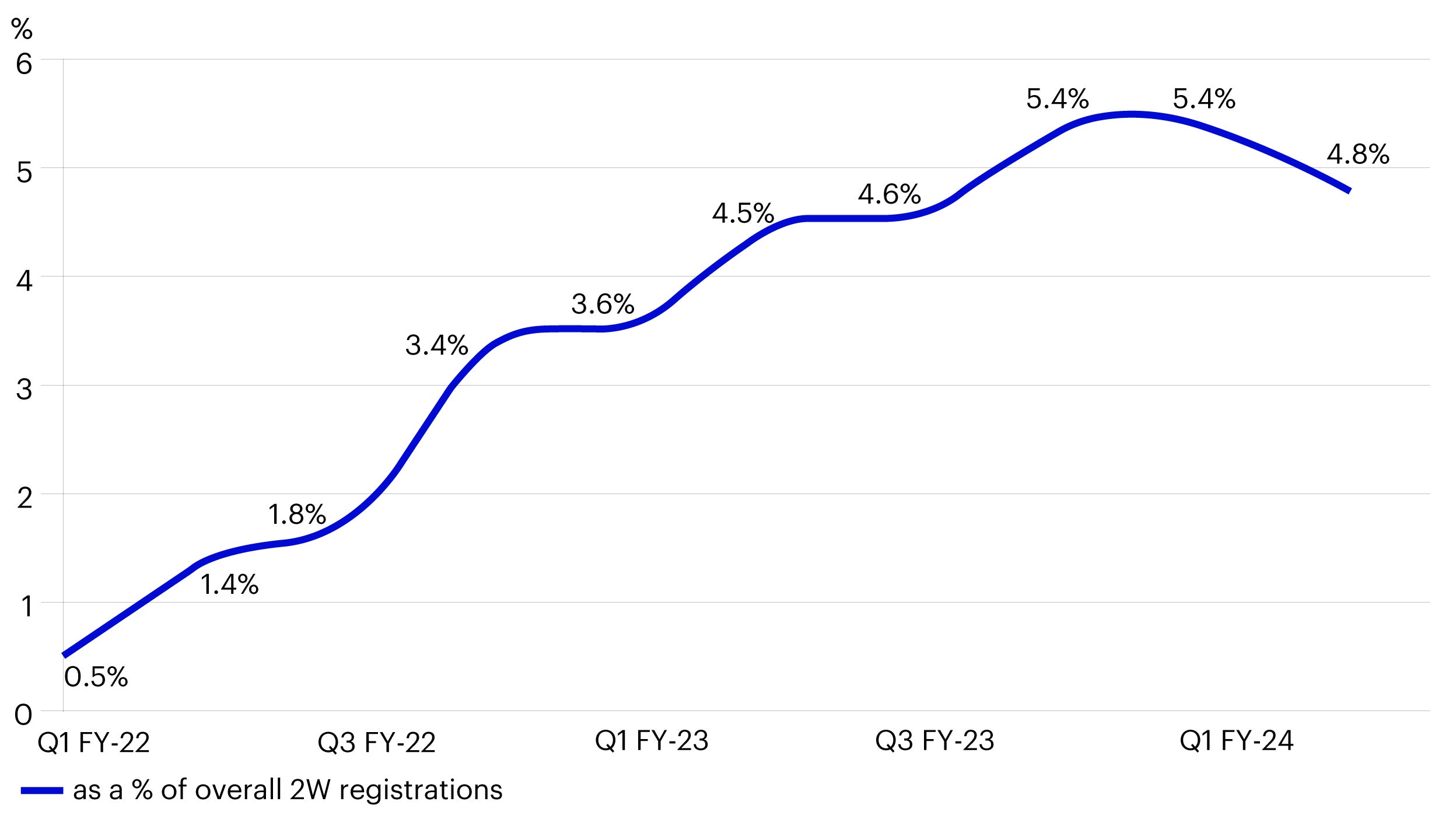

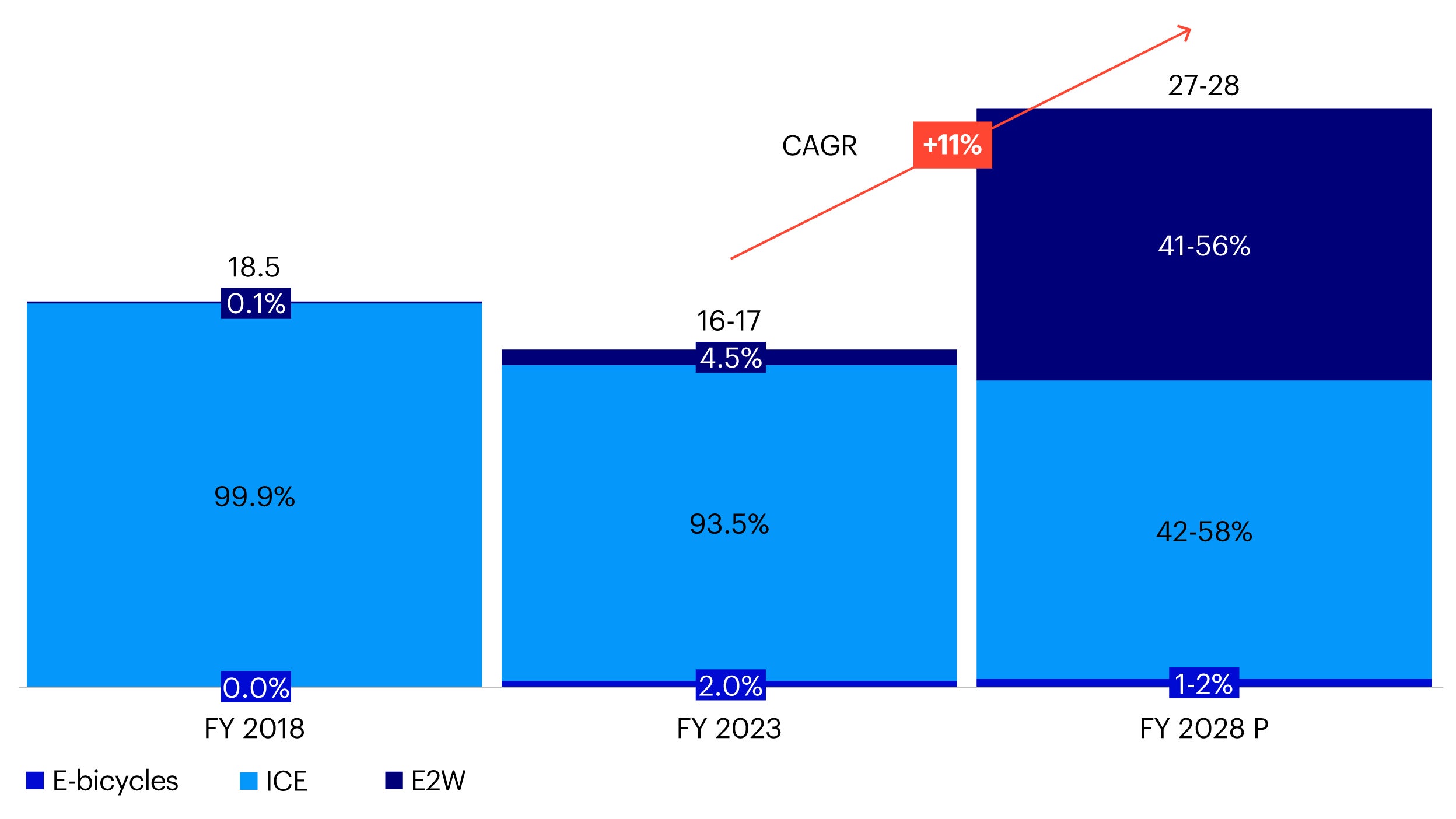

We expect the key drivers of steep adoption of E2Ws in India to be as follows:

- Consistent government push: Persistent regulatory support across supply, demand, infrastructure, and financing etc. is expected to continue.

- Lower total cost of ownership versus internal combustion engine (ICE) 2Ws: Lower fuel costs and other savings (maintenance, subsidies etc.) as well as declining E2W prices are being driven by a reduction in material costs and increasing economies of scale by E2W original equipment manufacturers (OEMs).

- Easier access to charging stations and improving driving range: The leaner charging and infrastructure requirements for E2Ws over E4Ws also contributes to faster adoption.

- Serving a variety of use-cases: Designing specific products to serve B2B use such as swappable batteries, greater carrying space, etc.

- Service and maintenance: E2Ws require a lower number of moving parts for service and repair to meet customer demand.

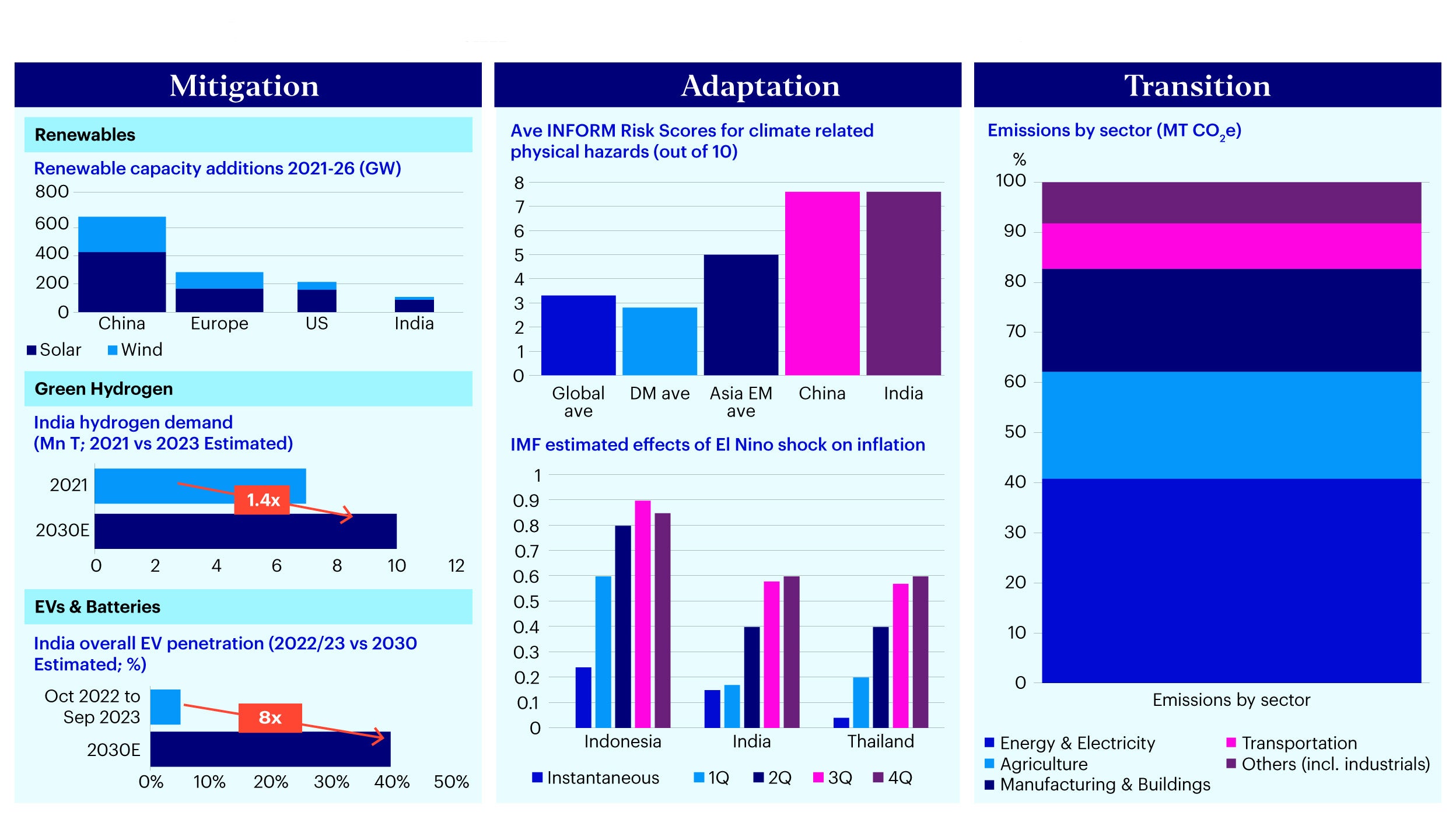

Adaptation: Increasing agriculture, food, and water security

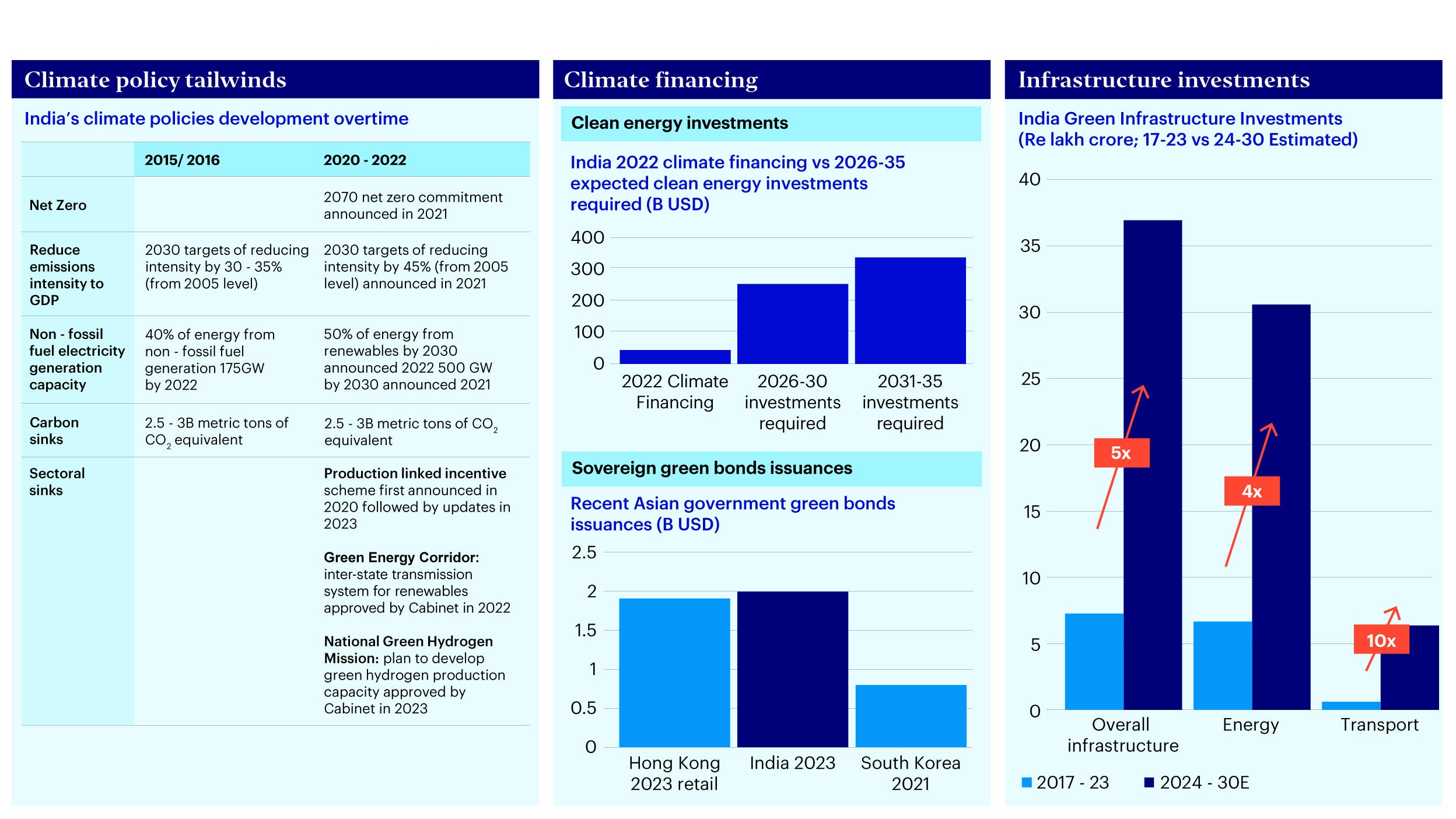

As per our previous piece on climate adaptation in Asia, India is highly vulnerable to physical risks be it floods and rainfall, extreme heat and wildfires, and rising sea levels. Previously India has spent over 13.35 trillion rupees on climate adaptation over 2021 to 2022 at just over 5.5% of GDP.22

- Agriculture and Food: El Nino in 2023 has affected agriculture supply which can lead to potential declines in yields and rising input costs. Additionally, India’s government price controls on agriculture could further exacerbate supply shortages. Export restrictions were placed on rice, wheat, and sugar which has led to rising prices in other Asian countries.23 Adaptation opportunities exist in helping agriculture to be more climate resilient and increase crop yields such as in weather warning systems, improving soil quality and irrigation, and other methods of agriculture digitization.

- Water security: India is one of the most water-stressed regions in the world where the country despite having 18% of world’s population only holds 4% of its water resources.24 Persistent droughts will continue to exacerbate challenges in ensuring clean water supply and sanitation. Given agriculture’s share of India’s economy, water security also impacts broader food security and economic growth. Challenges relate to the lack of proper water management systems, inefficient irrigation, and insufficient wastewater treatment facilities.25 We expect demand for adaptation financing opportunities to grow in relevant urban infrastructure and water sanitation and management projects that can also help improve health and productivity.

Transition: Transition planning across high-emitting sectors

The number of Indian companies committing to science-based targets has grown from 89 in June 202226 to near 300 as of February 2024.27 In line with global trends, transition planning will be critical for companies across high-emitting sectors. From an investment perspective, investors can consider assessing companies on financially material risks and opportunities based on transition progress in each sector:

- Power and energy: Electricity generation accounts for 40% of India’s total emissions.28 Capex for utilities and power corporates will increase given the move toward renewables. India’s deployment of renewables is targeted to reach 7400GW of estimated capacity by 2070.29 Oil and gas companies could increase existing production efficiencies and recovery rates while also exploring carbon capture technologies alongside developing green hydrogen.

- Agriculture: Agriculture currently accounts for around 20 to 25% of total electricity consumed30, primarily for irrigation purposes. Carbon sequestration and carbon sinks are required while also considering adaptation financing to ensure food security.

- Manufacturing and industrials: These sectors account for around 20% of India’s total emissions31; including energy-intensive sectors like iron, steel, cement, and chemicals, which requires manufacturing and production to shift towards electrification and building out of hydrogen-based infrastructure. Specific levers also exist for each sector including electric arc furnace and scrap recycling for steel and improving clinker efficiency for cement.32

- Transport: Around 10% of India’s total emissions are primarily from road transport,33 In addition to the electrification of two- and three-wheelers, the increase in infrastructure development would also facilitate a transportation shift from roads to railroads driving further electrification and energy efficiency.