

- Integration: More than 70% of APAC asset owners3 use some form of ESG integration and many asset owners think of ESG investment as identifying and considering material ESG factors that may affect investment returns and risks. Given the fiduciary duty they have, the institutions believe that proactively addressing these factors can lead to longer-term value creation and preservation of their funds as well as improved risk-adjusted returns over time.

APAC asset owners also recognize that integration approaches can vary by asset class and necessitate additional frameworks where required (such as for assessing labelled fixed income or considering ESG implementation in real estate).

Some asset owners also have a formulated assessment criteria of investment managers’ ESG capabilities which typically includes their integration and stewardship approaches, data and framework capabilities and broader industry commitments and initiatives. This again mirrors the trends observed in IGSAMS 2024 as the survey finds that a significant portion of global asset owners consider ESG capabilities when selecting external managers.

- Stewardship: More than 70% of APAC asset owners4 have also detailed their approaches to stewardship including both engagements and proxy voting. Many articulate the importance of utilizing ownership positions and rights to protect and enhance long-term investment returns. This often includes defining the most financially material ESG issues for discussion and monitoring the progress and outcomes over time. Asset owners also undertake a range of approaches including direct engagement, utilizing third-party service providers or joining in collaborative industry engagements.

- Exclusions: Select APAC asset owners also specify investment exclusions in their policies, driven both when looking at higher investment risk areas and in accordance with internationally accepted norms. For example, controversial weapons, tobacco, and thermal coal are the more commonly seen exclusions.

- Dedicated ESG team: Many APAC asset owners have also hired and built out dedicated in-house ESG investment teams. Interestingly the roles and functions of these teams differ across asset owners - for some the focus is on developing ESG integration frameworks and capabilities, for others its fully focused on stewardship and engagement, while others might be more focused on ESG investment research and portfolio construction or fund selection.

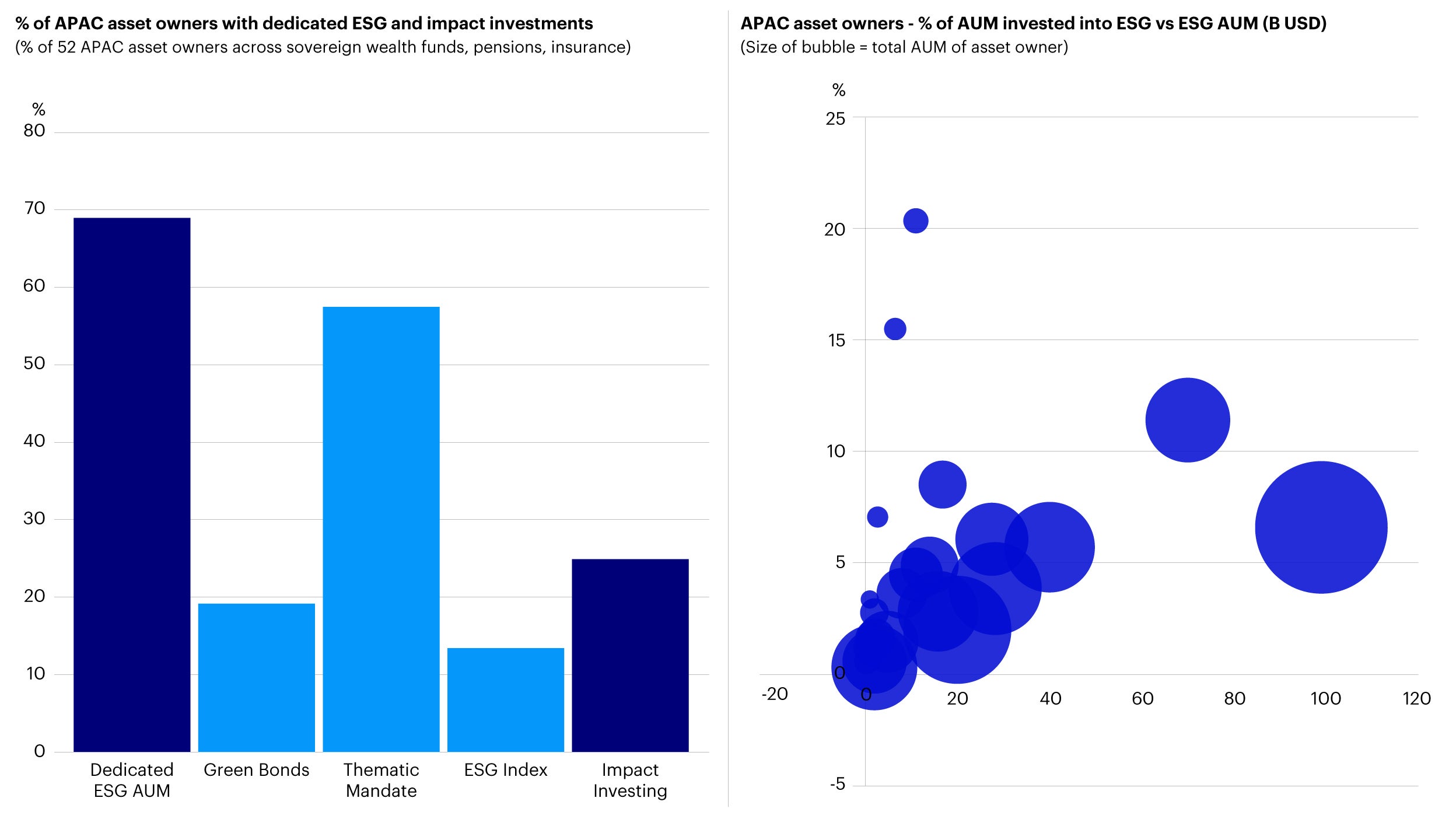

Capital deployment: Dedicated ESG and impact investments

As part of their broader ESG investment strategy, more than 70% of APAC asset owners5 have made investments into either ESG-related strategies or issuers. Within this group, some have also set longer-term ESG AUM deployment targets (as a proportion of AUM) with some also reporting on their AUM invested into ESG strategies till date. For now, of those that reported ESG AUM data, most have allocated on average between 1 to 10% of their total AUM into ESG-related investments.6 Such investments could include:

- Green and sustainable labelled bonds: In many cases these might not be top-down mandates but rather investments made as part of their broader fixed income strategies. This also allows specific targeting of use of proceeds and project areas aligned to the asset owners’ priorities.

- Thematic mandates: By far the most common approach, many APAC asset owners have previously issued ESG investment mandates including ESG leadership or positive screening strategies as well as climate-related thematic strategies.

- ESG index: Some APAC asset owners have also taken an index-based approach to ESG investment, formulating a more systematic approach of constructing ESG indexes based on different sustainability perimeters.

Source: Invesco analysis of 52 APAC asset owners based on publicly available policies and sustainability reports. Data as of August 2024.

In addition to above, another interesting trend we have observed is the growth in impact investing as a deployment asset class amongst asset owners. We previously shared our thoughts on the broader impact investment opportunity in Asia, where impact investments refer to strategies aiming to generate an intentional, measurable, and beneficial social or environmental impact. APAC asset owners that have deployed capital toward impact investing typically look to align to national development needs (where private capital can support on policy priorities), international development and aid (especially for climate financing), as well as embracing opportunities to develop their region as a hub for philanthropy and family offices. The focus of these strategies is often on intentionality (how investments lead to real world outcomes), investor contribution (impact resulting from investment or investor involvement), and on impact measurement (monitoring of intended outcomes).

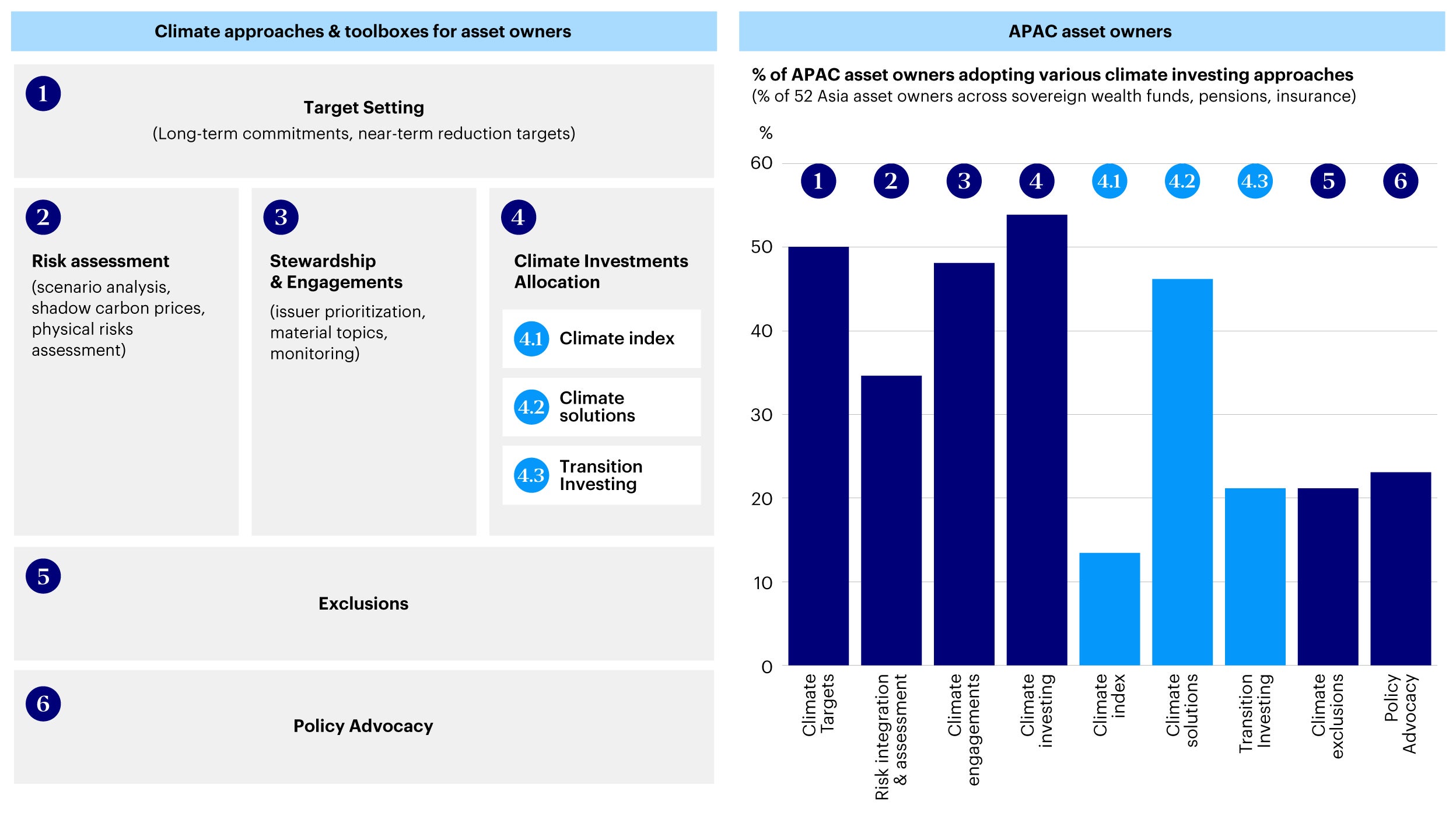

Climate, net zero and transition: Spectrum of approaches to manage climate risks and invest in climate themes

Source: Invesco analysis of 52 APAC asset owners based on publicly available policies and sustainability reports. Data as of August 2024.

Climate remains a key priority for asset owners globally, and 70% of IGSAMS 2024 respondents7 cited climate impact and transition risks as key risks for the global economy over the next decade. This is reflective of climate investment initiatives adopted by APAC asset owners which include:

- Targets: More than 50% of APAC asset owners8 have set in place climate targets as an organization. These range from longer-term net zero or carbon neutrality targets to near-term reduction targets such as reduction of emissions intensity (through weighted average carbon intensity, WACI). Average targets tend to be within ranges of a 30 to 50% reduction relative to baseline years of either 2019 or 2020.9

- Climate risk integration and assessment: 48% of global asset owner respondents from IGSAMS 2024 currently model and track their portfolio against climate goals. A third of APAC asset owners undertake similar assessments. Some asset owners also see themselves as a “universal investor or owner”, where understanding exposure to systematic risks from climate is critical in considering asset allocation and mitigation risks. Common approaches include:

- Scenario analysis: Understanding longer-term impact on portfolio valuation under different climate scenarios such as through climate valuation-at-risk figures. Consideration factors include price elasticity, costs pass-through and Scope 3 emissions.

- Shadow carbon price: Applying hypothetical costs for each ton of carbon emitted and evaluating extent of carbon liability if carbon taxes are implemented. Carbon price is a key driver of transition risks that allows the stress-testing of investees’ residual emissions after abatement, which factors into investment decisions and in constructing forward-looking portfolios.

- Physical risks assessment: Examining exposure to both physical acute and chronic climate risks and the relevant impact on a company’s physical assets, supply chains and operations. This also helps in identifying potential stranded asset risk considering companies’ mitigation or adaptation efforts as well.

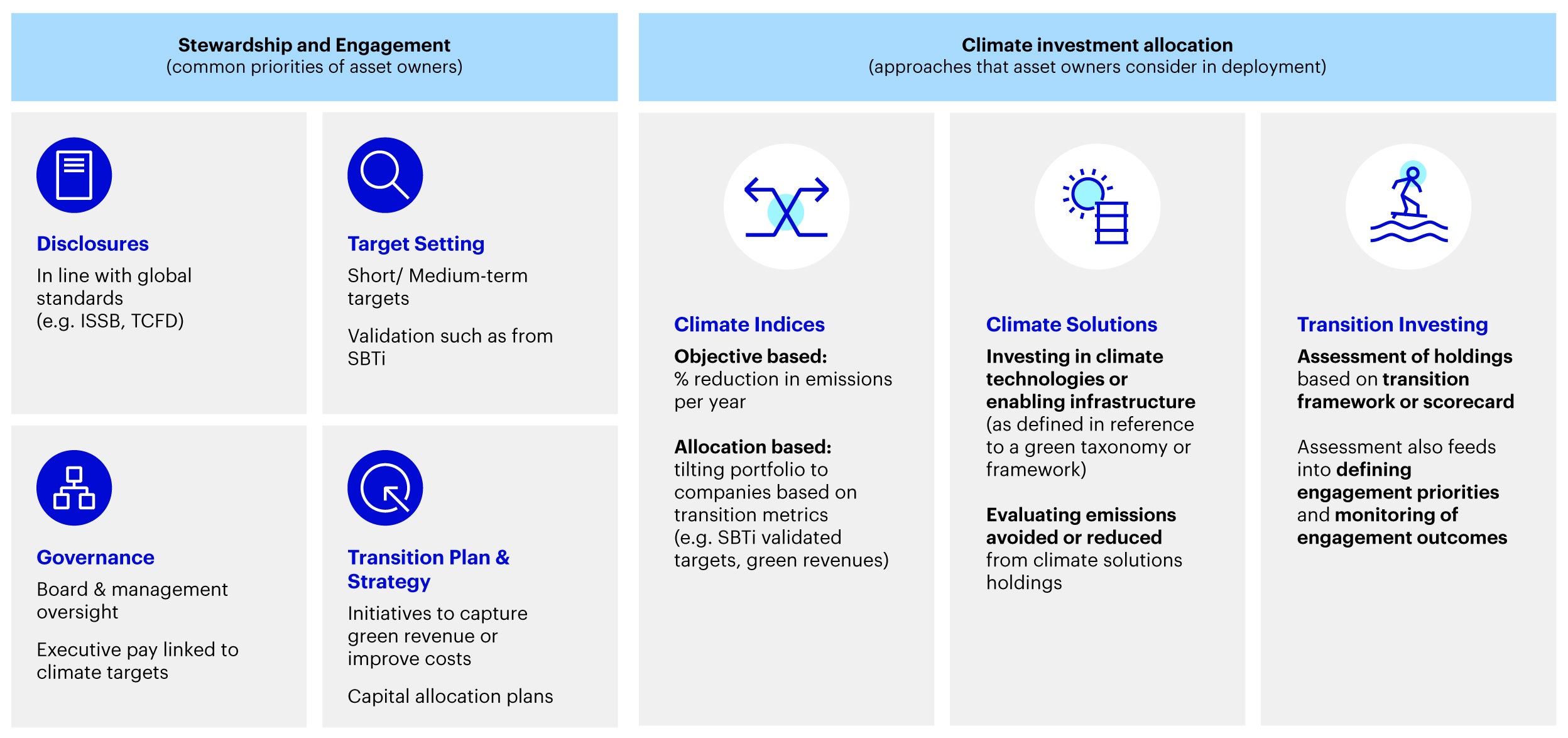

Source: Invesco analysis of 52 APAC asset owners based on publicly available policies and sustainability reports. Note: ISSB - International Sustainability Standards Board, TCFD - Task Force on Climate-Related Financial Disclosures, SBTi -Science Based Targets Initiative.

- Stewardship and engagement: 63% of global asset owner respondents from IGSAMS 202410 identify engagements as part of their approach to climate investing. Similarly, a third of APAC asset owners11 have detailed their stewardship approaches as part of their climate investment strategy to better manage systemic risks across portfolio while also driving value creation for investees. Some asset owners also focus on this as a priority topic of engagement with their external managers. Key components of an engagement capability include:

- Prioritization: Some APAC asset owners have detailed processes to identify priority names for engagements. This includes understanding the top contributors to portfolio emissions (on average asset owners target the issuers contributing to 50 to 80% of portfolio emissions12) and flagging these issuers as “priority names” or on a “watchlist”. Additionally, there might also be analysis of forward-looking transition risks including the credibility of transition plans published and transition capex impact on cashflows.

- Engagement topics: This broadly falls into categories of improving disclosures (including aligning to global standards and bodies like International Sustainability Standards Board, Task Force on Climate-Related Financial Disclosures, Carbon Disclosure Project), setting targets (such as having Science Based Targets Initiative validation), governance alignment (such as board and senior management oversight and compensation alignment) and transition plans and decarbonization initiatives (including capital allocation plans and progress on green revenues, low-carbon products or other operational improvements). Identifying the most financially material topics also feeds into setting suitable objectives for engagement.

- Monitoring and tracking: Monitoring of the engagement progress over time including tracking key items raised against plans announced or milestones achieved. For asset owners with direct investments, this also ties in to exercising their voting rights on climate-related proposals. More importantly, some asset owners will also have a process to feed back key learnings from engagements into their investment and decision-making processes.

- Climate investments allocation: 88% of global asset owner respondents from IGSAMS 202413 have made or planned allocations towards renewables and clean tech as part of their climate investment strategy. Among APAC asset owners, more than 50%14 have set aside investments into climate related themes and strategies including:

- Climate indices: Climate indices help asset owners to tilt portfolios towards decarbonization overtime while minimizing tracking error and portfolio diversification. Approaches include adopting existing industry recognized indices like Paris-aligned benchmarks to having proprietary construction using balancing forward-looking indicators like expected emissions reductions and green revenues alongside factors like liquidity and market capitalization.

- Climate Solutions: Investments in this space are often aligned to taxonomies or standards defining technologies and business activities that contribute to emissions reduction. This includes renewable energy infrastructure and assets, battery and energy storage technologies, circular economy and adaptation solutions. This also aligns to the Asia Investor Group on Climate Change’s research which shows that an increasing number of Asian asset owners have set targets for climate solutions, and more are actively considering doing so in the coming year.15

- Transition Investing: We expect multiple sectors (particularly high-emitting sectors) to be impacted by energy transition globally, creating capital and financing needs for transition. Some asset owners have started to identify opportunities in the broader theme of transitioning brown to green assets in addition to just investing in climate solutions.

- Exclusions: A select number of APAC asset owners16 have also transitioned their portfolios away from certain sectors notably those in the coal-related value chain.

- Advocacy: Select APAC asset owners17 also recognize policy as a critical enabler to accelerating energy transition. Engaging with policymakers whether on disclosures or regulatory consultations or in highlighting sectoral financing needs can help asset owners shape the systems in which they operate and invest in, leading to better financial outcomes over time.

Capital allocators: Evolving the sustainable investing landscape for the future

As mentioned in IGSAMS 2024, asset owners globally are enhancing their sustainable investing capabilities. As we’ve observed with APAC asset owners, the approaches to sustainable investing have broadened over time and serve as helpful best practices for the wider asset management industry. We look forward to continually learning and studying from these capital allocators as they invest in the broader energy transition.