Re-globalization series: What’s driving China’s economic transformation?

Given the Covid pandemic, geopolitical environment and policy uncertainty, the past three years haven’t been easy for investors focusing on China. Stimulus measures have been hard to predict, and the market has oscillated from being risk-on to risk-off. However, as the saying goes, it’s only when the tide goes out can you know who’s swimming naked. Instead of looking at naked swimmers, we are focusing on the companies that are not. In this piece we look beyond the noise and answer a key question on whether China still investable and if yes, where can we invest?

For the first ten years after China joined the World Trade Organization in 2001, export and domestic investment led the strong growth of GDP. So, export and domestic investment-related companies performed well, including Chinese banks. Then from 2011 through to 2021, consumer companies targeting domestic consumer demand were attractive. However, in the past two years, investment, export, and domestic consumption-related firms have been slowing. So how do we approach the next decade?

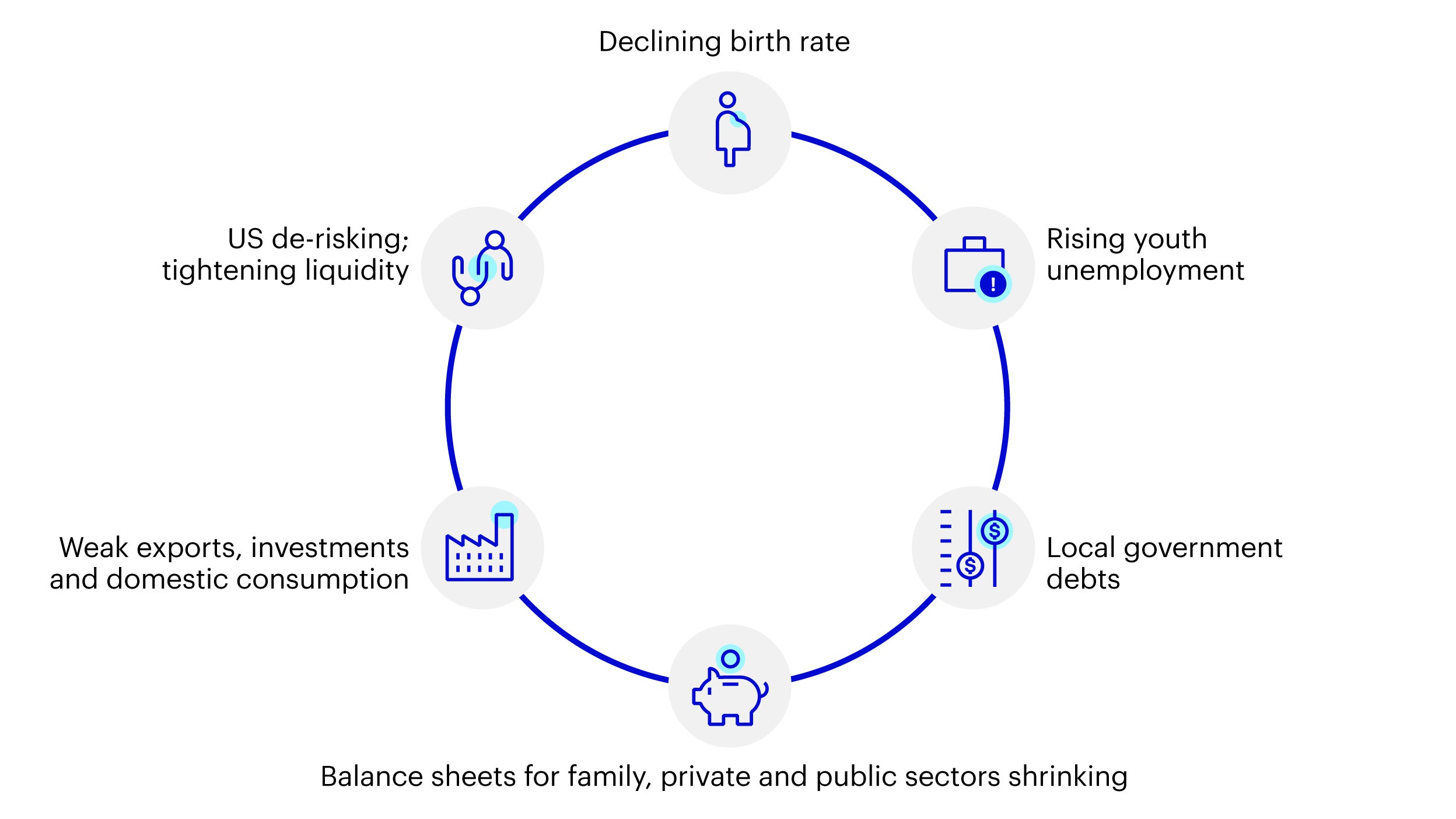

China’s economy faces significant challenges including a declining birth rate, rising youth unemployment, and rising local government debt levels. Exports, investments, and domestic consumption are weak and both public and private sector balance sheets are shrinking. On the external front, US de-risking and tightening liquidity due to the Fed’s rate hiking cycle is likely to persist for some time. We believe these six factors will continue to impact economic growth.

Source: Invesco, for illustrative purposes only.

Yet looking ahead we believe China’s economy will benefit from the key trends of re-globalization and greenization. These will rely on six competitive advantages as mentioned in our earlier piece:

- Diligent and efficient labor force

- Strong entrepreneurship culture

- Large domestic market, well-established infrastructure, access to large overseas market

- Large supply of inexpensive engineers

- Low funding costs and strong policy support for investment and business development

- Robust growth of AI/digitalization/automation

Since the 1990s, Japan and China have shared several similarities in terms of the domestic macro environment including declining population growth, reduction in working age population and falling property prices. Japanese companies have managed to side-step these macroeconomic pain points by expanding their businesses overseas, a process we term re-globalization. Taking from Japan’s experience, an increasing number of Chinese enterprises are now building franchises overseas to leverage on global demand for Chinese products. In doing so, China is evolving from “the world’s factory” to “a global local supply chain”, where the emphasis shifts beyond GDP growth towards GNP growth.

For Chinese suppliers, a global supply chain can enhance innovation, global experience and knowledge as well as expand their client base. Therefore, we believe EPS growth, rather than PE multiples, will be the share price driver for Chinese companies going forward. As companies expand abroad, we expect them to have a higher return-on-equity in the longer-term and more sustainable global growth.

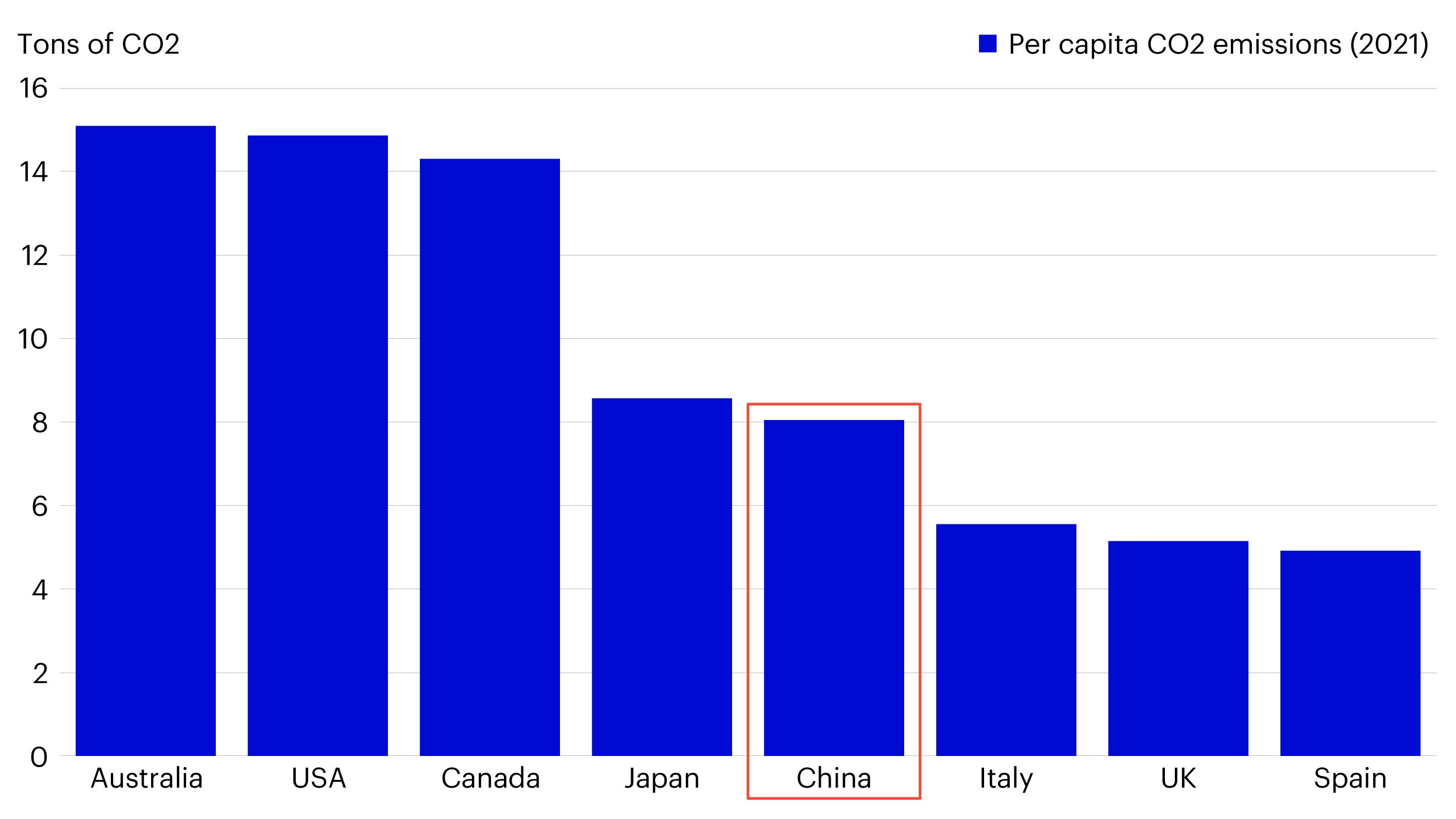

Another major trend that we believe will benefit China’s economic growth is their path to decarbonization or, greenization. China is the largest carbon dioxide emitter in the world, accounting for nearly 31 percent of global emissions in 2021.1 While this poses a major challenge for policymakers, it also presents an opportunity to be at the forefront of the world’s green energy transition.

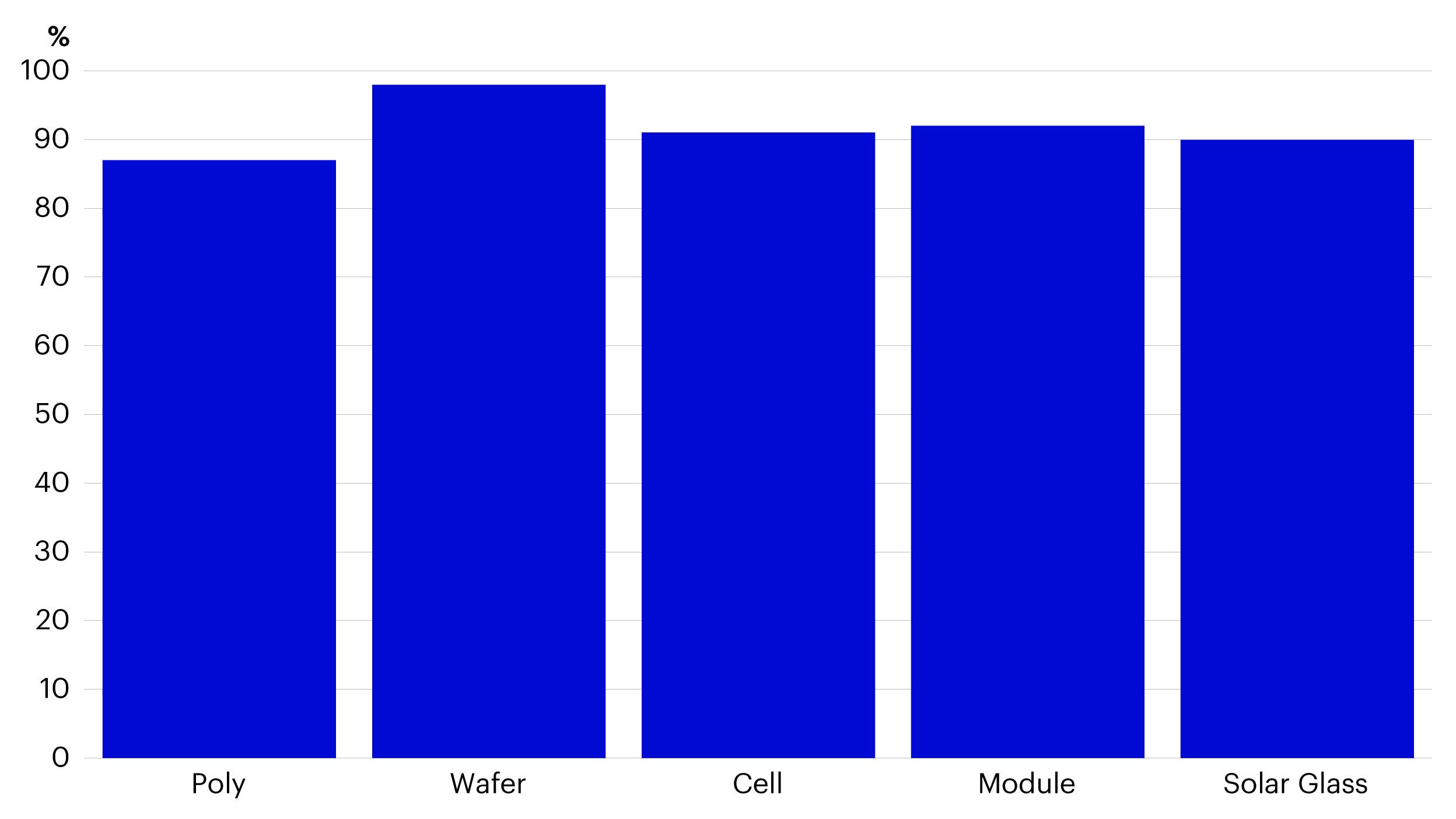

China is the largest producer of wind and solar power globally and boasts the largest electric vehicle (EV) industry. The country dominates renewable energy development and manufacturing, particularly as it relates to solar and wind power as well as EV supply chain. China’s exports of solar PV, wind turbines, and energy storage equipment was worth around US $100 billion in 2022 according to energy research firm Wood Mackenzie.2

Source: Company data, Goldman Sachs Global investment Research, Gao Hua Securities Research, March 2023.

Over the past decade China has made significant steps toward reducing carbon emissions to meet the goals of achieving peak carbon by 2030 and carbon neutrality by 2060. As a result, we are seeing high single digit declines for China’s CO2 per capita on a year-on-year basis. For example, major projects have been underway to transform deserts to grassland. By 2025, China plans to restore an additional 6.7 million hectares of desert areas with forests and grasslands, adding to the 18.8 million hectares (around the size of Syria) that has been recovered over the past decade.3 The Three-North Shelterbelt Project has planted over 35.6 million hectares of forests and aims to increase forest cover from 5% to 15% in the area by 2050.4 The project has stopped the expansion of Gobi Desert and decreased sandstorms as well as tackling food insecurity and global warming.

Source: Our world in data, 2021 (latest available data)

In conclusion, in terms of where we see value in China’s equity market, we believe that companies that are part of the reglobalization and greenization trends will demonstrate higher growth. We are seizing opportunities in the dynamic investment landscape by tapping into the potential of green transformation and the global expansion of Chinese companies. We are focusing on companies with a strong competitive edge, rising market share, solid balance sheet and cash flows and those with greater potential for global expansion.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.