Where next for emerging tech and AI in Asia?

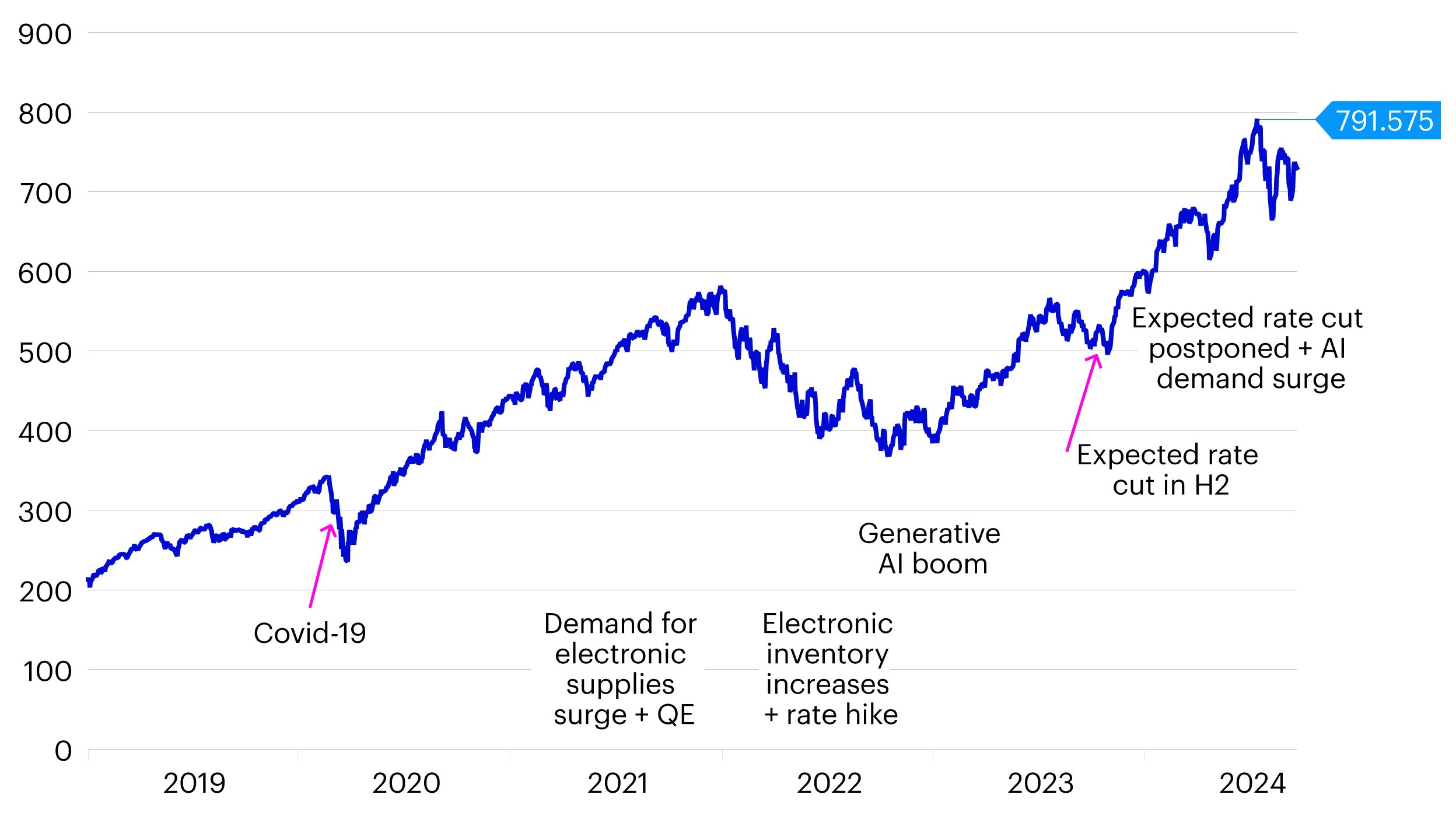

We’ve seen significant volatility in global equity markets since mid-July with rising investor concerns about a slowdown in the US economy and the overheating of tech stocks. While this led to a short-term sell-off in AI and semiconductor names in recent months, we still believe there are ample opportunities in the AI and parallel computing sector from both a supply and demand standpoint.

The recent market turbulence has primarily been due to weakening US non-farm payroll data and a drop in the US manufacturing PMI (Purchasing Managers Index) stoking fears of an economic recession. At the same time, uncertainty caused by product line adjustments at the world’s largest AI computing chip producer, has temporarily impacted market confidence.

Despite these headwinds, on the supply side, our long-term revenue expectations for semiconductor manufacturers and companies at various stages of the AI supply chain have not changed. In terms of demand, we are seeing major cloud service providers continue to invest in AI data centers with multi-year plans for this space. Software companies and the governments of several countries are also being urged to develop related AI functions and services.

Source: Bloomberg, data as of September 17, 2024.

Investment implications

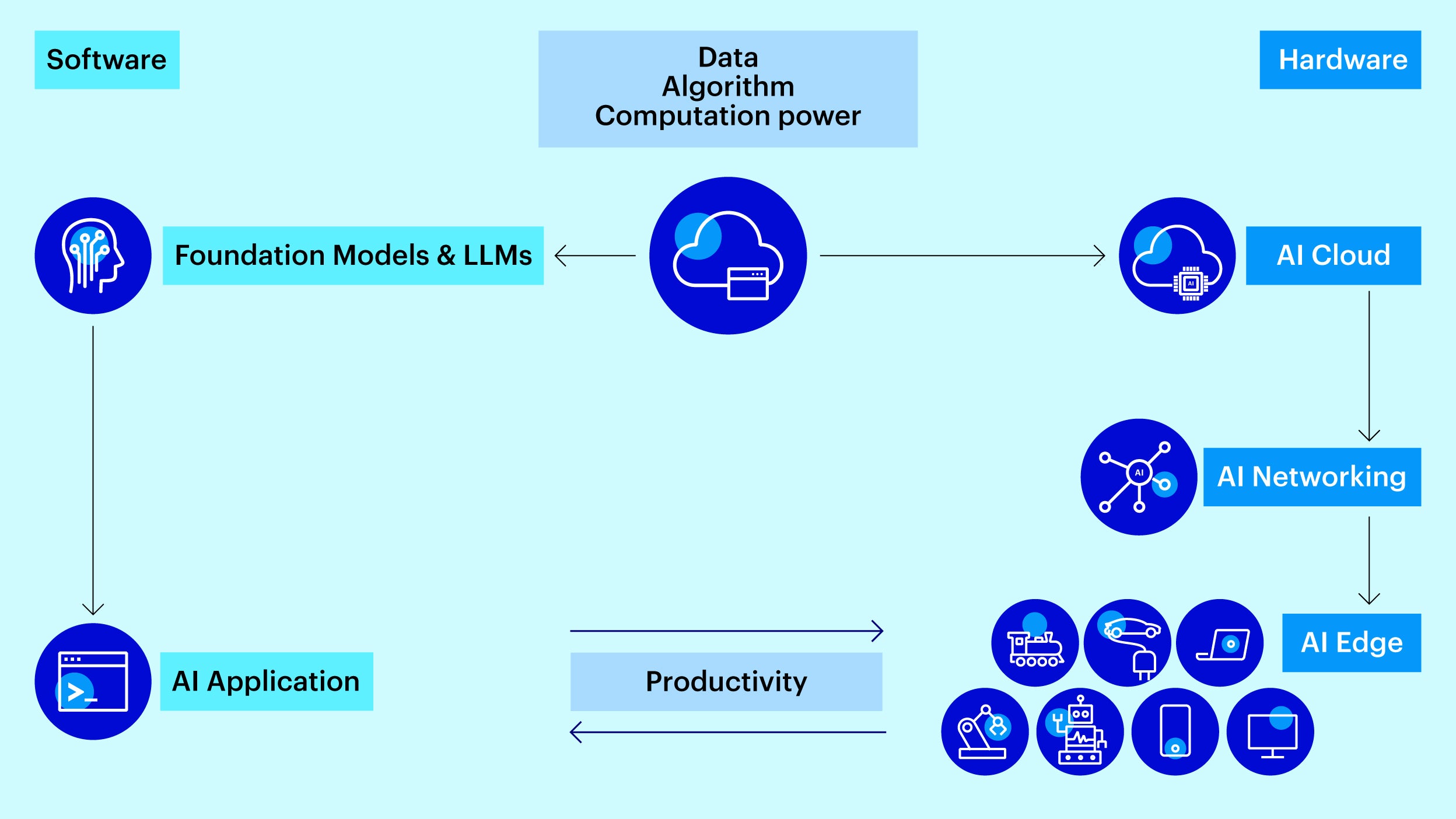

We believe we are in an Internet of Everything and parallel computing era. The advent of generative AI has caused a market boom. Despite the short-term correction, we expect to continue to see strong demand for tech stocks as new applications for the technology emerges. In our view, investors looking to participate in AI trends will need to adopt a dual approach, integrating both hardware and software, and look to invest globally.

We are positive on Asian companies in various emerging technology sectors including AI, the metaverse, automation intelligence and robotics, autonomous vehicles and alternative clean technologies. We believe these applications will integrate further in time to create new applications and areas of demand. For example, smart manufacturing in Asia integrates AI, the metaverse and robotics, while FSD (full self-driving) is an AI application integrated with autonomous vehicles.

Source: Invesco, for illustrative purposes only.

We like AI supply chain names from Taiwan, Japan and Korea. These companies are at the forefront of the industry globally and continue to improve their manufacturing processes. We see huge demands for cooling systems, advanced packaging and application-specific integrated circuits (ASIC) as well as the intellectual property for these areas. Silicon photonics technology, by replacing electrical signals with optical signals for high-speed data transmission, is the next key technology that companies are looking to develop for faster data processing. We are also positive on China’s tech giants and other companies developing AI-related technologies as well as Chinese semiconductor manufacturers.

Looking ahead, we think the combination of discriminative and generative AI in end devices has the potential to enhance consumer experiences. The market is shifting from a focus on AI servers toward end applications, which could further stimulate a new wave of upgrades. At the same time, we are closely monitoring potential investment risks to this thesis including the upcoming US presidential election and the slowing pace of global economic recovery.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.