China’s latest stimulus could boost the economy and market sentiment

The Chinese equity market experienced a rally over the past two days, with the CSI 300 and Hang Seng Index increasing by 5.9% and 4.7%, respectively.

What is the event?

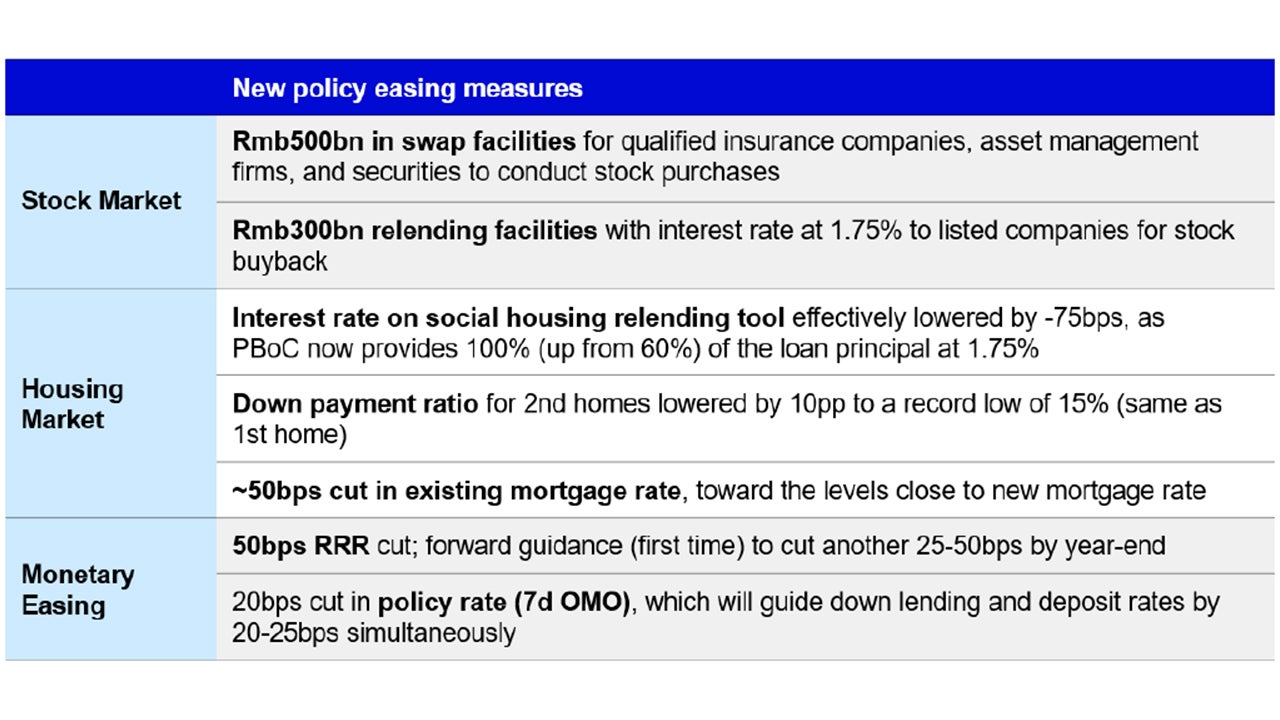

On September 24, the PBOC announced a series of unprecedented policy easing measures aimed at stabilizing and supporting the stock market, bringing positivity to the China market. The measures include:

Source: Morgan Stanley, 24 September 2024

On September 25, the PBOC further cut the 1-year medium-term lending facility (MLF) loans to 2% from 2.3% previously. 1

The announcement signals a commitment by the Chinese government to address economic headwinds with greater clarity and transparency.

We believe the measures aim to stabilize growth and improve liquidity of the financial system.

We believe the announced monetary-policy centric and trading- focused easing measures could be the first of many, and that we anticipate additional fiscal and property easing measures in the coming quarter.

Investment implications

We believe that the stimulus measures will boost investment sentiment and cause the economy to reflate again.

The measures may help boost consumption-related sectors, as the cut in outstanding mortgage rate is expected to lead to 150bn RMB in interest expense savings. 2

With the upcoming Golden Week holiday in China next month, we hope to see a surge in consumption demand during the festive period subsequent to these policy announcements.

We continue to favor Chinese companies that are expanding overseas and participating in the green transition.

We also favor Chinese companies that demonstrate growing dividends per share and those that engage in share buybacks, as these companies exhibit strong cash flow and solid fundamentals.

Market outlook

We remain constructive on the Chinese equity market.

We believe the latest easing measures will benefit the equity market, by improving the quality of listed companies, establishing credit facilities to enhance liquidity, and providing funding for share buybacks.

In the short to medium term, we expect that the China market will be stimulated and market sentiment will turn positive. Policy rate cuts will facilitate greater access to credit for businesses, allowing them to borrow at lower costs.

Look forward, we believe the measures may also lead to increased fund inflows, higher levels of buybacks, and enhanced corporate governance in the long run.

We believe that further fiscal and property easing measures, which can improve aggregate demand, are needed in order to achieve a growth target of 5%.

In long run, the Chinese equity market will continue to be impacted by global market dynamics, including the US election results. We will closely monitor the development of the US elections and the impact on Chinese equities.

With the MSCI China trading at an attractive valuation, we view the recent announcement by Chinese policy makers as a positive surprise for the market.

We believe that improvements in return on equity (ROE) will drive sustainable long-term returns in China's equity market.

Investment risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.

Reference:

-

1

Source: Reuters , as of 25 September, 2024

-

2

Source: Bloomberg, as of 25 September, 2024