2022 Investment Outlook – Asia Equities: Policymakers will play a key role over 2022 in the Asian ex Japan markets

Key Takeaways

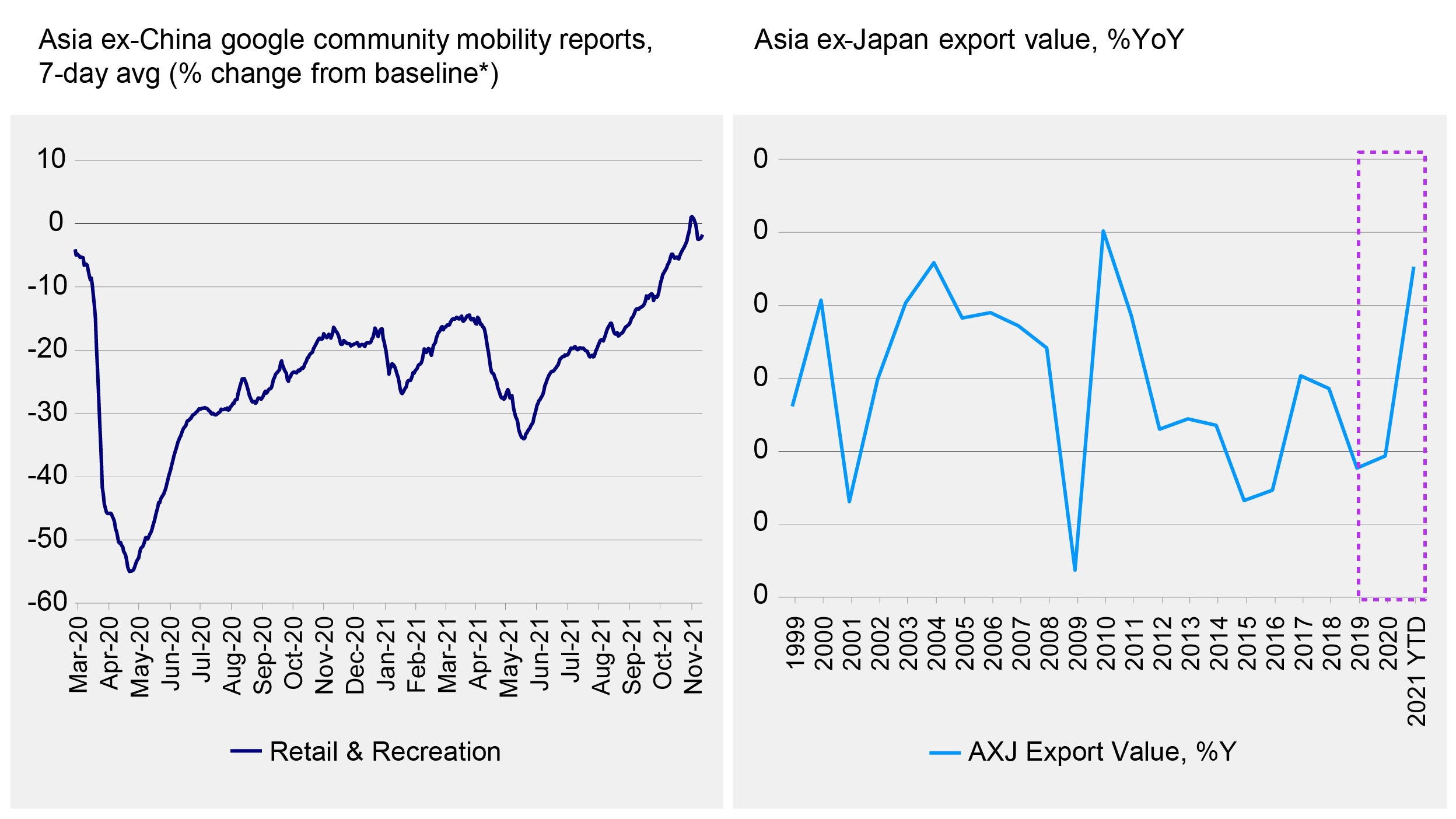

Source (LHS): Google, CEIC, Morgan Stanley Research. *The baseline is the median value, for the corresponding day of the week, during the 5-week period Jan 3-Feb 6, 2020. Source (RHS): CEIC, Haver Analytics, IMF, Morgan Stanley Research. Export data as of Sep-21.

We believe 2022 will be a year when policy makers in Asia will be tested. On the economic front, economies are at different stages of recovery. Some are sticking to a zero-COVID strategy; while others are relaxing restrictions to boost domestic mobility and reopen borders.

On the policy front, central banks are closely monitoring rising inflation and a potential shift in Fed policies. Many other urgent challenges, from supply chain disruptions to climate change risk and rising inequality are awaiting long-term solutions.

We believe policy makers will need to play an active role in addressing these issues and their actions will impact how we see opportunities in the region. In this piece, we shared our thoughts on four key questions that are weighing on our investment decisions in 2022.

1. Will there be a change in COVID strategy?

For much of the pandemic, most Asian economies have adopted a stringent zero-COVID strategy aimed at eliminating the virus. This has started to change since the summer. Some countries, notably Singapore, indicated willingness to live with COVID by reopening public spaces and resuming cross-border travel.

Vaccination rates have been accelerating in Asia and are ahead of the world average. In wealthier economies including Singapore, South Korea and China, above 70% of population have been fully vaccinated. We see vaccination efforts continue to ramp up in Vietnam, Taiwan, India and ASEAN.

We believe regardless of what COVID strategy each market is adopting, severe cases of COVID infections and hospitalization rates will likely trend lower broadly in the region as in Western countries, which will support a base case of continued recovery.

That said, the difference in how the pandemic is handled will have implications on local economies. There is currently no sign that China, including Hong Kong, will abandon its zero-COVID strategy and growth in 2022 will likely slow amid ongoing restrictions as it did in the summer.

We see other markets more ready to shift, which should help them move towards further normalisation and faster growth.

2. Will central banks tighten policies?

At Invesco, we believe inflation is always a monetary phenomenon. From December 2019 to August 2021, US money supply, measured by M2, grew by $5.5 trillion, a stunning +35.7% increase. Even after deducting those used to finance economic growth and the increase in money balances that the public wishes to hold relative to income, the balance remained at $3.1 trillion.

The excess money in our view will fuel real growth and persistent rather than transitory inflation for the next two to three years.

In Asia, South Korea is the first country that has embarked on policy normalisation by hiking policy rates in August and there are rising expectations that more central banks will follow suit. What is different in Asia is that money growth in major economies such as China remained subdued than that in the US.

We are confident that inflation will not erupt in these economies in the way it will in the US, allowing accommodative policies to stay longer. In addition, given the rate differentials and growth opportunities in Asia thanks to improved macro stability, we see demand for US dollar assets might not be as strong as it was in 2013.

3. Will there be a reconfiguration in regional supply chains?

Countries in Asia such as Vietnam, Thailand and Malaysia have emerged as some key players in global supply chains in recent years as China is moving up the value chain. Business activities in these countries are disrupted amid ongoing COVID outbreaks, causing investors to worry whether there might be a reconfiguration in regional supply chain going forward.

We believe Asia continues to hold many advantages as a major production hub thanks to abundant and high-quality labour, improving infrastructure and reform-minded governments. Even in China where cost of doing business is rising, the majority of foreign companies still prefer to stay to serve the growing domestic market and to rely on its supply chain ecosystems.

We believe what COVID has highlighted is the importance of diversification, to have a strategy available that can utilise the strength of different locations and operate as usual when one location faces certain risks. Asia with its diverse demographics, geography and culture, will provide a range of choices for companies. Reshoring, despite happening, will be limited.

4. What impacts can ESG investing have on Asia?

Asia is facing challenges on all aspects of ESG. Three of the five top emitters of greenhouse gases, measured in tonnes of CO2 equivalent, are from Asia, including China, India and Indonesia. Meanwhile, inequality is causing social anger across countries and concerns for corporate governance are often cited as a key factor by global investors to underweight Asian exposures.

A sustainable future is important for Asia. We see policymakers making efforts to address the imbalances in the economy. In China, common prosperity is the overarching development concept aimed at promoting quality growth, social wellbeing and environmental sustainability.

In Singapore, the Green Plan, unveiled this year, is a new initiative to advance the national agenda on sustainable development. We believe these efforts will eventually help lead to a strong regional economy and rising compelling opportunities, boosting attractiveness and inflows into the asset classes.

We are placing a strong focus on ESG factors and actively promoting changes we would like to see. Our interests as investors are fully aligned with policymakers.

What’s attractive for 2022

We believe policymakers will play a key role in 2022, to set the near-term growth trajectory and to address structural issues on supply chain and ESG. We believe China, thanks to its long-term focused development objective of common prosperity, will remain a compelling asset class and regain investor confidence.

In particular, its relative attractiveness has risen in recent days compared with India given valuation discount. Meanwhile, we expect ASEAN to gain more traction as vaccinations ramp up and borders gradually reopen.