Greenization series: Green sectors for China’s quality growth

Q: What is greenization and what are green sectors?

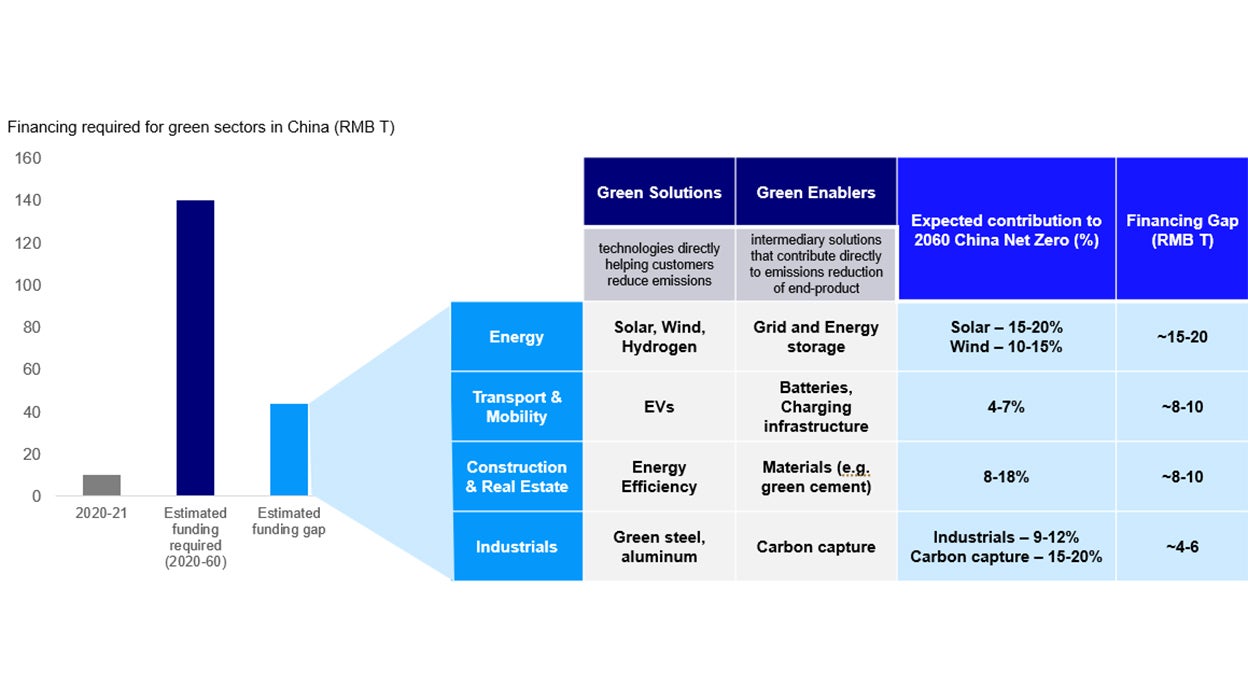

A: The global energy transition creates demand for green technologies, products and services (Chart 1). These enable other sectors to decarbonize and includes technologies and segments of:

- Transport: Electrification of transportation through EVs supported by underlying battery technologies.

- Energy: Generating electricity and power through alternative renewable energy like solar (PV), wind, hydrogen supported by underlying grid and energy storage technologies.

- Construction and real estate: Improving energy efficiency through building energy management and use of renewable energy. Also supported by underlying materials in construction such as green cement and materials.

- Industrials: Greener production processes for materials like aluminum and steel such as through electric furnaces or using scrap materials. Further complemented by use of carbon capture, utilization and storage technologies.

Source: WEF Financing transition to net zero (WEF_Finance_the_Transition_NewZero_Future_China_2022.pdf (weforum.org) ) ; Mckinsey Financing the net zero transition (financing-the-net-zero-transition-from-planning-to-practice.pdf (mckinsey.com) )

Q: Is Greenization a priority for China?

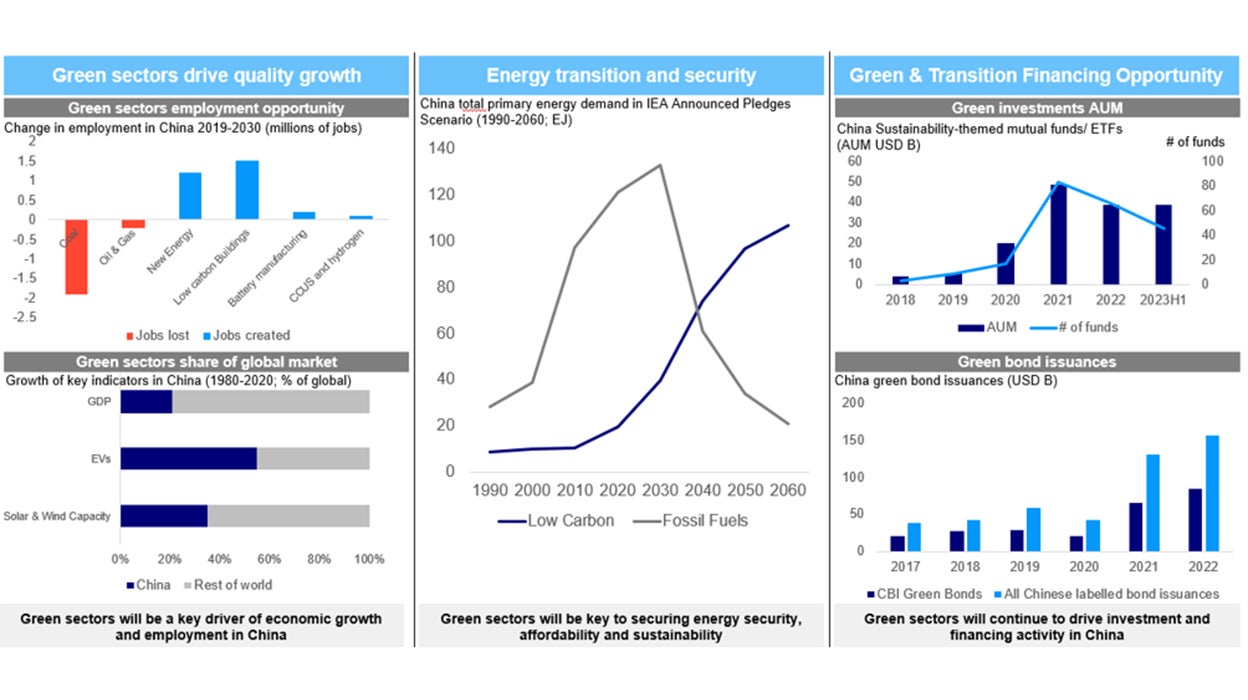

A: Policy tailwinds are driving the development of green sectors (Chart 2).

Green sectors to drive quality economic growth in China

- Increasing emphasis on “quality of growth” where green sectors have a higher degree of technology and innovation, export potential and ability to deliver on sustainability outcomes.

- “1+N” policy framework has helped to set national targets alongside supporting policies to drive domestic growth and penetration of green sectors. For example, this includes targets for the EV share of new auto sales to be 45% by 20271 alongside purchase tax exemption of up to 30K RMB per unit for purchases of new EVs in 2024 and 2025.2

- Exports to drive economic growth as these green sectors are backed by cost advantages, economies of scale and transition demands.

- China’s share of EVs sold in Europe has grown significantly to 8% in 2023 and could reach 15% by 2025.3

Energy transition and security (ETS)

- China remains the largest emitter globally4 and 3060 goals will drive the transition from a coal-based economy to green economy. This is to address goals related to energy security, affordability and sustainability.

- China’s ETS is expected to be a critical policy driver as carbon prices reached a record 70 RMB/ton in 20235.

Green and transition financing

- The World Economic Forum previously estimated that 140 trillion RMB6 is required in China for green and transition financing betwen 2020 and 2060.

- Green sectors provide the financial sector with broader financing and investment opportunities, serving as a good diversifier against traditional consumption, infrastructure or property related financing.

- This is supported by the People's Bank of China’s monetary tools for carbon reduction projects as well as clarity in standards through the publication of the Green Bond Project Catalogue and Green Bond Principles which defines green activities for the market.

Source: IEA Energy Sector Roadmap to carbon neutrality in China (Executive summary – An energy sector roadmap to carbon neutrality in China – Analysis – IEA ); CBI China Green Bond Market Report 2022 (cbi_china_sotm_22_en.pdf (climatebonds.net) ); Cerulli ESG Investing in Asia 2023

References:

-

1

Source: Nikkei Asia China moves NEV target forward to 45% of auto sales by 2027 - Nikkei Asia.

-

2

Source: HKTDC Research Tax Exemptions for NEV Purchases Extended to 2027 | HKTDC Research

-

3

Source: Invesco COP28 implications for China and the Middle East - AP Institutional | Invesco

-

4

Source: Invesco Re-globalization series: What’s driving China’s economic transformation? - AP Institutional | Invesco

-

5

Source: Bloomberg China’s Carbon Price Hits Record as Polluters Rush for Permits – Bloomberg

-

6

Source: WEF WEF_Finance_the_Transition_NewZero_Future_China_2022.pdf (weforum.org)