Indian equities - the fundamentals, trends and beyond (Part 1)

India has become the top performer among emerging Asian countries. NIFTY 50 and BSE SENSEX returned 4.35% and 3.96% YTD, and more encouragingly, rose 79.94% and 81.63% over the past five years, doubling the growth of MSCI All Country World Index.1 The number of firms going public also hit a record high with 184 IPOs being hosted in India this year.1

We are positive to this region and its outlook, considering its comparative advantages in fundamentals and the potential of emerging trends.

Why India?

Strong growth momentum

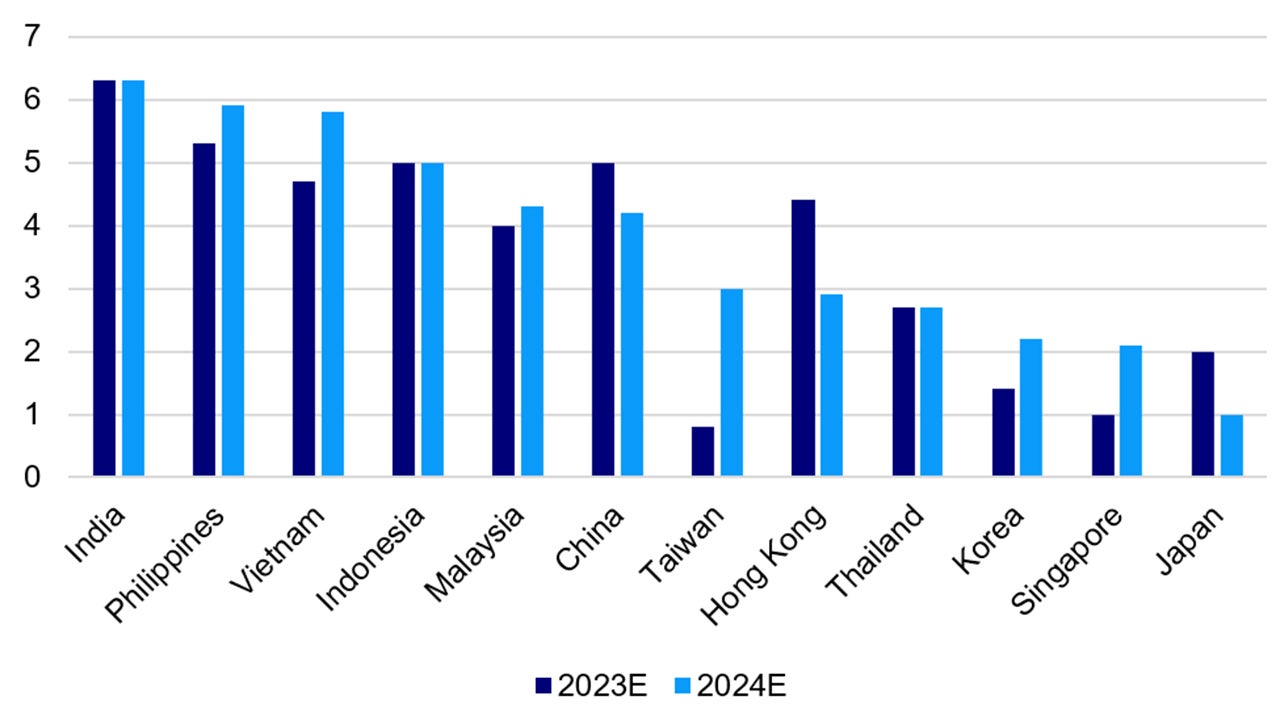

India is the fifth largest economy in the world with a GDP of 3.38 trillion in 2022.2 It is also the fastest growing country in Asia with annualized GDP growth expected to reach 6.5% over the next five years.3

The International Monetary Fund (IMF) has recently upgraded India's growth forecast for 2024 to 6.3% from 6.1% due to stronger-than-expected consumption in the second quarter. The forecast for 2023 and 2025 remains unchanged at 6.3%.4

Source: International Monetary Fund, October 2023

Favorable demographics of young population

- India surpassed China in 2023 to become the most populous country in the world, per UN estimates.

- With a median age of 27.6 and a total of 254 million youths (aged between 15-24), India is also one of the youngest countries and has the world’s largest youth population.3

- Lifestyle spending is expected to increase as youths enter working population, signifying massive potential in the consumer discretionary sector.

Rising income and discretionary spending

- For India, the share of the working age population is 67%.6 It is still on the rise and have already passed the peak in China, Brazil, or even the global average.6

- On the other hand, total dependency rate is expected to fall from 65.2 in 2011 to 53.8 in 2031, implying rising income per household.6

Is the existing valuation reasonable?

- One of the biggest questions we receive from investors is about the valuation of Indian equities.

- Indian companies have demonstrated a consistent pattern of achieving mid-teen profitable growth and have displayed a propensity to enhance their Return on Equity (ROE).

- Indian companies are currently experiencing lower leverage on their balance sheets. They have been gradually and steadily building capacities, and their prudent allocation of capital has led to a more cautious approach in generating better reserves.

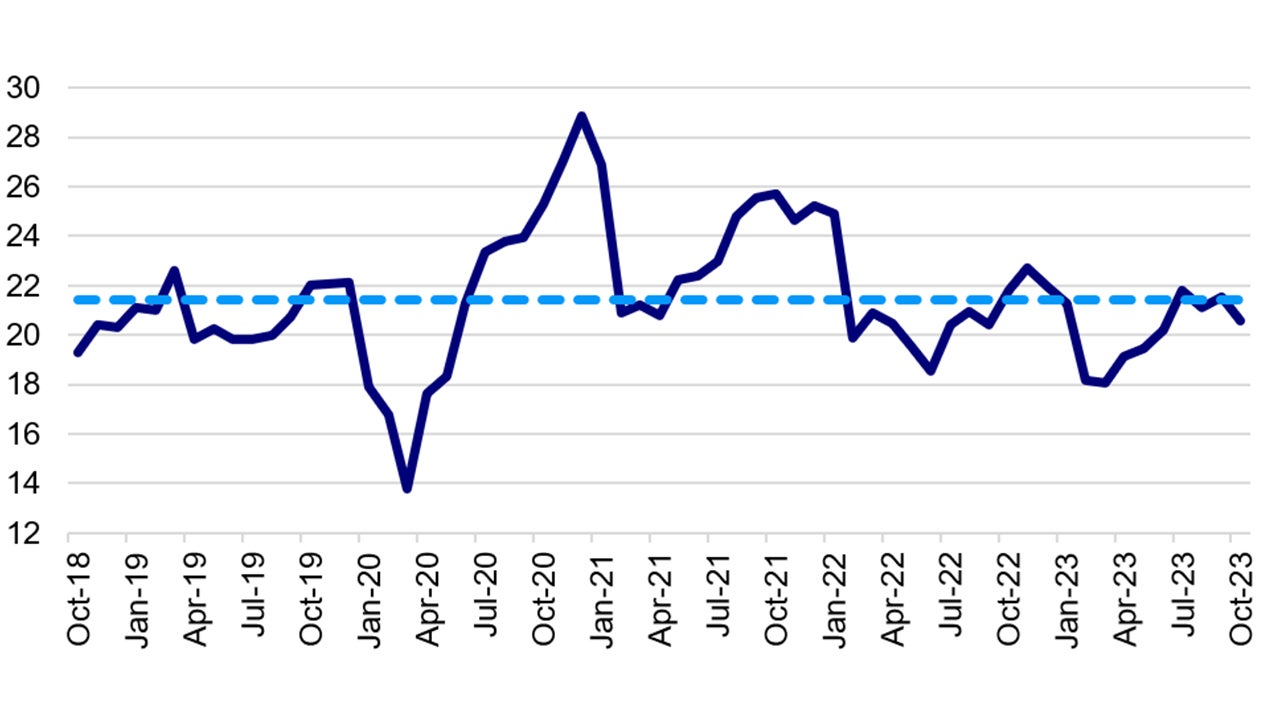

- In fact, the current P/E ratio of NIFTY 50 is at a reasonable level of 20.6x, lower than the 5-year average of 21.4x.7

- Following the earlier rally and rerating in the Indian market, we maintain a mindful approach towards the valuation of Indian equities.

- We prefer stocks with reasonable valuation and benefits from structural trends which will be introduced in the next episode of this series.

Source: Bloomberg, 31 October 2023

References:

-

1

Bloomberg, 2 November 2023

-

2

World Bank, 1 July 2023

-

3

HSBC Global Research, September 2023

-

4

International Monetary Fund, October 2023

-

5

Mint, “Does the 4% inflation target need a reset?”, 29 August, 2023

-

6

Macquarie Research, August 2023

-

7

Bloomberg, 31 October 2023