Insight

Indian equities - the fundamentals, trends and beyond (Part 3)

- The Indian stock market has demonstrated robust growth, resulting in an above-average valuation.

- It is worth noting that small-cap equities in India tend to have higher price-to-earnings (P/E) ratios compared to the MSCI India, approximately 1.3 times higher.1 We anticipate a larger upward trend for large-cap stocks in 2024, as they generally exhibit higher return on equity (ROE).2

- When comparing India's equities to their own historical performance, they are currently trading close to the +1 standard deviation level of the past 10 years. Given the robust earnings visibility of Indian companies, we expect the P/E ratio to sustain.2

Source: Bloomberg, Jefferies.

- The valuation of the Indian market is expected to remain within the range of the longer-term trend.

- When considering the price-to-earnings (P/E) ratio alongside growth, the Indian markets are found to be fairly valued and outperform other major economies. In fact, the MSCI India's PEG ratio of 1.3x is notably better than developed markets, Korea and Mexico.

- We believe while maintaining a disciplined valuation approach, it is crucial to acknowledge the strong fundamentals and macro stability that underpin India's equity valuation, paving the way for further upside potential.

We believe that India's stock market valuation is supportive because of the following reasons:

1.Robust corporate earnings growth:

- Strong demand in manufacturing and consumer discretionary sectors is leading to improved pricing power and driving earnings growth.

- Corporate earnings across various sectors consistently demonstrate an upward trend, with return on equity (ROE) ratios reflecting positive growth.

- India's companies are estimated to achieve a decadal high of ROE at 15% by FY 2024, with the potential for further upside with disciplined expansion.2

- Earnings for Indian companies is growing strong, EPS growth in the last 5 years was 22% on average. The earnings are currently experiencing a significant cyclical uptrend.2

- The EPS growth of Indian companies is much higher than that of most developed economies and emerging markets, anticipated to be around 17.0% in CY 2024.3

- Historical trends confirm that India’s growth translates into substantial corporate earnings.4

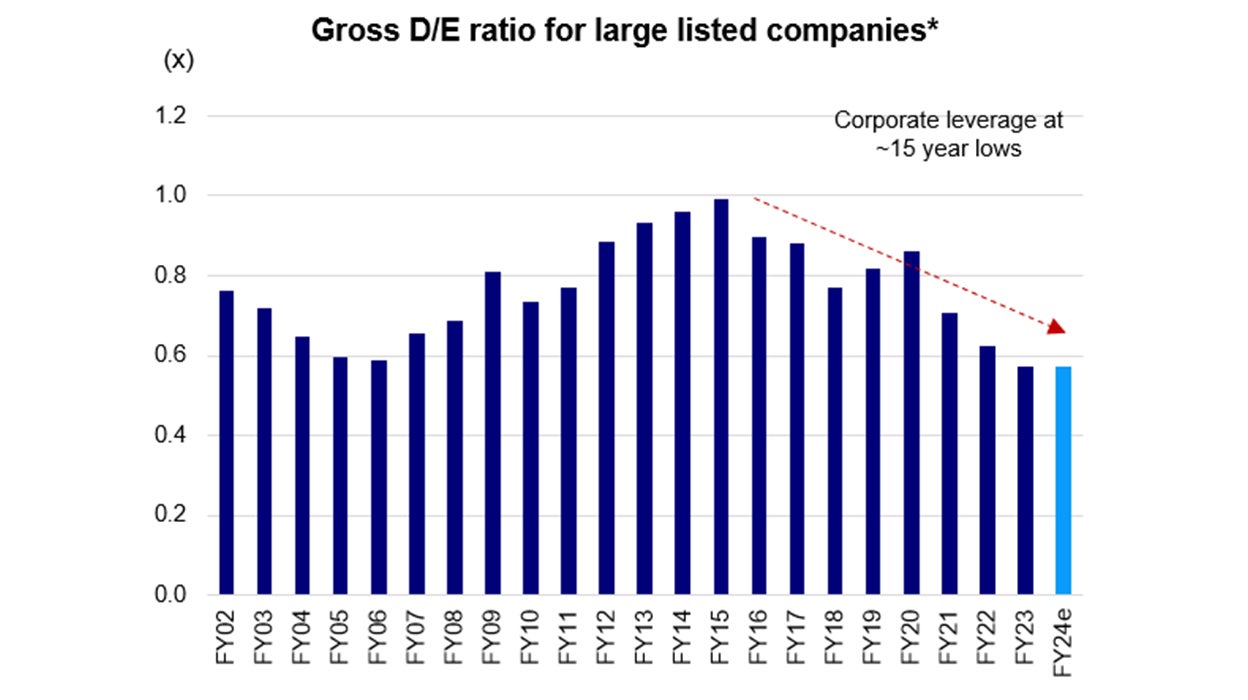

2. Strong corporate fundamentals:

- Indian companies have effectively managed their balance sheets over the last 10 years, maintaining underleveraged positions that support their participation in demand-led growth.

- The debt/equity ratio of Indian corporates is at an all-time low of ~0.5x.3

Source: ACE Equity and Jefferies. *Sample of ~600 listed companies.

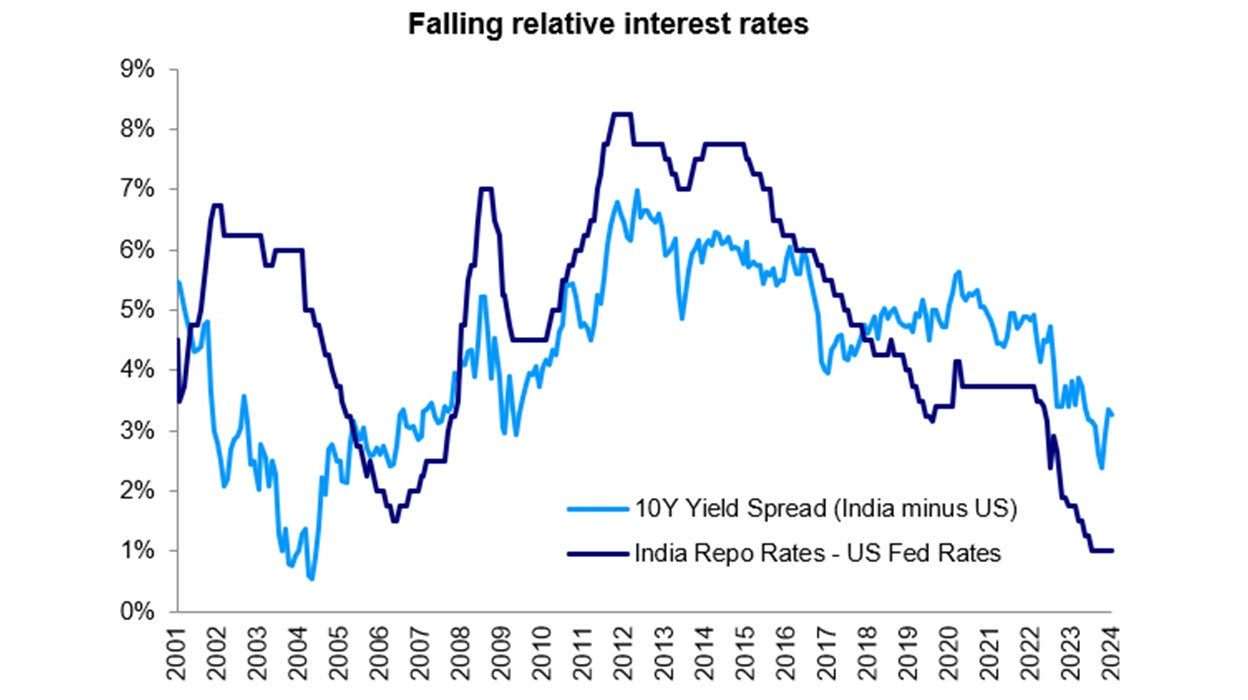

3. Positive macro factors:

- Structural changes in India's economy over the past decade have contributed to market confidence.

- India's upward growth cycle is expected to generate strong earnings for the next 3-4 years.

- The expected falling interest rates will boost market confidence in India's future cash flows, while its strong relative growth further supports this positive outlook.

- India is gaining share in global trade, reducing oil intensity of the economy and flexible inflation target have narrowed India's inflation differentials with the world, leading to lower interest rate differentials.

Source: Bloomberg and Morgan Stanley Research.

References:

-

1

Morgan Stanley, 24 January 2024

-

2

Jefferies, February 2024

-

3

ACE Equity and Jefferies, February 2024

-

4

JP Morgan, December 2023