Re-globalization series: China’s paving the way to re-globalization and success

China is evolving from “the world’s factory” to “an alternate global supply chain” with an increasing number of enterprises expanding overseas to leverage on the immense global demand.

We are positive to China’s re-globalization considering its competitive advantages. This is the key theme for investors looking to tap the opportunities in the Chinese equity markets.

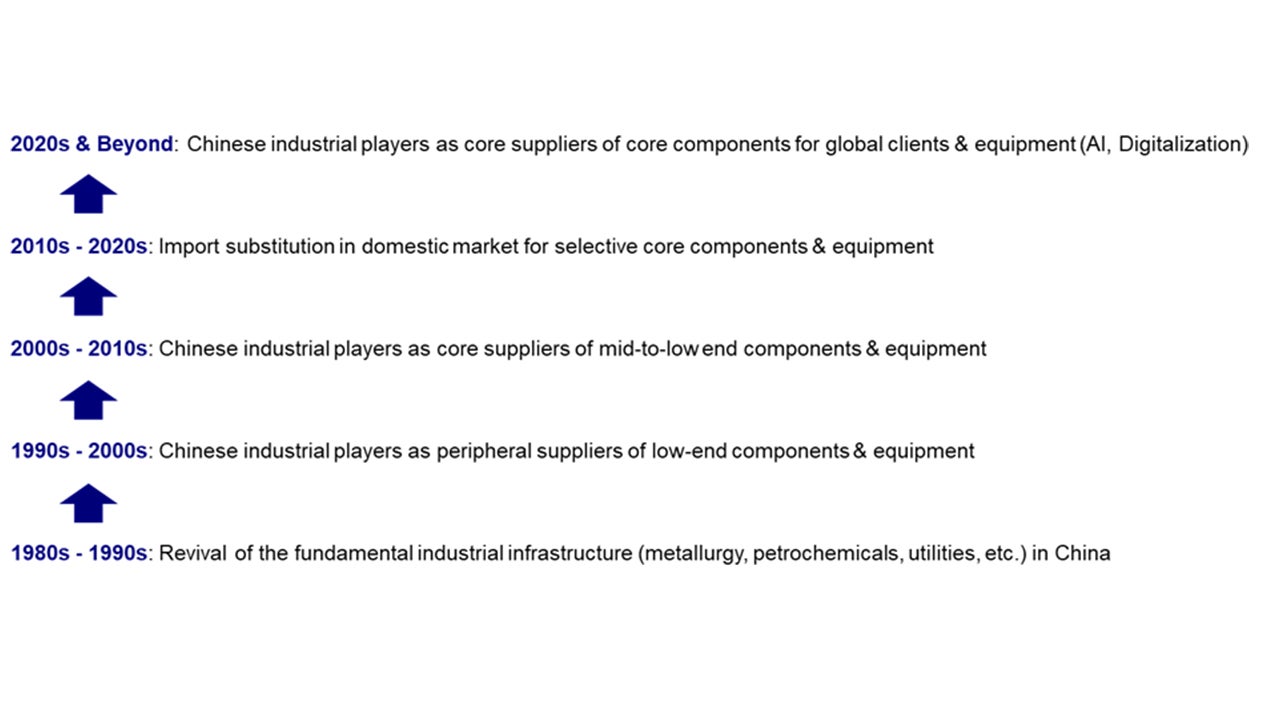

China’s supply chain evolution

- China has developed fundamental industrial infrastructure in the 80s and has since played a vital role in global supply chain.

- With years of technological transformation and enhancement, Chinese industrial players have evolved into essential suppliers of components to global counterparts.

- China has the capabilities to transform from an exporter to a global supplier - an evolution from focusing on GDP (Gross domestic product) to GNP (Gross National Product).

- Chinese suppliers have actively participated in the formation of the world’s second supply chain, we expect it to be a key player in the global supply chain with strong competitive advantages.

- We see opportunities in global giants and manufacturers that could benefit Chinese suppliers.

- In April 2023, US manufacturing spent USD189 billion annually on new factories, tripled the average in the 2010s.1 China’s direct investment and capex overseas are the main driver.

- China’s engagement in global supply chain could lead to a win-win situation for key stakeholders:

- A global supply chain with Chinese suppliers could bring in talents, capital, expertise, efficiency, lower cost, cluster of networks and local employment.

- Chinese suppliers have the opportunities to enhance innovation, global experience and knowledge, clients and growth.

- Companies going global will likely achieve higher ROE (Return on equity) and sustained growth.

- Overall, China may benefit from the larger economies of scale with its presence in global supply chain, achieving competitive pricing and a diverse customer base.

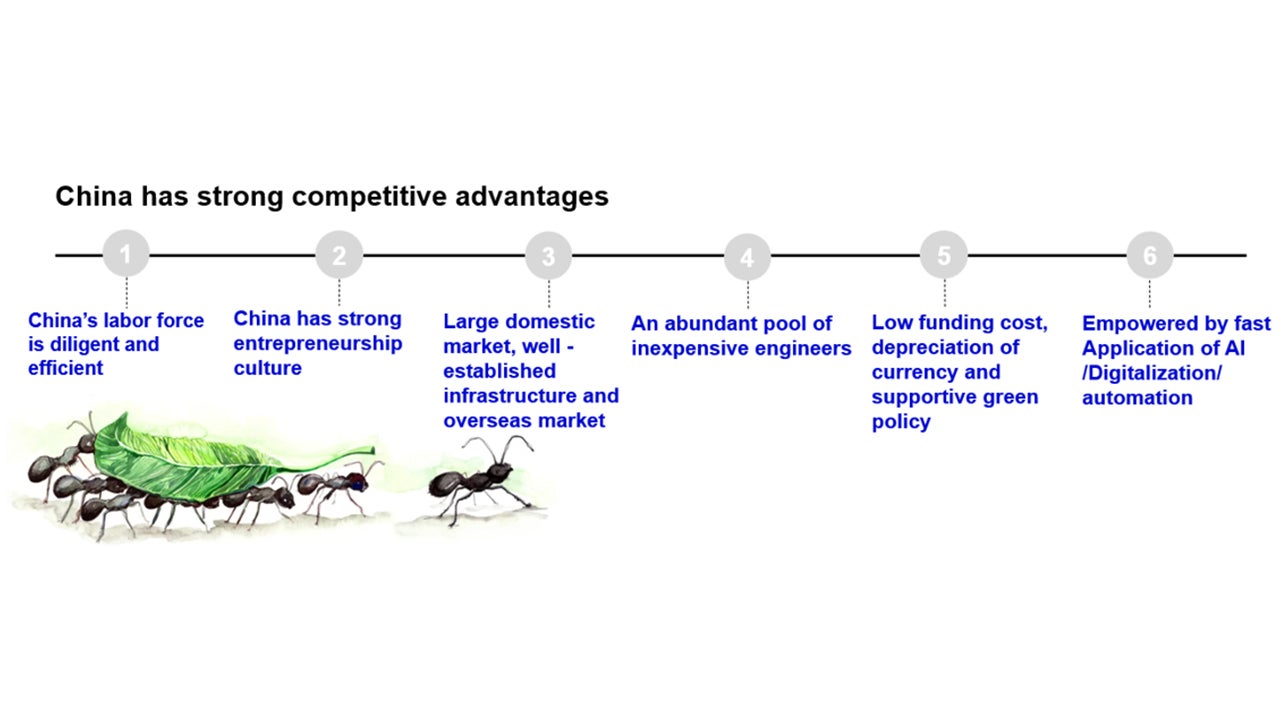

China has strong competitive advantages to go further

- China has a strong supply chain ecosystem backed by six competitive advantages that will continue to drive growth and consolidate its role in the global supply chain scene.

1) China’s labor force is diligent and efficient

- Chinese labour has hardworking attitude, with an average working hour of over 47 hours per week, higher than the rest of the world.2

2) Strong entrepreneurship culture

- The total number of small and medium enterprises exceeded 52 million in China, with over 23,800 newly registered enterprises per day.3 They currently contribute to over 60% of GDP in China.4

3) Large domestic market, well-established infrastructure and overseas market

- China’s well-connected roads, rails and transport networks enable a highly efficient system - shorter time taken and lower costs for the movement of goods within the value chains and overseas exports.

4) China has abundant supply of inexpensive engineers

- In 2020, 37% of working population achieved high school qualification. China is adding 600,000 engineers each year and has the most engineering graduates in the world compared to the US, India, or European countries.5

5) Low funding cost and policy support for development

- The low-interest rate environment in China has lowered borrowing cost. With more liquidity available, it would facilitate investment and business development, especially in capital-intensive industries.

6) Empowered by application of AI/digitalization/automation

- China’s strong digital capability is well-positioned to benefit from next-generation technology, which includes automation, new materials, blockchain, the Internet of Things, and 5G network.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Reference:

-

1

US Census Bureau, May 2023

-

2

everhour.com, June 2023; CEIC, March 2023

-

3

The State Council Information Office, PRC, March 2023

-

4

OECD, statistics from 2020

-

5

Ministry of Education, data from August 2021