AI and ESG: Investment implications across mitigation, transition and adaptation

AI has been a big driver of market and investment momentum, whether globally or in Asia.

In this piece we take an ESG lens to looking at AI, specifically analyzing investment implications that AI presents across climate mitigation, transition and adaptation.

AI & ESG: applications and implications

From an ESG perspective, AI could:

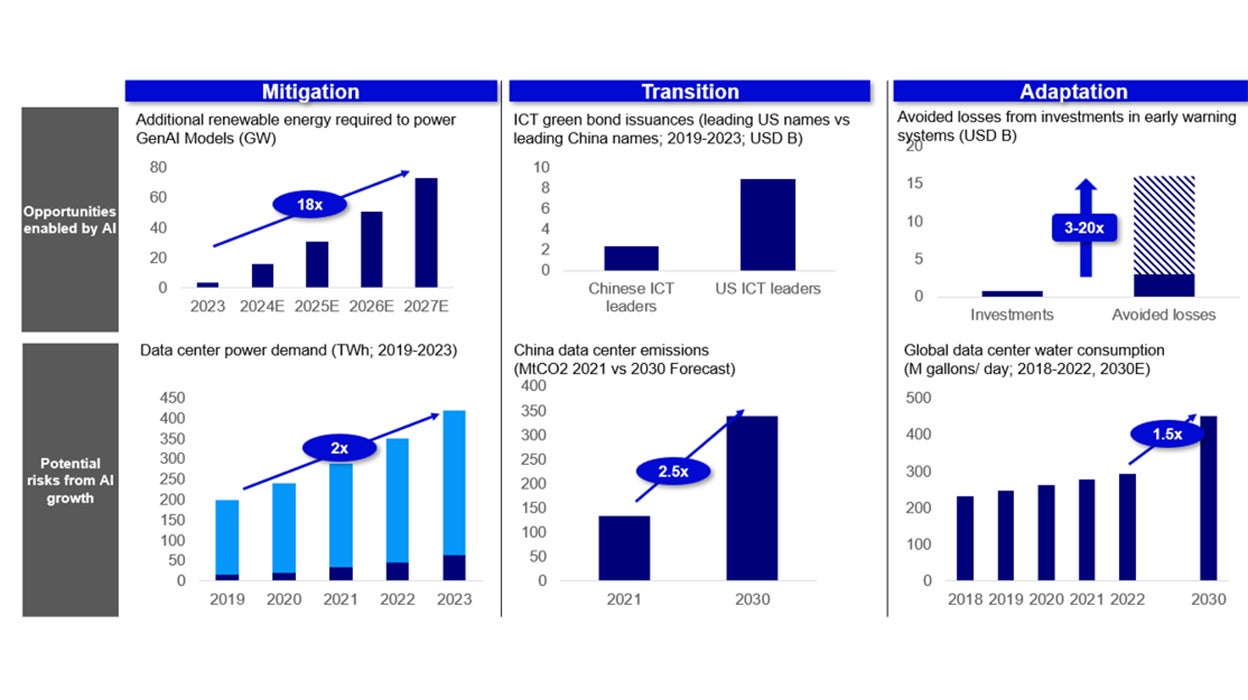

- Enable climate applications and solutions: AI, capable of accurate predictions and make more optimized recommendations, will enable broad applications and technologies that can potentially unlock insights to mitigate 5-10% of global emissions by 20301 while also increasing climate resilience.

- Create risks relating to power and water consumption: Boom in AI will lead to data centers expansion, fueling both power and water consumption. For example, rise of AI can increase water use by 20x in China2 while data center boom in China could increase Information and Communications Technology (ICT) sector emissions by 2.5x by 20303.

- Broader ESG considerations: Issues relating to diversity and access, such as on diversity of datasets for machine learning or on equitable access and disparities of technologies.

Source: MS Powering GenAI Analysis; GS AI & Data Centers (Generational Growth AI, data centers and the coming US power demand surge (goldmansachs.com)); IEA Smart Grids (Smart grids – IEA ); UNDRR, Early warnings for all, Mar 2022, https://www.undrr.org/implementing-sendai-framework/sendai-framework-action/early-warnings-for-all; Oil Price, JPM Global AI Data Centers will consume huge amounts of fresh water, JPMorgan: Global AI Data Centers Will Consume Huge Amounts of Fresh Water | OilPrice.com ; China Water Risks China ICT Transition (https://chinawaterrisk.org/wp-content/uploads/2023/09/CWR-2023-China-ICT-Transition-The-good-bad-ugly-of-5-HKEX-ICT-listcos-net-zero-pledges-climate-action.pdf#page=6 )

Mitigation

- Renewable energy growth and delivery: AI can enable better prediction of energy demand, grid optimization and integration allowing for greater energy efficiency and reliability. There will be greater renewables demand growth in line with growing power consumption from data centers. China State Grid Energy Research Institute expects electricity demand in China data centers to double to 400TWh by 2030 compared to 20204.

- Grid and infrastructure: Rising energy and power consumption create demand for grid infrastructure upgrades. More than $800B USD investments on transmission and distribution5 may be required to support the electricity growth especially in regions like Europe which have older power grid systems.

Transition

- Information and Communications Technology (ICT): ICT issuers with net zero commitments will see pressure to decarbonize data centers with construction of new data centers increasing total emissions. Many ICT issuers have committed to having data centers fully powered by renewable energy and some have become the largest purchasers of renewables PPAs (power purchase agreements) globally.6 This leads to opportunities for green financing and green bond issuances especially in China.7

- Power: Exponential power growth expected given strong AI server shipment growth and higher power consumption of silicon chip migration. ICT names with climate commitments will be prioritizing power sources with lower emissions and higher energy efficiency creating opportunities for power and energy producers with exposure to these solutions.

Adaptation

- Climate modelling & early warning systems: AI enables more accurate analysis and modelling of physical risks such as assessment of climate exposures and potential value-at-risk in supply chains. Early warning systems can better predict impending disasters such as looking at flooding patterns and weather modelling. For example, investing $800M USD in early warning systems can prevent losses of $3-16B USD in developing countries annually.8

- Agrifood productivity: Range of applications from weather assessment, optimizing planting times, soil health, monitoring pest and disease outbreaks, reducing water usage that can strengthen agrifood security and enhance productivity.

- Water stress: Total water consumption from global data centers has grown 6% p.a. from 2017 to 2022 from both on-site cooling and power generation9. Water stress could present material risks that may disrupt operations and further expansion.

Investment implications

1] Climate solutions: Identifying and investing in climate technologies and solutions enabled by AI. The Asia Investor Group on Climate Change (AIGCC's) State of Net Zero report highlights increasing number of asset owners and managers with target allocations for climate solutions10 through identifying issuers with exposure to these solutions or green revenues. Potential beneficiaries include renewable energy developers, equipment manufacturers, grid infrastructure and new technologies like nuclear. There’s also opportunity to invest in labelled fixed income instruments where use of proceeds is in scaling these solutions such as adaptation financing for areas like agriculture, water and energy security.

2] Assessing water and power risks: ICT issuers including internet, semiconductors and telecommunications names could see financially material risks relating to water and power. Many ICT names operate data centers in areas with water stress further exacerbated by continued data centers growth due to AI. These companies could face disruptions to operations unless they enhance water use efficiency and better manage against physical risks. The key is in identifying companies better prepared against such risks through assessing these companies on their transition plans, supply chain policies, green financing issuances and potential operations or supply chain disruptions.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Reference:

-

1

Source: BCG, Accelerating Climate Action with AI, Nov 2023 https://web-assets.bcg.com/72/cf/b609ac3d4ac6829bae6fa88b8329/bcg-accelerating-climate-action-with-ai-nov-2023-rev.pdf

-

2

Source: China Water Risk, China ICT running dry?, Apr 2024 https://chinawaterrisk.org/wp-content/uploads/2024/04/CWR-2024-China-ICT-running-dry-The-rise-of-AI-climate-risks-amplify-existing-water-risks-faced-by-thirsty-data-centres.pdf

-

3

Source: China Water Risks, China ICT Transition, Sep 2023, CWR-2023-China-ICT-Transition-The-good-bad-ugly-of-5-HKEX-ICT-listcos-net-zero-pledges-climate-action.pdf (chinawaterrisk.org)

-

4

Source: Neterra Cloud, AI and crypto double electricity demand of data centers by 2026, Mar 2024, https://blog.neterra.cloud/en/ai-and-crypto-could-double-the-electricity-demand-of-data-centers-by-2026/

-

5

Source: GS, AI poised to drive 160% increase in data center power demand, May 2024, https://www.goldmansachs.com/intelligence/pages/AI-poised-to-drive-160-increase-in-power-demand.html

-

6

Source: IEA Data Centers and Data Transmission Networks, https://www.iea.org/energy-system/buildings/data-centres-and-data-transmission-networks

-

7

Source: China Water Risk, China ICT Transition, Sep 2023, CWR-2023-China-ICT-Transition-The-good-bad-ugly-of-5-HKEX-ICT-listcos-net-zero-pledges-climate-action.pdf (chinawaterrisk.org)

-

8

Source: UNDRR, Early warnings for all, Mar 2022, https://www.undrr.org/implementing-sendai-framework/sendai-framework-action/early-warnings-for-all

-

9

Source: Oil Price, JPM Global AI Data Centers will consume huge amounts of fresh water, https://oilprice.com/Energy/Energy-General/JPMorgan-Global-AI-Data-Centers-Will-Consume-Huge-Amounts-of-Fresh-Water.html#:~:text=Citing%20data%20from%20Bluefield%20Research,450%20million%20gallons%20per%20day.

-

10

Source: AIGCC State of Net Zero Investments AIGCC-State-of-Net-Zero-in-Asia-Report_5-4-24.pdf