5 Asia ESG investment ideas for 2024

In 2022, we shared our views on ESG opportunities and risks in Asia. Two years on, while the macro and geopolitical context has changed, trends such as energy transition and ongoing secular regulatory developments have remained a constant. The key question is how to turn these trends into actionable investment ideas. As we enter 2024, we present a framework for ESG asset allocation and share five Asia ESG investment ideas that are capturing our attention.

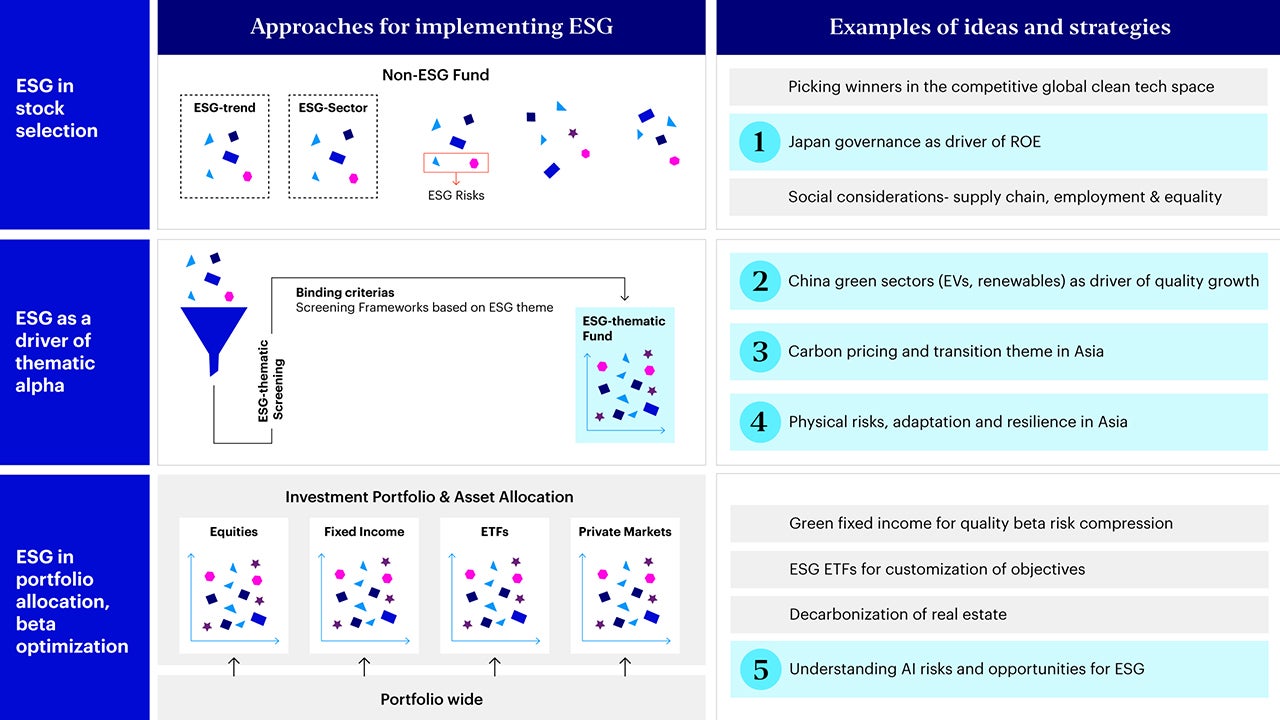

ESG asset allocation and investment strategies

Source: Invesco, for illustrative purposes only.

The global ESG trends we shared in our ESG outlook can be translated into investment ideas and strategies on multiple levels including stock selection or sector allocation, thematic strategies and broader asset allocation opportunities.

- Sector or stock allocation: Relevant trends can present opportunities through exposure to sectors or issuers or pose material risks that impact investment or engagement decisions. Notable opportunities include identifying winners from the continued growth in global renewables, Japanese governance reforms as well as supply chain and social risks.

- Thematic strategy: ESG-related thematic strategies can arise from various longer-term trends that promise sizeable market growth and have a wide impact on multiple sectors. We previously shared our investment thesis on climate mitigation, adaptation, and transition and in this piece, we examine specific Asia opportunities relating to China green sectors, carbon pricing and all things related to transition and physical risks and adaptation financing.

- Asset allocation: Finally, taking an investment-led approach to ESG investing, different asset classes can cater to different investment objectives. Green and sustainable fixed income can enhance risk compression and enable the selection of higher quality credit. ESG ETFs allow for the customization of investment preferences while the decarbonizing of real estate suits investors looking to obtain real assets exposure while pursuing climate related outcomes. Certain macro and structural trends may also impact longer-term asset allocation particularly the role of AI in ESG related themes.

Five Asia ESG investment ideas for 2024

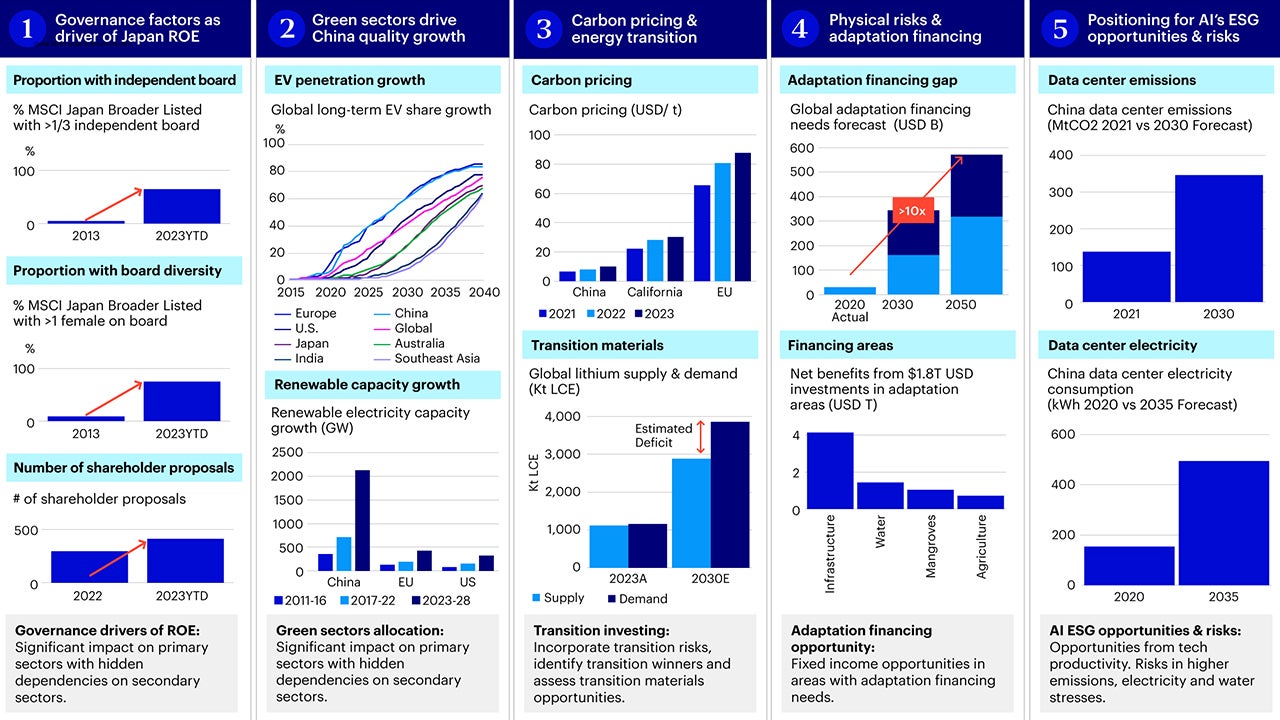

Source: RIMES, Morgan Stanley Research (2023Q3); MSCI, FactSet, Bloomberg; Bloomberg NEF (EVO Report 2022 | BloombergNEF | Bloomberg Finance LP (bnef.com)); IEA (Renewables 2023 (windows.net) ; Wood Mackenzie, Company Filings, UBS estimates. ; ICAP (Allowance Price Explorer | International Carbon Action Partnership (icapcarbonaction.com) ) ; China Water Risks China ICT Transition; Data Centre Magazine (China’s data centres to use 222% more power by 2035 | Data Centre Magazine )

Based on the above asset allocation framework, we present five ESG investment ideas for 2024:

1. Governance factors as a driver of return on equity (ROE) in Japan

Japanese stocks have experienced increased investor momentum recently, driven in large part by a push by the Tokyo Stock Exchange (TSE) to pressure Japanese companies to undergo corporate governance reform. In a name and shame regime, the TSE has committed to publish a list of companies that are meeting goals to improve capital efficiency and drive better governance every month starting 2024. The TSE’s frustration is well founded as Japan equities’ ROE levels have lagged global peers for years, and markets have punished them with lower valuations. Until recently, about 60% of Japanese 'standard' listings had an ROE of less than 8% and were trading at price-to-book (P/B) ratios of less than one1. The first list in January of this year revealed that coercing Japanese companies to change may take more effort. While 40% of firms on TSE’s prime section disclosed improvement plans, only 12% of companies on the standard section of the exchange did2. As a result, Japanese equity returns could experience some dispersion going forward. Governance improvers would appeal to value investors and those looking to identify mispriced assets. By the same token, those companies more reluctant to reform could get penalized by markets. Investors can focus on key governance metrics for Japanese companies this year in areas such as shareholder structure, board diversity and investor engagement and can watch for other outright restructuring measures.

2. Green sectors as a driver of China quality growth

China’s economy is at a pivotal moment of structural change. As the debt-fueled expansion in property and infrastructure has become more unsustainable, policymakers have been keen to emphasize “high quality development”, supporting green sectors such as electric vehicles (EVs), batteries and renewables to take up the growth baton. These three sectors have frequently been referred to as the “new three”, boosted also by shifting priorities from policymakers to double down on decarbonization efforts. Already, China has invested more than any other country in clean energy, creating Chinese companies that are world leaders in renewable energy manufacturing. This trend is expected to continue. The International Energy Agency estimates that China will account for close to 60% of renewable energy capacity additions in the 2023-28 period3. Other green sectors such as EVs have also seen exponential growth particularly in export opportunities. In 2023, China overtook Japan as the largest passenger car exporter, and a significant portion of those were EVs or hybrids. Chinese EV production volume has grown from just 1 million units in 2018 to 6.7 million units in 20224. In sum, we expect Chinese equities exposed to these longer term decarbonization trends and resulting policy support, to benefit.

3. Carbon pricing and energy transition opportunities in industry and materials

Energy transition continues to be a secular theme on many investors’ radars. This includes incorporating material transition risk considerations and identifying transition leaders. There has been increasing regulatory emphasis on transition, be it on clarifying definitions such as ASEAN or Singapore-Asia taxonomies5 or on transition planning guidance (such as by the MAS6 and HKMA7). Once carbon is fully priced in by investors, we will see this theme gain traction. Carbon pricing is still in its early stages in Asia but is seeing increasing momentum. China’s emissions trading scheme (ETS) reached record prices in 2023 to as much as 70 RMB per ton8 and eyes are also on the potential relaunch of the voluntary carbon market scheme CCER (China Certified Emission Reduction). At the same time, Japan’s Green Transformation (GX) Basic Plan is also expected to drive carbon levy and trading development9. We believe investors will need to assess companies with the relevant transition framework such as by looking at capacity to drive ROE from green capex and green revenues to identify transition winners. Transition growth will also create a demand-supply gap for critical materials used in green sectors like renewables and EVs. Vertically integrated players and those with increased focus on the circular economy and materials recovery would be better positioned longer-term.

4. Physical risks and opportunities for adaptation financing

Physical risks will likely drive increased losses and economic impact on sectors like water, food and agriculture supply as well as lead to infrastructure damage, insurance costs and supply chain disruptions. Annual projected insured losses from natural catastrophes are expected to surpass $100B USD in 202310. For equities, we expect those companies that adopt adaptation solutions and increase resilience in areas like energy and electrical appliances, water-related equipment and energy storage, to see longer-term demand. While corporates’ initial revenue alignment may not be significant, such exposure offers investors good thematic and sector diversification in climate-themed portfolios. Investors can also look deeper into the physical risks of companies by sector, such as maintenance, operation and insurance expenses in real estate or material shortage and cost inflation for agriculture and food. Fixed income offers a direct approach to support adaptation financing and impact by channeling use of proceeds towards specific projects. This also focuses on addressing significant financing gaps through blended finance instruments.

5. Positioning for ESG opportunities and risks arising from generative AI

The boom in generative AI will continue to have implications across sectors and themes. For one, we believe it will enhance the operationalization of ESG investing by aiding in the collection and analysis of unstructured ESG data or the identification of companies aligned to key ESG themes. We expect AI itself will also lead to innovation and productivity gains for transition and adaptation by optimizing energy production and consumption, enabling predictive analytics for energy demand, and facilitating early warning systems and natural disaster prediction. At the same time, the growth of AI will likely create demand for more data centers with a corresponding increase in emissions, power demand and water usage- some of which may create material ESG risks that investors may wish to consider.

Executing ESG ideas in 2024

When examining these various ESG trends, the critical question is when these trends will get priced in. As always, timing is everything. We have intentionally selected a breadth of time-differentiated ideas, some with nearer-term horizons and others with longer-term positioning. We believe these secular trends will continue to impact investors’ portfolios and allocation decisions in the year ahead.