Signposts for China’s economic recovery

The Chinese market shows a positive recovery trend year-to-date, with the market index rebounding 13% since the trough in January 20241.

We believe that two significant signposts, including export data and electricity consumption, can provide insights into the momentum and growth of the Chinese economy.

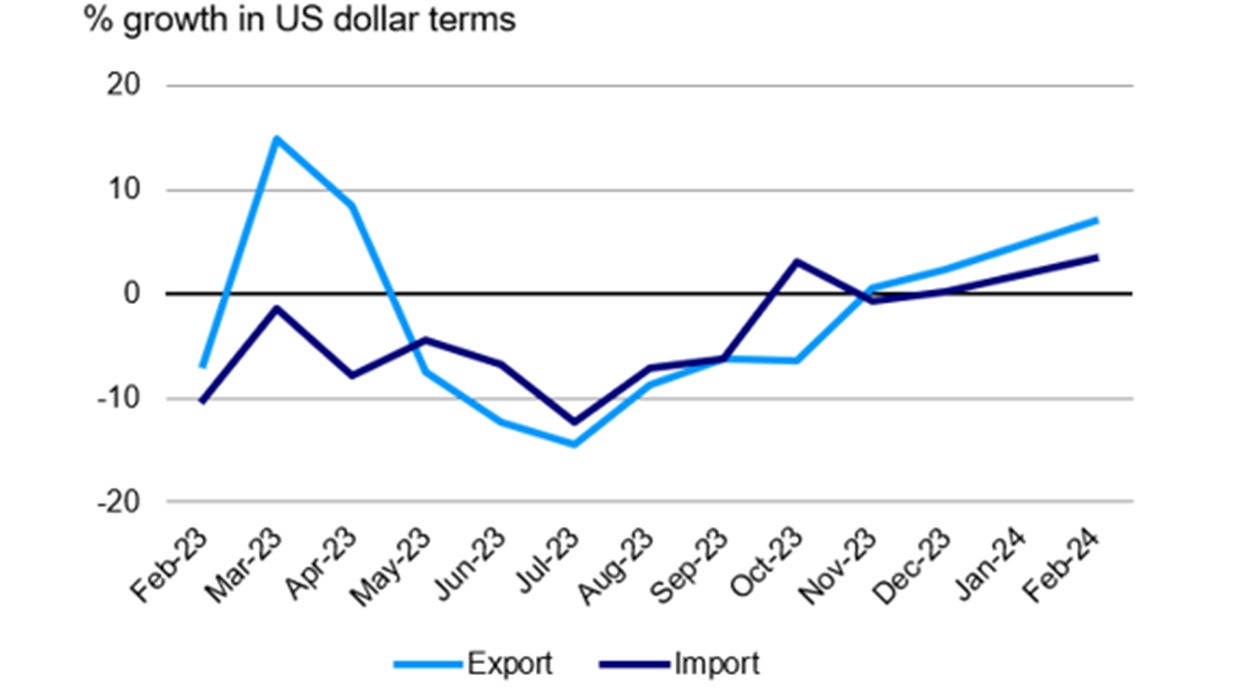

1.Export data

- Export data reflects the momentum around business activities and production activities of Chinese companies.

- China's exports increased by 7.1% in January and February compared to the same period last year.2

- The trade surplus for the period rose to USD 125.2 billion. 2

- Exports to ASEAN, Latin America, and Africa have grown, indicating expanding market reach.

- The current trend of export data is positive, but ongoing monitoring of upcoming March-April data will determine how sustainable it is.

- We believe that increasing exports will benefit our preference for Chinese companies expanding overseas.

January – February data combined since 2020

Source: China Customs, February 2024

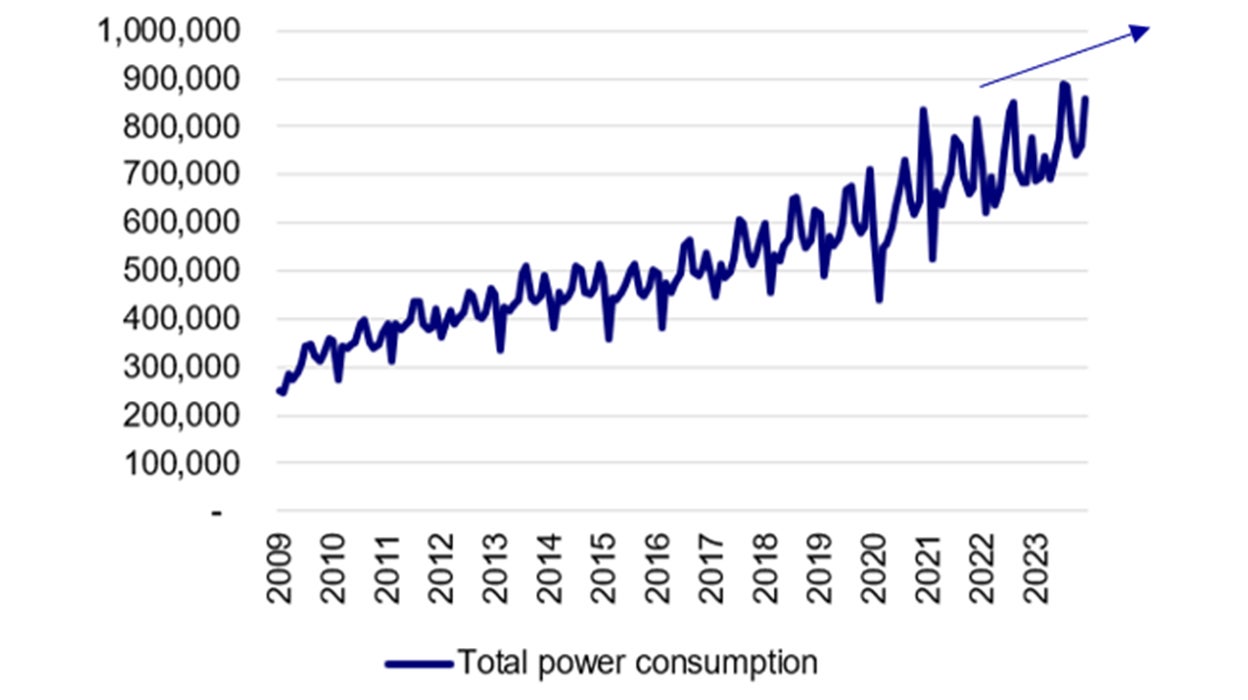

2. Electricity consumption

- Electricity consumption data reflects residential, industrial, agricultural and consumption activity momentum in China.

- We believe industrial power consumption will be a leading indicator of the recovery of production activities, followed by residential.

- The market expects mid-single-digit power consumption growth in China this year. It has been roughly similar to the GDP growth in recent years.

- Industrial usage was up 6.5% y-o-y in 2023, up from 1.2% y-o-y in 2022.2

- Despite a high base in 2023 due to the COVID reopening since early last year, we believe that industrial usage in 2024 Q1 can still exhibit robust y-o-y growth.

- Residential edged up just 0.9% y-o-y last year. It should continue to grow because of electrification.2

Source: HSBC, March 2024

Current juncture presents an opportune time to consider positioning into Chinese equities

We are optimistic about the Chinese economy in mid-to-long run and we see recovery coming in the short term. We have identified several compelling factors that make Chinese equities appealing and believe that the current juncture presents an opportune time to consider positioning into Chinese equities.

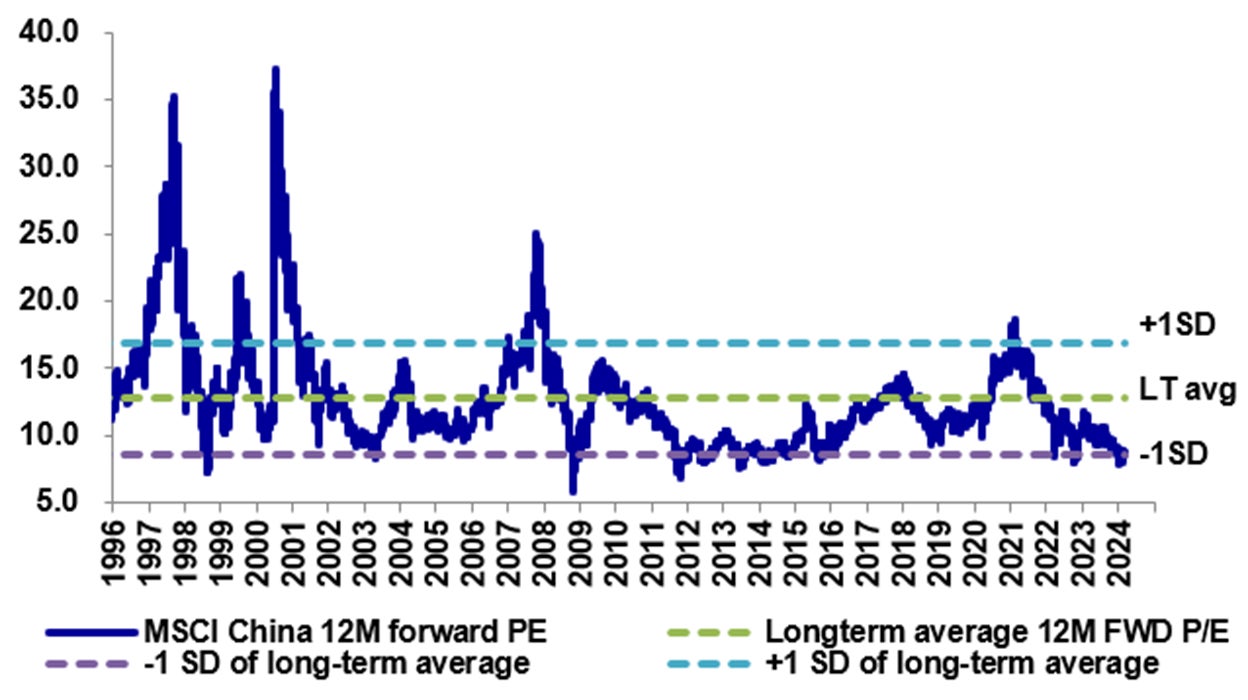

1. Chinese equities’ valuation is attractive

- Chinese equities’ valuation is currently in attractive territory.

- The MSCI China P/E ratio stands at 8.7x, which is approximately one standard deviation below the long-term average.3

- In comparison to developed markets and within Asia, Chinese equities’ valuation remains relatively low.

- This suggests that a favorable investment opportunity is now available in Chinese equities due to their relative and absolute low valuation levels.

Source: Datastream, Morgan Stanley Research; Data as of March 11, 2024.

MSCI China P/E compared to other markets

| MSCI China | MSCI USA | MSCI Asia ex-Japan | MSCI EM | |

| 12M Forward P/E | 9.10 | 20.80 | 12.72 | 12.26 |

| % discount* | NA | 56% | 28% | 26% |

*MSCI China P/E discount compare to other markets

Source: Data from Factset, March 2024

2. Earnings are still supportive

- According to market estimates, Chinese companies continue to demonstrate decent EPS growth, with MSCI China companies averaging 14.0% EPS growth and CSI 300 companies averaging 16.8% in 20244

- In particular, we note that selected Chinese leading internet and e-commerce companies have experienced upward earnings revisions, however their stock prices have been moving in the opposite direction over the past few years.

3. Policy direction is clear

- We believe that China policy risk has bottomed out and is in a turnaround, as evidenced by the recent policy support, for instance, the cut in loan prime rate and relaxation in property purchase restrictions.

- While we acknowledge that we do not see the large stimulus that the market has been expecting, the key is that the policy direction is now clear, and more supportive policies are expected to come.

- The target for GDP growth this year is 5%, and last year China surpassed the target with a GDP growth of 5.2%. The market anticipates further policy support to achieve the target this year.5

- Historically, there has been consistency in meeting the target. Coming up, we believe that supportive policies will continue to unfold. We believe that it will take some time for the economy to reflect the effects of these policies.

- Looking ahead, there are growth drivers on the horizon, including the two identified themes – (1) Chinese companies expanding into the overseas market and (2) China energy transition and electrification opportunities.