Is now the time to consider Chinese government bonds?

Amid the ongoing woes in the onshore property debt market, we believe Chinese government bonds (CGBs) are still a bright spark for global investors when it comes to China fixed income. In the current low-rate environment, CGBs has boasted higher yields and diversification potential relative to other major rates markets. As of early November, while the 10-year Chinese sovereign bond yield sat at 2.94%, the 10-year US Treasury yield was at 1.56% and the 10-year German bund was yielding -0.13%.1

The onshore economy is currently at a different stage of the economic cycle versus developed markets. Unlike the rest of the world which will be tightening their monetary policies next year, China is likely to step up monetary easing efforts in 1H22 given the growth slowdown. This may bode well for the onshore rates market.

The US Federal Reserve has already started tapering and chairman Powell has recently indicated a quicker tapering timeline than before. The Fed fund futures market is now predicting nearly 3 rate hikes by next year-end.2 While in China, the People’s Bank of China (PBoC) announced a 50bps RRR cut3 that will be effective on December 15th and the recent Politburo meeting has also indicated there will be more monetary policy easing.

Relative to the rising inflation rates in the US and Europe, China’s rate of inflation has been slowing. As such CGBs have historically boasted positive inflation-adjusted return.4 Yields have also been less volatile than those of other sovereign peers as a result of the steady RMB exchange rate. We believe favorable fundamental and policy factors should continue to support a stable RMB exchange rate which may be good for CGB investors. Strong export data and the potential softening of US-China trade tensions could also serve as a positive catalyst for the RMB’s performance.

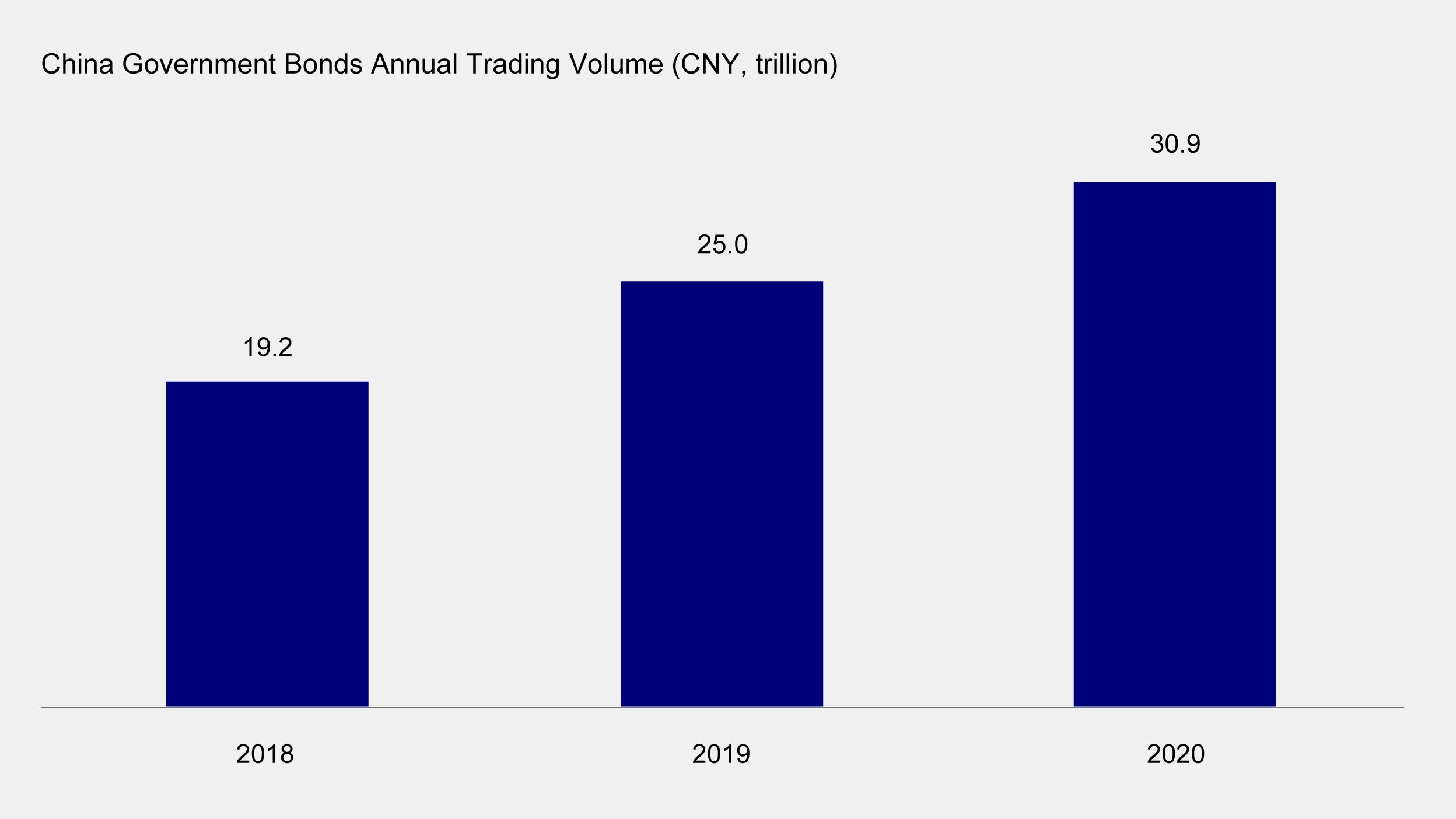

From a diversification standpoint, CGBs have a low correlation with other major bond markets and bond indices as well as US and Chinese equities. Financial market reforms in recent years have helped to improve investor access to these securities and widened the hedging tools on offer to manage risk. Thus, secondary market liquidity in CGBs has improved significantly as indicated by the increases in annual trading volume since 2018 (see Chart 1).5

Source: Macrobond, ChinaBond; data as at March 2021.

While regulatory uncertainty remains a concern for global investors looking at onshore debt. We believe the risk of sudden policy actions such as capital controls impacting the rates space is limited. On the contrary, in the past five years, policymakers have taken targeted steps to open up China’s bond market to foreign investors. The outcome of this has been evidenced most recently in the inclusion of CGBs into the third major global bond index, the FTSE World Government Bond Index (WGBI), starting at the end of October 2021.6

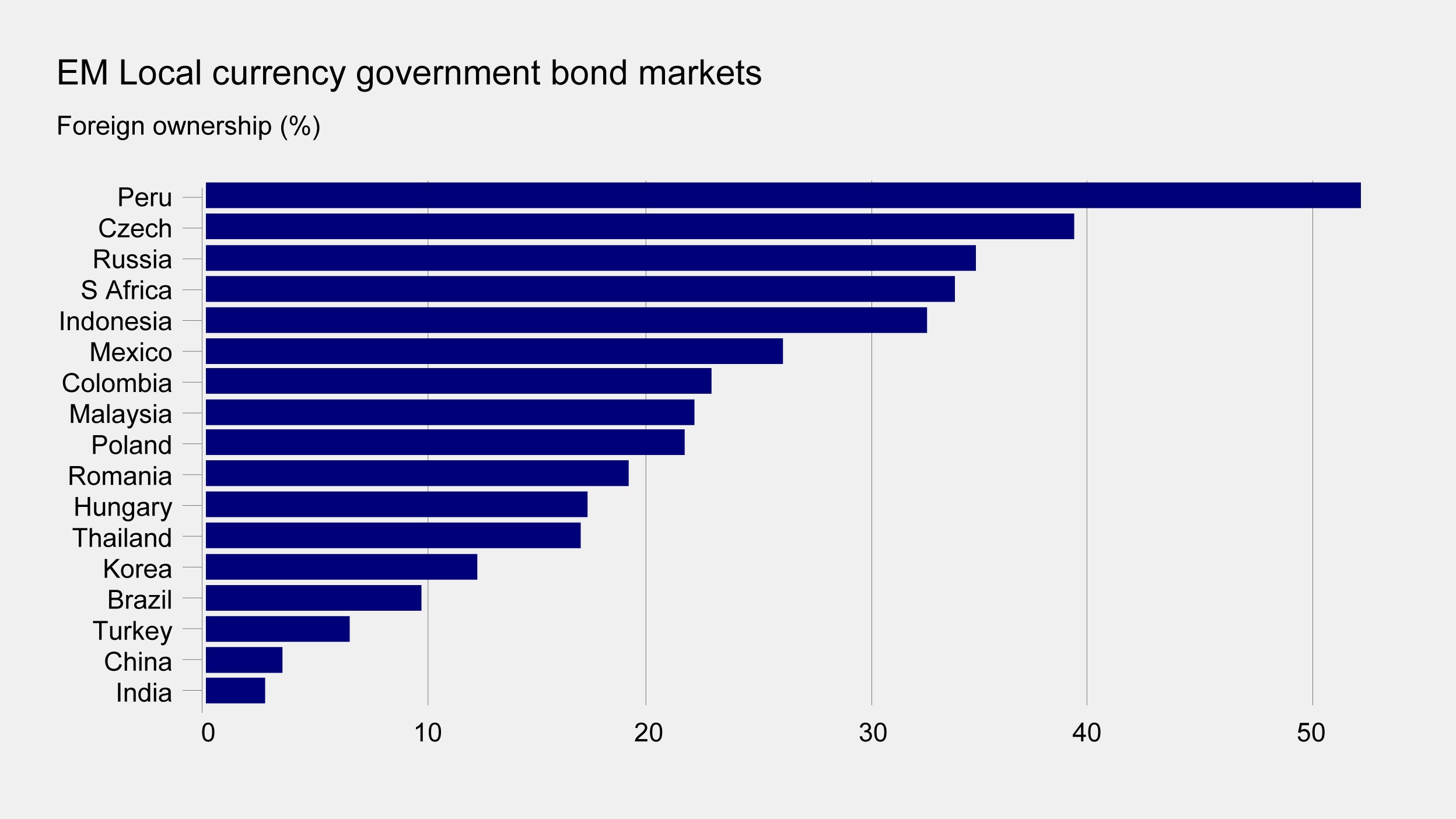

We expect global investor demand in CGBs to remain robust in the near term. Foreign holdings have grown by 513.7 billion yuan (US$81 billion) in the first 11 months of the year, the most ever for this period since 2014 (see Chart 2).7 Yet compared to other developed and emerging markets, the proportion of foreign ownership is still low and the potential for further inflows is huge (see Chart 3). HSBC estimates that the recent FTSE index inclusion will lead to passive inflows into Chinese government bonds (CGBs) worth USD140 billion to USD150 billion over the 36-month inclusion process.8

Source: ChinaBond, Bloomberg; data as at November 2021.

Source: Institute of International Finance, FT; data as of March 2020

1 Chinese bonds win on yields, against inflation; November 2021, https://www.asianinvestor.net/article/chinese-bonds-win-on-yields-against-inflation/473672

2 Traders move up expectations for the Fed’s first rate hike to the summer of 2022, November 2021, https://www.cnbc.com/2021/11/03/traders-move-up-expectations-for-the-feds-first-rate-hike-to-the-summer-of-2022.html

3 China frees up $188 bln for banks in second reserve ratio cut this year, December 2021, https://www.reuters.com/markets/rates-bonds/china-central-bank-cut-reserve-requirement-ratio-second-time-this-year-2021-12-06/

4 China’s Bid to Rival U.S. as Debt Haven at Risk After Crackdowns, December 2021, https://www.bloomberg.com/news/articles/2021-12-08/china-s-bid-to-rival-u-s-as-debt-haven-teeters-after-crackdown?sref=xv12TOW5

5 China Government Bond Market – Too Big to Ignore, April 2021, https://www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-connect/2021/China-Government-Bond-Market-Too-Big-to-Ignore.html

6 Chinese Bonds: Yields, credit quality are too strong to ignore, November 2021, https://www.funds-europe.com/china-report-november-2021/chinese-bonds-yields-credit-quality-are-too-strong-to-ignore

7 Ibid.

8 China bonds: scoring a global inclusion hat trick, October 2020, https://www.gbm.hsbc.com/insights/securities-services/wgbi-the-latest-major-index-inclusion-for-china