MSCI index inclusion for China A shares can wait

Key takeaways

- MSCI has not opened consultations for further weight increase of China A shares in its indices since the last phase of inclusion, indicating that June 2020’s decision will maintain status quo.

- Improvements in micro structural issues in China A-share market are important for next round of inclusion, but harmonizing cross-boundary settlement cycles can be hard to resolve.

- Active investors need not wait further to unearth attractive opportunities in the already highly investable China A-share market.

June is typically the month that MSCI announces its country classification decision. For the past several years, China A shares have been the center of attention of MSCI’s announcement amid growing investors’ interest in the asset class, culminating in late 2019 with a 20% inclusion factor for China A shares’ representation in its global indices. Over the past two and a half years, MSCI’s endorsements have marshalled billions of dollars into Chinese onshore equities.

However, I do not expect any fanfare for China A shares in MSCI’s coming decision. This is despite the fact that China continues to show its determination to open the market with a series of recent announcements, including moving two major inbound investment schemes to a registration-based system, and scrapping investment quotas for them. MSCI’s determination has nothing to do with the current US-China tensions nor the softer economic outlook due to coronavirus-related concerns. Those who know MSCI well would understand that any important benchmark decision is preceded by an investor consultation. As a matter of fact, MSCI has not opened the consultation for further weight increase of China A shares in its indices.

This lull might be the window of opportunity for active investors to further extend their lead on investing in China against passive index-trackers as they await the next benchmark decision. The inaugural round of index inclusion for China A shares is proof that the market is already investable following multi-year market reforms and accessibility improvements.

Criteria to meet for next round of inclusions are technical in nature

While the initial round of inclusions by major index providers (including FTSE Russell and S&P) was prompted by better access to China’s onshore market, the nature of the next phase of inclusion will be quite different. The criteria listed by the three index providers for increasing A-share weighting mainly seek to address micro structural issues within the A-share market.

Take MSCI for example. The provider has listed four criteria to upgrade the weighting of A shares. One of them is access to hedging and derivatives instrument for international institutional investors. In order to expand their allocation to China and manage their increased exposure, offshore institutional investors require liquid index futures and options contracts to manage the risks. On this front, there is a pre-existing FTSE A50 contract on the Singapore Stock Exchange.

MSCI might prefer to see a listing of its MSCI China A Index futures with the Hong Kong Exchange1 but it’s important to point out that through China’s proposed new registration system for the dollar-dominated qualified foreign institutional investor (QFII) scheme and its yuan-denominated sibling, RQFII2, foreign investors can already, in practice, access the onshore CSI futures contracts.

I do not intend to second guess how would MSCI evaluate this criteria on China’s progress in allowing access to such instruments. China’s recent announcement is an interesting and important development that effectively provides a means to allow foreign investors access to risk-management instruments for China A shares.

The second MSCI criteria is about trading holidays. It’s an operation nuisance for investors because there is a misalignment between onshore China and Stock Connect (a cross-boundary investment channel that connects the onshore Shanghai and Shenzhen Stock Exchanges with the Hong Kong Stock Exchange) holidays. The current rule does not allow Northbound Connect investors to trade on the day before an actual holiday in Hong Kong even when the mainland A shares market is open due to settlement limitation. The same is true for mainland investors trading Hong Kong stocks.

We should not expect a perfect harmonization of holidays between mainland China and Hong Kong – it would not happen. Instead, I think that a partial resolution that removes the day before any actual holiday in either market as non-trading day should be sufficient to make most exchange participants happy.

The next MSCI criteria is about allowing an omnibus trading mechanism in Stock Connect. The ability to place a single order on behalf of multiple client accounts is critical to facilitate best execution and lower operational risk to international institutional investors. Since the issue was raised, the Hong Kong Exchanges and Clearing, which runs the territory’s bourse, have been working on a solution. They recently announced that they will soon roll out the new Master Special Segregated Account (Master SPSA) service for fund managers which will enable more efficient pre-trade checking and facilitate average pricing execution at the fund manager level. Once approved by the regulator, this issue could be considered solved.

Extending settlement cycle the most difficult to resolve

I view the last criteria as the most challenging to be addressed in the near term. MSCI has expressed that the settlement cycle for A shares is too short. China currently operates on a T+0/T+1 settlement cycle that does not use a Delivery versus Payment (DvP) settlement mechanism. The lack of a DvP mechanism falls short of global standards and creates operational challenges and risk in a short settlement cycle. International investors hope to have it move to T+2 DvP eventually. Having the settlement cycle standardized is important in harmonizing cash flows in a global portfolio.

However, changing the settlement cycle means that China has to change the entire infrastructural backbone of its stock market and associated rules and regulations. Accomplishing this will take time.

Yet, I believe that if China keeps focusing on these four key issues that MSCI has raised, keep improving and deliver on them, we can then expect to see the MSCI upgrade.

Difficulty in resolving issues affords active investors window of opportunity

Of course, index inclusion carries important implications in terms of directing asset-allocation decisions and driving passive money flows. While I do not expect the next round of inclusion to start soon, I view the current market environment and the lull in index inclusion as windows of opportunity to gain long-term strategic exposure on China A shares before more investors joining the party.

In the latest 2019 Invesco Global Sovereign Asset Management Study, we surveyed asset allocation preferences among global sovereign wealth funds. China was singled out as the market where allocations were increasing. In fact, over 90% of large sovereigns (>$100 billion of assets) indicated that they have exposure in China3. What’s also interesting is that close to four-fifths of allocations to China were cited as active decisions as opposed to benchmark driven allocation3. More importantly, about 85% of these active allocation into China equities were long-term strategic in nature3.

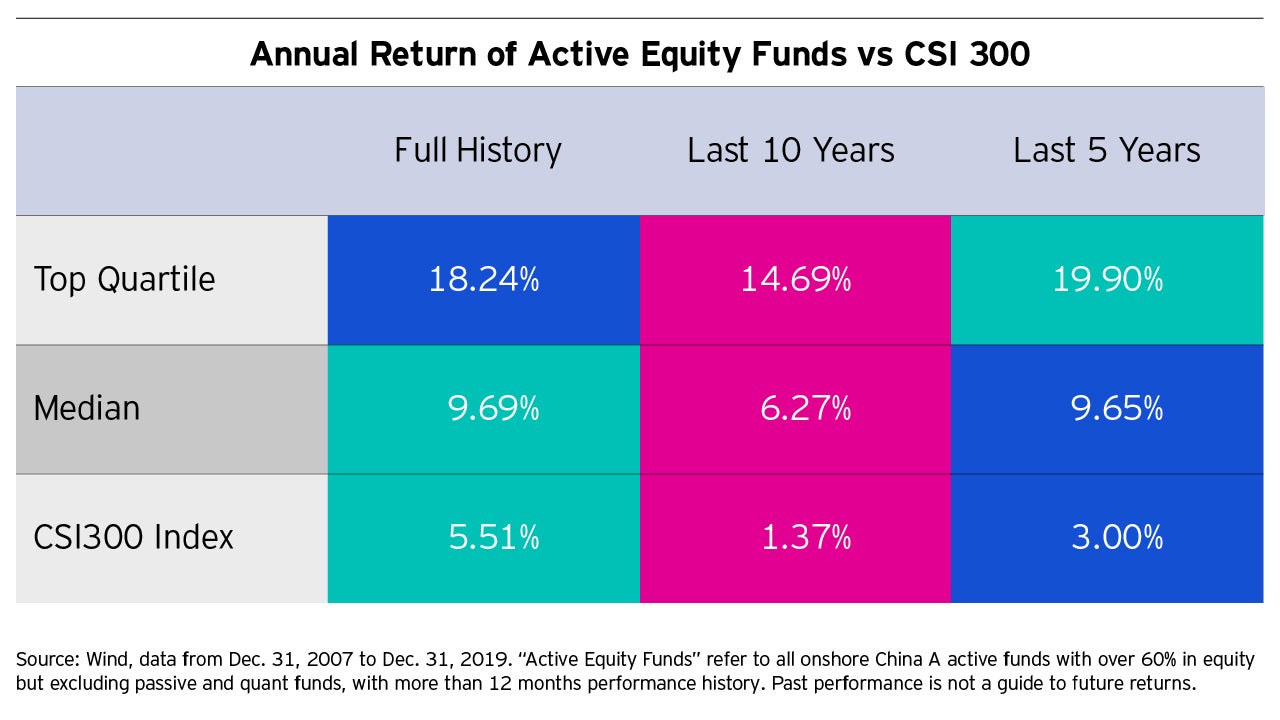

The results are not surprising. With the right expertise and skill, our experience suggests that the China A share market has remained one of the best alpha hunting grounds that investors can find. Our research found that active managers have been able to overcome inefficiencies in the China A-share market using a fundamentals-based approach to generate outsized investment return over the years. Median managers outperformed the benchmark A-share index CSI 300 by more than 4% a year, while top quartile managers outperformed by over 12% a year.

Conclusion

As the latest decision by China to scrap investment quotas for QFII and RQFII schemes shows, China continues to open its market. Foreign institutional investors are finding the A share market more accessible than before. Index providers have in turn acknowledged these market-opening efforts and gave their stamps of approval by embarking on the initial rounds of inclusion of A shares into their indices.

The China A-share market still has several gaps to fill in terms of market accessibility standards, aimed mainly at smoothening out and streamlining operations that would have the biggest impact on passive investments, before index providers would consider moving ahead with the next round of inclusions. Advancements in market structure help improve trading efficiency and investor confidence, but waiting for a barrier-free entry might be the last in mind of smart investors; an active investing approach can unearth attractive opportunities in the A-share maket before it gets too crowded.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

^1 “HKEX to offer MSCI derivatives, replacing Singapore as index provider’s Asia derivatives hub”, South China Morning Post, published May 27, 2020.

^2 “Beijing opens financial markets further amid tension with Washington”, Reuters, published May 8, 2020.

^3 Figure quoted is based on a sample of among respondents to the study. Some 139 chief investment officers, heads of asset classes and senior portfolio strategists (68 sovereign funds and 71 central banks) were interviewed between January and March 2019 for the study. These investors are responsible for managing over US$20 trillion in assets (as of March 2019).