How China stands out from other Emerging Market asset allocations

The transformation of China’s financial markets is reshaping how CIOs and institutional investors manage their asset allocation of Emerging Markets (EM). We speak with Andrew Tong, Senior Portfolio Manager for China A Shares Quant to discuss constructing portfolios with China and EM exposure.

Q: Has asset allocation changed in the last few years with the developments in China’s capital markets?

China’s capital markets have grown rapidly in the last few years driving global investors to re-examine their asset allocation strategy to China. Within the Emerging Markets (EM) space, China’s presence is growing. The MSCI Emerging Market Index has increased the country’s weighting from 30% in 2007 to 42% this year1. Fund flows into China continue to rise by US$13.9 billion this year.2

With easier access to the onshore market, traditional EM investors no longer rely on offshore equities to gain exposure to China but are integrating the rich opportunity set available from Chinese A shares. Global investors may eventually categorize Chinese equities as a distinct asset, disentangled from the rest of the emerging markets.

What are the benefits to having China exposure? How is portfolio construction different with China compared to other emerging markets?

An exposure to China creates not just a much larger investment pool for EM investors (China accounts for 714 companies out of the 1387 in the MSCI EM Index as of Sep 30, 20203), but a dominant pool in every sector category. We believe sectors that will benefit from major trends in China: 1) a rising tertiary (services) industry and an “upgrade” in consumption behavior, 2) technology and digitization from a higher value-add economy, and 3) a more globalized and mature capital market.

A well-constructed portfolio with China allocation consists of aligning sector exposures to these major shifts in the economy to maximize growth potential. This careful analysis of sector trends and shifts in consumer behavior can be a key attribute to portfolio performance.

What are the challenges or risks when determining asset allocation to China?

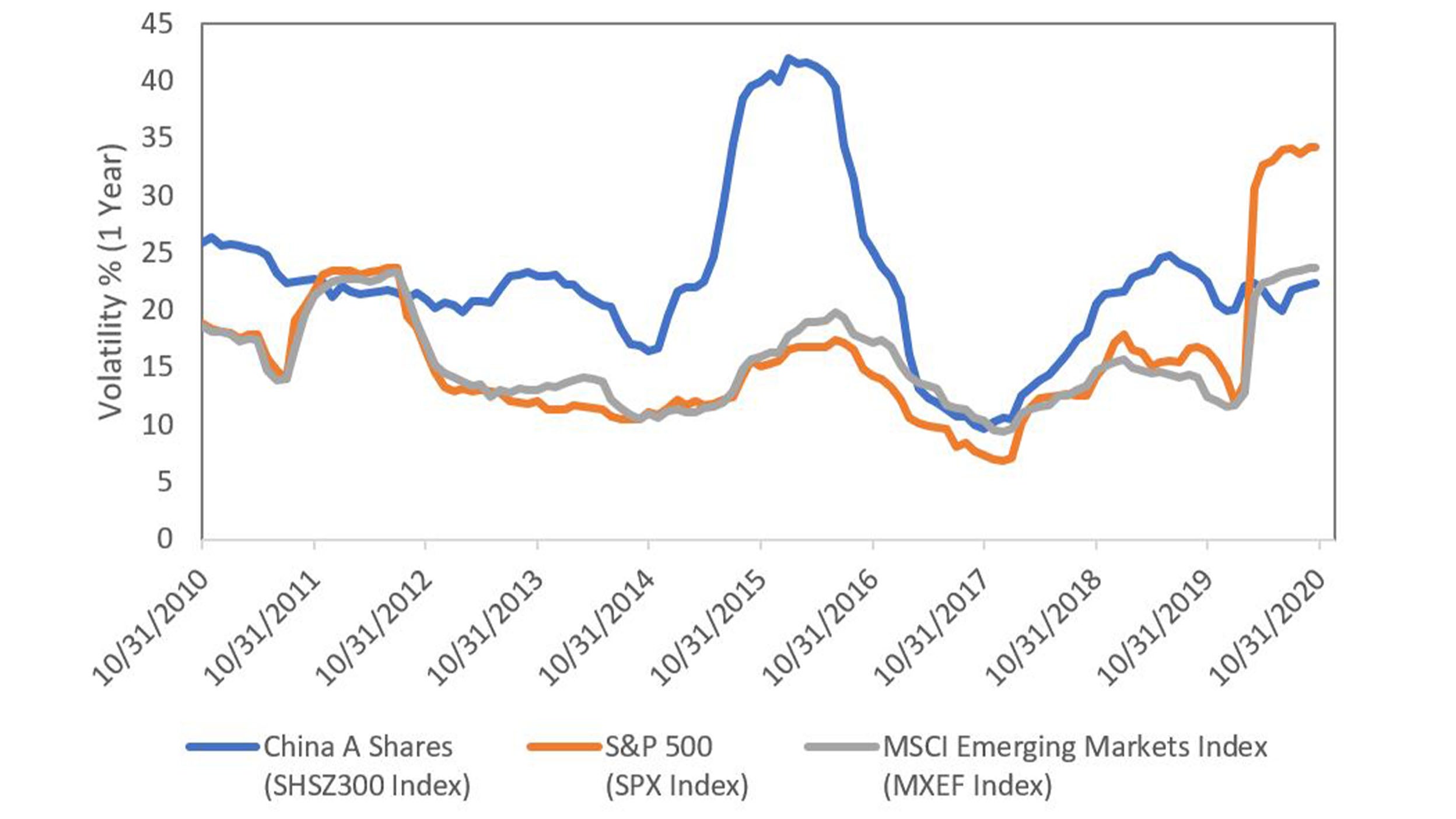

One of the major challenges to allocating into the China A-Shares market has been a high level of market volatility in the past, mainly driven by speculative behavior from domestic retail investors. After the stock market decline in 2015, China embarked on market reforms and expanded its domestic investor base with more institutional and foreign investors, bringing rationality to the market. As a result, China’s market volatility has declined from its peak of over 40% per annum (p.a.) in 2015 to a more normalized 20-25% p.a. range. The China A share market, ironically, has become less volatile than the MSCI Emerging Markets index which reached a 10-year high of 24% p.a in risk during this pandemic year.

How does your team manage factors or risks that are specific to the Chinese market?

We believe that a high degree of discernment is needed when analyzing the systematic and idiosyncratic risks in China. The techniques used in the developed world for constructing portfolios such as factor analysis need to be skillfully adapted in China to avoid creating an ill-fitted model or erroneous results. For instance, financial models with long historical datasets may not be effective. We observed that using Chinese stock market data prior to the Non-tradable Share Reform (2005-2006) period holds little predictive power in today’s market. Projecting the behavior of EM stocks onto the Chinese equity market may not be accurate as well. For example, applying a broad overlay of EM stocks may not work with China allocations given the stark contrast in the performances of China A growth and value baskets. To find the right performance attributes, we study various factors’ efficacy among different universe segments (e.g., large caps vs. small caps) and examine conditions influencing these factors.

Our China team consists of quantitative analysts that study these market factors in depth. With the likes of artificial intelligence and alternative data, we can better analyze higher frequency signals, unstructured datasets and diversify our sources of alpha. We take a nimble and adaptive approach so data assumptions can respond to market reforms and changes in Chinese investor behavior.

How does analyzing market factors help CIOs and financial institutions with their asset allocation strategies to China?

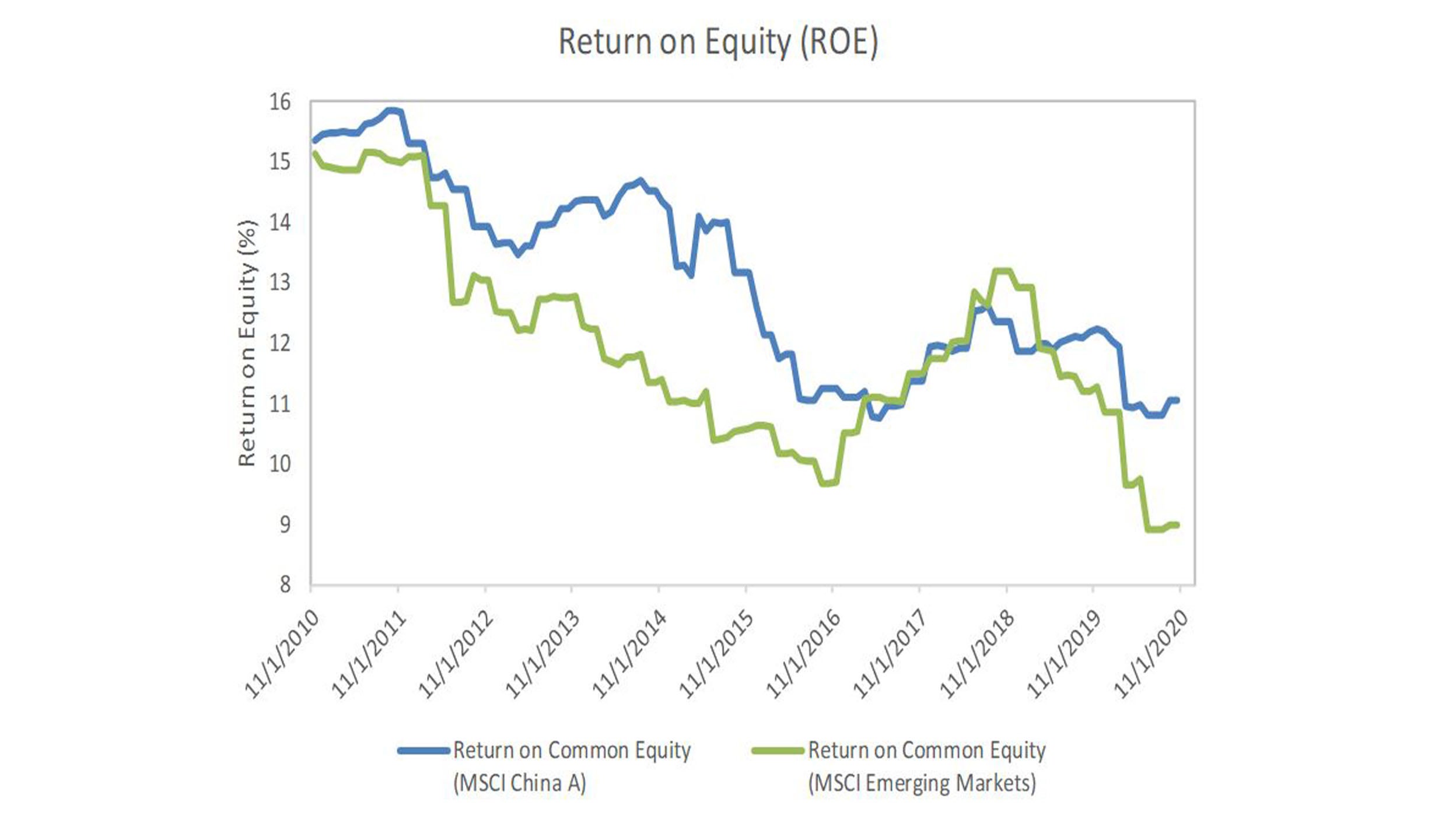

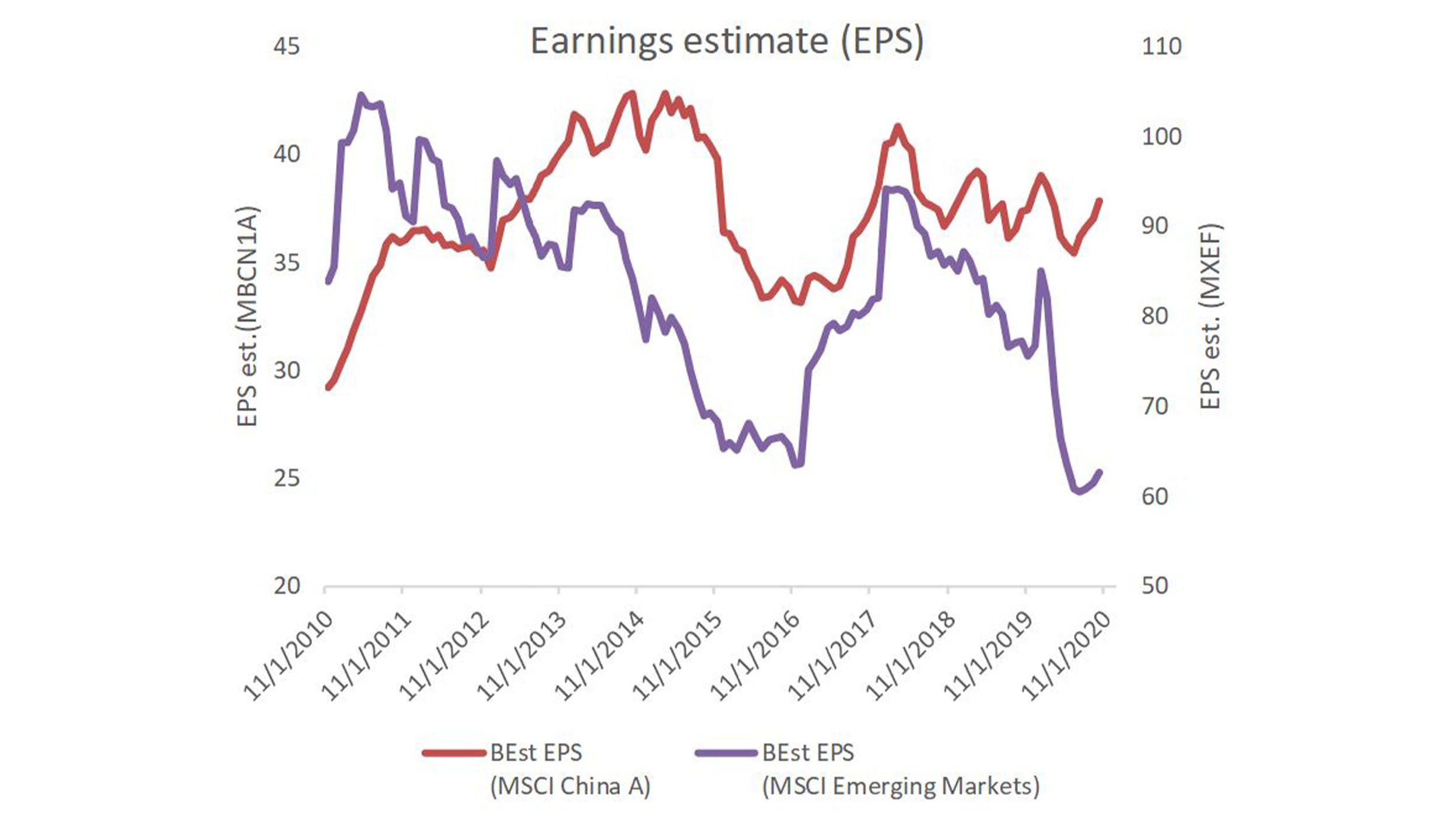

In the last few years, factor strategies have become more widely adopted in strategic and tactical asset allocation.4 According to the Invesco Global Factor Investing Study 2020, around half of investors have increased their factor allocations in the last 12 months prior to the survey period (April-May 2020) and a similar proportion are planning to increase factor exposures over the next 12 months.5 The factor exposures of most interest to these investors include Value and Quality, which we observe Chinese equities to have a significant advantage. While Chinese equities are valued at similar earnings multiple (Price/Earnings 18 times) as emerging markets, the former’s Return on Equity (ROE) remains resilient while the latter’s has sharply declined. Coupled with analyst forecast of a near V shape recovery6 in the Chinese economy and in corporate earnings, a larger allocation into China has garnered much attention.

Seeking alpha can be a huge challenge in uncharted market conditions, it is therefore necessary that investors consider allocation into China with a more systematic approach. As China plays a larger role in global portfolios, we believe factor investing is a valuable complement to creating the optimal asset allocation mix.

^1 MSCI data as of 30 September 2020.

^2 Wind data of 19 October 2020.

^3 MSCI data as of 30 September 2020.

^4 Invesco. Factor investing: A permanent shift in asset management. https://www.invesco.com/apac/en/institutional/insights/factor-investing/factor-investing-a-permanent-shift-in-asset-management.html

^5 Invesco. Invesco Global Factor Investing Study 2020. https://www.invesco.com/apac/en/institutional/insights/factor-investing/global-factor-investing-study.html

^6 Invesco. China’s Q3 GDP grew 4.9% as it continues to recover from COVID-19. https://www.invesco.com/invest-china/en/institutional/insights/china-q3-gdp-grew-as-it-continues-to-recover-from-covid-19.html