Insight

China’s E-Commerce giants gearing up for Singles’ Day

What is Singles’ Day?

- Singles’ Day (or Double 11) is a shopping festival to celebrate people who are single.

- During Singles’ Day, E-Commerce platforms in China introduce massive discounts to boost revenue, similar to Black Friday.

- This year marks the 14th anniversary of Singles’ Day.

- Total gross merchandise volume (GMV) reached US$134.07 billion (Rmb 965.12 billion) in 2021, an increase of 12.2% comparing to 2020.1

- Escalated from 27 brands joining the Single day sale 13 years ago, there are more than 290,000 brands from 90 countries participating in the Sale this year in the largest E-Commerce platform in China.2

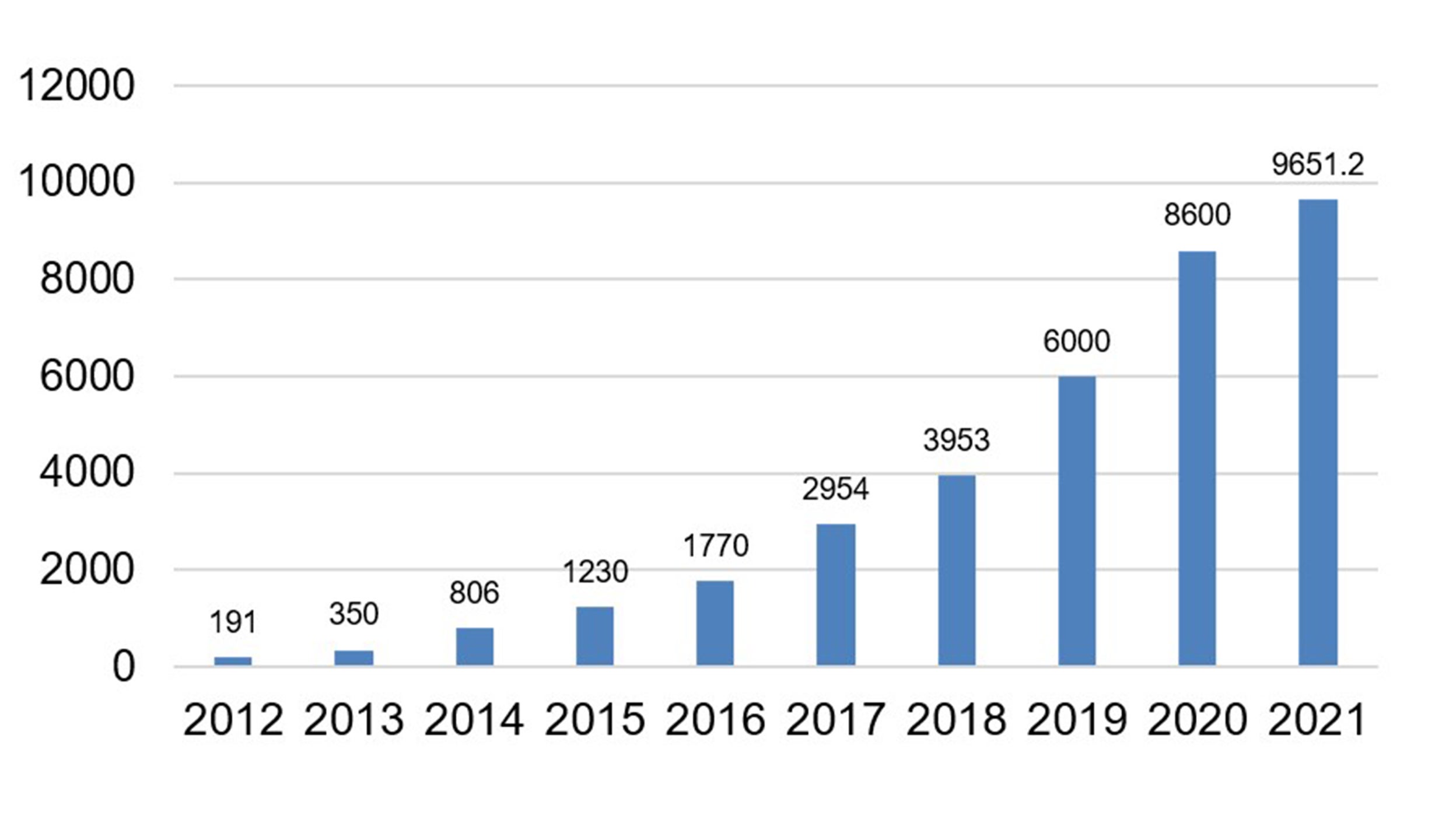

Overall Singles’ Day GMV (in Rmb billion)

Source: Huaan Securities, as of November 15, 2021.

What’s special this year?

- Online consumption still on positive trend: Total sales of a leading B2C platform rose by 79% during Golden Week from a year ago as shoppers bought more foreign goods online.3 China online retail sales also grew 8.3% yoy in September 2022.4

- Pre-sale excitement: Starting as early as 20 Oct 20225, various platforms offer pre-sale, with great discounts, hyping up customers’ anticipation towards the event. On the first hour of official sale started on 31 Oct 2022, over a hundred brands captured over Rmb 100 million GMV in one of the largest E-commerce platforms.

- Deep discount to buyers: Discounts such as cross-store rebates, longer return period of the purchased product, compensation for the price difference should customer discover cheaper price of same product in another platform is offered.

- Innovative channels: Metaverse will be launched, where consumers can create a personal image in the metaverse and virtually participate in online shopping.

- Sustainability: More than 3 million green products6 are offered in an E-commerce platform, and supported by green logistics, such as offering self-pickup locker network to reduce carbon footprint.

The Outlook for China’s E-Commerce sector

- Penetration to lower tier cities: Not only customers from tier 1 city is enjoying the festival. Penetration to lower-tiers cities have increased in recent years. Last year, non-tier 1 cities shoppers accounted for 77% of all shoppers during the festival 7. We believe more rural areas will adapt to online shopping and drive the growth of the industry.

- Increasing market competition: We are positive towards the long-term prospect considering a healthier market competition due to the increasing number of competitors, E-commence platforms’ support for merchandisers and the efforts to improve user experience. We anticipate the E-commerce GMV and revenue growth will be sustainable and reasonable growth will be achieved in the long term.

China Online retail sales of goods growth

Source: Morgan Stanley Research, as of October 2022.

References:

-

1

Huaan Securities, November 2021

-

2

Alibaba, October 2022

-

3

CNBC, October 2022

-

4

Morgan Stanley Research, October 2022

-

5

Morgan Stanley Research, October 18, 2022

-

6

http://www.xinhuanet.com/

-

7

JD Corporate Blog, December 2021