Takeaways from China’s Two Sessions point to continuation of growth recovery

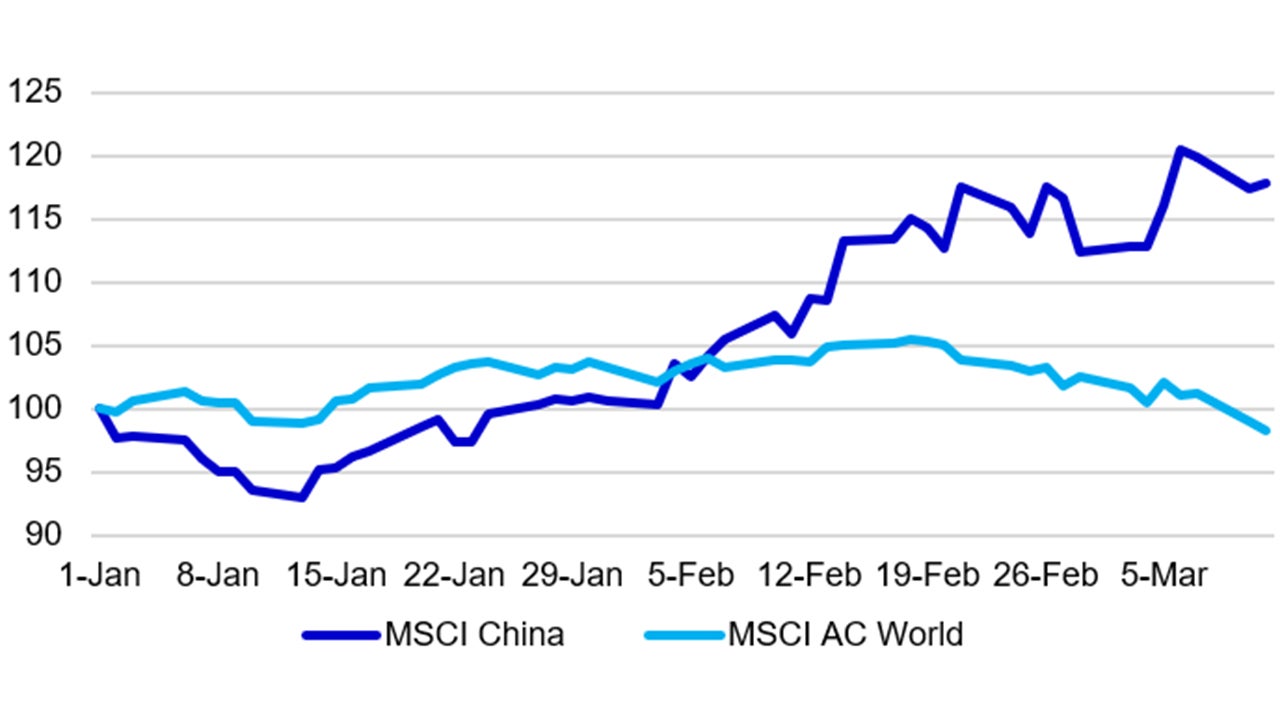

Market sentiment in Chinese stocks has been further lifted following the “Two sessions” – MSCI China Index has been up 17% YTD.1

A bright spot for this year’s Two Sessions is the emphasis on domestic consumption, and new focus on AI and technology advancement.

The recent DeepSeek breakthrough and the Two Sessions’ emphasis on technology and AI have clearly led investors to re-assess the growth potential of Chinese equities and whether they have adequate exposure to this asset class.

With the government’s commitment to boost domestic consumption and focus on new growth drivers in AI and technology, we believe that re-rating of Chinese stocks will continue, which could present opportunities for investors to add exposure to Chinese stocks.

What is the Event?

The “Two Sessions" is a key event that decides on China's development agenda including growth targets.

China set a roughly 5% growth target for 2025.2 It also announced proactive fiscal policy, a record high budget deficit to 4% of GDP in 2025, up from 3% in 2024.3

China also plans to issue RMB 1.3 trillion ultra long-term special treasury bonds this year, up from RMB 1 trillion in 2024.4

Out of this RMB 1.3 trillion, RMB 300 billion will be used to support the expanded consumer subsidy scheme for electric vehicles, appliances and other goods.5

On the tech front, the government pledges to support the extensive application of large-scale AI models and to develop new-generation intelligent terminals and smart manufacturing equipment, including intelligent connected new-energy vehicles, AI-enabled phones and computers, and intelligent robots.

Source: Bloomberg, 11 March 2025

Investment Implications

AI and technology

According to Goldman Sachs Research, China’s AI adoption rate was originally estimated at 10-20% by 2030. However with the recent AI development in China and DeepSeek breakthrough, it now expects AI adoption rates in China to exceed 30% by 2030.6

We believe that, as the government is gearing to support the extensive application of large-scale AI models, this could benefit the development of frontier technologies, such as biomanufacturing, quantum technology, AI-linked robotics and 6G technology.

Not only does DeepSeek help improve efficiency, but it does also create new demand in the economy. For example, the need to have stronger computing power across various industries means new demand in cloud service and hardware.

Tech companies are expected to significantly increase their AI-related spending in the coming years as they develop AI infrastructure, platforms, and applications.

Already, a leading e-commerce company has announced RMB380 billion (US$52.4 billion) capital expenditure for computing resources and AI infrastructure.7 The is likely to draw local peers into the fray.

Domestic demand

China has room to boost domestic demand - its household spending is less than 40% of annual economic output, some 20 percentage points below the global average.8

During the Two Sessions, the government announced supportive measures including expansion of consumer goods trade-in program which will receive RMB300bn funding support from ultra-long special treasury bonds (vs. RMB150bn last year).9 We expect this to further stimulate consumer spending and sentiment.

The budget also announced measures to improve social services, including education spending, elderly care, childcare, and domestic services, which can encourage consumption in the long run.10

Investment opportunities

Internet services and online gaming companies

Many large Chinese tech giants are listed in Hong Kong with solid earnings. Their businesses, which are diverse and well-established, could now integrate their AI interface with AI models like Deepseek.

Internet companies and search engines can become more sophisticated by leveraging AI to better understand user intent and personalize results. This could potentially boost revenue.

It is anticipated that AI automated online advertising will gain popularity, utilizing large models to analyze user behavior, and further increasing revenue and profit in the advertising business.

On online gaming, AI's impact on 2D and 3D art generation is progressing faster than expected, leading to innovative online games and reducing R&D expenses.

Consumer electronics

The government announced subsidy policy for smartphones, tablets and wearable devices - already 20.1 million consumers have applied for subsidies to buy 25.4 million units of electronic products such as mobile phones in 3 weeks time.11

We believe the trade-in subsidy scheme can benefit the consumer electronics industry, including smartphones, laptops, tablets, and wearable devices, and continue to drive industry growth.

Product upgrades in consumer electronics, driven by technological advancements, are transforming the industry. The rise of energy-efficient and customizable appliances is enhancing user experience and leading to increased revenue of consumer electronics.

Meanwhile, Deepseek is anticipated to significantly lower AI training and inferencing costs, which will boost the adoption of AI applications and drive demand for edge AI devices.

The launch of AI PCs and AI smartphones is anticipated to boost consumer enthusiasm. Along with the onset of product replacement cycle, could invigorate the market and propel a steeper growth trajectory.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Footnotes

-

1

Source: Bloomberg, March 11, 2025

-

2

Source: Xinhua, March 6, 2025

-

3

Source: Xinhua, March 6, 2025

-

4

Source: Xinhua, March 5, 2025

-

5

Source: China Daily, as of March 12, 2025

-

6

Source: Goldman Sachs, March 6, 2025

-

7

Source: SCMP, as of February 26, 2025

-

8

Source: Reuters, as of March 5, 2025

-

9

Source: China Daily, as of March 12, 2025

-

10

Source: Xinhua, March 7, 2025

-

11

Source: Xinhua, February 10, 2025