Where do we see value in Korean equities?

In this Q&A we speak to Fiona Yang, Fund Manager, Invesco Asia & EM Equities, on where she sees opportunities in Korean equities, which other Asian markets look attractive, and what the potential risks could be to Asian stocks in the current environment.

Q: What is your market outlook for Korean equities in the year ahead?

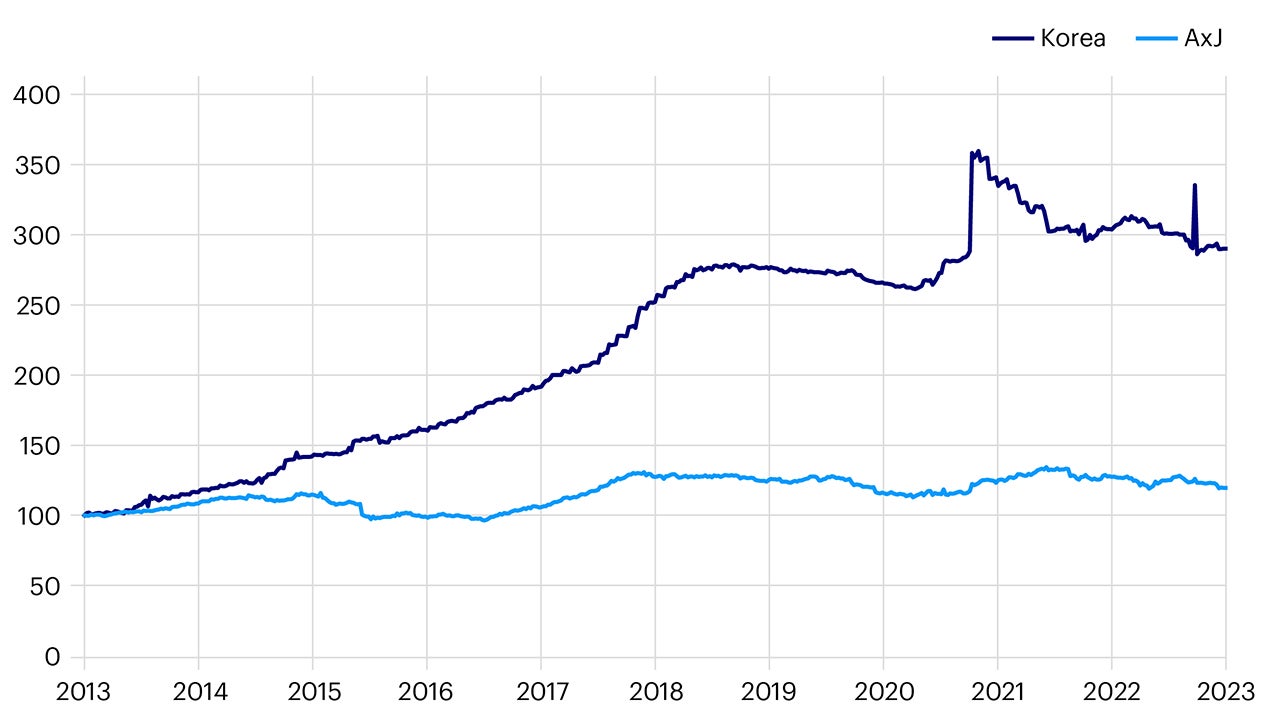

A: We are positive on Korea equities for the near term. This market has historically traded at a deep discount relative to its Asian peers. We’ve recently seen a paradigm shift in terms of corporate governance as regulators have stepped in to improve market access for foreign investors and amended tender offer rules to protect the interest of minority shareholders. There have also been major changes in shareholder return policies which have caused dividends per share on Korean stocks to grow by around 300% over the past decade.1

Source: Refinitiv, data as at 30 June 2023. For illustrative purposes only. Past performance is not a guarantee of future results.

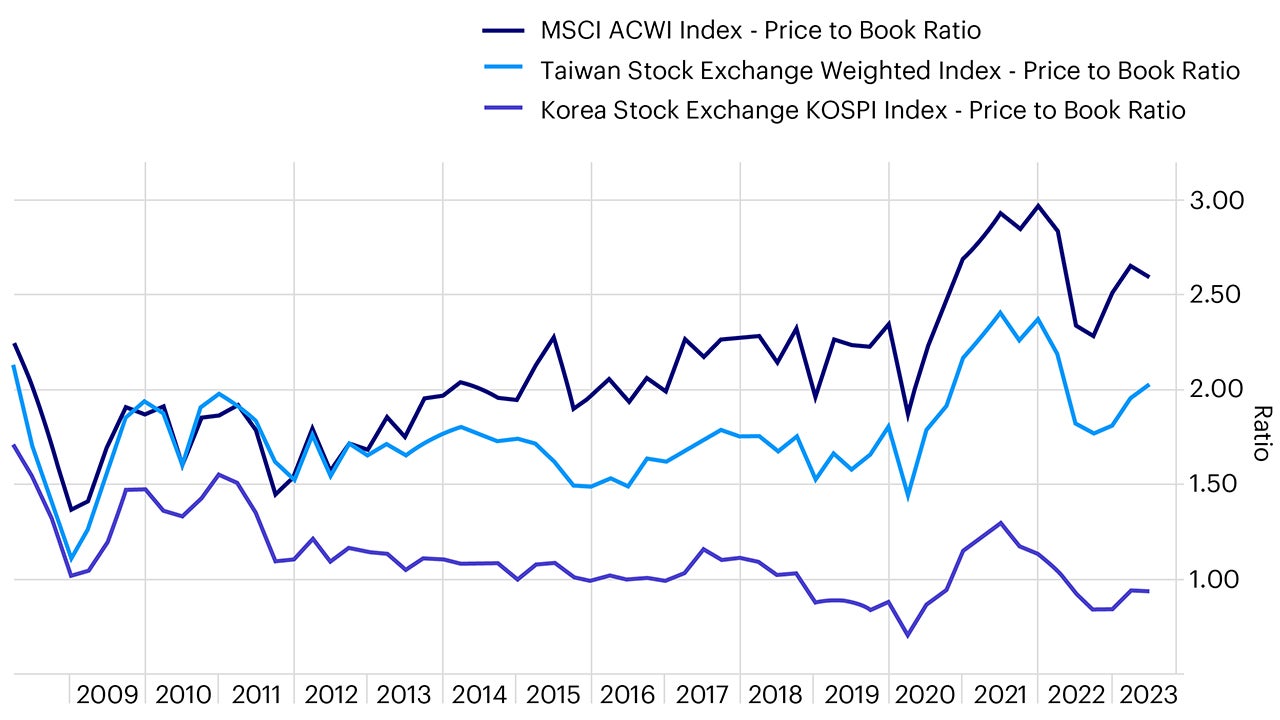

We believe Korean stocks are likely to enjoy a cyclical recovery going into the next year. Net profit growth expectations for companies are over 50% for 20242 and the equity market typically moves ahead of such strong earnings prospects. Korean equity valuations are still low at 1x price-to-book3, trading a deep discount to the likes of Taiwan and India. This valuation discount could narrow however on the back of a strong earnings recovery and more significant improvements in corporate governance.

Source: Bloomberg. For illustrative purposes only. Past performance is not a guarantee of future results.

Q: What does the Bank of Korea’s recent rate decision indicate about the health of the economy?

A: The Bank of Korea (BoK) left rates unchanged at 3.5% in mid-July since core consumer price index (CPI) has come down close to the targeted 2% level.4 We do not expect an interest rate shock in Asia in the near term given the much milder inflationary environment compared to developed markets. Most central banks have already paused their rate hikes ahead of the Fed. We believe the BoK is waiting for Fed to pause before they cut rates more meaningfully to stimulate growth.

Q: Which sectors do you favor right now in terms of Korean stocks?

A: We like the dynamics playing out in the memory sector which leads us to have an overweight in this part of the market. Looking back to the 1940s, there were over 40 manufacturers in the dynamic random-access memory (DRAM) market. Fast forward to the present day and just three major players dominate. In 2019 we saw these firms respond to lower prices with capital expenditure cuts, thus sowing the seeds for better pricing as and when supply meets demand and a renewed bull cycle given the lead times required to add supply in the next cycle. We see this cycle repeating as these companies have been more focused on improving profitability in recent months rather than on gaining market share at all costs.

Demand drivers have also become more diversified. In the 1990s, DRAM demand was dominated by PCs and then in the 2000s mostly by mobile phones. Nowadays demand comes from PCs, mobile phones and servers thanks to the rapidly increasing computational power needed across all these devices. At present we are observing rational and disciplined capex decisions from all three DRAM players. We therefore expect the demand and supply imbalance to be resolved much earlier than the market anticipates.

We are also overweight on the EV supply chain and expect distinctive gains in the coming year given the Inflation Reduction Act that has been introduced by the US. We expect the three major Korean EV battery manufacturers to make up over 80% of the US EV battery capex over the next decade. We believe strong order momentum and margin expansion will continue to drive earnings growth for companies in this sector.

Q: Apart from Korea are there any other Asian markets that look attractive from an equities standpoint?

A: We currently also like Vietnam from a structural standpoint. Vietnam has been benefiting from supply chain diversification and favorable demographics in recent years. While policy tightening in the real estate sector has had a ripple effect on the economy and this market, the government swiftly stepped in to mitigate the impact of this.

Q: What are the major risks to Asian equities right now that might keep you awake at night?

A: A deeper than expected global recession. This is likely to impact Asian economies significantly given the expected capital repatriation from emerging markets back to the US. Yet, looking back to the Global Financial Crisis, although Asia underperformed at the outset, by 2010 to 2011 Asian markets recovered at a faster pace than their global peers because of the stronger policy response coming out of the region. Another threat is the systemic risk coming out of China right now, especially in the real estate sector since it is a significant part of China's GDP.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

Refinitiv

-

2

Bloomberg, data as of July 2023

-

3

Bloomberg, data as of July 2023

-

4

Monetary Policy Decision & Opening Remarks to the Press Conference(July 13, 2023), July 2023, https://www.bok.or.kr/eng/bbs/E0000627/view.do?nttId=10078380&menuNo=400022&pageIndex=1