Nikkei 225’s historical high again: What’s next for Japanese equities?

On 4th July, the Nikkei 225 Index renewed an all-time high of 40,913.65 for the first time in three months1 after having broken the 40,000 level in March.

Reasons for the recent rally

The last two-week rally was primarily led by top-cap stocks amid weakness in the Japanese yen and rising long-term interest rates in Japan.

In fact, the Bank of Japan’s (BoJ) decision at the Monetary Policy Meeting (MPM) in June to un-change the policy rate of 0-0.1% and to make a detailed plan to reduce the Japanese government bond (JGB) purchases by the next MPM in July2 reduced expectations for early monetary tightening, sending the Japanese yen lower, below the 160 level against the US dollar.

At the same time, the market started to price in the quantitative tightening, sending the 10-year Japanese Government bond (JGB) yields higher, above 1%.

Against these backdrops, top-cap financial and export-oriented companies were favoured.

Outlook

Looking ahead, given the momentum the rally this year, we believe that market could take a pause.

That said, we maintain a constructive view on the Japanese equity market thanks to the ongoing structural changes in Japan.

We continue to believe the scope for stock selection is likely to widen, unearthing unique investment opportunities and prompting the rotation into laggards.

For the Japanese yen, the exchange rate is admittedly subject to the US inflation and the resultant US Federal Reserve’s (Fed) path on interest rate cuts.

The higher-for-longer situation has put substantial downward pressure on the Japanese yen so far, but we continue to expect it to ease later this year.

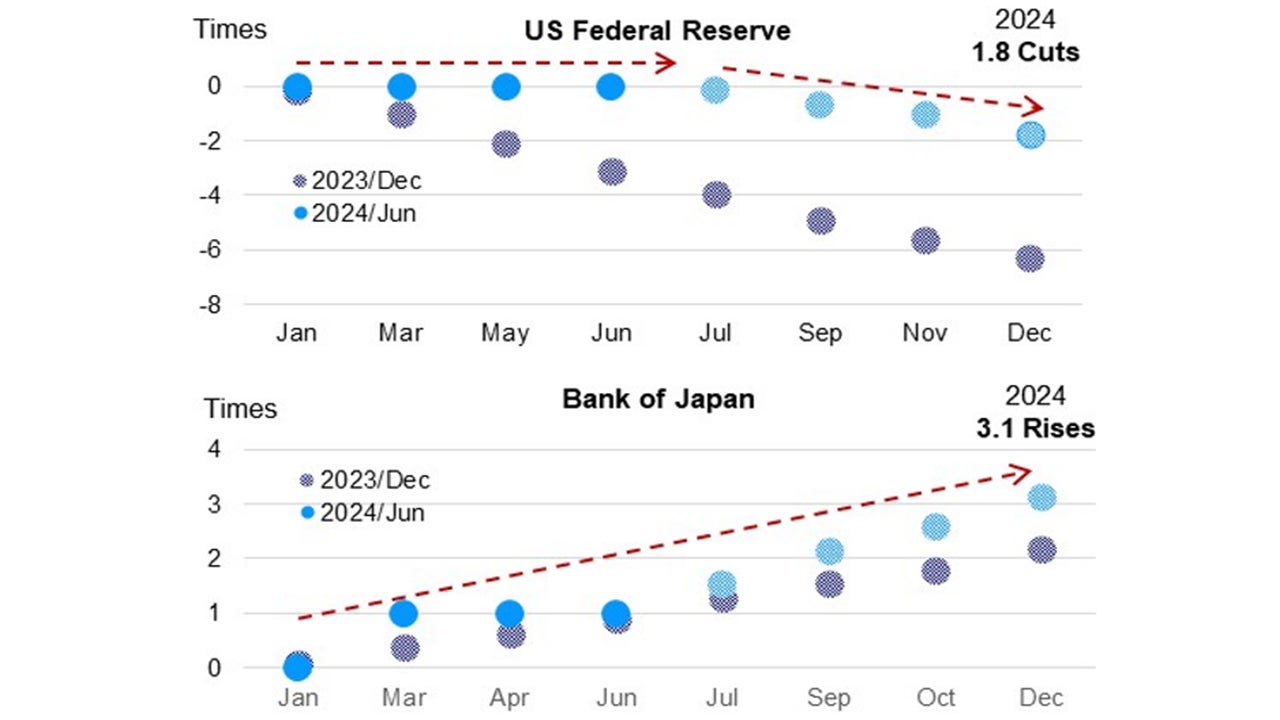

In fact, the BoJ has already started policy normalisation from the unconventional ultra-loose monetary measures amid improving macro backdrops. Also, the US Fed’s monetary policy pivot is finally coming into sight of us. This could lead to a strengthening of the Japanese yen in the future. (chart 1)

Source: Bloomberg. As of June 2024.

At the same time, the yen’s upside risk, which could materially hurt exporters’ earnings, should be limited, considering the current interest rate gap between the US and Japan. The high interest rate scenario like the US is also unlikely given the level of the consumer price index (CPI) – 2.8% as of May.

The recovery of the Japanese yen should ease inflation pressure, which currently suppresses household consumption.

A long-awaited wage-price spiral reviving domestic demand is coming closer to reality

Furthermore, this year’s influential “Shunto” spring wage negotiations yielded higher wage rises than last year, which finally exceeded the current inflation rates.

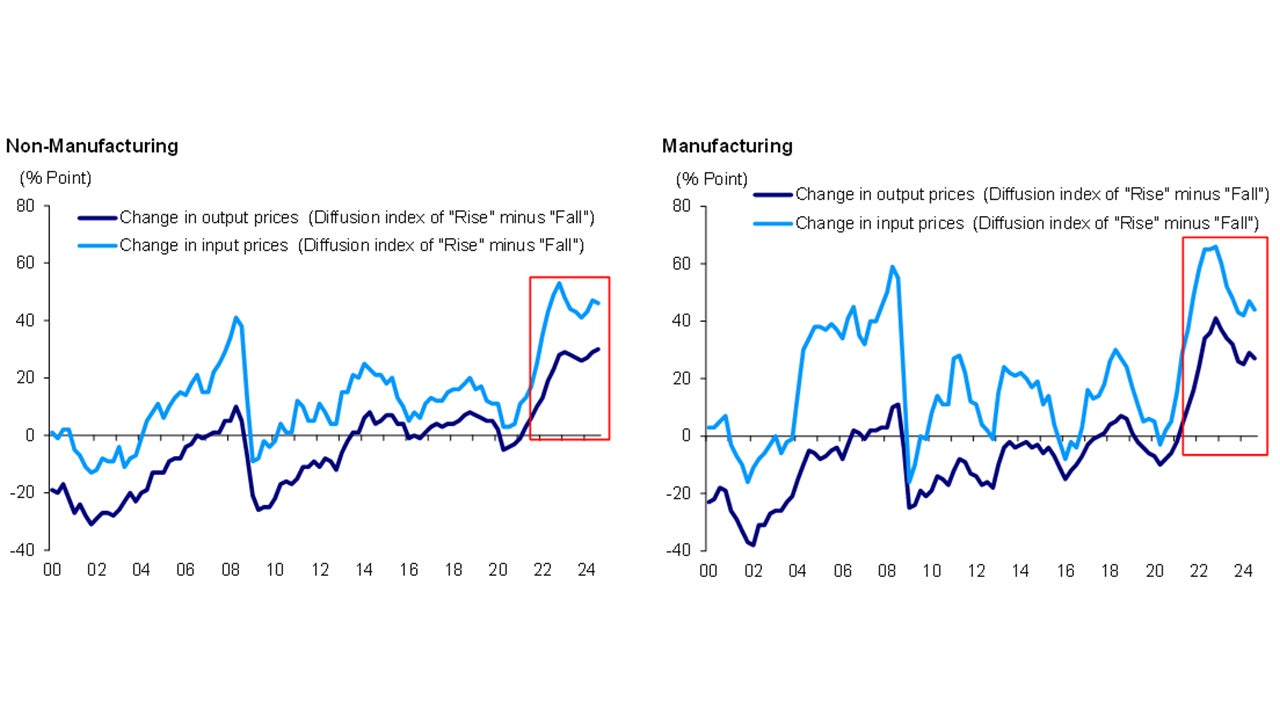

On the other hand, Japanese companies have been overcoming the deflationary norm. According to the June BoJ’s Tankan survey, Japanese companies have been increasing prices for the last three years. This is almost the fast-ever sustained price hikes for decades. (chart 2)

Such norm changes should help Japanese companies to improve margins and sustain healthy earnings growth, allowing them to distribute increasing wealth to their employees.

We believe that a long-awaited wage-price spiral reviving domestic demand is coming closer to reality.

We also expect the Japanese company’s robust capex trend to continue, given the solid earnings trend combined with the much-needed demand for digital transformation and automation in the ageing society.

All in all, Japan is on track for a significant shift from the lost three decades of economic/price/wage stagnation to a normal economic environment with positive growth.

At this moment, the market focus concentrates on near-term macro factors, namely rising interest rates and the weakening yen.

Towards later this year, we expect investors to eventually try to capitalise on the ongoing structural changes by broadening investment opportunities and looking into individual companies’ fundamentals and competitive advantages.

Source: Bank of Japan, “Tankan” Survey. As of June 2024

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

References:

-

1

Source: Bloomberg, as of July 4, 2024

-

2

Source: Bank of Japan, as of June 14, 2024