Global investor interest in China alternative assets

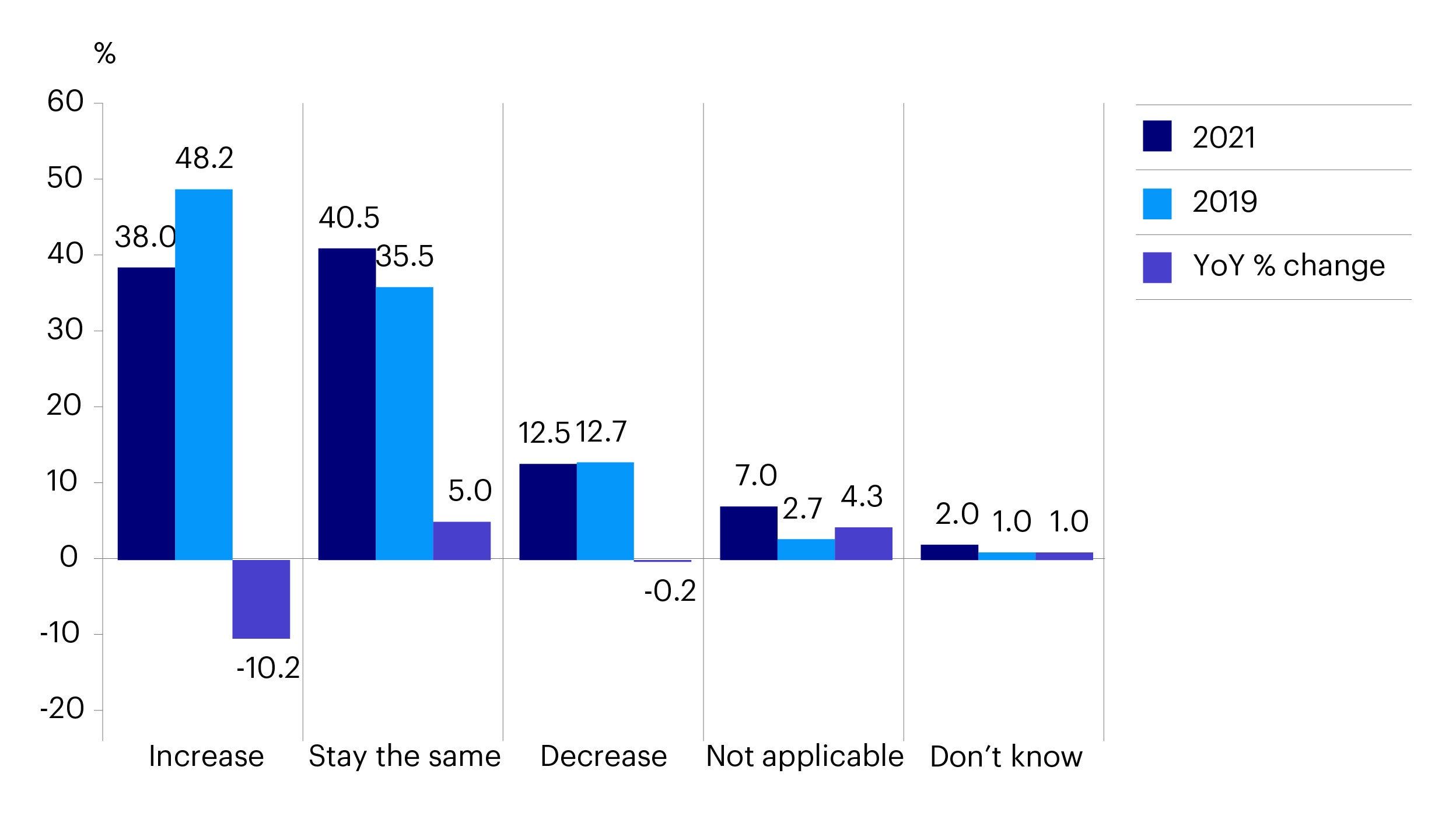

The recent China Position 2021 study sponsored by Invesco and conducted by Economist Impact (previously The Economist Intelligence Unit), interviewed 200 asset owners globally during June and July of this year on their investment stance toward China. When asked what changes the respondents are planning to make to their China allocations in the next 12 months, on average, just over a third say they will increase holdings in different asset classes with the highest numbers planning increases in real estate (40%), direct ownership of companies (39%) and alternatives (e.g., private equity and hedge funds) (38%).

While the survey was conducted prior to the worsening debt issues of China’s second largest property developer and rising property sector woes, this finding is not surprising in light of the current low-rate environment affecting fixed income and the obvious volatility in equity markets. For asset owners who typically have longer-term investment horizons, private markets offer a significant return premium relative to their public counterparts.

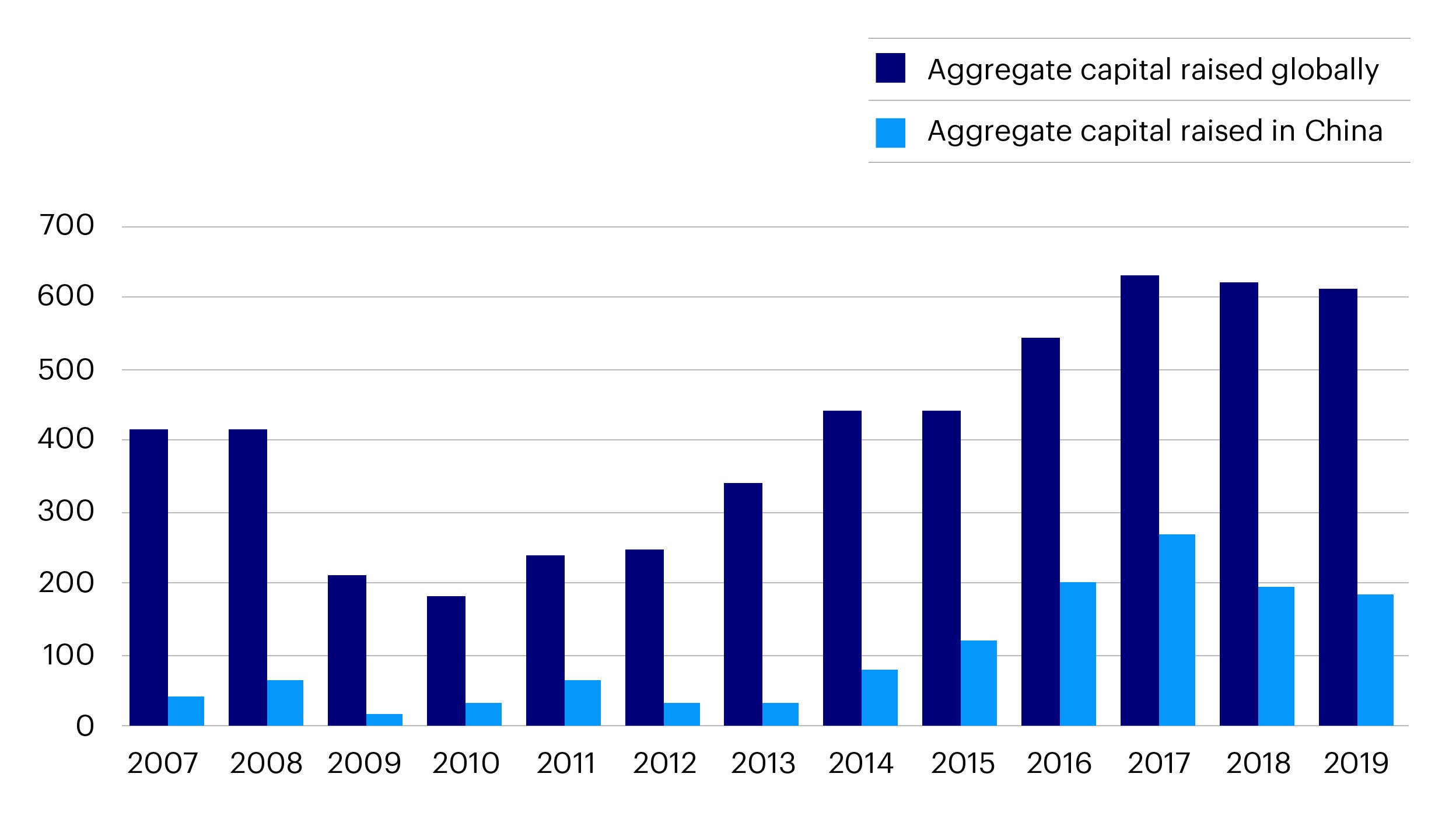

Focusing specifically on alternatives, investors are attracted to China private equity (PE) investments because of the strong growth and diversification potential it offers, not to mention the governance structure.1 China is the world’s second largest PE market and is dominated by local names. In 2019, China’s PE fund raising accounted for a third of global PE fund raising.2 As of July 2021, China’s private equity and venture capital funds managed a total 12.6 trillion yuan ($1.95 trillion), tripling from the end of 2016.3

In recent months, there has also been greater regulatory oversight of China’s private equity industry promoting the healthy functioning of this market. The aim is to root out “fake” funds with malpractices in the areas of compliance, liquidity risks, and illegal fund raising while supporting genuine private funds. In a speech to a fund-industry association in August, CSRC’s chairman Yi Huiman said, “Private equity funds must return to the defined role of being private and supporting innovation and startups”.4

The China private equity space has typically been concentrated in high-growth sectors such as tech, consumer services, and healthcare. As a result of the latest onshore regulatory crackdown in areas such as big tech and for-profit-education, many firms are also concentrating on sectors that are aligned with China policy support including semiconductors, automation, renewable energy, and business-focused tech services.5

1 China PE still attractive despite tighter regulatory scrutiny, September 2021, https://www.asianinvestor.net/article/china-pe-still-attractive-despite-tighter-regulatory-scrutiny/472603

2 Private equity in China: five charts that show what investors could be missing, May 2021, https://www.schroders.com/en/au/institutions/insights/investment-insights/private-equity-in-china-five-charts-that-show-what-investors-could-be-missing/

3 Chinese Regulator Vows to Crack Down on Private Equity Funds, August 2021, https://www.bloomberg.com/news/articles/2021-08-30/chinese-regulator-vows-to-crack-down-on-private-equity-funds?sref=xv12TOW5

4 Ibid.

5 Private equity firms revise China strategy as regulatory crackdown widens, August 2021, https://www.reuters.com/business/finance/private-equity-firms-revise-china-strategy-regulatory-crackdown-widens-2021-08-09/