Revisiting China’s healthcare sector

Executive Summary

China’s healthcare sector is set for a healthy revival in 2023, rebounding from market selloffs linked to the Covid pandemic, regulatory uncertainties, and geopolitical tensions. In this article, we highlight three key factors that support our optimism for China’s healthcare industry.

Firstly, the relaxation of the three-year restrictive Covid policy has unleashed pent-up demand for healthcare services and medical procedures. This presents a favorable growth trajectory for medical services, medical devices, and companies involved in drugs and vaccines.

Secondly, policy development plays an instrumental role in shaping the China healthcare industry dynamic and investment opportunities. For example, private healthcare participation remains key to China government’s long term healthcare reforms, offering opportunities for entrepreneurial, innovative, and well-run companies that can plug the public healthcare gap to thrive. Recent changes in public health insurance are making it more convenient and accessible for insured patients to get prescription drugs benefiting retail pharmacies. On the other hand, earnings uncertainties linked to volume-based procurement (VBP) are diminishing as companies increasingly allocate resources towards innovative drugs with higher pricing power. Domestic drug manufacturers are also gaining market share from foreign counterparts as the VBP rollout reshapes the competitive landscape. The traditional Chinese medicine (TCM) sector is also becoming more interesting as government rolls out policy initiatives including market liberalization, improved manufacturing standards, and efforts to foster talent cultivation and international trade.

Lastly, opportunities for overseas expansion, particularly for contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs), abound. Previous concerns over the US’ biomanufacturing plan and potential increased regulatory hurdles for Chinese CROs/CDMOs have moderated. Chinese CROs and CDMOs, known for their cost competitiveness and strong talent supply remain attractive business partners and would be hard to replace in the short term. The market is also expecting fresh rounds of biotech funding to return following the peak of the US rate-hiking cycle which may provide further upside to investment opportunities in this area.

We are confident that these factors can drive a comprehensive earnings recovery across China’s healthcare industry.

Introduction

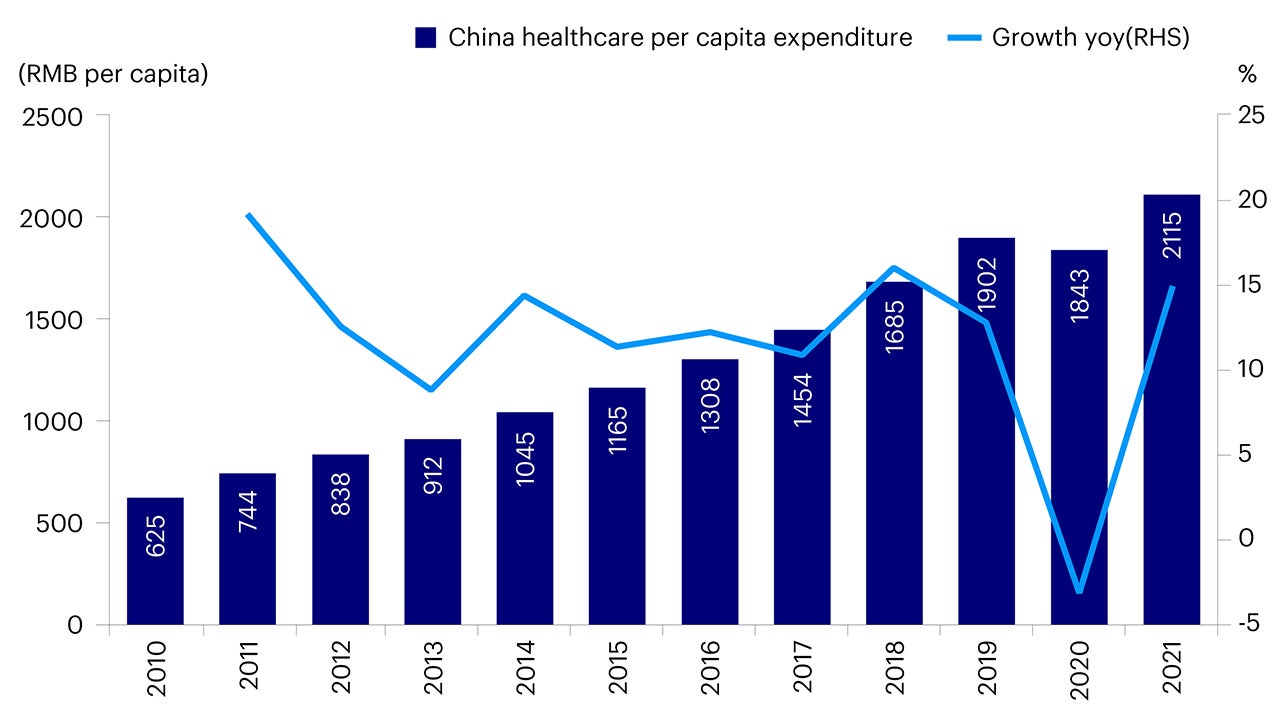

China healthcare is a unique multi-decade investment opportunity. Supported by the country’s aging demographics, affluent middle class and improvements in medical technology, the pursuit of quality healthcare has led to a rapid expansion of China healthcare industry. Spending on healthcare soared over the last decade from under 500 billion yuan in 2000 to more than 6.5 trillion yuan in 2019.1

China’s healthcare market is now the second largest globally and in 2021 generated RMB 10 trillion (around US $1.5 trillion) in total revenue.2

Source: NBS, CLSA.

2022 was a year of major contraction and a deceleration in the growth rate for healthcare firms due to, among many reasons, the Covid-19 pandemic and weaking economy. Earnings growth for firms in the sector was in low single digits (Figure 2) and valuations for healthcare stocks dropped substantially. Short term investors fled the sector as growth prospects were questioned.

Source: Wind, data as of May 2023.

Since China pivoted on its zero Covid policy in late 2022, China’s healthcare sector outlook is turning positive once again. Analyst consensus indicates a recovery of average earnings growth to the high teens on the back of what we believe will be the revitalization of the sector (Table 1). We expect that the average earnings growth in 2023 will be much better given the country’s reopening and resulting economic growth. In our view, most subsectors will see better growth rates, especially medical services, medical devices, TCM and drug retailers. CROs and CDMOs remain a fast growth sector but may see some slowdown due to the high base from 2022 driven by Covid-related businesses.

Table 1 - Earnings growth consensus forecast for China healthcare sector

| 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | |

| Total Revenue(1M) | 1,134,485.36 | 1,288,081.27 | 1,323,268.40 | 1,460,507.41 | 1,597,469.24 | 1,839,097.97 |

| YoY | 4.62% | 13.54% | 11.89% | 10.37% | 9.38% | 15.13% |

| Profit(1M) | 101,786.42 | 145,164.57 | 142,245.67 | 165,843.49 | 189,386.62 | 228,804.10 |

| YoY | 29.73% | 16.37% | 2.49% | 16.59% | 14.20% | 20.81% |

| EPS - Diluted | 0.90 | 1.28 | 1.31 | 1.48 | 1.79 | 2.16 |

| YoY | 45.93% | 41.51% | 2.66% | 12.70% | 20.75% | 20.81% |

| PE | 49.73 | 28.21 | 28.86 | 22.86 | 20.01 | 16.57 |

| PEG | 2.54 | 1.17 | 27.85 | 1.08 | 0.94 | -- |

| Profit(1M) | 1,102.39 | 1,525.50 | 1,495.26 | -- | -- | -- |

| YoY | 44.17% | 38.38% | -1.98% | -- | -- | -- |

Source: Wind, data as of May 2023.

Pent up demand from China’s reopening

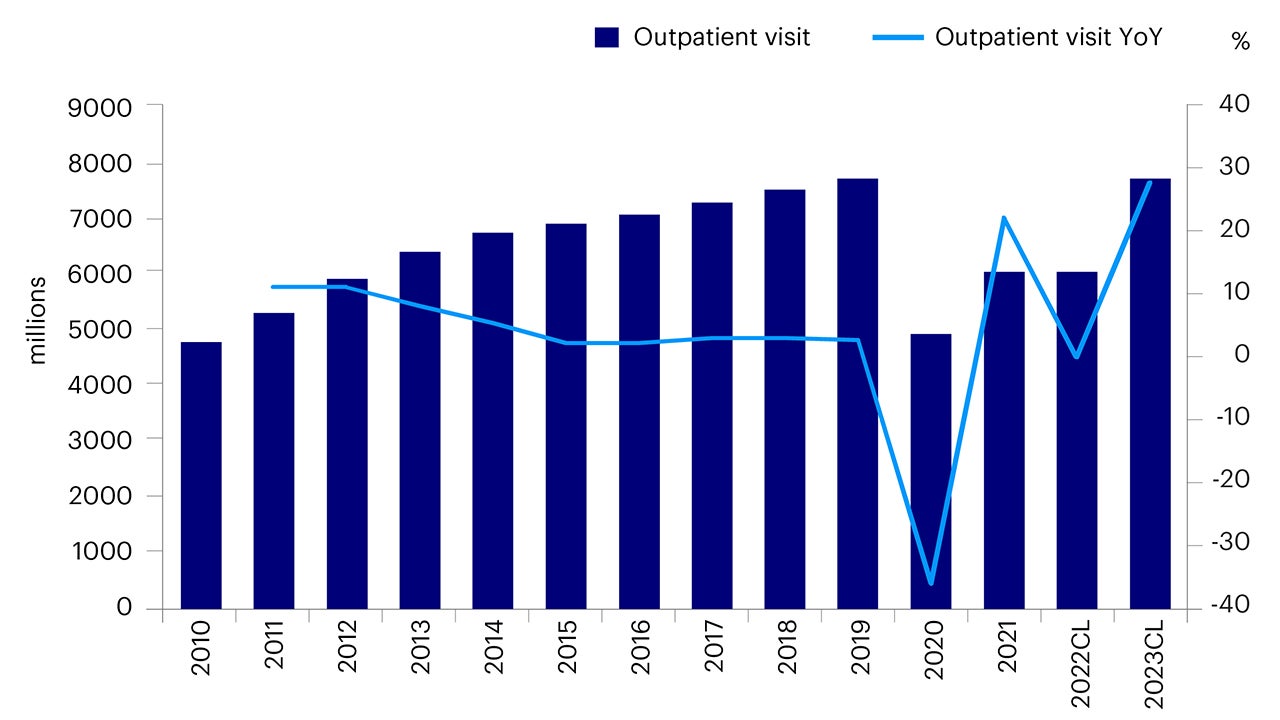

China began to shift away from its long-standing Covid-19 restrictions towards the end of 2022 and in early 2023 lockdowns and travel restrictions were lifted. The healthcare sector has been positively impacted by the country’s reopening given the pent-up demand for healthcare services that were put on hold during the pandemic. The resumption in surgeries and medical procedures are benefitting medical service and medical device subsectors (Figure 3). The pandemic has also meant the emphasis on health and medical security has been brought to the forefront. As a result, we are seeing increasing investment in healthcare infrastructure as well as more opportunities in drug and vaccine-related development.

Source: NHC, CLSA

Healthcare reforms remain a key policy direction

Private participation to plug the service gap

The goal of providing adequate basic healthcare for China’s 1.4 billion people has always been a top priority for healthcare policymakers, but it comes with ambitious challenges. The Chinese government recognizes the limitations of relying solely on public healthcare provision, a weakness further exposed by the Covid-19 pandemic. Hence, encouraging private healthcare provision has always been a part of the national strategy. To address this, regulators have put in place policies to increase supply and enhance public healthcare systems to ensure basic medical needs are met. At the same time the government is encouraging private sector participation to cater to affluent patients who can afford higher quality services with less waiting time.

According to the National Health Commission, China’s private hospital sector delivered 17% revenue CAGR during the five-year period from 2016 to 2021, outperforming China’s public hospital sector CAGR of 9% during the same period.3

Concerns arose in late 2021 when the private sector faced regulatory tightening in areas like Big Tech, education, and online gaming, raising fears that the healthcare sector would be affected next. As a result, the sector experienced a significant downturn, and investors worried about potential government measures to control rising healthcare costs, potentially impacting domestic healthcare companies.

However, since the 20th Party Congress in October of last year, the policy tone toward the healthcare sector reaffirmed that the government welcomes private sector participation. This is evidenced by the supportive policies being implemented for the development of private hospitals and online healthcare platforms. We believe private hospital operators are in a good position to capture long-term structural demand growth and demand recovery that was foregone during the Covid-19 pandemic.4

Increased flexibility of public health insurance

Changes in healthcare insurance withdrawal is another important positive catalyst. In mid-February, China’s National Health Insurance Administration (NHSA) issued a notice “Further Improving the Incorporation of Designated Retail Pharmacies into Outpatient Collective Account Management”. 5 The policy enables certain pharmacies to gain access and use of collective insurance accounts for outpatient services, making it more convenient and accessible for insured patients to prescription drugs.

This move is expected to accelerate prescription drug sales at retail pharmacies rather than from hospitals where they are prescribed. HSBC Research estimates the policy change could generate RMB 70 to 170 billion in incremental revenue for domestic pharma companies from 2025 to 2030 due to these “prescription outflows”. 6 The regulation also emphasizes strengthening prescription circulation management as well as monitoring the use of insurance funds.

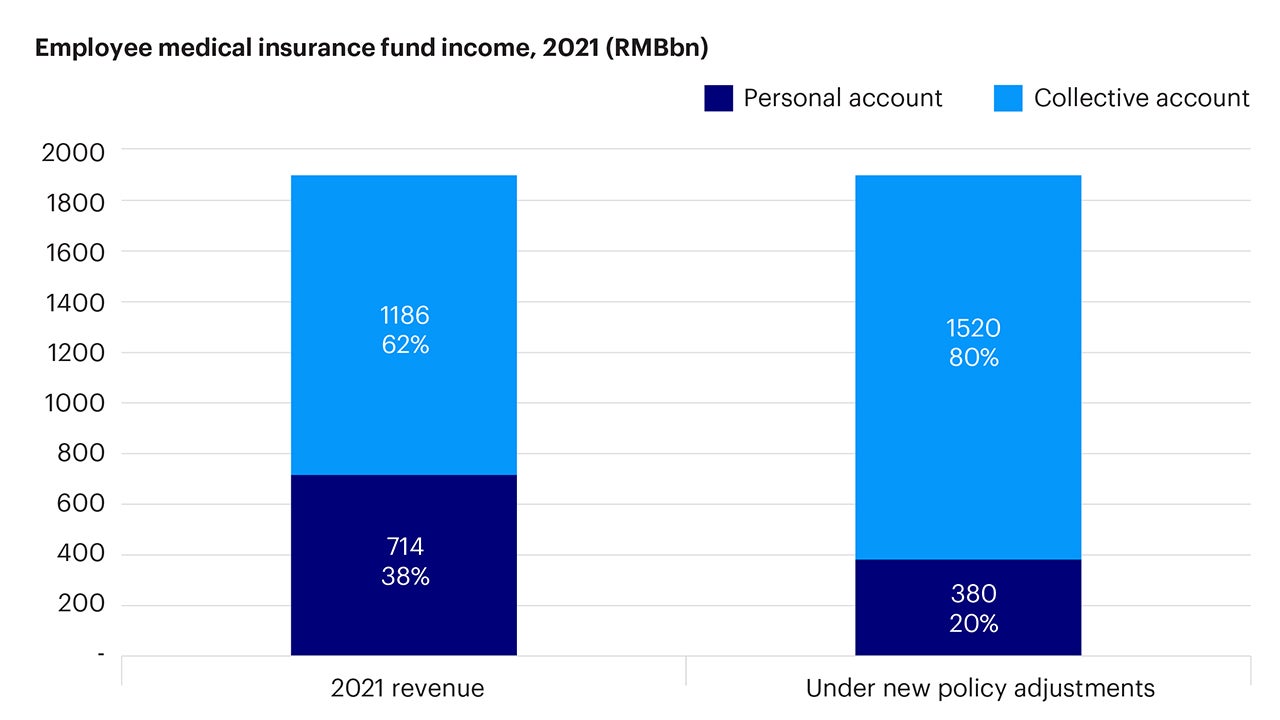

China’s employee medical insurance fund includes both collective and personal accounts. The use of collective accounts requires drug prescriptions from medical insurance-designated healthcare institutions, while personal accounts can be used directly at retail pharmacies. In the earlier system, 30% of employer contributions would be distributed to employees’ personal accounts. This led to uneven funding over time as young individuals typically had a high surplus on their personal accounts while elderly people or those with chronic diseases would have inadequate balances. It also sometimes led to “non-medical” or even “fraudulent” spending from personal accounts in many cases, where citizens would use the funds to buy consumer-oriented products such as groceries or personal care products.

Under recent reforms from the NHSA, all contributions from employers will now be allotted into the collective account (Table 2). We anticipate these changes will strengthen outpatient protection and ensure more insurance is allocated to the elderly and patients with chronic diseases.

Table 2 - Changes of individual accounts and collective accounts after reforms

| Before | After | Other changes | |

| Individual account | Employees: 2% of the employee’s salary contributed by employees and 30% of the contribution from employers. Retirees: a preset ratio of his/her own pension. |

Employees: 2% of the employee’s salary contributed by employees. Retirees: a preset ratio of the average pension in the specific region. |

Can be shared flexibly with immediate family

|

| Communal Pool | 70% contributed from employers | Reimbursement scope expanding to outpatient departments and clinics and pilot retail pharmacies | Reimbursement scope expanding to outpatient departments and clinics and pilot retail pharmacies |

Source: NHSA, Morgan Stanley Research

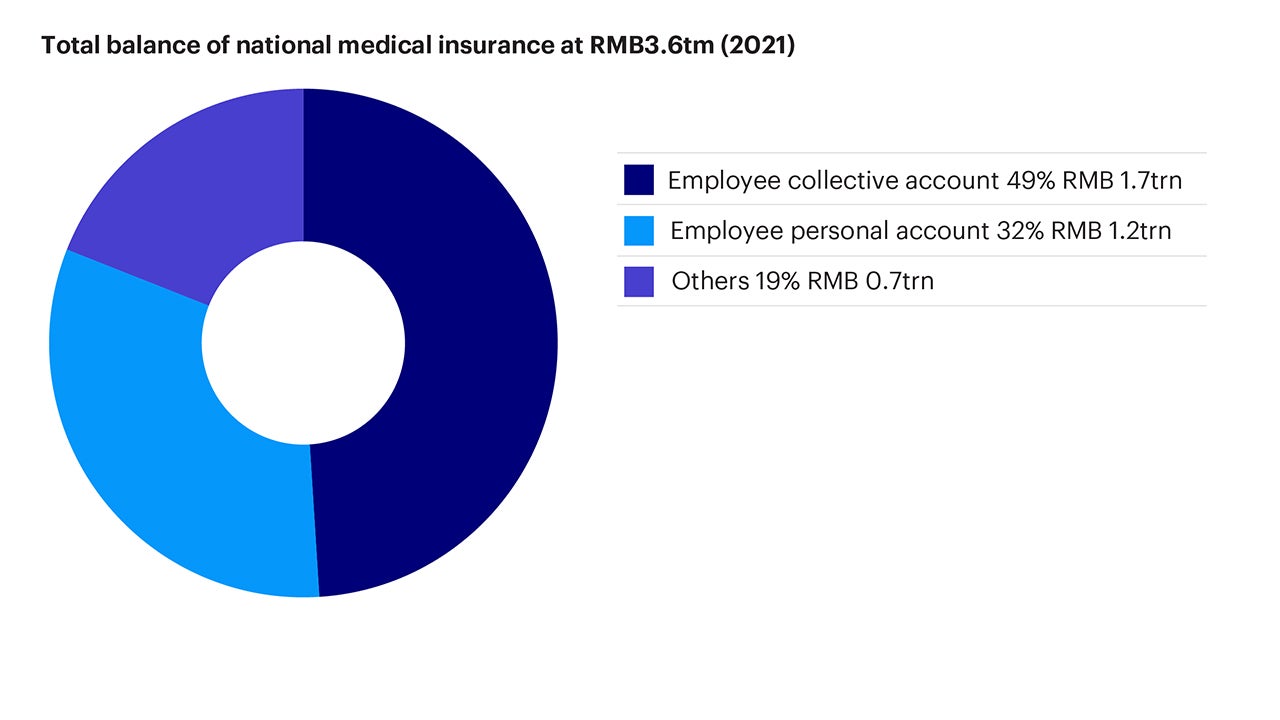

The latest data from 2021 indicates that personal accounts amounted to RMB 1.2 trillion, or 32% of the total balance of the medical insurance fund (Figure 4). If the aforementioned reforms were to be applied to the 2021 figures, HSBC estimates about RMB 300 billion or 18% of the employee medical insurance fund’s total revenue would have been redistributed from personal to collective accounts (Figure 5).

Source: NHSA, Qianhai Securities estimates

Source: NHSA, Qianhai Securities estimates

Balancing affordability and innovation

Historically, the largest regulatory overhang for healthcare firms in China has been the volume-based procurement (VBP) policy which began in November 2018. High prices for drugs in the country led the government to enact a set of regulations for drug procurement to lower the prices of generic drugs. In 2019, the policy was extended to medical devices.

Till date there have been eight rounds of VBP covering 333 drugs with average price cuts of above 50% (Table 3).7 Going forward we are less concerned about the impact of VBP on drug prices as most generic drugs have already been included into the National Reimbursement Drug List (NRDL). In the future fewer price cuts are expected as generics on the list will simply undergo price renewals with more stable pricing.

For innovative drugs, the policy is likely to remain accommodative to encourage innovation.8 This is evident from the January 2023 the 2022 NDRL VBP results where price cuts of key innovative drugs were less than market expectations and occurred through a simple renewal process.

On the other hand, the medical device subsector can expect continuous pressure in coming years as VBP is still at an early stage. Price cuts have dampened the margins of medical device companies. Yet on the volume growth side, the story is actually positive.9 Since foreign medical device makers do not typically participate in VBP, this gives the market share to domestic players. So, while medical device manufacturers might suffer on profit margins and revenue, they gain on overall market share.

Table 3 - Changes of individual accounts and collective accounts after reforms

| VBP | Bidding result released | Procurement started or planned for | Average price cut |

| Pilot in 4+7 cities | 17/12/2018 | 03/2019 | 52% |

Pilot Nationwide (1st) |

30/09/2019 | 12/2019 | 59% |

| 2nd | 21/01/2020 | 05/2020 | 53% |

| 3rd | 24/08/2020 | 11/2020 | 53% |

| 4th | 08/02/2021 | 05/2021 | 52% |

| 5th | 28/06/2021 | 10/2021 | 56% |

6th (exclusive for insulins) |

30/11/2021 | In the first three months of 2022 | 48.75% |

| 7th | 18/07/2022 | 11/2020 | 48% |

| 8th | 11/04/2023 | 07/2023 | 56% |

Sources: What’s New About China’s 8th Volume-based Procurement (VBP) of Drugs,

https://baipharm.chemlinked.com/news/whats-new-about-chinas-8th-volume-based-procurement-vbp-of-drugs; The Deloitte Research Monthly Outlook and Perspectives,

https://www2.deloitte.com/cn/en/pages/about-deloitte/articles/deloitte-research-issue-63.html;

China’s Record-Breaking 5th VBP Round Achieves Average Price Reductions of 56%,

https://www.eversana.com/2021/06/25/chinas-record-breaking-5th-vbp-round-achieves-average-price-reductions-of-56/;

China’s Insulin VBP Sees Average Price Cut of 48.75%,

https://baipharm.chemlinked.com/news/chinas-insulin-vbp-saw-average-price-cut-of-4875 ;

327 Drug Products to Enter China’s 7th Round of Volume-based Procurement (VBP),

https://baipharm.chemlinked.com/news/327-drug-products-to-enter-chinas-7th-round-of-volume-based-procurement-vbp;

China’s 8th VBP Round Results in Average Price Cut of 56%,

https://www.navlindaily.com/article/16490/china-s-8th-vbp-round-results-in-average-price-cut-of-56

Policy support to the TCM sector

China’s TCM sector has been getting more support from the government and several new policy directives have been implemented, targeting the development of a strong TCM industry by 2025.10 This entails targets for the number of TCM providers (hospitals and clinics), hospital beds, practitioners, and the penetration rate in specific areas such as geriatrics, rehabilitation, obstetrics, and gynecology.

For example, in late 2021 regulators opened the formula granules market and pushed for uniform manufacturing standards for around 700 formula granule products. Given that roughly half of the TCM market currently uses herbal pieces, this shift to formula granules is expected to bode well for certain TCM manufacturers.

The State Council also recently released a document titled “Upgrading and Developing the Traditional Chinese Medicine Industry” in February of this year which looks at how to boost the TCM industry through cultivating talent, implementing modern industrial techniques, lowering entry limits, improving urban and rural service networks, and enhancing international trade and investment. As a result, we have seen the sector outperforming in recent months and expect more supportive policies to be rolled out in the future including more public hospital prescriptions of TCM (Figure 6).

Source: Wind, data as of May 18, 2023.

Overseas opportunities

CROs and CDMOs had a volatile 2022 with the sector correcting in the latter half of the year on the back of geopolitical risks and the pandemic.

In terms of the biotech/CRO and CDMO sectors, considering the US rate-hiking cycle is nearing its end, we anticipate that overseas biotech funding could recover going forward.11 We expect more liquidity will be released into the premarket funding for biotech companies from private equity, venture capital and industrial capital. It is likely we will see more M&A and investments in the biotech industry going forward, and we also believe global R&D outsourcing demand could recover given improved biotech funding.

On the supply side, there were some jitters particularly in September 2022 as the U.S. government announced they will spend over US $2 to 3 billion to fund a National Biotechnology and Biomanufacturing Initiative.12 In our view, this amount of expenditure is too small to make a meaningful difference to global biotech manufacturing capacity.

Conclusion

The dynamics of the China healthcare sector have undergone significant changes in the past three years, driven by regulations and the impact of the pandemic. However, certain factors have remained constant, such as the continued growth of healthcare spending in China, fueled by the country’s aging population, expanding middle class, and increasing demand for high-quality healthcare services. China healthcare remains a unique secular investment opportunity.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Footnotes

-

1

Health expenditure in China from 2001 to 2021,

https://www.statista.com/statistics/279400/health-expenditures-in-china/

-

2

Investing in China’s Healthcare Sector, March 2023,

https://www.asiabriefing.com/store/book/investing-china-healthcare-sector.html

-

3

China Healthcare Service Sector Outlook, CLSA Research, February 2023

-

4

China Healthcare Service Sector Outlook, CLSA Research, February 2023

-

5

China Pharmacy – Medical insurance reform to benefit leading pharmas, HSBC Global Research, March 2023

-

6

Ibid.

-

7

What’s New About China’s 8th Volume-based Procurement (VBP) of Drugs, April 2023,

https://baipharm.chemlinked.com/news/whats-new-about-chinas-8th-volume-based-procurement-vbp-of-drugs

-

8

2022 NRDL Released; Price Cuts Appear Benign and within Expectations, Morgan Stanley Research, January 2023

-

9

Import substitution: where rising stars continue to emerge, BofA Research, January 2023

-

10

Four Investment Angles from Latest Policy Document on the TCM Industry, Morgan Stanley Research, February 2023

-

11

China CRO, CLSA Research, February 2023

-

12

FACT SHEET: The United States Announces New Investments and Resources to Advance President Biden’s National Biotechnology and Biomanufacturing Initiative, September 2022 ,

https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/14/fact-sheet-the-united-states-announces-new-investments-and-resources-to-advance-president-bidens-national-biotechnology-and-biomanufacturing-initiative/

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.