Investing in China’s electric vehicle revolution

China’s commitment to energy transition and its pursuit of net-zero emissions has been nothing short of transformative. As the world's largest emitter of carbon dioxide accounting for a 31% share of global emissions in 20211, China has set goals to reach peak emissions before 2030 and achieve carbon neutrality by 2060.

This commitment is driving a process we call greenization, supporting China's journey towards net-zero emissions, electrification, and an energy revolution. China’s regulatory targets and policies to reduce carbon emissions has spurred noteworthy growth in the green industry, attracting substantial investments into electric vehicles (EVs) and its supply chain.

China has a competitive edge in the EV industry due to its technological advancements, highly skilled workforce, and complete EV manufacturing supply chain. This has enabled Chinese suppliers and companies to strengthen their leadership position in this industry.

At the same time, in recent years China’s EVs have faced increasing tariffs and export restrictions by the EU and US, posing a risk to their leadership position going forward. Price competition has also lowered the profit margins and earnings of domestic companies. We believe that there will be challenges for the industry in the short term, and China’s EV brands will continue to consolidate. However we still expect to see investment opportunities along the EV supply chain including in batteries, die-casting machines, SiC power devices and charging stations.

In this piece we deep dive into what’s driving growth in China’s EV sector, including government policies, competition, industry trends and the evolution of the EV supply chain including battery advancements and various other upstream and downstream factors. We then address how we expect the sector to evolve in the medium to long term and what investment implications this could have.

Government policies driving the growth of new energy vehicles (NEVs)

China’s 1 + N policy framework (“1” refers to the long-term approach to combating climate change and “N” refers to solutions to achieve peak carbon emissions by 2030), has had an impact on different segments of the NEV2 industry.

In the early stages of growth of the NEV sector, prior to 2016, subsidies and the exemption of vehicle acquisition tax played a significant role in reducing purchase costs for NEVs and accelerating their market penetration. In 2016, China’s National Development and Reform Commission (NDRC) and other government departments announced a new policy that adjusted subsidy standards and resulted in an overall decline in subsidies.

Since 2016, China has been undergoing a transition from subsidies and tax exemptions to a points system for NEVs. After several years of planning and hearings, the initial CAFC & NEV Credit Regulation (also known as the dual-credit policy) was announced in September 2017. This policy was officially implemented on April 1, 2018. Subsequent amendments to the policy were issued in 2020 and 2023.

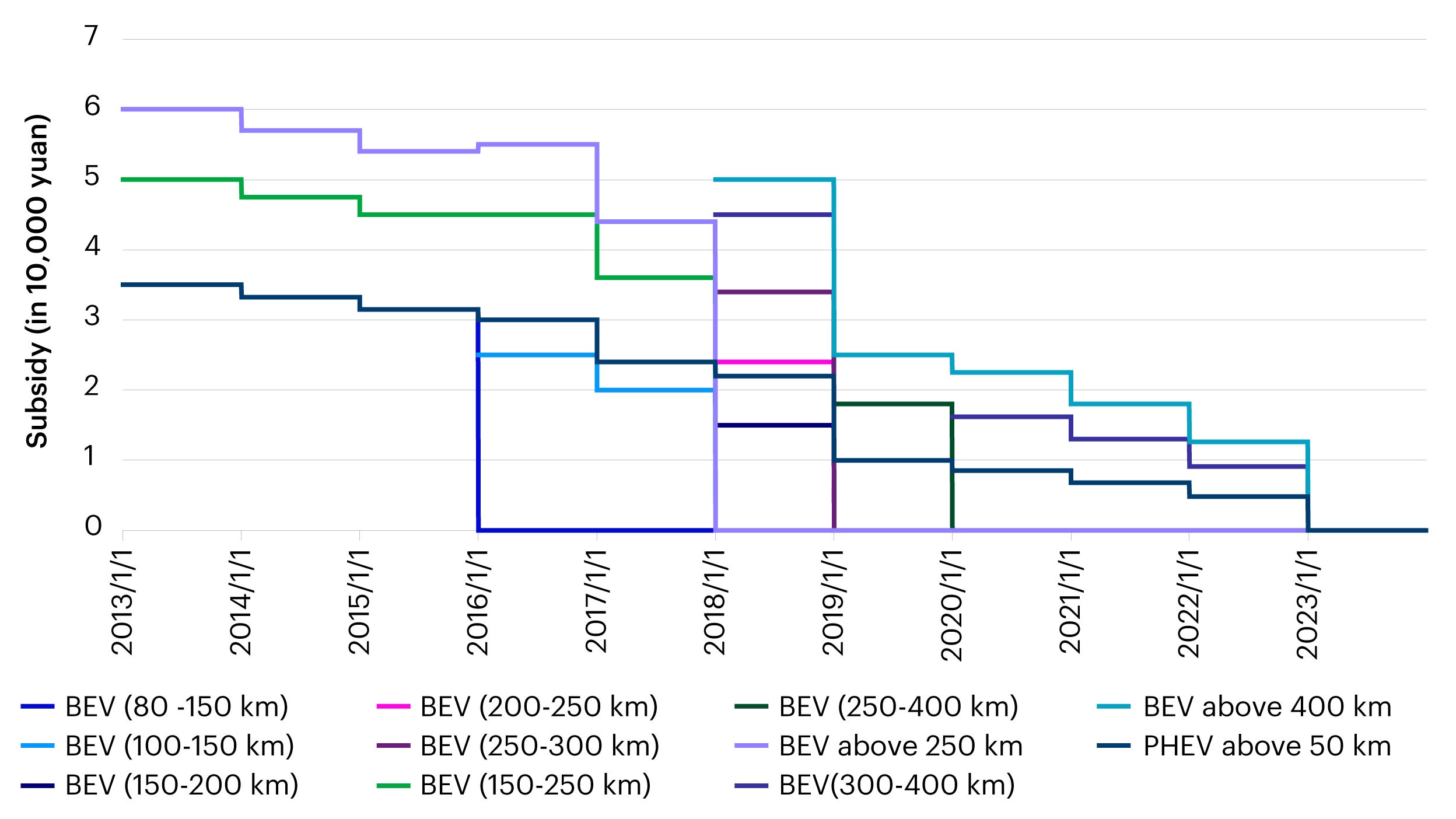

The dual-credit policy comprises of two components: NEV credits and corporate average fuel consumption (CAFC) credits. Original equipment manufacturers (OEMs) are required to achieve a specific level of NEV credits based on the production volume of NEVs. The credits vary depending on the type of NEV, such as battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). Additionally, the driving range of BEVs also influences the credit calculation. As a result over the past ten years, the minimum driving range for subsidizing BEVs has continued to increase, while the subsidies themselves have been decreasing (Figure 1).

Figure 1 - Subsidies across NEV driving ranges3

Source: Tsinghua University Research

Under the dual-credit policy, the CAFC credit component requires OEMs to collectively reduce the average fuel consumption of their entire vehicle portfolio, which includes both NEVs and internal combustion engine (ICE) vehicles. The objective is to reach a certain level of average fuel consumption. As of 2021, the target for average fuel consumption has been set at 4.0 liters per 100 kilometers by the year 2025. OEMs are therefore expected to work towards reducing the overall fuel consumption of their vehicle fleet to meet this target.

China’s NEV industry trends

Regulations like the dual-credit policy have played a key role in the growth of NEV sales in China, which continues to increase as a proportion of overall passenger vehicle (PV) sales. China’s PV retail sales reached 21.7 million units in 2023 up 5.7% year-on-year, while NEV retail sales during the same period reached 7.76 million units up 36.9% year-on-year, accounting for 35.7% of total PV sales.

As domestic demand for NEVs grow, Chinese brands have been increasing their overall market share in this sector. In 2020, Chinese brands accounted for about 42% of the domestic NEV market. This figure rose to 50% in 2021 and 58% in 2023.4

The key reasons why Chinese brands have been increasing their market share in NEVs include:

- Extensive line-up of models: Chinese automakers offer an extensive array of NEV models, with many firms introducing more than two new models annually and revamping existing models every one or two years. Automakers’ best-selling cars cater to diverse market segments and consumer needs, offering a wide range of options, such as BEVs, PHEVs, extended range electric vehicles (EREVs) as well as sports utility vehicles, sedans, and multi-purpose vehicles. The average selling price of these models varies from below 100,000 yuan to over 300,000 yuan, ensuring affordability across different price points.

- Variety of features: Chinese brands have been offering NEVs with comparable or longer driving ranges, more smart content features (e.g. advanced driver assistance system or ADAS, smart cockpit), and more features to promote safety and comfort (e.g. air suspension, seat heating, seat ventilation).

- Competitive quality: Decent and/or comparable overall quality to western brands.

- Attractive pricing: Apart from the features outlined earlier, Chinese automotive brands have been able to offer attractive prices to customers primarily due to fierce competition and improvements in vertical integration and cost control with their parts suppliers. However, increased margin pressure may also pose a challenge going forward.

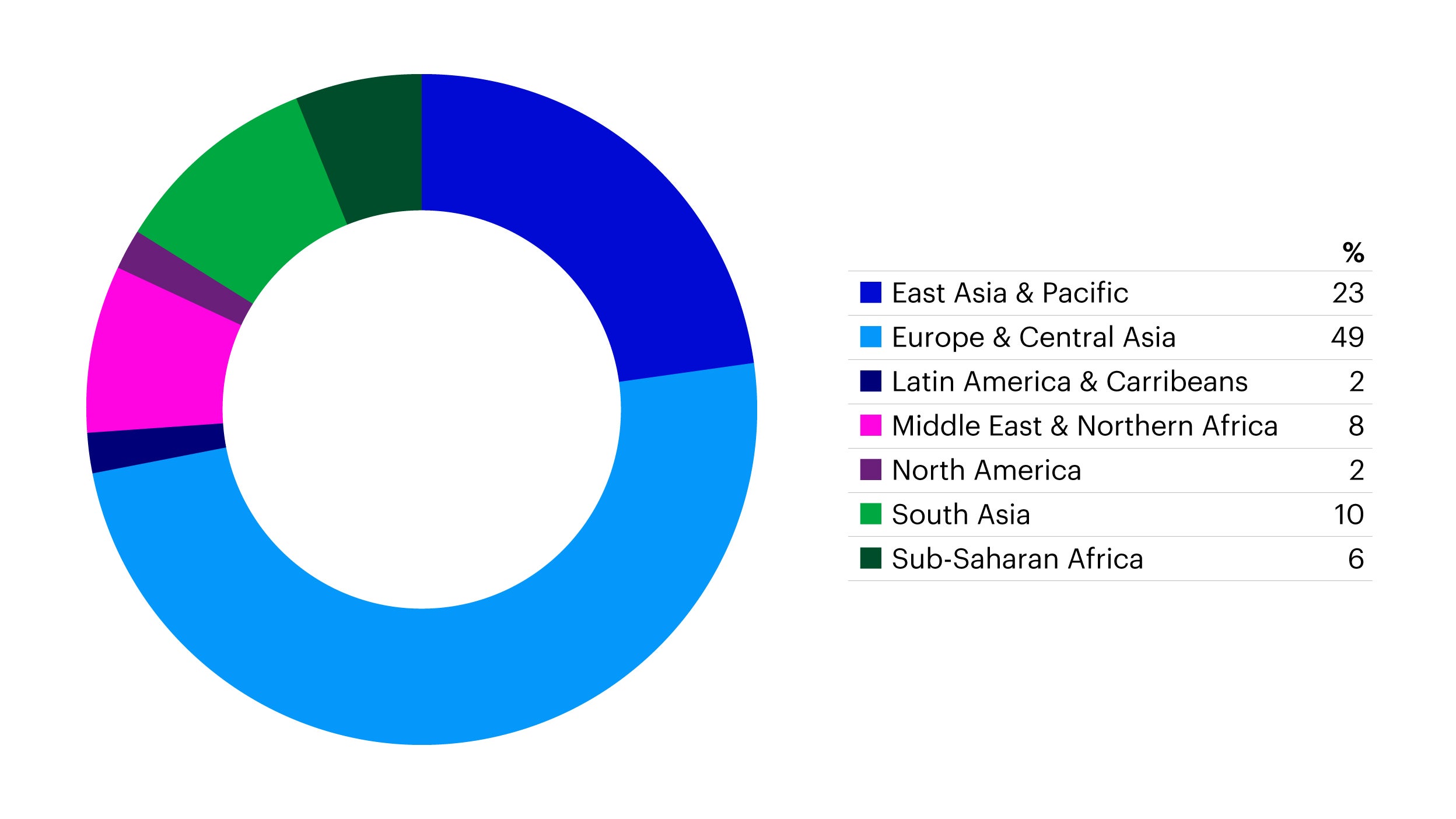

Chinese OEMs have not only been increasing market share in the domestic market but are also showing strong overseas growth. Chinese NEV exports increased from only 130,000 units in 2015 to 1.06 million units in 2022, an eight-fold increase. During that period, the NEV ratio of total automobile exports also increased from 18% in 2015 to 33% in 2022.5 The breakdown of exports by destination is shown in Figure 2.

Source: World Bank

In recent years, several countries have set NEV development targets to align with their decarbonization initiatives. China, for example, has set a target for BEVs to account for most new auto sales and aims to achieve total electrification of public automobile transportation by 2035. By 2027, the proportion of new energy vehicles relative to all newly added vehicles is expected to reach 45%, and at the same time older internal combustion engine vehicles are expected to be phased out.6

While NEV usage contributes to a reduction in carbon emissions, a major source of emissions also comes from the production of the NEVs themselves, and we see room for improvement in this area. When assessing the overall manufacturing supply chain of NEVs, there is scope for greater use of recycled materials as the production of steel, aluminum, and active materials is still relatively carbon intensive. At present, the utilization of recycled steel accounts for only 11% of total consumed steel. In comparison, the usage of recycled steel is significantly higher in other regions, with the European Union (EU) utilizing 56% and the United States utilizing 70% recycled steel.7

According to available data, 70% of carbon emissions arising from the production of NEVs comes from the refining and processing of raw materials8, followed by battery production including battery cells and battery packs. The increased application of aluminum to produce lighter automobiles is also a high-emitting activity.

Key drivers of China’s NEV supply chain

By delving further into the whole NEV supply chain, we see many growth opportunities for this sector with the potential to contribute to China’s electrification more broadly.

In recent years we have seen strong domestic price competition in NEV batteries as well as an increasing global trend toward low-cost battery development. Going forward we expect to see the development of higher energy density batteries with the potential to give cars about 10% more range than existing battery packs. The advancement of battery charging speed is also expected to drive the market forward by providing users with greater convenience.

We believe these factors will collectively contribute to the growth and adoption of NEVs by making them more affordable, extending their range, and enhancing the overall user experience.

In addition to advancements in NEV batteries, we are seeing a few other key trends and beneficiaries along the NEV supply chain, namely further electrification and increased smart content technologies (including ADAS) to name a few.

Battery film capacitors are also playing an important role in NEVs to smooth out direct current (DC) voltage and protect low voltage loads from voltage overshoot. As NEVs adopt high-power designs to improve operational efficiency, we expect new models will require more complex thin film capacitor systems to accommodate high power usage.

We also expect battery connectors to benefit from higher average selling prices given the expected overall increase in demand for high-voltage and high-speed connectors from increased electrification and smart content. Connecters for specific functions like battery-swap connectors and NEV-charging connectors will see increased demand as NEV demand increases. We are seeing increased localization in these areas to enable capacity expansion, lower costs, and improved product quality.

Smart content technologies such as smart cockpit products are not limited to NEVs. This technology has been adopted in ICE vehicles as well, however the penetration rate in NEVs has been more substantial than ICEVs. Smart cockpit products such as head-up display, liquid crystal display dashboards, and in-vehicle infotainment has significantly enhanced driver safety and convenience, thus penetration of these technologies into lower priced models also continues to increase.

Investment opportunities in supply chain players that are benefitting from NEV trends

We also outline the outcome of domestic and international NEV adoption on other various upstream and downstream NEV supply chain players apart from NEV battery manufacturers and smart content technology manufacturers. We are positive on companies in the below industries and believe the NEV supply chain will continue to benefit from ongoing electrification trends.

Lithium battery manufacturing equipment: On the upstream side, lithium prices are expected to remain low due to larger market surpluses and with weaker demand outweighing excess supply. We expect Chinese lithium battery equipment makers to benefit from increased NEV demand as China has the world’s largest supply capacity for lithium battery equipment. Several Chinese lithium battery equipment makers have also been expanding overseas and are providers to global battery makers in Japan and Korea. Although we do believe overcapacity risks may remain.

Die-casting machines: We are seeing the increased utilization of high-pressure die casting machines for chassis manufacturing. This can replace numerous welded components with a single module, which could help NEV makers simplify manufacturing and cut costs. The chassis is estimated to account for around 5 to 10% of the bill of materials (BOM) cost for NEVs. Batteries account for the largest proportion of NEV costs at around 30 to 40%, followed by the electric controls and motor at around 10 to 15%.9

SiC power device and substrate supply chain: Silicon carbide (SiC) is a semiconductor material used to control and switch high-power electrical devices. The market for upstream SiC substrates and power devices has traditionally been dominated by foreign players and Chinese companies only entered the market in 2020. In the past few years, Chinese players have expanded their capacity in this space and signed long-term delivery contracts with several multinational semiconductor and automotive supplier companies. We expect to see the first Chinese SiC products in NEVs by the end of 2023.

Charging stations: China’s NEV to charger ratio was around 2.5:1 in September 2023 (18 million NEVs and 7.6 million NEV chargers).10China’s Ministry of Industry and Information Technology (MIIT) has set a target to achieve an NEV to charger ratio of 2:1 by 2025 and 1:1 by 2030. We estimate that this would imply a 40% 23-30E CAGR of charging piles, with the number of charging piles reaching over 100 million by 2030.11 Most charging piles are loss-making right now due to high fixed costs. We also expect competition to remain fierce due to low barriers to entry for NEV charging stations. However, we expect some turnaround, especially for those stations located in prime locations, as we anticipate utilization rates will improve gradually over the next few years as the number of NEVs increases.

Conclusion

In summary, the driving forces behind EVs in China include a combination of policy frameworks, competition, battery advancements, and other upstream and downstream supply chain trends. These factors have contributed to the growth of the EV market, increased market share for Chinese brands, and led to advancements in the overall EV supply chain. While the trends we observe are promising, China’s EV sector will still need to address recent challenges arising from tariffs and export restrictions imposed by the EU and US, as well as internal price competition. We are seeing China and other countries and regions make efforts to align their vision and collaborate in addressing these challenges. Overall we are positive on China’s EV industry and expect companies along the supply chain to benefit in the medium to long term.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.