A unified approach to investing in Chinese equities

Key takeaways

Historical developments and presence of capital controls in China have resulted in the existence of different share classes for Chinese equities. They can be largely split into onshore and offshore ones: onshore equities include stocks that are traded on the mainland Shanghai or Shenzhen Stock Exchanges, while their offshore counterparts are listed on Hong Kong, the US or other overseas bourses.

As onshore equities are due to take a larger representation on global indices, we believe international investors should revisit how they are to invest in China. In our view, investors can consider adopting an all-China approach. We define the approach as capturing the best investment opportunities across all China share classes regardless of listing locations.

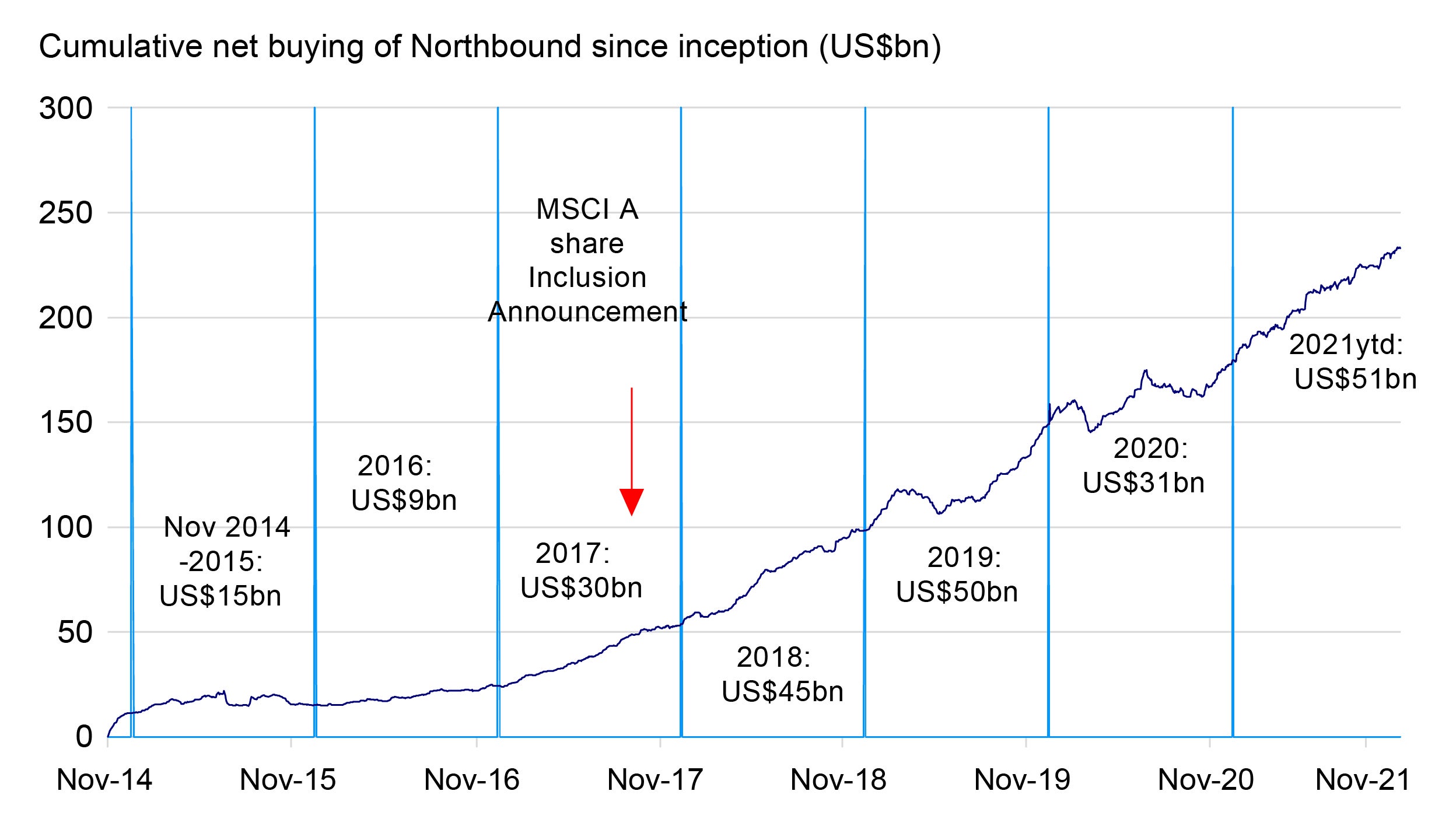

Chinese onshore equities were once relatively unknown to outsiders due to limited access and knowledge of the market. Now, onshore equities are getting more notice from foreign investors as global index providers increase their representation in global equity indices. At the same time, the emergence of the Stock Connect program, a scheme allowing international investors to buy domestic shares and onshore investors to invest in Hong Kong-listed Chinese stocks, is facilitating foreign inflows into the market.

In view of these trends, we believe the distinction between onshore and offshore markets will narrow, and investors will be able to adopt a unified strategy that combines the best opportunities across markets and offers better return potential. Indeed, international investors have been complementing their existing portfolios by adding onshore names. As a result, their participation into domestic share markets has significantly increased (Figure 1).

Source: Wind, Goldman Sachs Global Investment Research. Data as of November 2021. Accessed in December 2021.

As such, we believe an all-China approach may give the best exposure to China’s growth and should be the way forward when it comes to investing in Chinese equities. The mix of onshore and offshore shares should be based on a bottom-up stock selection process that assesses the investment merits of individual names. We believe investors may want to consider selecting experienced portfolio managers with deep knowledge of both onshore and offshore markets to seize the unprecedented opportunity.

Offshore equities offer many names with growth potential

We believe offshore equity markets provide a compact universe with an abundance of high-quality names. We think that investors should continue to look for attractive opportunities in offshore markets and stick to their allocations.

A large selection of opportunities with growth potential

We have found a good and large selection of opportunities with growth potential in offshore markets including consumer, services and technology companies, or what we call the structural growth sectors. We believe the transitioning of Chinese economy towards a consumption- and services-led one is an ongoing positive story, and this is what is boosting the prospects of companies in the structural growth sectors. They, being the driver of economic growth going forward, are expected to register faster growth and provide more opportunities thanks to industry innovation and new listings.

Several of the ten largest Chinese listed companies in the communication-services and consumer-discretionary sectors by market capitalization are listed offshore in Hong Kong and the US. Both sectors are good proxies for the structural growth sectors.

Strong outperformance of offshore equities. Regulatory actions aim at promoting long-term growth.

Offshore equites have registered faster earnings in the past. Earnings per share for MSCI China Index companies reached compound annual growth rate (CAGR) of 12.0% from 2011 to 2020, compared with 8.4% delivered by A share companies over the same period1. The MSCI China Index has been historically dominated by offshore China equities2.

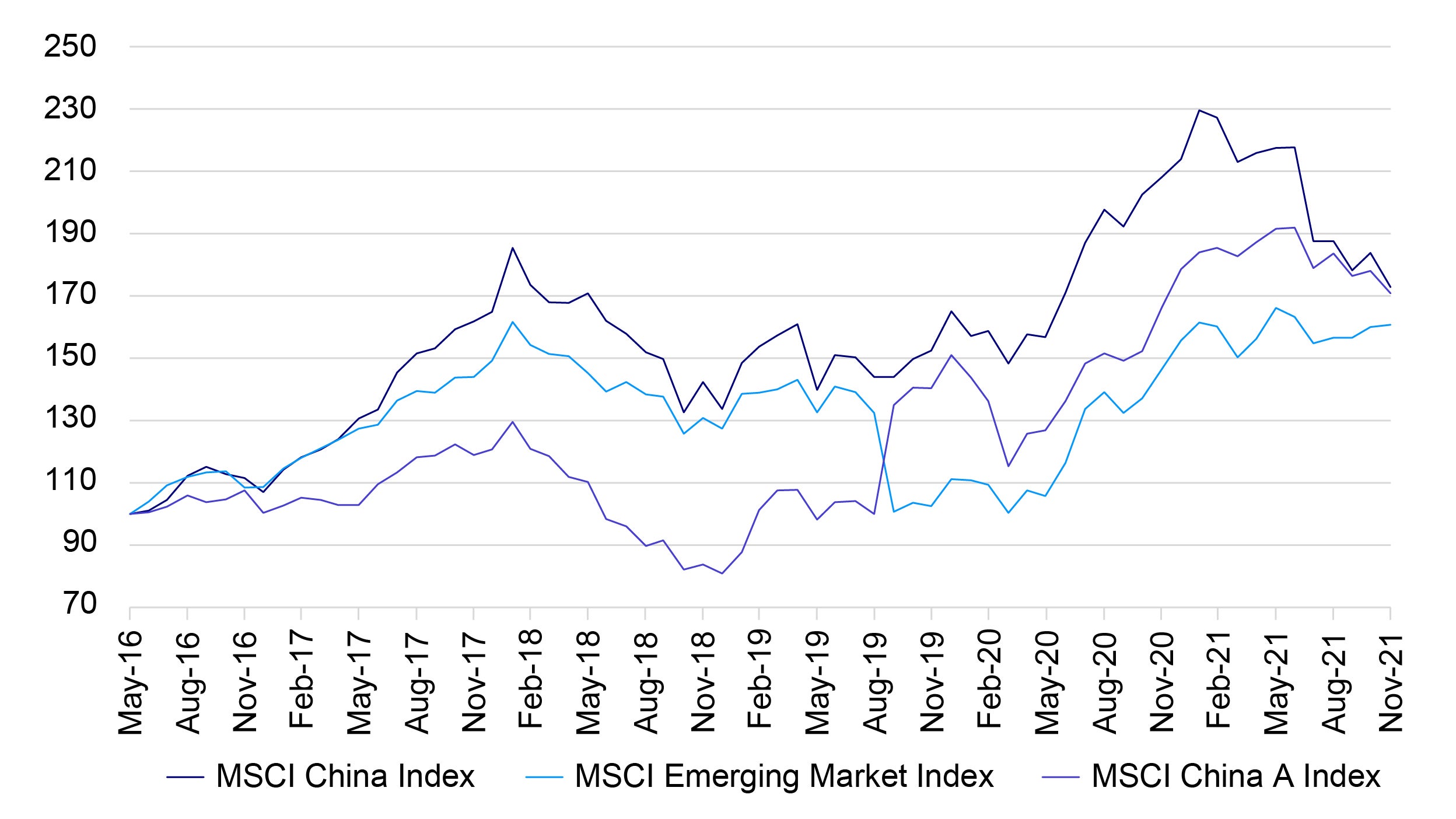

Strong growth of offshore listed equities has translated into their solid market performance. Figure 2 compares the performance of MSCI China Index, MSCI Emerging Market Index and MSCI China A Index since the completion of ADR inclusion (ADR stands for “American Depository Receipts”. They refer to US-listed Chinese companies). It is not difficult to conclude that offshore equities have been well-rewarded given their growth potential.

Source: Bloomberg, Invesco. Data as of November 2021. Accessed in December 2021. Past performance is not a guarantee of future results. An investment cannot be made in an index.

That said, regulatory actions towards the technology sector since July 2021 have led to market volatility and dragged down outperformance of offshore equities. We believe these policies aim at promoting long-term sustainability and competitiveness of related industries. Regulators have no intention to undermine offshore equities, comprising mostly private companies that account for more than 60% of GDP and nearly 90% of employment. Promoting technological advancement is key to boost China’s productivity and economic growth. We see communications regarding these regulations have become clearer in recent days and we believe the focus will be placed on execution going forward.

Strong entrepreneurship

We believe the growth potential of offshore listed companies is partially owing to many of them being private enterprises. The private sector in China is highly competitive. The intense competition has fostered a strong sense of entrepreneurship and propelled companies to stay agile and focus on innovation to deliver performance. We are excited about their future growth and believe they will continue to gain strength given the government’s desire to improve the overall efficiency of the economy.

Prevalence of industry leaders

Industry leaders are also very prevalent in the offshore markets. As they are known for their products and services, they are in a better position to attract offshore capital. Smaller companies, on the other hand, do not have the resources or expertise to manage an offshore listing. We believe that industry leaders have stronger capability to expand market shares, further helping solidify their leading positions.

Onshore equities provide complementary opportunities

Onshore equities on the other hand is a deep investment universe with around 4,000 stocks that cover a broad range of economic sectors. We believe it provides complementary stock names that complete the investment opportunity set of Chinese equities.

Complementing the opportunity set

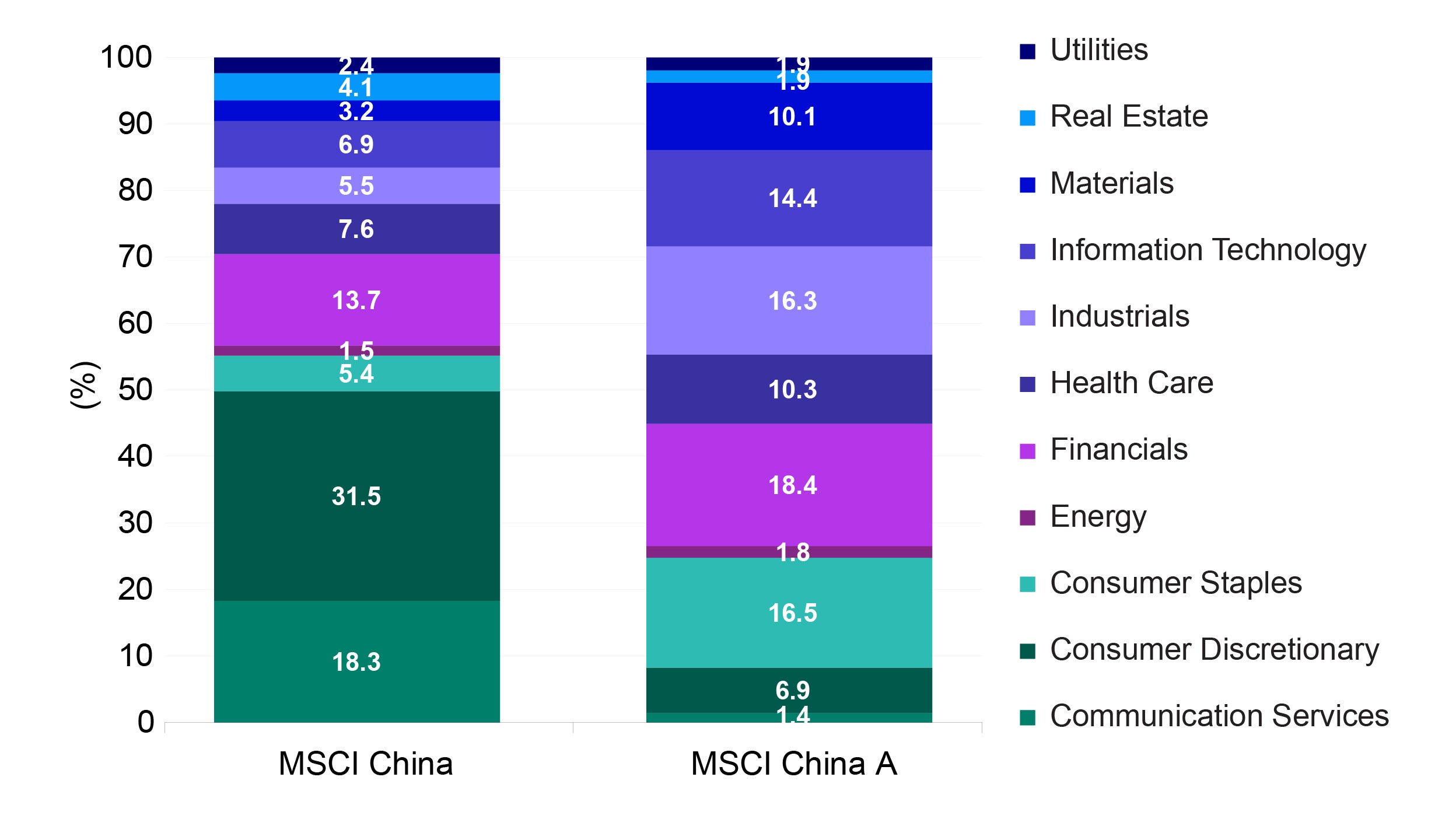

Figure 3 illustrates sector composition of MSCI China Index and MSCI China A Index. We can see some sectors that exhibit structural growth (including healthcare and consumer staples) are better represented in the domestic stock exchanges.

One example is a leading pharmaceutical company focusing on the development and production of oncology and surgery drugs. It has been on the Shanghai Stock Exchange since 2000 when it went to public. The company offers strong product pipelines and ranks the top in terms of research and development spending among listed pharmaceutical companies. It has been favoured by both domestic and international investors.

There are many other examples such as Chinese liquor producers and home appliance manufacturers that have been gaining tractions since domestic shares become more widely known after the index inclusion. What is special about them is that they are unique opportunities only available on domestic exchanges and not listed elsewhere.

Source: Factset, Invesco. Data as of November 2021. Accessed in December 2021.

Tap into attractive traditional growth sectors

Meanwhile, onshore equities account for majority of the investible opportunities in the traditional growth sectors such as financials, materials and industrials. Even though on an aggregate level their growth might be limited, we believe that some can still offer attractive growth if they derive their revenues from the rising consumer and service demand or are benefiting from continued reform efforts. The materials sector provides such an example. There has been significant and sector-wide improvement in profitability and reduction in leverage due to the supply side reform that has cut the excess capacity in the industry since 2016.

A share as an evolving asset

We believe onshore markets are still at a developing stage with some market idiosyncrasies that investors should pay attention to. It has led us to be selective on domestic shares for the time being as we believe there is a scarcity of quality names, especially given the wide universe.

That said, we believe A share will demonstrate itself as an evolving asset that will offer a more mature market environment and more attractive stock opportunities for investors to select going forward. Looking ahead, we believe financial reforms aiming at improving accessibility and regulatory framework and index inclusion will be key catalysts.

An immature market

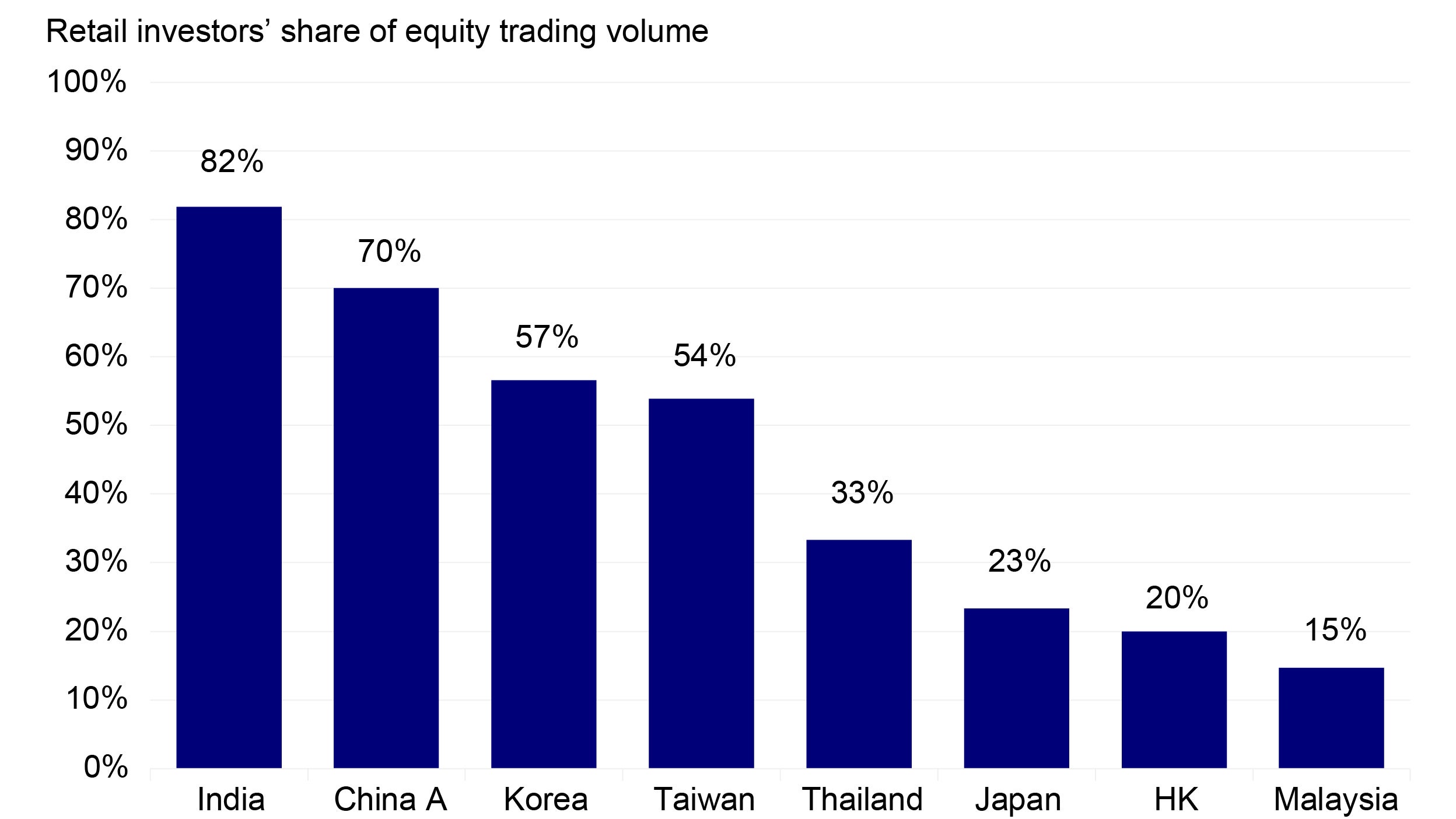

Retail investors dominate the onshore market and account for 80% of equity trading volume (Figure 4). Most retail participants are less sophisticated investors. They tend to overreact with new information and have shorter investment horizons. Sentiment often plays a bigger role in driving their investment decisions. This has led to higher volatility in onshore markets and more concentrated buying in certain sectors and stocks.

Source: HKEx, SSE, Wind, Bloomberg, Goldman Sachs Global Investment Research.

China A as of 2020, Hong Kong as of 2019, other markets as of November 2021.

India's data refers the Domestic Retail & Corporate turnover implied by the total turnover.

The restrictive regulatory framework of onshore market worries some international investors as well. In order to protect retail investors, onshore regulatory requirements limit the pool of borrowable stocks for single-stock short-selling – a method which helps uncover the true value of stocks. There are also restrictions on pricing in initial public offerings (IPOs) which mask the market value of newly-listed stocks. The approval-based IPO process also means that the securities regulatory authority must approve applications before they can list.

The dawn of a new era

China has been earnest in opening up the onshore market to global investors. In recent years, Chinese authorities have been gradually relaxing restrictions to allow foreign investors to enter the market. We expect that there will be a more diverse array of investors in the domestic market, with sophisticated, institutional investors taking up a bigger presence. We believe A share inclusion into global indices is another catalyst that will help institutionalize the A share market and make it more efficient.

There are also hopes that the regulatory landscape of onshore market may improve. The recently launched Scientific and Technology Innovation Board (STAR) in Shanghai has many regulatory innovations. If done well, these innovations on the STAR Market may be rolled out to other stock exchanges.

A unified approach is the way forward

With the distinction between onshore and offshore markets dwindling, we believe investors can focus on combining the best opportunities in both onshore and offshore markets to adopt a unified China approach. We believe such an approach may enable more efficient alpha generation and could lead to favourable returns.

This is because we believe that offshore Chinese equities provide abundant high- quality names and investors should consider them as important building blocks in their allocation to China. At the same time, we believe unique opportunities and wide universe of onshore markets deserve attention. We believe a selective approach at the moment will add the most value, but as its market features are evolving towards higher institutional participation and efficiency, we believe A shares will provide more opportunities over time.

All these would mean that an all-China approach make more sense as investors look to tap into the best opportunities that Chinese listed companies have to offer. It also may give them the best exposure to China’s phenomenal growth. We believe investors should leave it to experienced managers as they are likely to make better stock selection with their deeper knowledge of both onshore and offshore markets.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Past performance is not a guide to future returns.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

Sources: FactSet, MSCI, Goldman Sachs Investment Research. Data as of end October 2020.

-

2

MSCI China Index captures large- and mid-cap representation across all China share classes. It initiated the inclusion of ADRs in November 2015 and that of Chinese domestically traded A shares in May 2018. Upon full inclusion, A shares will account for around 40% of MSCI China Index.