Central bank allocations to the Renminbi are rising

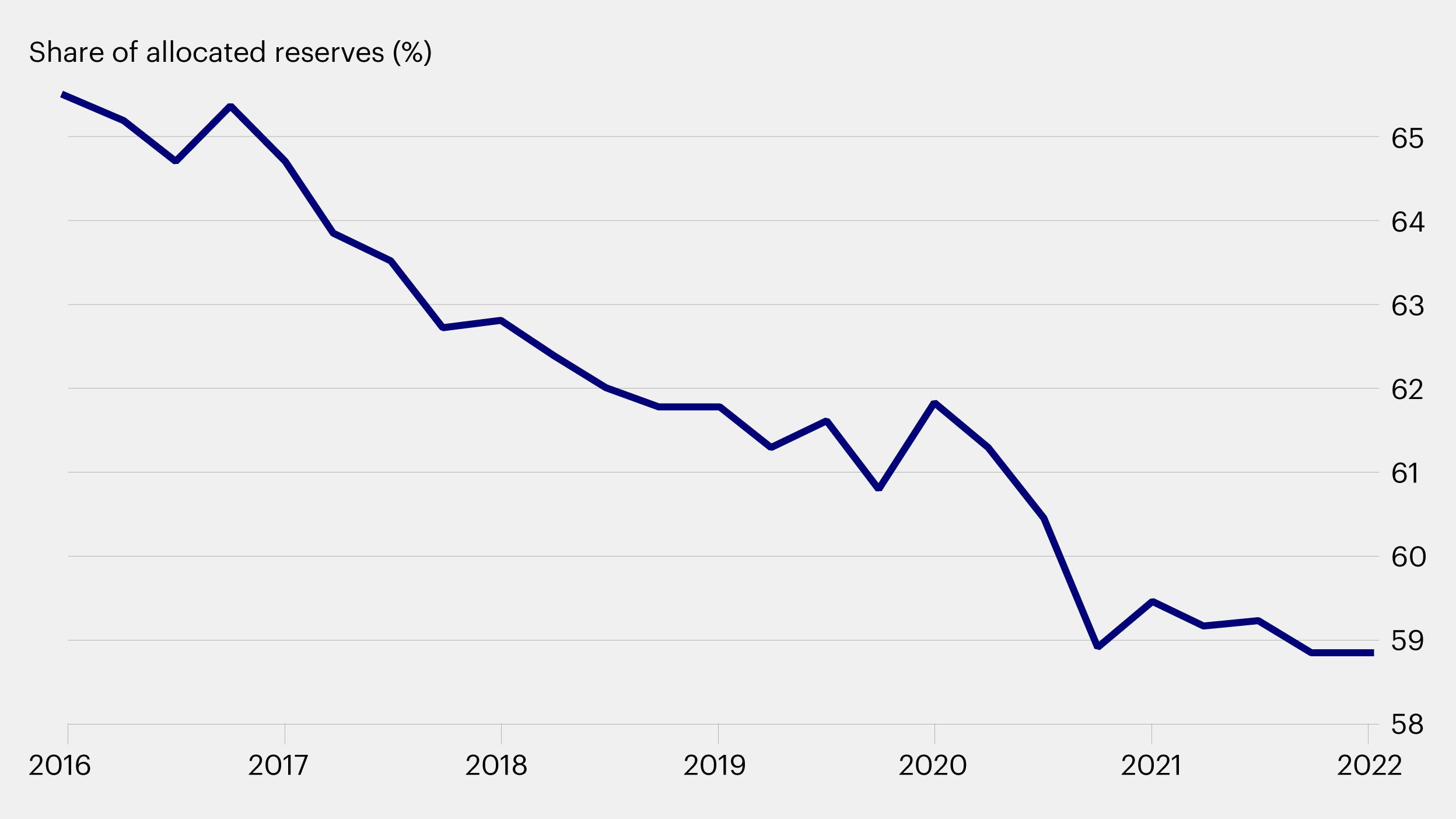

Central banks’ diversification of foreign currency reserves away from the US dollar has been occurring steadily over the last two decades, in part reflecting the emergence of a multipolar currency system and the declining role of the dollar in the global economy (Figure 1). IMF research from earlier this year found that a quarter of the reduction in US dollar flows over the past two decades had moved into the Renminbi while the remaining proportion was allocated to the currencies of smaller countries including the Australian dollar, Canadian dollar, Singapore dollar, Korean won and Swedish Krona.1

Source: IMF, data as of December 2021.

This push for diversification is likely to have been exacerbated by Russia’s invasion of Ukraine earlier in the year raising fears about the weaponization of the US dollar. Nearly half of the approximately US$640 billion in Russian gold and foreign currency reserves have been frozen by sanctions imposed by the US, Europe, and other western governments.2 Central banks of countries that could be subject to direct or secondary sanctions as a result of the ongoing war are diversifying into other currencies to lower their risk.

The role of almost all major western central banks in freezing Russia’s central banks’ foreign exchange reserves, may encourage reserve holding central banks to seek diversification away from both the dollar as well as other traditional reserve currencies that have so far benefitted from dollar reserve diversification. If the frozen reserves are seized and redeployed for the reconstruction of Ukraine, as has been proposed by several western countries, this shift may gain momentum.

To the extent that central banks wish to avoid jurisdictions that may freeze reserves, such as the Eurozone, UK, Canada, Switzerland, Japan and Australia, other potential reserve currencies could be an attractive alternative. The Renminbi of course stands out among these given its size, depth, and liquidity.

Steps in this direction are already underway with reports of increased international trade in the Renminbi (alongside some other non-traditional international currencies). Credit balances in these currencies could serve as the basis of alternative reserves over time. In a recent paper by the Center for Economic Policy and Research, economists have found a strong correlation between countries’ trade volumes with China and the size of their central banks’ Renminbi reserves.2 That said it’s important to note that both the Euro and Yen have held larger roles in global trade than in reserves for many years, so it’s not a given that trade settlement diversification can always lead to reserve diversification.

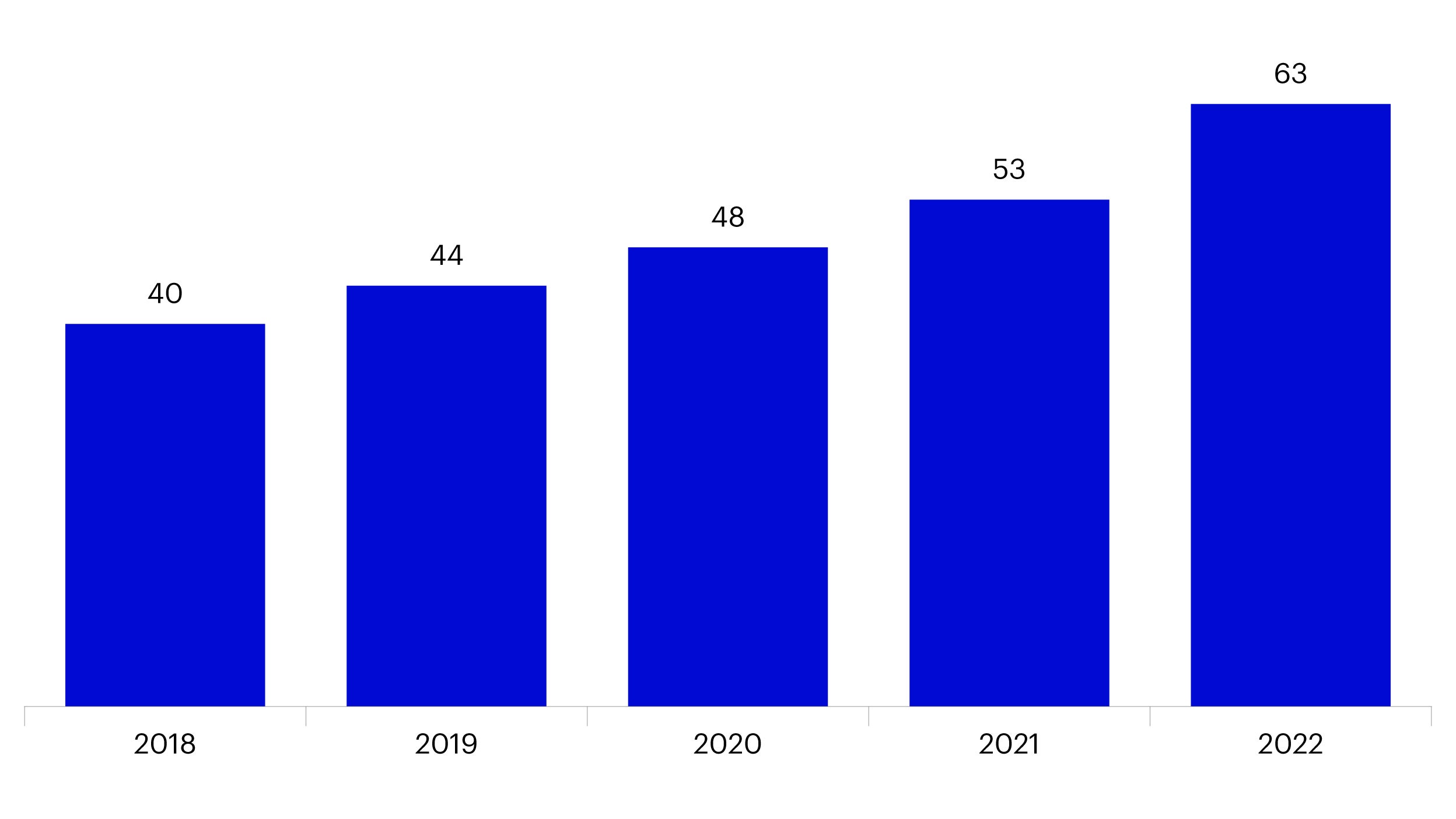

The findings of Invesco’s recent Global Sovereign Asset Management Study (IGSAMS) also show wider Renminbi adoption among central bank respondents this year. 63% of central banks reported having RMB allocations in 2022, up from 40% in 2018 (Figure 2).

Source: IGSAMS 2022; Question: Do you have any allocations to Renminbi? ; Sample size: 2018 = 56, 2019 = 44, 2020 = 55, 2021 = 53, 2022 = 49.

While the central bankers surveyed did not dispute the role of the US dollar as the world’s dominant reserve currency, they do recognize the growing importance of the Renminbi, with stronger sentiment coming from China’s closer geographic neighbors and trade partners. At the same time, they note ongoing challenges around the liquidity and convertibility of the currency given capital controls. Most still only hold allocations within their investment tranche.

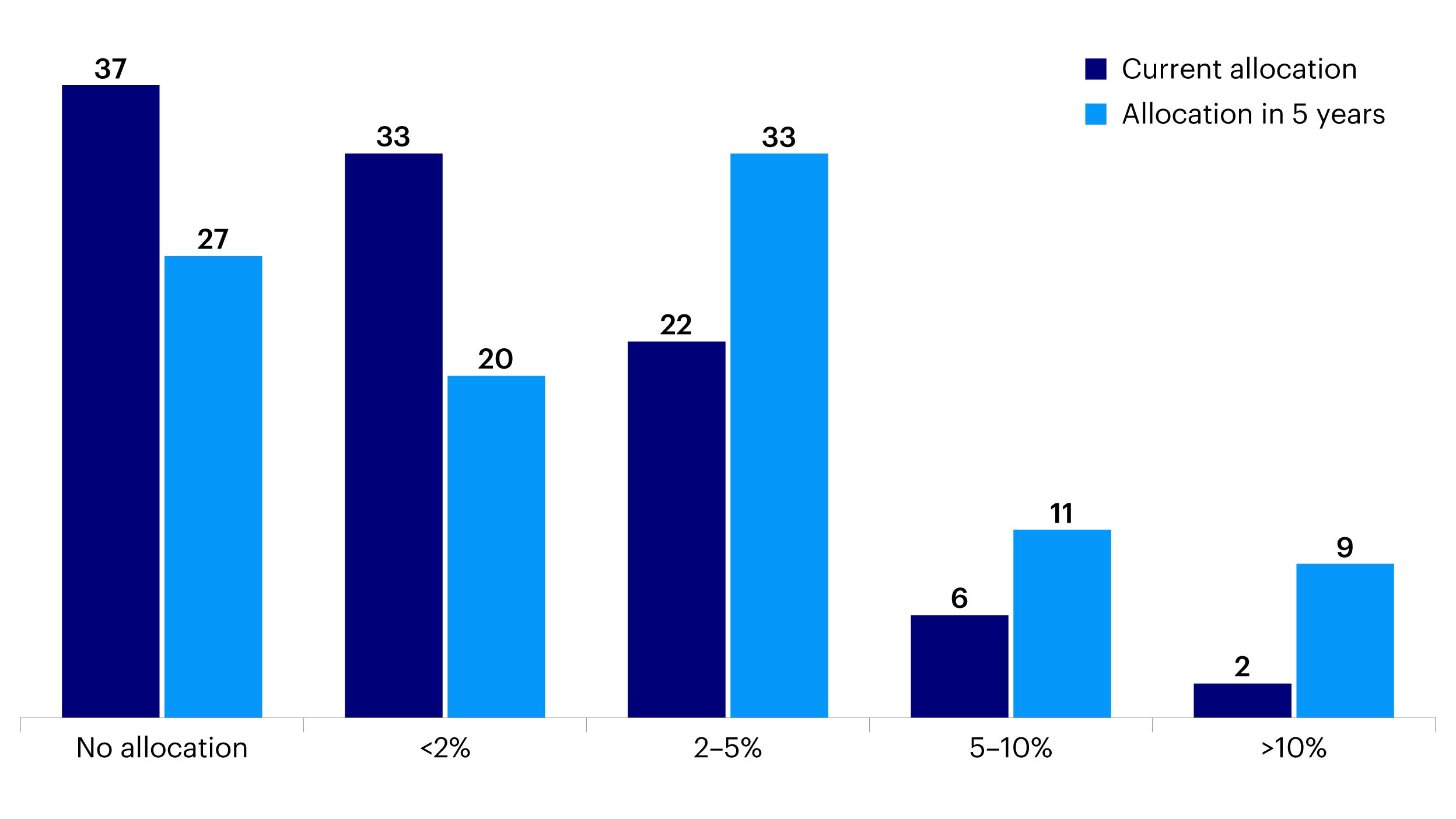

At present the Renminbi only accounts for a small proportion of allocated central bank reserves according to IMF data, at less than 3%.3 Most central banks that took part in this year’s study view their RMB positions as being underweight and expect to further increase allocations to the currency over the next five years (Figure 3).

Source: IGSAMS 2022; Question: What is your current allocation to Renminbi? What do you think your allocation will be in 5 years’ time? ; Sample size: 49.

Onshore policymakers are also taking steps to promote the internationalization of the Chinese currency. The latest being the yuan reserve pool announced by the People’s Bank of China in June with the Bank for International Settlements and five other central banks including Bank Indonesia, Bank Negara Malaysia, the Hong Kong Monetary Authority, the Monetary Authority of Singapore and the Central Bank of Chile. This reserve pool, called “Renminbi Liquidity Arrangement”, is being set up to provide liquidity to these economies during periods of market volatility.4

About Invesco’s 2022 Global Sovereign Asset Management Study

Running since 2013, this year marks the tenth anniversary of the Invesco Global Sovereign Asset Management Study, and represents the views and opinions of 139 chief investment officers, heads of asset classes and senior portfolio strategists at 81 sovereign wealth funds and 58 central banks. Combined, these investors are responsible for managing around US$23 trillion in assets (as of March 2022). The fieldwork for this study was conducted by NMG between January and March 2022.

Footnotes

-

1

The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Reserve Currencies, March 2022,

-

2

Russian central bank plays down role of dollar and euro at home and globally, May 2022, https://www.reuters.com/markets/europe/russian-cenbank-downplays-role-dollar-euro-home-globally-2022-05-31/

-

3

IMF COFER data as of December 2021.

-

4

中国人民银行参加国际清算银行发起的人民币流动性安排, June 2022, http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4586982/index.html