Tokenized funds: The third revolution in asset management decoded

This report is co-authored by:

Invesco: Ken Lin, David Reed

Boston Consulting Group: David Chan, Yue Hong Zhang, Teddy Hung, Allison Xu

Aptos Labs: Alexandre Tang, Solomon Tesfaye

Executive Summary

Amid all the hype over Generative AI, interest in distributed ledger technologies (DLT) seems to have waned over recent months. But in the financial services industry, DLT-based solutions are attracting increasing levels of interest. Through an innovation called fund tokenization, the technology’s many advantages are finding a new home in the asset management space, where they can boost value creation, increase transparency, and streamline transaction processing. When combined with smart contracts, which automate various aspects of business logic, it’s clear why market participants are eager to participate.

As DLT use cases proliferate, banks are ramping up initiatives aimed at enhancing efficiency in markets from cross-border payments to fixed income. But fund tokenization – which we call the third revolution in asset management – offers the potential to create billions of dollars of value for both financial institution and end investors. In late 2024, tokenized funds had garnered more than US$2 billion in assets under management (AUM)1, with one manager raising significant sums in just a few months – and at higher-than-average fees. This reflects a pattern of growing investor demand, particularly from virtual asset owners (i.e., holders of crypto) such as crypto foundations. Over the coming period, we expect demand to continue rising, especially when regulated on-chain money (such as regulated stablecoin), tokenized deposit, and central bank digital currency (CBDC) projects materialize.

In this report, we provide industry practitioners with an overview of the emerging market in fund tokenization, highlighting what the technology can achieve in practice, the incentives for end-investors and financial institutions, a potential tipping point for rollout, and how fund managers can capture opportunities.

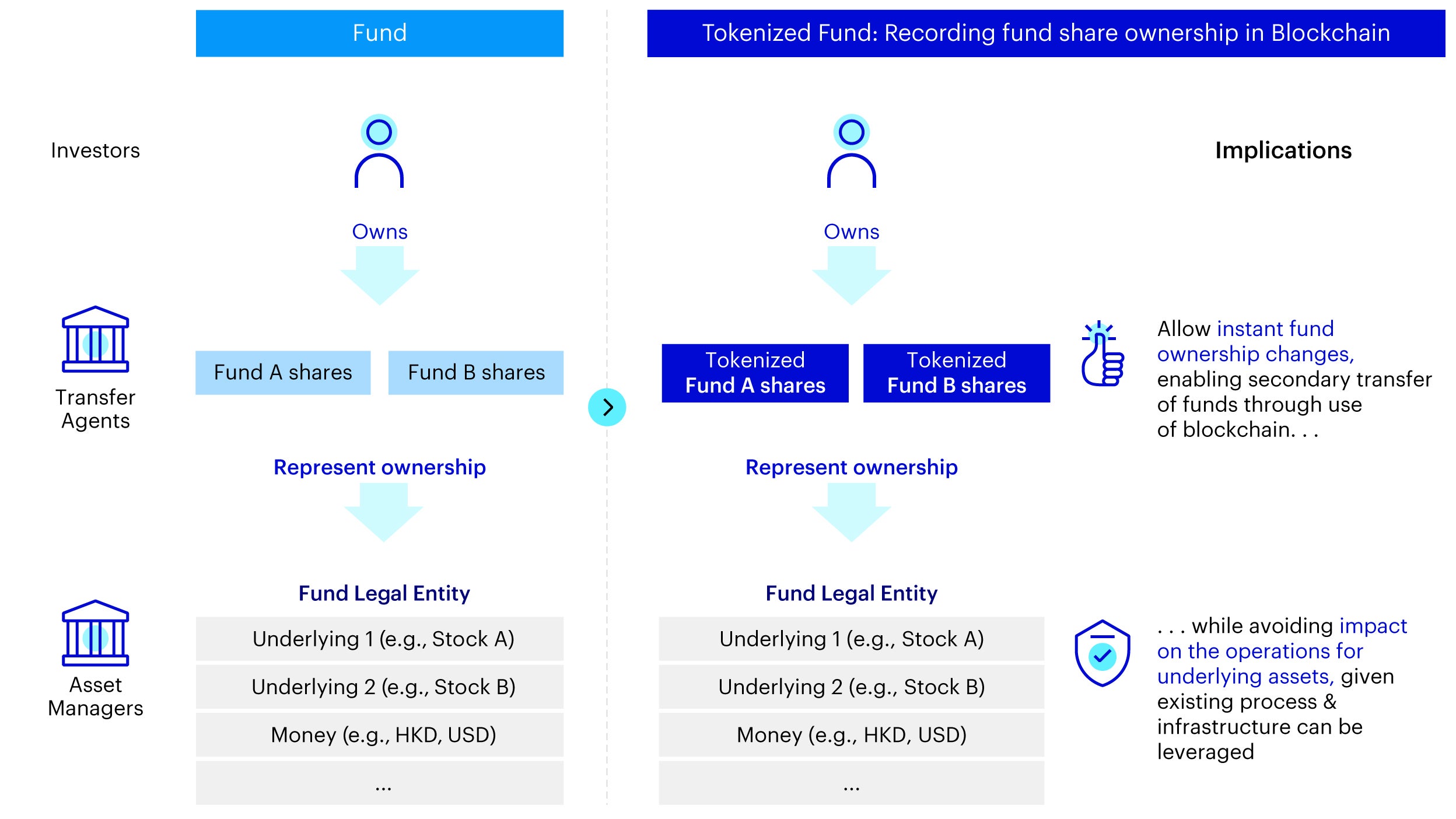

First, however, a short primer: Fund tokenization refers to the use of blockchain-based digital tokens to represent fund ownership, functioning similarly to how transfer agents record fund shares today. Early tokenization use cases have seen companies use special purpose vehicles (SPVs) to manage assets such as real estate. Similarly, fund tokenization can be achieved using existing unit trusts and / or fund company vehicles, meaning asset managers should see little friction in the process or in their operations.

Once up and running, tokenized funds offer advantages to investors including 24/7 secondary transfers and fractionalization, a lower threshold for investing, and instant collateralization if regulatory guardrails are put in place. If all the mutual funds globally were tokenized, we estimate that mutual fund investors could realize additional annual investment returns of about US$100 billion, while sophisticated investors could potentially generate US$400 billion by taking positions on intra-day value changes.

For financial institutions such as asset managers and wealth managers, there is an opportunity to unlock new investor pools, protect existing investor pools, and enhance business offerings. Indeed, as regulated on-chain money – such as stablecoins, tokenized deposits, and CBDCs – becomes more prevalent, demand for tokenized funds will surge. We estimate that virtual asset owners represent around US$290 billion in potential demand for tokenized funds, with potentially trillions of dollars more driven by the rise of on-chain money adoption among traditional financial institutions. There will also be innovative fund distribution opportunities through secondary tokenized brokerage and embedded investing. And managers have an opportunity to enhance their distribution models, using smart contracts to tailor fund composition and create hyper-personalized portfolios.

Taking lessons from the evolution of exchange-traded funds (ETF) - the so-called second revolution in asset management - tokenized fund AUM could reach 1% of global mutual fund and ETF AUM in just seven years. This would imply AUM of more than US$600 billion2 by 2030. If regulators permit the conversion of existing mutual funds and ETFs to tokenized funds, even trillions of dollars of AUM would be possible.

We believe there could be an inflection point for tokenized funds in the next 12–18 months, as on-chain money innovation creates a flywheel effect triggered by use of stablecoins among early adopters such as virtual asset owners. Subsequently, we could see rapid scaling with the launch of tokenized deposits and CBDCs. Among asset managers, first-movers are likely to attract significant market share and occupy preferred white spaces, with simple products helping them build brand recognition and economies of scale. Fast followers, by contrast, may need to innovate within niche areas.

To fully realize fund tokenization’s potential, the industry must first establish robust foundations, including clarity on regulation, global operating standards, and technical interoperability. From there, financial institutions will benefit from six foundational capabilities: a strategic tokenized fund vision, a use case road map, on-chain compliance, blockchain technology and operational setup, the ability to manage cross-chain interoperability, and a center of excellence to orchestrate their endeavors. Successful execution across these building blocks will open the door to effective adoption and competitive impetus for the longer term.

Fund Tokenization: A Game-Changing Blockchain Use Case In Financial Services

With successful proof-of-concepts, the adoption of blockchain technologies becomes increasingly compelling for financial institutions that have been on the digitization path. The ability to store immutable data from multiple parties creates both trust and significant efficiencies, effectively connecting companies with business opportunities and paving the way for collaborative innovation. Through tokenization, a process to create digitally represented ownership of real-world assets on blockchains, instant delivery versus payment (DVP) could be easier to execute than ever before.

Tokenization has continuously grown in all market conditions

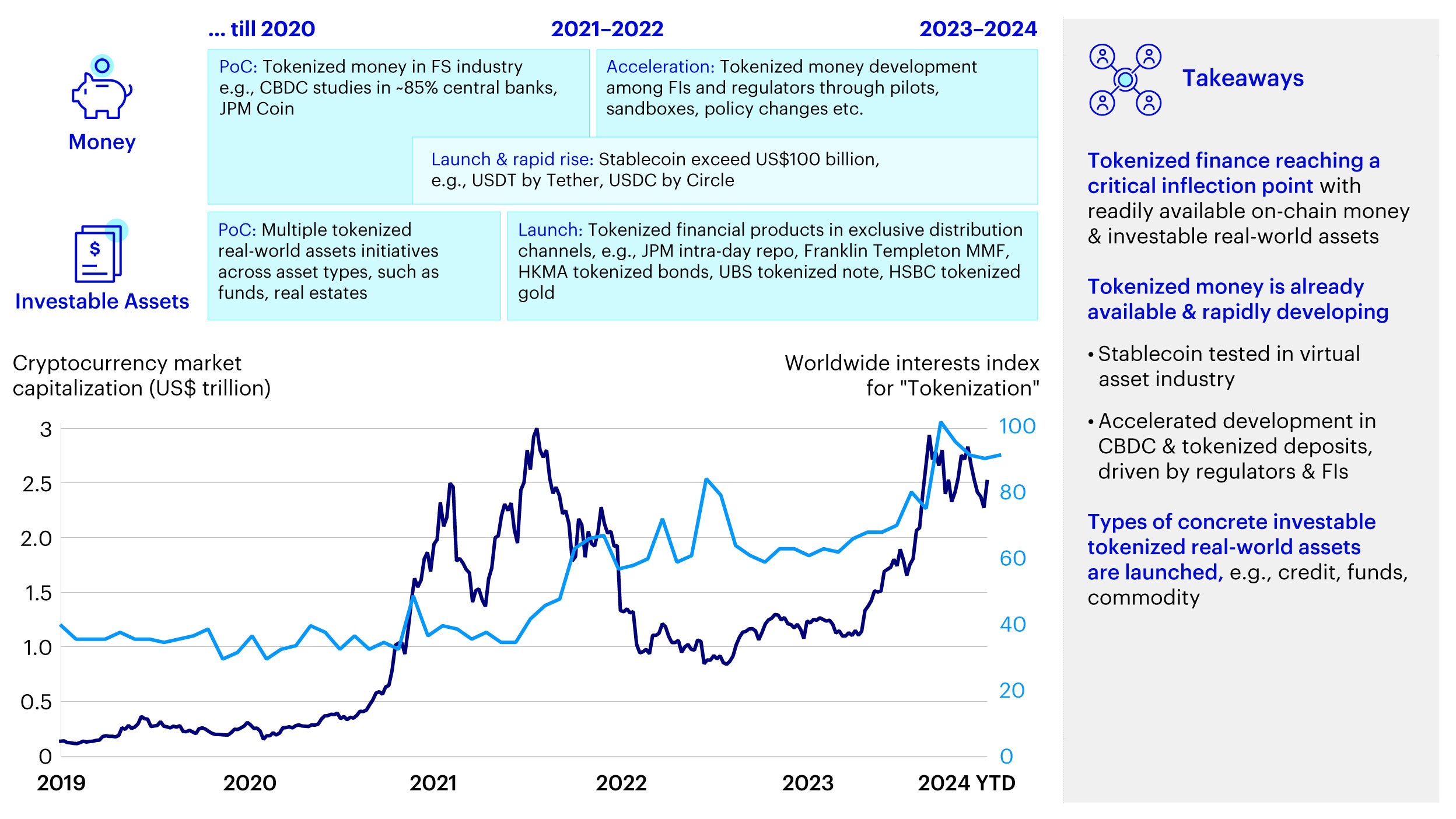

Interest in tokenization has steadily grown, with concrete production-grade initiatives launched in the past five years, led by financial institution incumbents and supported by regulators. With increasing volumes and different asset types in tokenized form, we see the emergence of a stronger foundation for tokenized finance, which could reach a critical inflection point with readily available on-chain money. (See Exhibit 1.)

Fund tokenization is not just another innovation effort by a few asset managers. Instead, it is an industry-wide movement across numerous global asset managers. Franklin Templeton launched its first U.S.-registered fund (Franklin OnChain U.S. Government Money Fund, FOBXX) using a blockchain in 2021, while BlackRock in 2024 launched the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), quickly achieving a market cap of over US$500 million in months.

Sources: Press release; Google; CoinMarketCap; Company websites; BCG analysis.

Fund tokenization is scalable and impactful

We perceive this as a two-step transformation. Step One involves registering the fund shares on the blockchain to facilitate instant ownership transfers. Step Two entails utilizing tokenized funds to invest in other tokenized assets, such as tokenized bonds. The completion of Step One can already unlock significant value and pave the way for a future scenario where tokenized funds can directly own tokenized assets.

Tokenization often involves use of SPVs to hold underlying assets, such as real estate, and issuing tokens that represent shares. This is similar to how funds are structured and operated today. For example, asset managers use unit trusts to hold assets like stocks and bonds, with transfer agents managing investor records. However, in contrast to other asset types, fund tokenization does not require use of SPVs. Secondary transfers can take place through price setting by authorized participants and market makers, ensuring compliance with regulatory standards. This makes tokenized funds more comparable with exchange-traded funds (ETFs). (See Exhibit 2.)

Source: BCG analysis.