How should investors be positioned in a Fed tightening cycle?

Key takeaways

US stocks

Positioning

Sectors

The Fed’s hawkish pivot is on many investors’ minds, and with good reason. I answer these top questions from clients about stock market performance during Fed tightening cycles.

How did US stocks perform in past Fed tightening cycles?

Contrary to popular belief, US stocks generally did better during Fed tightening cycles than during Fed easing cycles.

That’s because Fed tightening occurred in the second half of US business cycles 67% of the time, and Fed easing overlapped with US economic recessions 67% of the time.

It would be unusual for the stock market advance to end this early in a Fed tightening cycle. In my view, the last hike matters more than the first. Until then, we remain buyers of stocks on the dips (Figure 1).

Figure 1: Fortunately, the US stock market generally did better during Fed tightening cycles, which occurred in the second half of business cycles 67% of the time.

Sources: Bloomberg L.P., Invesco, 12/31/21. Notes: Shaded areas denote Fed tightening cycles from first to last hike (1983-1984, 1987-1989, 1994-1995, 1999-2000, 2004-2006, and 2015-2018). CAGR = Compound annual growth rate. US stocks = S&P 500. Price returns in US dollars. An investment cannot be made into an index. Past performance does not guarantee future results.

How should global investors position themselves in this Fed tightening cycle?

Similar to US stocks, global equities generally did better when the Fed was raising interest rates. Indeed, style, size, US, and non-US equities all performed better when the Fed was raising interest rates.

Unfortunately, investors who are looking for consistent global equity leadership (myself included) during Fed tightening cycles may be disappointed.

Whether it was style, size, US, or non-US equities, not a single category ranked in the top three more than 50% of the time in our sample.

As a combined category, however, US large-cap growth stocks did top the leader board in the 2015-2018, 1999-2000, 1994-1995, and 1983-1984 Fed tightening cycles. I could live with those odds.

In my view, the combination of slower economic and earnings growth, exacerbated by tighter fiscal and monetary policy, point to higher quality positioning in large-cap growth stocks, the recent selloff in which I believe presents another attractive entry point (Figure 2).

Figure 2: Change was constant across tightening cycles. But I expect US large-cap growth to resurface, given tighter fiscal and monetary policy coupled with slower activity.

Sources: Bloomberg L.P., Invesco, 12/31/21. Notes: Shaded areas denote episodes when US large-cap growth underperformed. White areas denote episodes when US large-cap growth outperformed. An investment cannot be made into an index. Past performance does not guarantee future results. These comments should not be construed as recommendations but as an illustration of broader themes.

What about sectors?

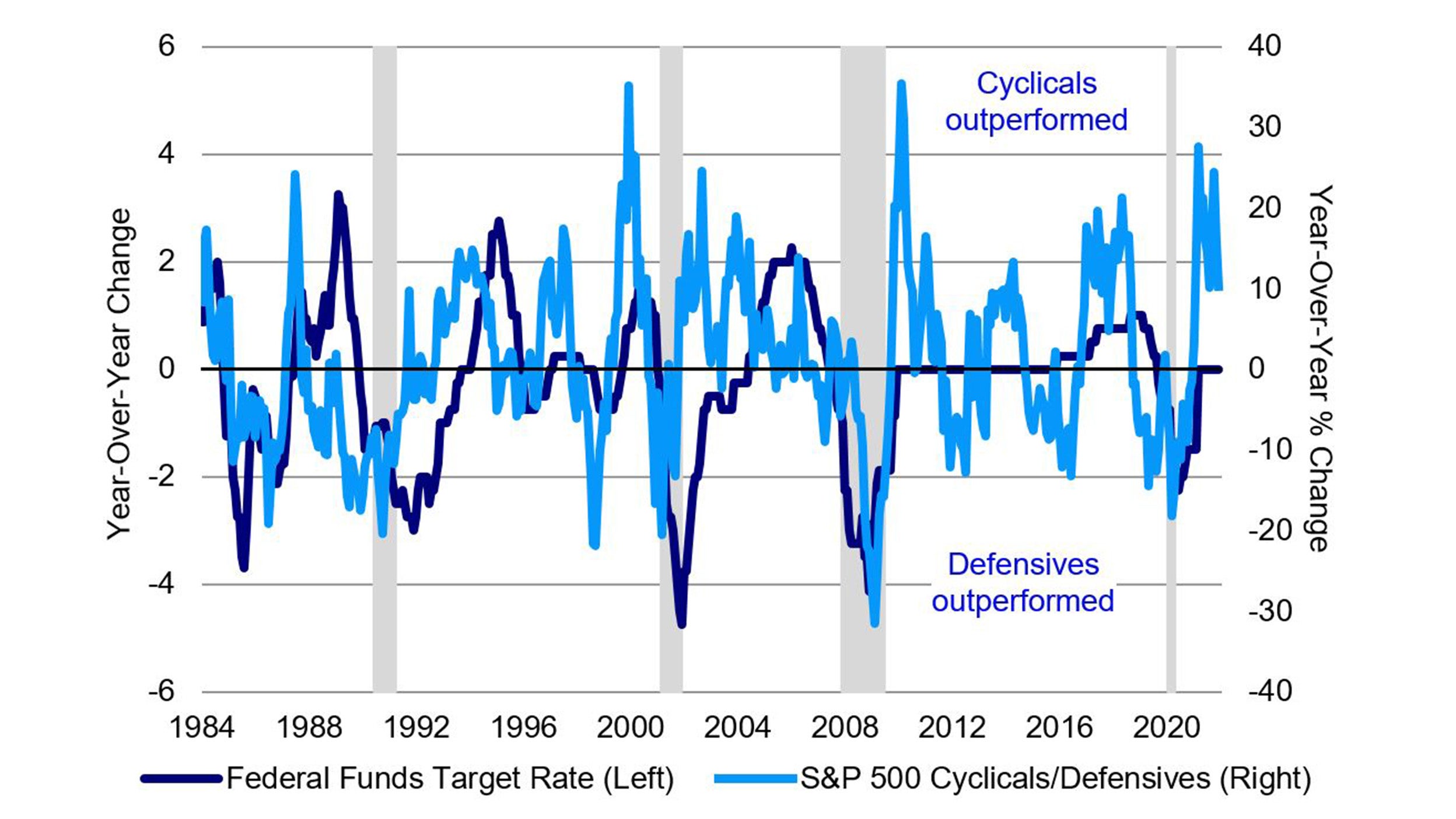

It would be unusual for the cyclical advance to end this early in a Fed tightening cycle. As we’re fond of saying, the last hike matters most. Until that time, I remain a buyer of cyclicals on the dips (Figure 3).

Figure 3: US cyclical sectors outperformed their defensive counterparts in four of the last six Fed tightening cycles.

Sources: Bloomberg L.P., Invesco, 12/31/21. Notes: Cyclicals = S&P 500 consumer discretionary, energy, financials, industrials, information technology, and materials indices. Defensives = S&P 500 consumer staples, health care, telecommunication services, and utilities indices. In the left chart, shaded areas denote NBER-defined US economic recessions. An investment cannot be made into an index. Past performance does not guarantee future results.

Within cyclicals, what should investors favor?

In Fed tightening cycles, tech (growth) outperformed financials (value) most of the time. Consistent with my expectation for continued US large-cap growth outperformance, I believe that tech stocks will become interesting to investors once again after their recent correction. More often than not, tech outperformed financials during Fed tightening cycles.

The bottom line is that I believe persistent defensive sector outperformance likely awaits an economic downturn. However, I see plenty of runway ahead for this business cycle, barring a Fed policy error. As such, I think it’s too soon to get outright defensive by fully embracing counter-cyclicals. In my view, the economy-sensitive, cyclical sectors of the market remain the place to be for now. Stay tuned.

Click here for more charts and all of the reasons why I think investors should favor stocks in Fed tightening cycles.