Asia's US dollar bond market: A new asset class

Key takeaways

The Asian US dollar bond market has grown rapidly in recent years, bolstered by strong Asian demand for bonds of regional issuers.

China's share of the Asian US dollar bond market has expanded since 2010, with Greater China now accounting for the majority of outstanding bonds in the Asian US dollar bond space.

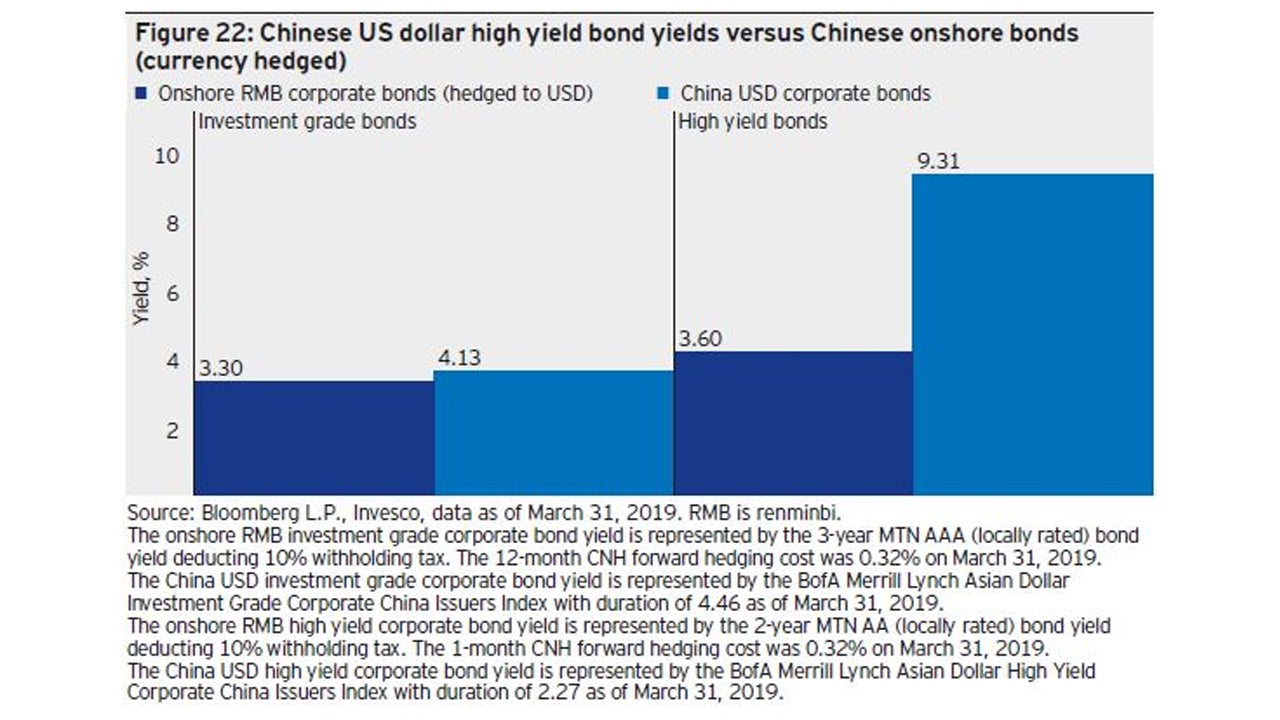

Asian US dollar bonds typically offer a yield advantage over comparable US and European bonds, and are particularly attractive, in our view, compared to Chinese onshore corporate bonds on a currency hedged basis.

The Asian US dollar bond market has grown rapidly in recent years. At USD1.1 trillion in outstanding bonds (Figure 1), it now ranks alongside the US bank loan and high yield bond markets, which each total around USD1 trillion.1 Because Asian banks are increasingly constrained by tighter regulatory capital requirements, they alone cannot meet the financing needs of Asian companies. This has led many Asian companies to increase their reliance on bond markets, including those denominated in US dollars.

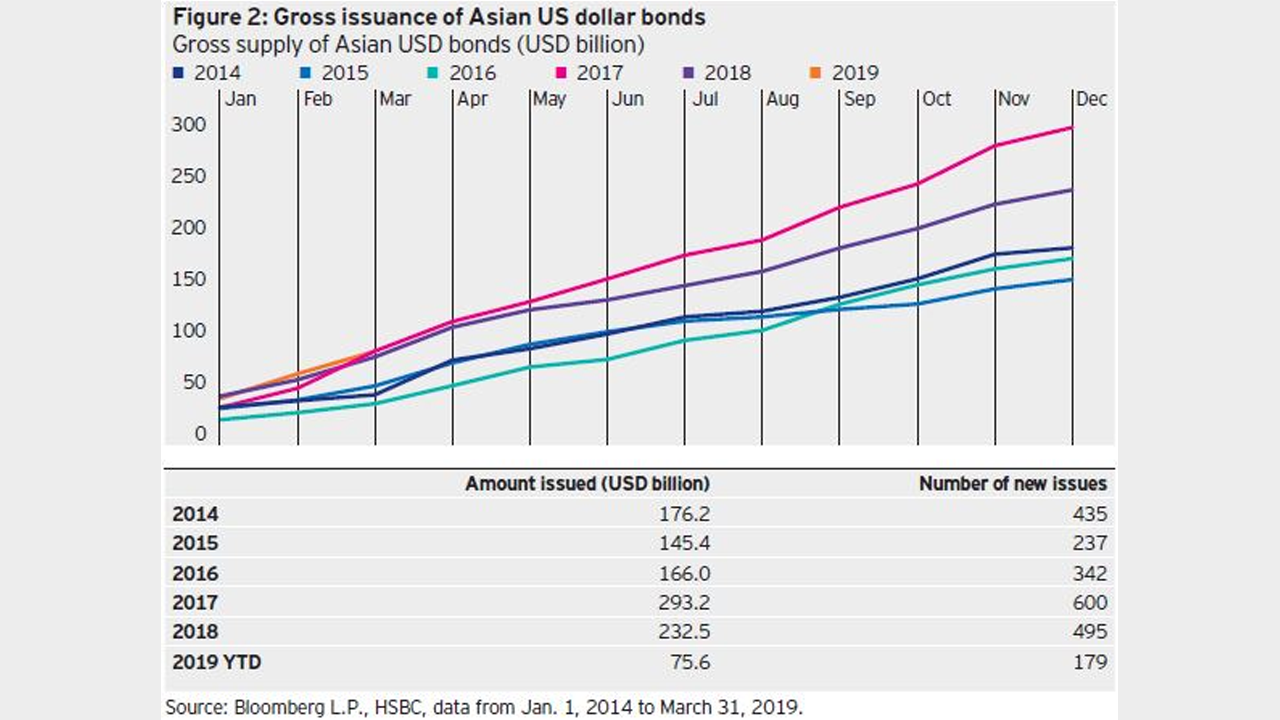

Figure 2 shows the steady upward trend in the gross issuance of Asian US dollar bonds since 2014. Although the volume of issuance dropped in 2018 due to several factors (weakened sentiment caused by US-China trade tensions, new regulations imposed on China’s shadow banking sector and uncertainty surrounding major Asian regional elections), issuance activity rebounded in the first quarter of 2019 boosted by China’s reflationary policies, expectations of a resolution of US-China trade tensions and a slowdown in the Asian election schedule. We expect continued momentum in gross US dollar issuance in the coming years as Asian companies further diversify their refinancing sources away from banks.

China has dominated the Asian US dollar bond market

China’s share of the Asian US dollar bond market has grown rapidly since 2010, as shown in Figure 1. Including Hong Kong, Greater China now accounts for 63% of outstanding bonds in the Asian US dollar bond space. Given China’s dominance in the market, both the valuation and technical factors of the Asian US dollar bond market are increasingly affected by Chinese policies, the supply and demand dynamics of Chinese US dollar bonds, and to a certain extent, the yield differentials between China’s US dollar bond market and its onshore renminbi bond market on a currency swap basis. For example, the large offshore versus onshore yield differentials of Chinese high yield bonds (Figure 23), present incentives for Chinese investors to buy Chinese US dollar denominated high yield bonds. The relative attractiveness of Chinese US dollar high yield bonds may also drive the performance of high yield bonds of other Asian countries. In-depth macroeconomic research on China, systematic investment processes with respect to the onshore renminbi bond market and an understanding of local Chinese investor behavior have become important elements of Asian US dollar bond investing.

Attractive risk-reward profiles amid high domestic savings

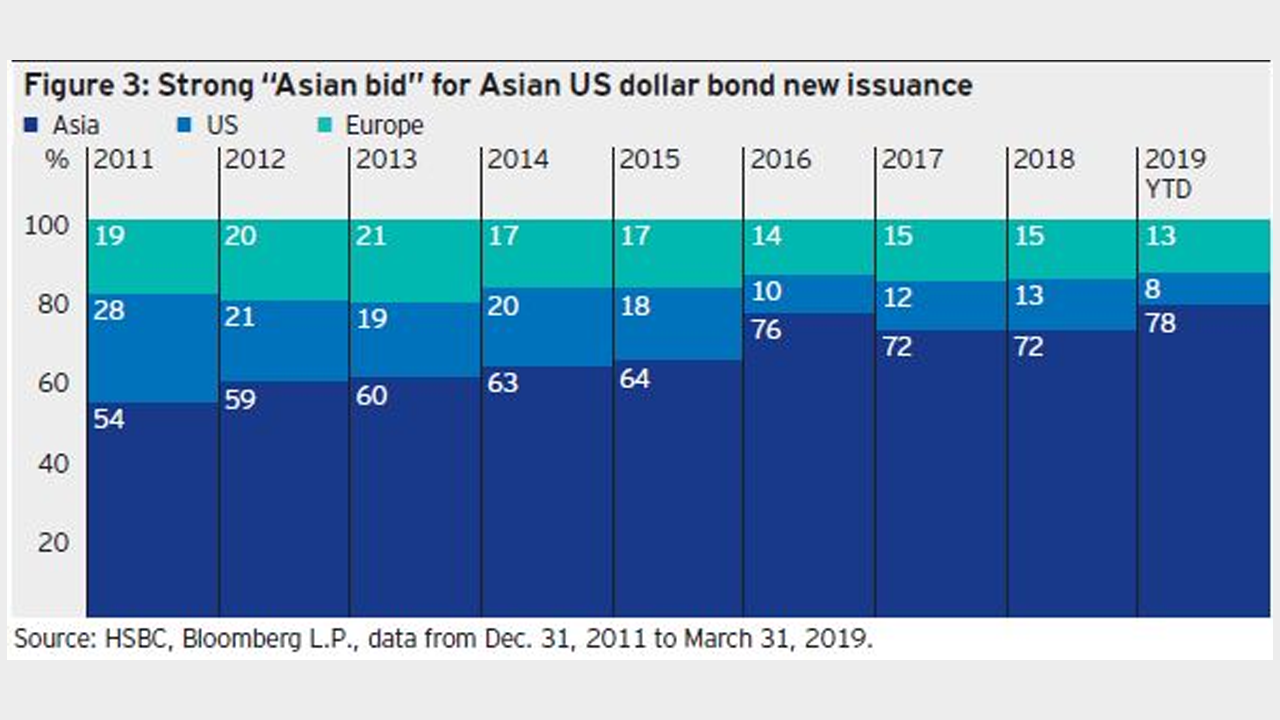

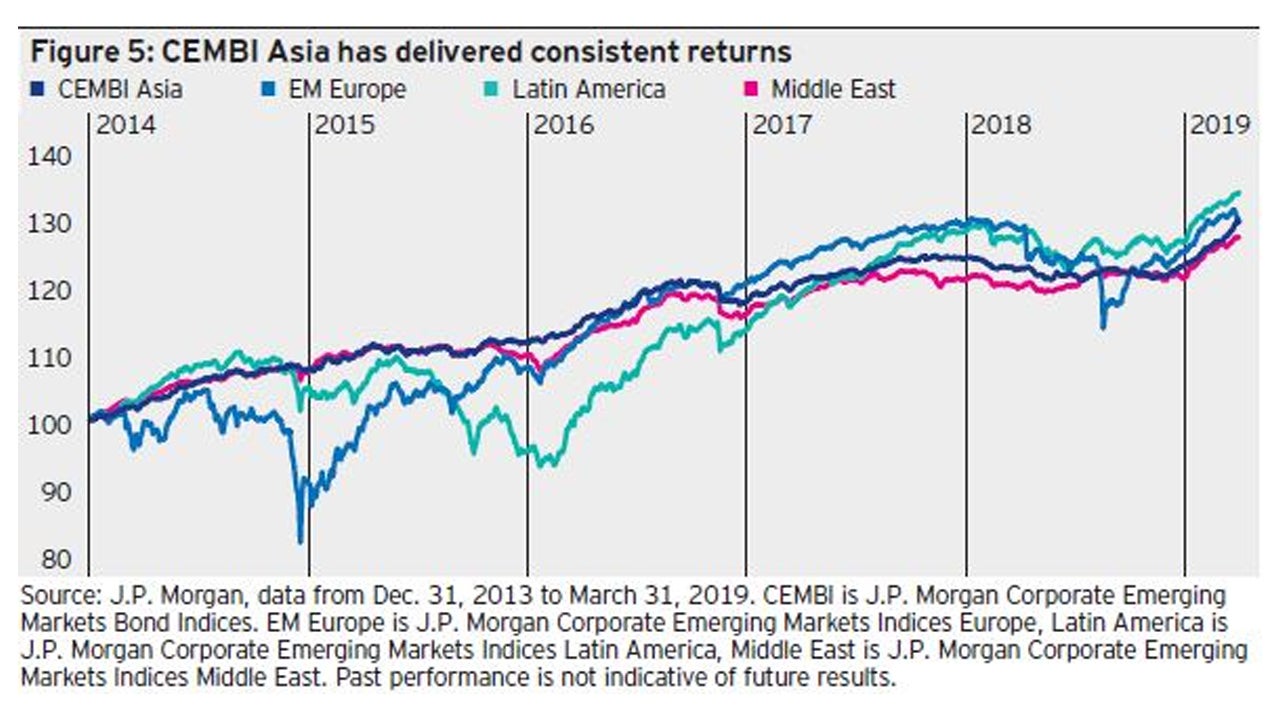

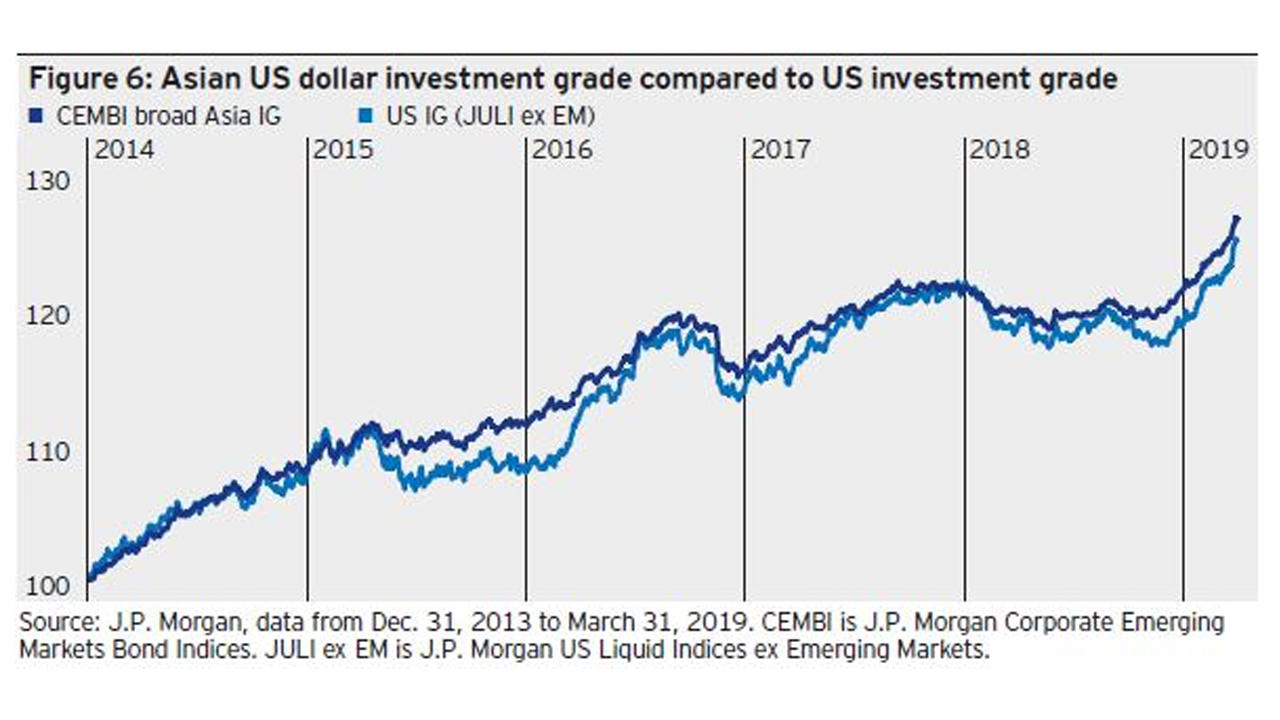

High rates of domestic savings across most Asian countries have led to strong demand for Asian US dollar bonds among Asian investors, the so-called phenomenon of the “Asian bid.” Figure 3 shows that Asian investors have purchased over 70% of Asian US dollar bond new issues since 2016. The so-called Asian bid is diverse, representing Asian insurance companies, banks, private bank investors and retail investors, but their shared demand appears to be based on their familiarity with Asian bond issuers and a “home bias.” We believe this source of demand has contributed to lower volatility of the Asian US dollar bond market compared to other major bond markets, as shown in Figures 4-7.

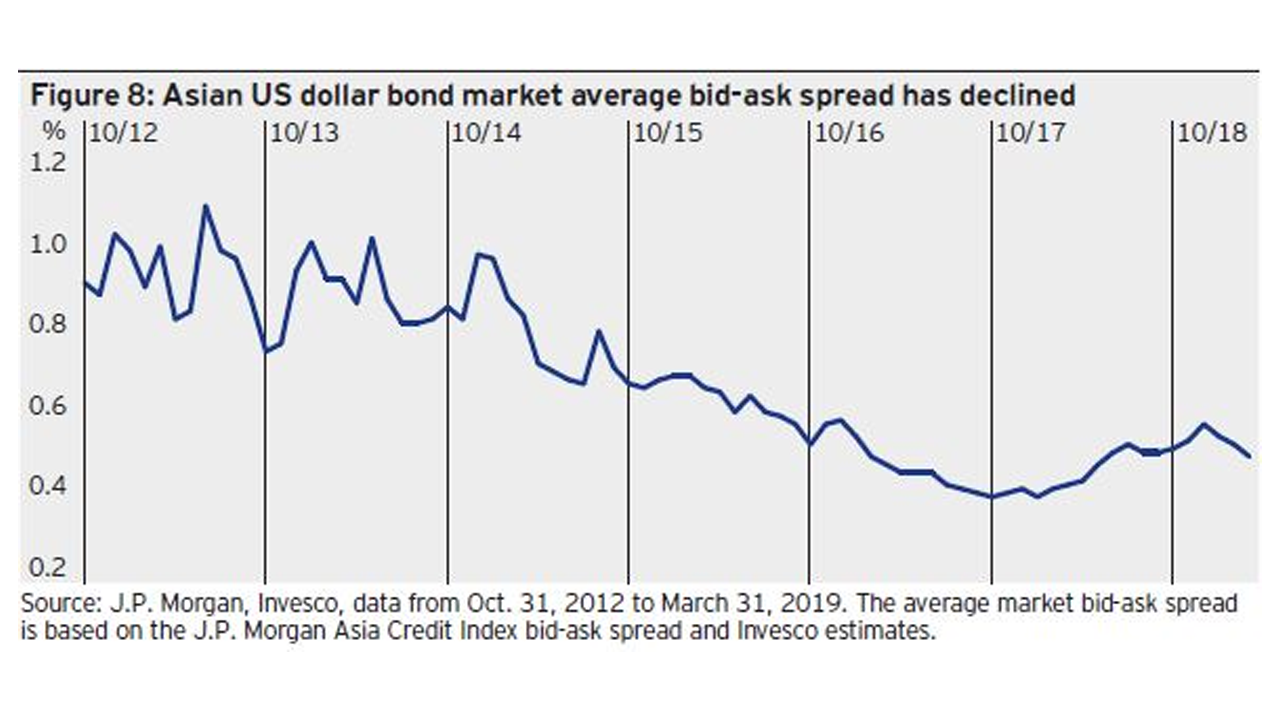

As the size of the Asian US dollar bond market has grown, we have seen not only increased participation of market makers but also increased capital commitments by trading desks. Market liquidity has consequently improved significantly, as reflected in the decline in the market’s average indicative bid-ask spread, as shown in Figure 8.

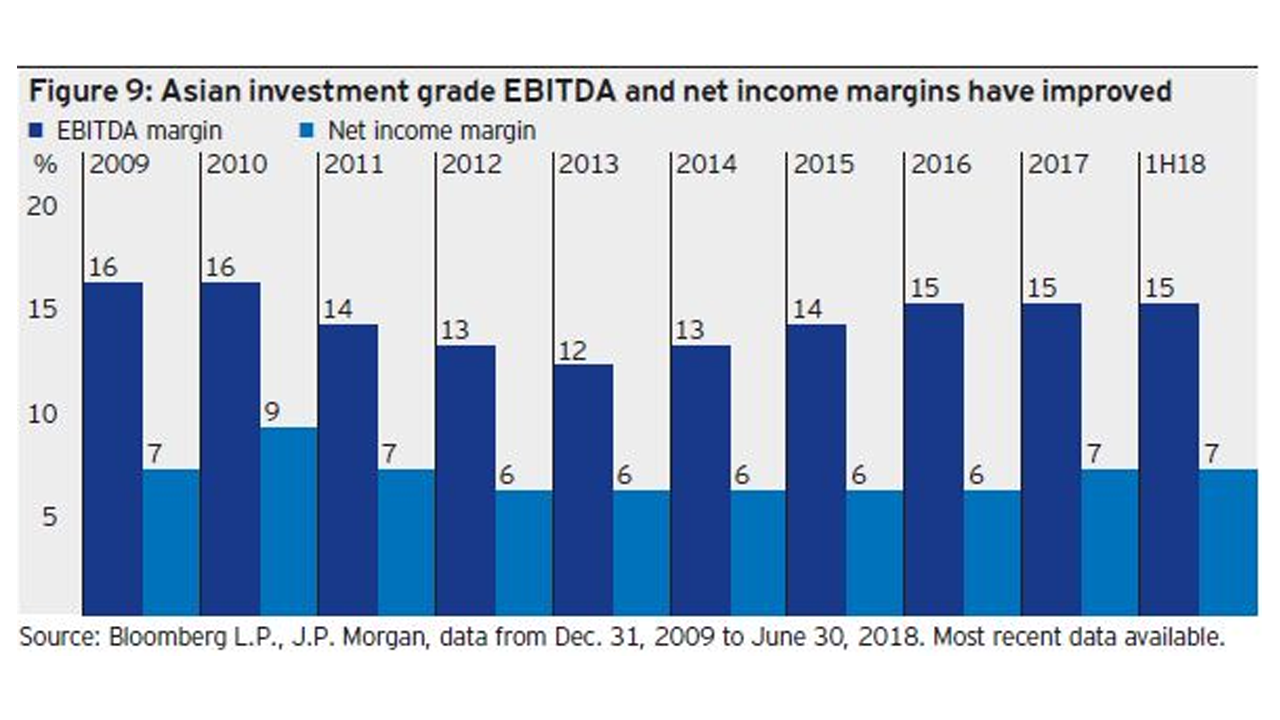

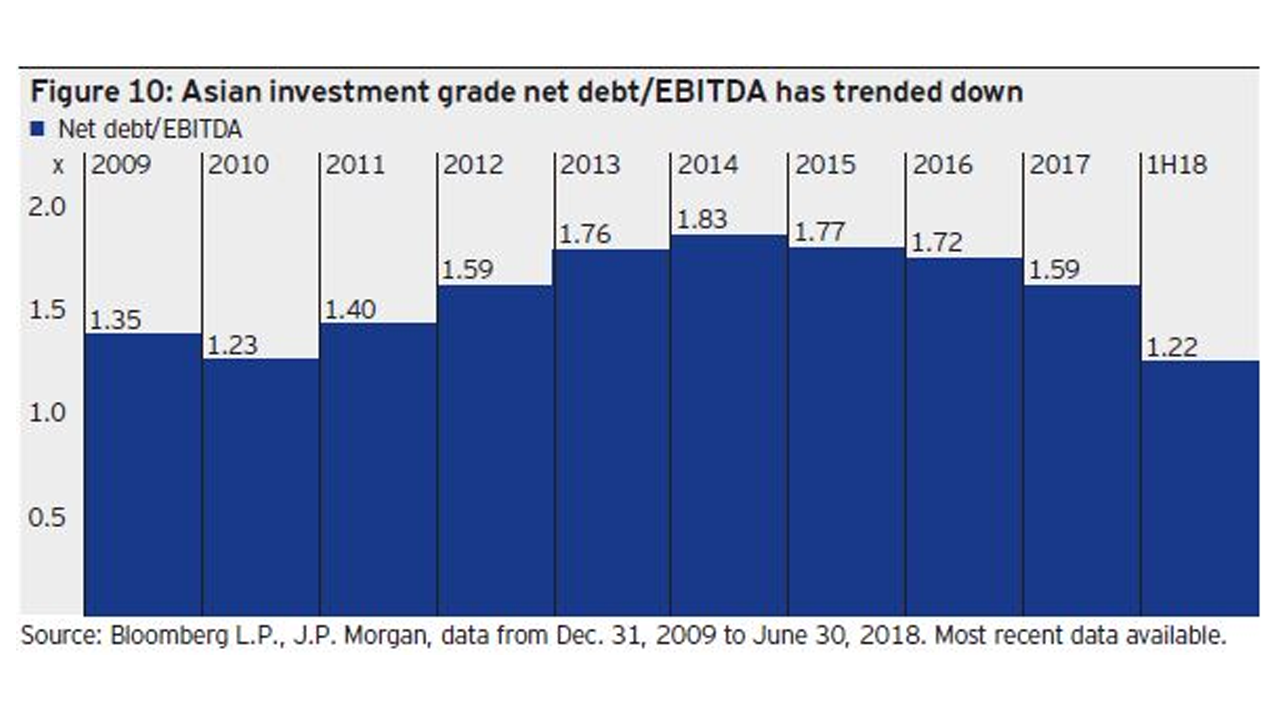

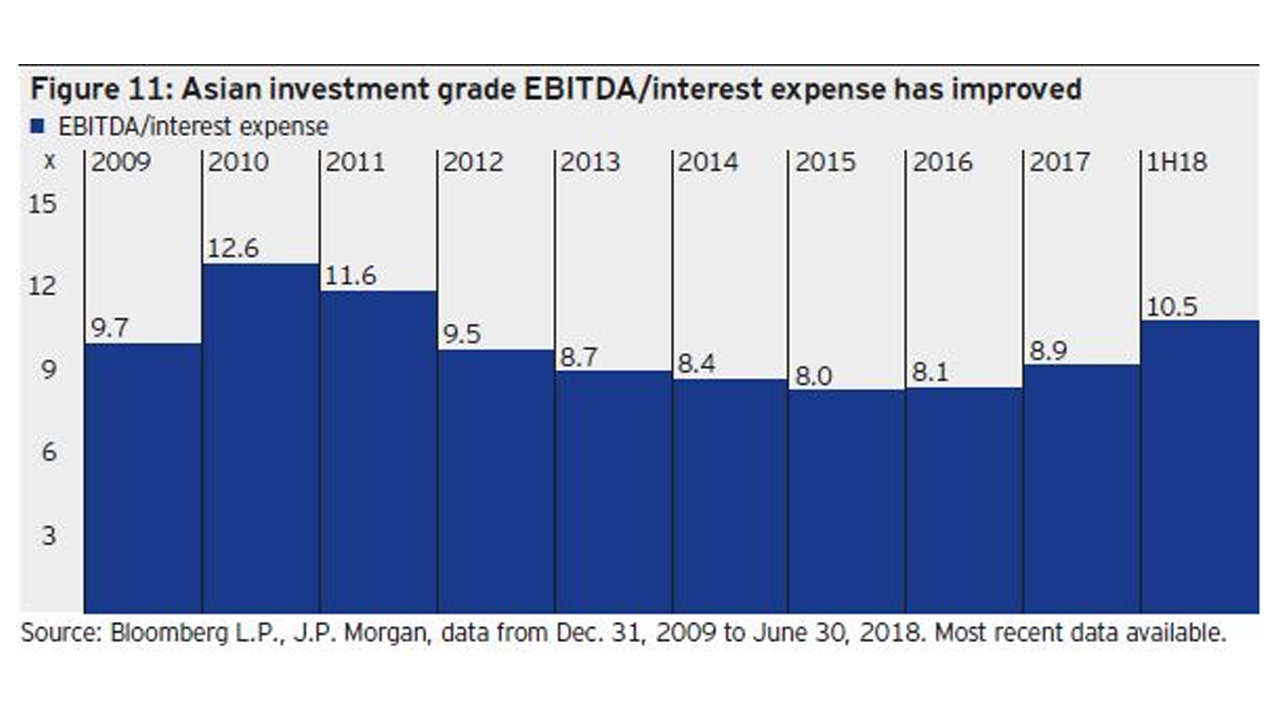

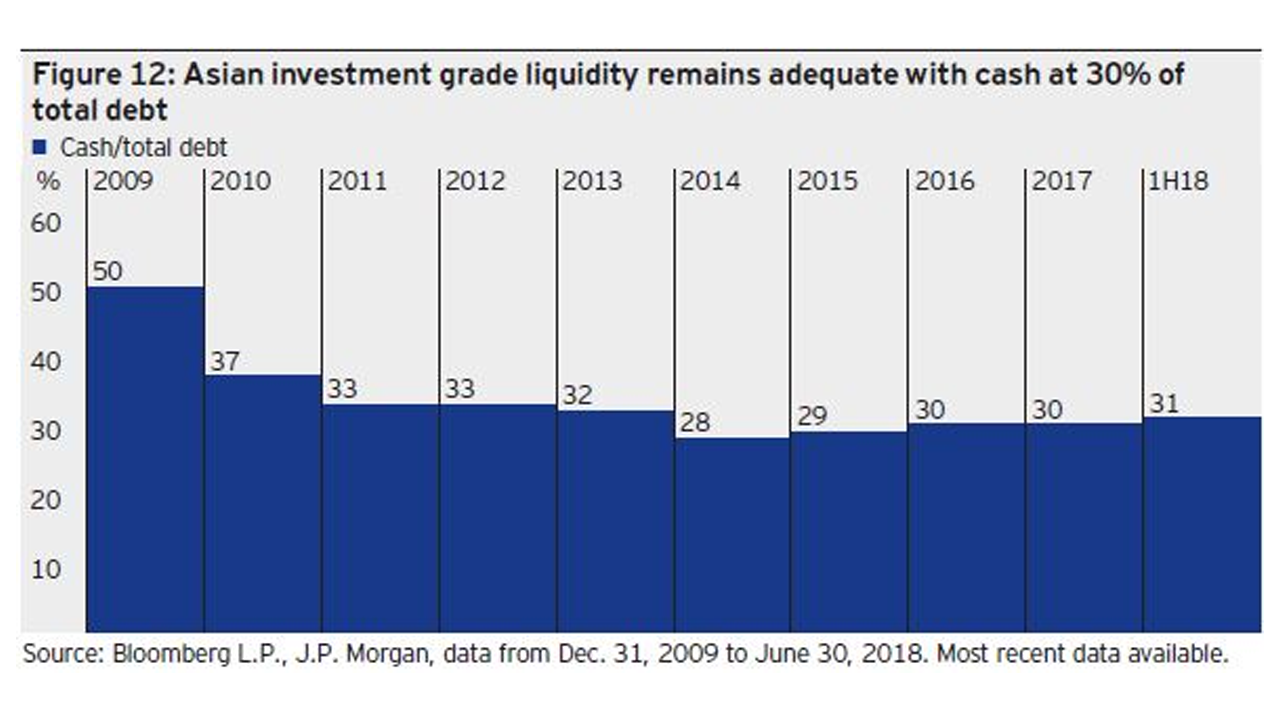

Thanks to corporate de-leveraging efforts in China, Indonesia, Malaysia, Thailand and Korea, the credit metrics of Asia’s investment grade corporate issuers have generally improved, as shown in Figures 9-12.

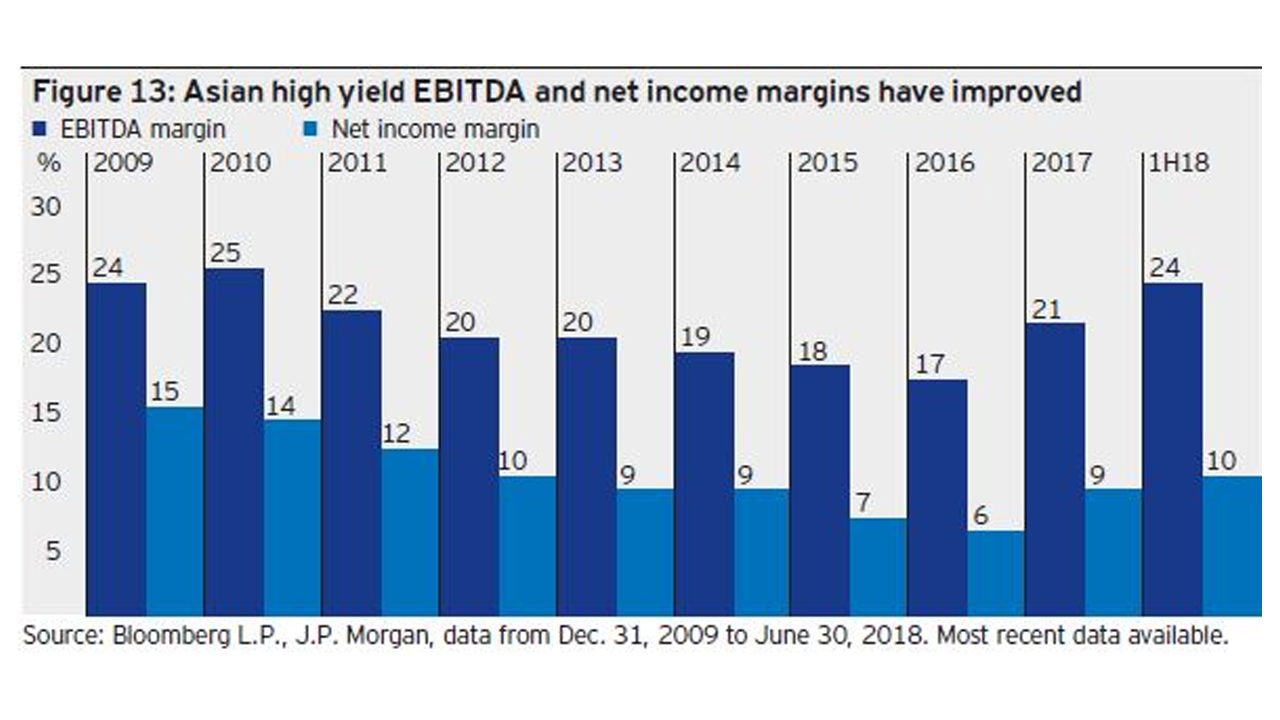

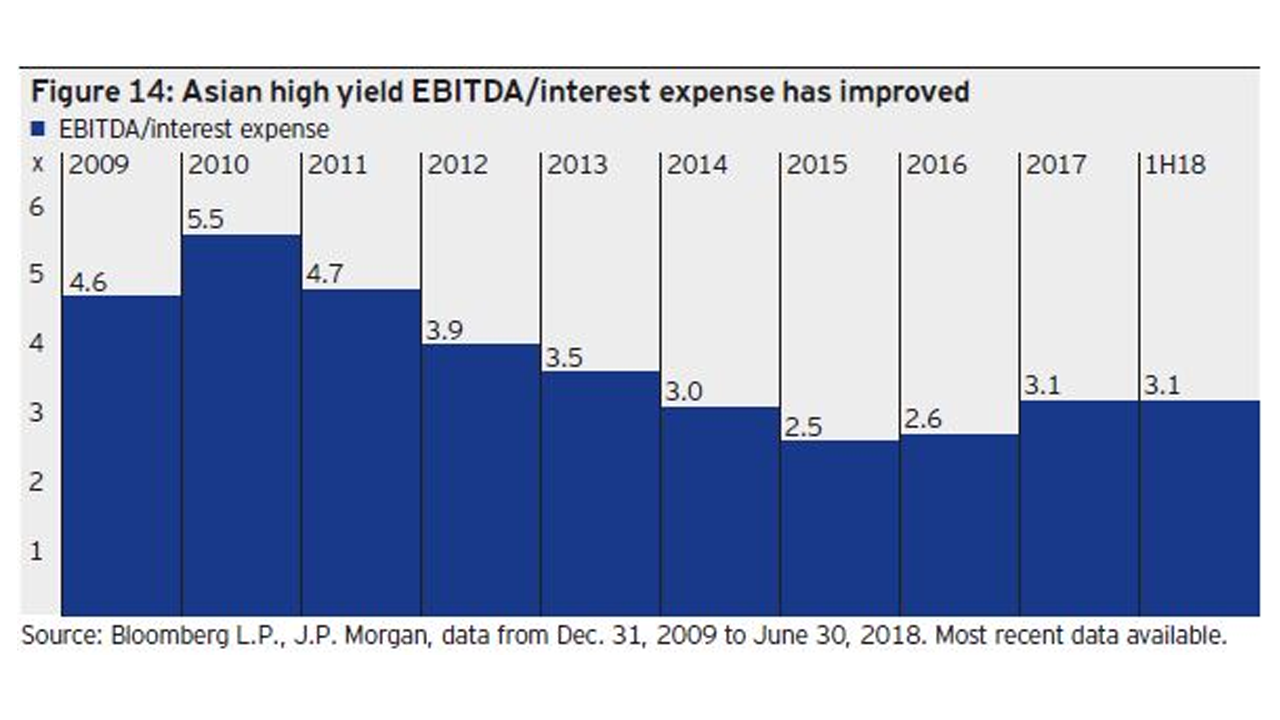

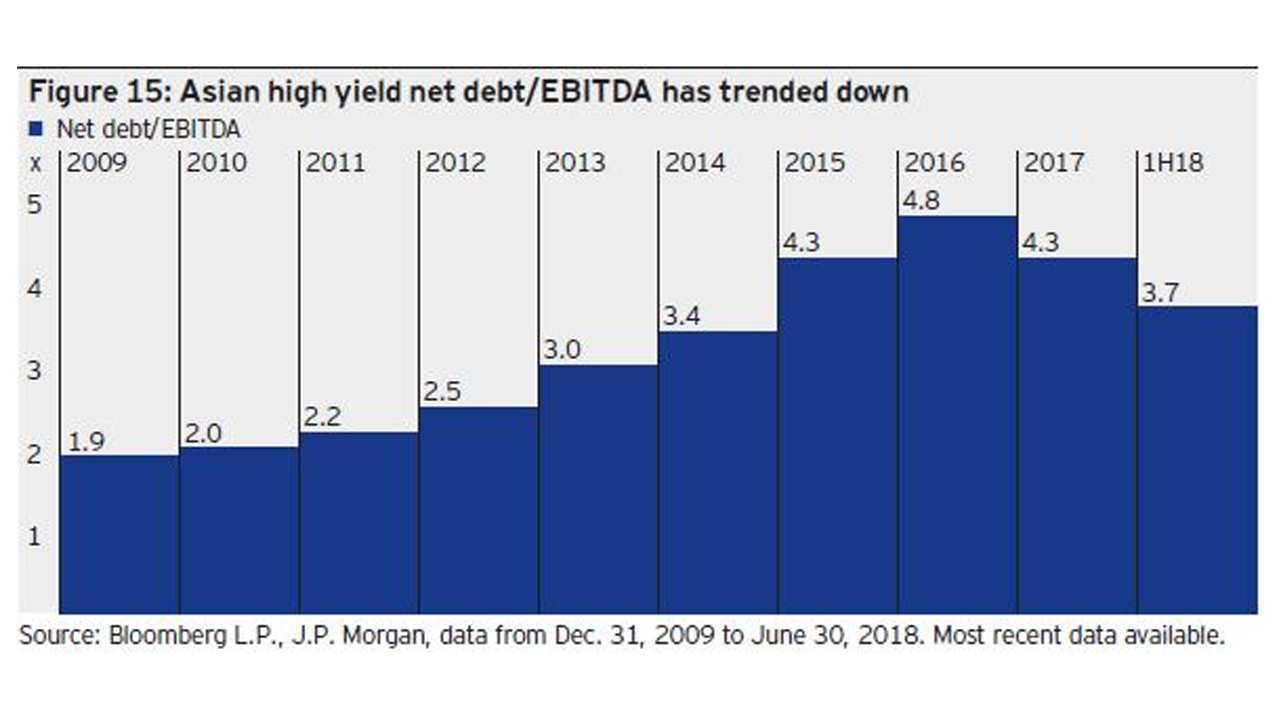

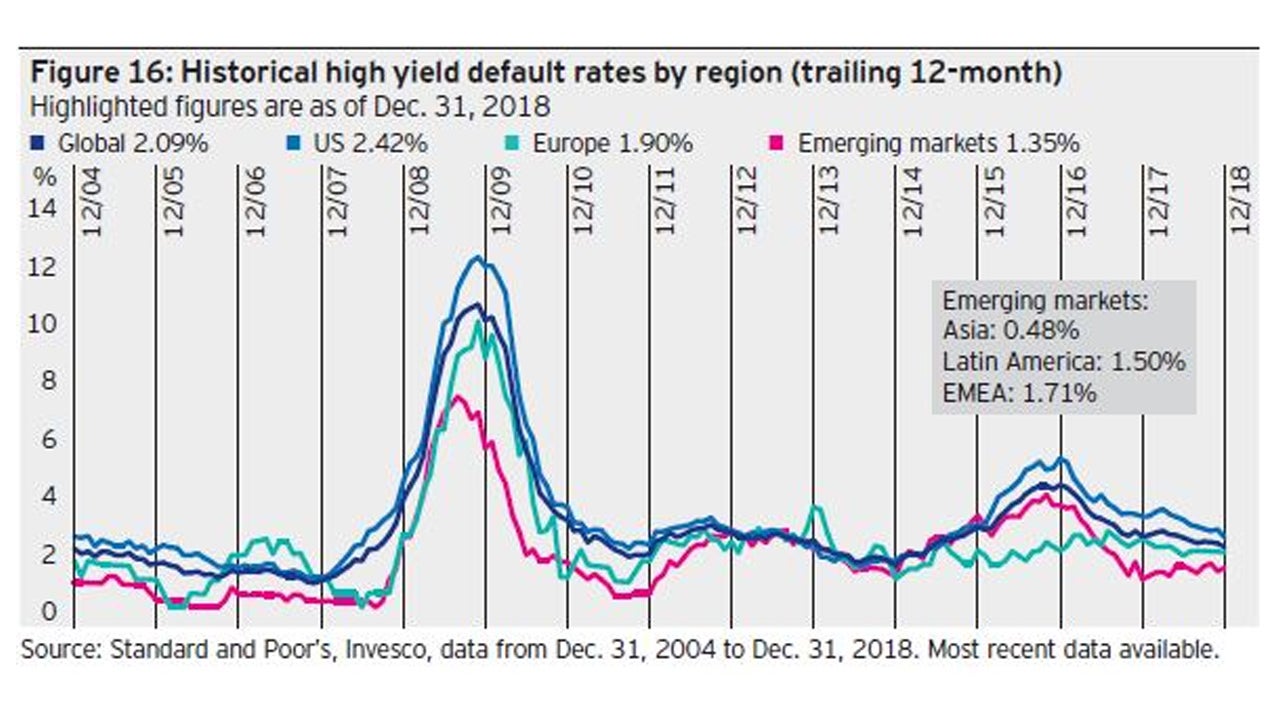

Similar credit improvement has occurred among Asian high yield corporate bond issuers, as shown in Figures 13-16.

Asian high yield US dollar bonds have demonstrated lower default rates than those of other regions, as shown in Figure 16.

Yield advantages remain in Asian US dollar bonds

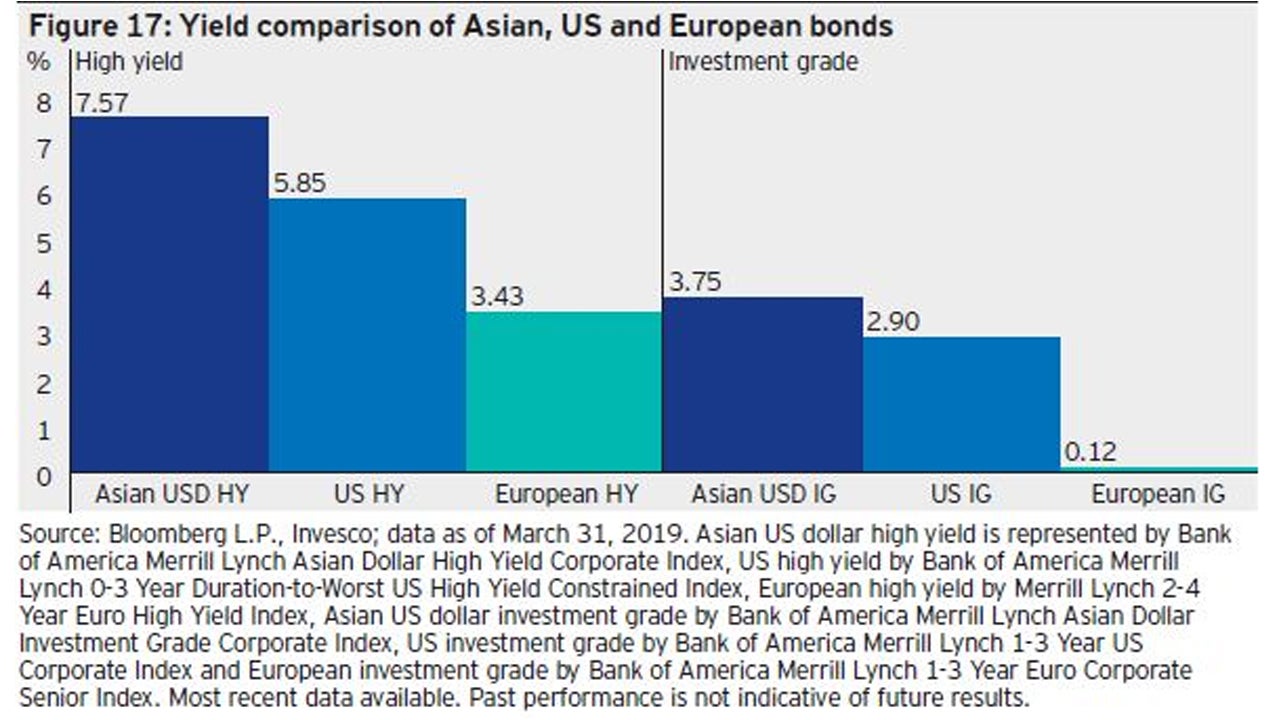

Asian US dollar bonds provided higher yields, overall (as of March 31, 2019), compared to US and European corporate bonds, as shown in Figure 17.

Asian investment grade and high yield corporate bonds also provided wider credit spreads as of March 31, 2019, compared to US investment grade and high yield corporate bonds for similar maturities and credit ratings. We see room for Asian investment grade and high yield corporate credit spreads to tighten in the next twelve months relative to comparable US investment grade and high yield bonds, based on our expectations of continued corporate de-leveraging efforts and improved credit metrics among Asian issuers going forward (Figures 18-19).

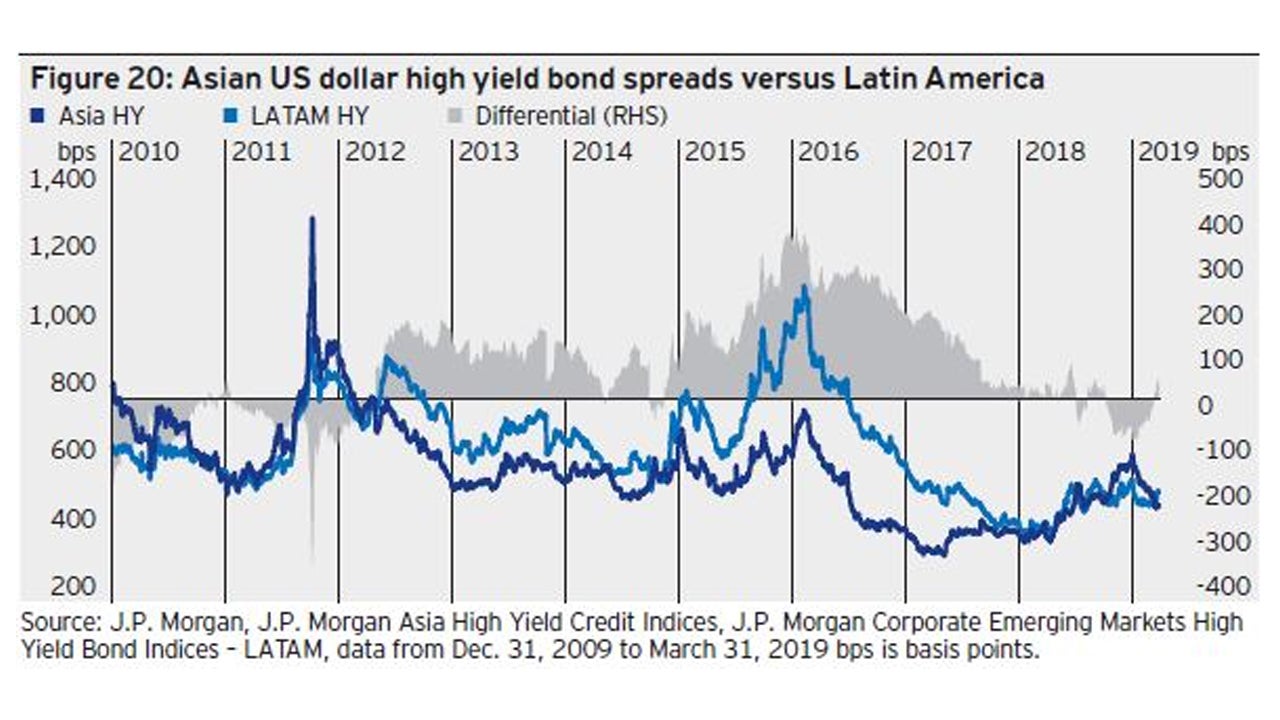

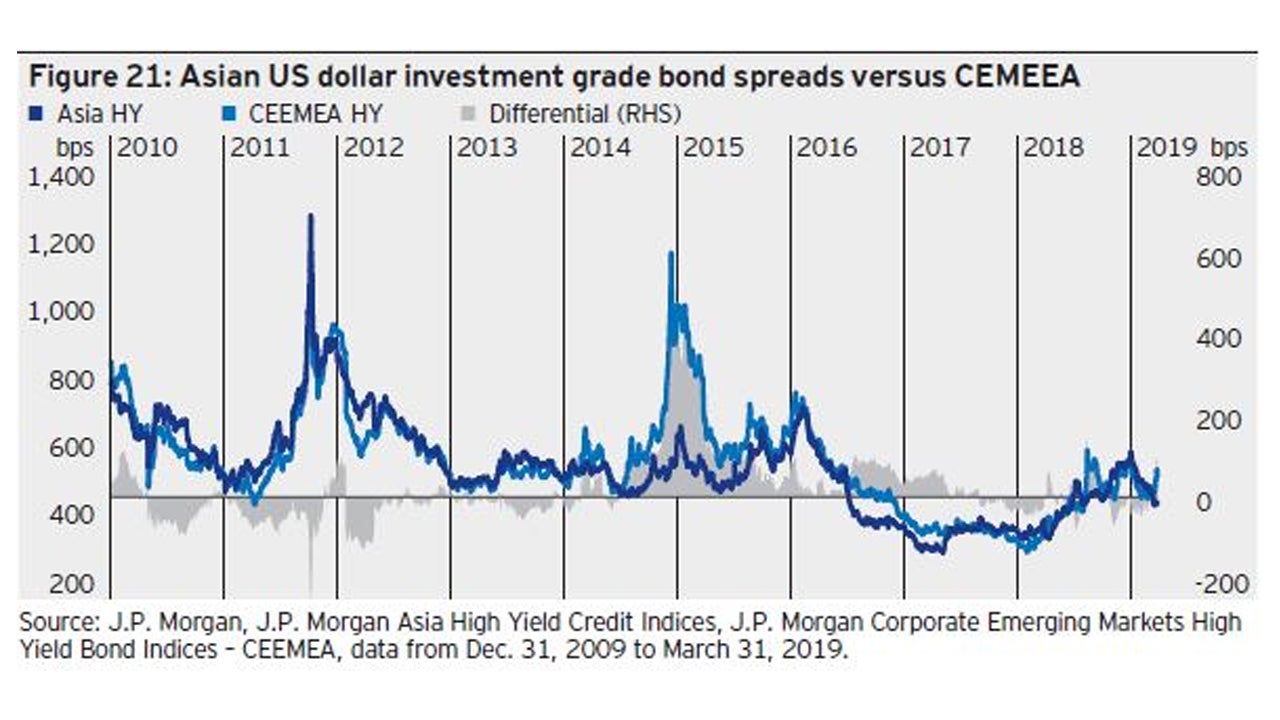

From an historical perspective, Asian US dollar high yield bonds currently appear cheap, in our view, relative to comparable Latin American and Central and Eastern European/Middle East/Africa (CEEMEA) US dollar high yield bonds, as shown in Figures 20-21.

Chinese US dollar high yield bonds have been particularly attractive, in our view, when compared to onshore Chinese corporate bonds on a currency hedged basis, as shown in Figure 22.

Conclusion

Rising new issue volumes and the Asian US dollar bond market’s expanding size have resulted in ample liquidity from a structural standpoint. Cyclically, positive trends in credit metrics and default statistics of Asian US dollar corporate issuers point to improved credit risk. In terms of valuation, we believe yields and credit spreads of Asian US dollar bonds are attractive compared to other major credit markets. While Chinese monetary and fiscal policies remain accommodative, we believe the large yield differentials between China’s US dollar bond market and its onshore renminbi bond market will likely be supportive of both the Chinese and broader Asian US dollar bond market.

Ken Hu is CIO for Fixed Income, Asia Pacific. Yifei Ding is Portfolio Manager, and Haidan Zhong is Client Portfolio Manager at Invesco Fixed Income in Asia. A summary of this article was included in Global Fixed Income Strategy - May 2019.

^1 Source: US bank loan data is from S&P/LSTA Leveraged Loan Index, as of April 30, 2018,

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/leveraged-loan-news/ official-us-leveraged-loans-1-trillion-market. The high yield bond market data is from Fitch High Yield Default Index, as of Dec. 31, 2017, link: https://www.fitchratings.com/site/leveragedfinance/data. Most recent data available.