Opportunity or caution? The outlook for European and Asian real estate

Key takeaways

Considerable market potential

Disruption and secular demand shifts are driving unique opportunities and growing investor interest in European and Asian real estate.

Diverse opportunities

In Europe, investors who can see through the short-term noise may be well-positioned to realize extremely attractive valuations.

Experience matters

Diverse investment opportunities on the back of a divergence in credit markets / monetary policies within Asia.

Exploring opportunities in European and Asian real estate

Disruption, capital market volatility, and secular demand shifts in European and Asian real estate are driving unique opportunities and growing institutional investor interest. Kevin Grundy, Managing Director, Fund Management, Europe, Invesco Real Estate, and Jason Choi, Managing Director, Senior Portfolio Manager, Asia Pacific, Invesco Real Estate, discuss the broader market environments in each region and where they are finding the most compelling investment potential for value-add and opportunistic strategies.

1. What are some of the broader trends unfolding in the European and Asian real estate markets?

Kevin Grundy: In Europe, there has been a significant disconnection between two different cycles — the traditional real estate cycle linked to fundamentals, which remains on sound footing, and the capital markets cycle which is determining pricing and is driven by a lack of liquidity and sharply higher interest rates. The result has been a major pricing correction, and investors able to see through the short-term noise appear well-positioned to acquire exceptional real estate at attractive valuations.

Jason Choi: Asia is experiencing considerable bifurcation across the region driven by a wide range of inflation levels and resulting monetary policy. Korea and Australia are closely correlated to the US with the interest rate environments in both countries kindling liquidity squeezes and potential distress as well as asserting significant downward pressure on valuations. In contrast, China is experiencing a markedly distinct cycle with intensifying expansionary monetary policy vis a vis considerable economic and real estate headwinds. Japan is again unique with the persistence of its generally “lower for longer” policy position resulting in healthy capital markets liquidity, a strong equity market surge recording an all-time high for the first time since 1989, long awaited but healthy levels of inflation at 2-3% and a persistently weak Yen.

2. Where are you finding the most interesting investment potential in each region?

Grundy: In Europe, we have been seeing three broad themes of opportunity. First, there has been a generational repricing in reaction to rate changes. This is a key area to watch over the next six to nine months as market participants continue to try to establish a new equilibrium based on where rates are headed.

The second is providing flexible structuring solutions across the capital stack. It’s powerful to have capital in a capital-starved market. It’s even more powerful to have the capability to offer creative and flexible funding solutions. An investor in this disrupted European market who is active across the capital stack has the opportunity to secure fundamentally well-performing real estate with the best possible risk-adjusted return profile.

Indeed, a market opportunity along those lines surfaced recently when the traditional market for mezzanine financing became largely unavailable in Europe. An investor with a high-returning mindset who historically would have achieved performance through a full-risk equity position in a value-add business plan could have achieved similar value-add / opportunistic IRR levels and healthy minimum equity multiples in an insulated mezzanine position between 50-75% LTV secured against fully performing real estate. That specific window is already closing, but we expect others to open.

The third area is a brown-to-green sustainability investment trend. Regardless of sector or strategy, if you’re not investing with an active approach to sustainability in Europe then you are missing a major shift in the market that transcends traditional market cycles. Europe remains at the ESG forefront, and the forced obsolescence of non-sustainable assets in the years ahead is going to be driven not just by tenants and investors but also by regulation. We’re all familiar with the net-zero promises that have been made by corporates and investors alike with an ultimate target date of 2050. Many of those promises are linked to interim goals in 2030. That’s only six years away. Occupational decisions that are taken today are directly influenced by that 2030 objective; likewise for investment decisions by European institutions. There is an opportunity for investors in Europe to bridge the gap between sustainable and non-sustainable assets, seeking to acquire the unwanted non-compliant assets at discounted pricing and then rehabilitating them before resale. The opportunity is large, the amount of capital chasing it is going to be large, and the winners are likely to be those who can match capital with the technical expertise required to deliver the sustainability turnarounds.

Choi: Looking across the Asia-Pacific markets, developed Asia — Japan, Korea, and Australia — is presenting a barbell investment landscape.

Korea and Australia have experienced a rapid rise in borrowing rates and a sharp capital markets pull back which has begun to put downward pressures on real estate valuation and created motivated owners / borrowers / sellers particularly for transitional / non-core assets. Providing structured solutions in this space has become an in-focus theme for our platform in the near term.

On the other hand, the widening gap in policy rates in Japan versus the US / Australia / Korea presents the opportunity to acquire / create strong relative cash-on-cash yields in high demand, high conviction secular growth sectors.

3. European deal activity was down about 60% for the first half of 2023 compared to the same period in 2022. How has this affected the market?

Grundy: The stall in transaction volumes has been largely a reaction to the increase in interest rates. On the buy side, some investors have been forced by denominator effects to lower real estate allocations. Others don’t have new funds to invest due to portfolio legacy issues requiring them to redirect resources toward deleveraging or redemption requests in the open-ended universe. Still others have a core mindset and are happy to sit on the sidelines until the market has settled into a new equilibrium. A smaller number have dry powder earmarked for the kind of distress that the market isn’t showing yet.

On the sell side, real estate owners generally haven’t been under immediate pressure to sell either from lenders or from other stakeholders. Most recognize that valuations have been lagging the market reality, so it has made little sense for owners to come to market to prove that the situation is worse than expected and to find the only buyers being the most aggressive parties looking for substantially discounted pricing.

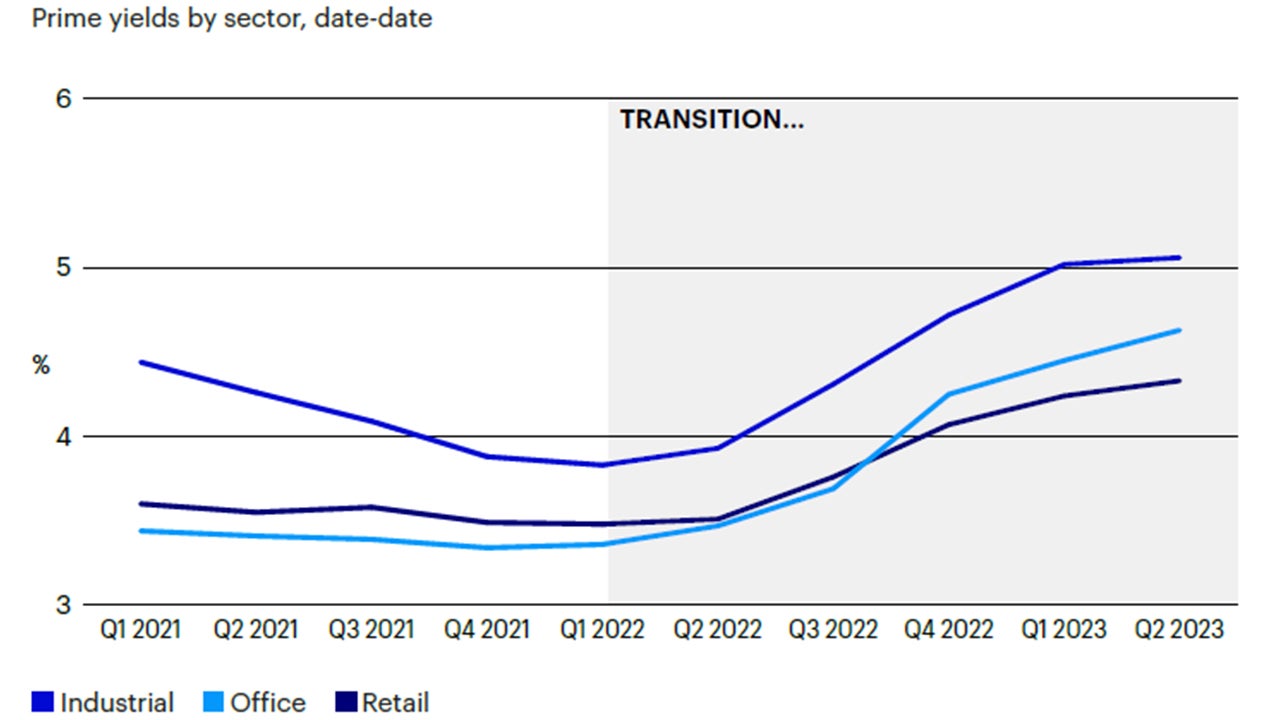

From a buyer’s perspective, the plus side is that yields have been rising across sectors (see Exhibit 1) while at the same time the underlying real estate remains attractive. The expectation is that the market will open up more in 2024 with higher transaction volumes as expectations for future interest rates stabilize and valuations catch up with market reality.

Source: CBRE Eurozone Prime Yields as of Q2 2023.

4. How are tighter sourcing trends shaping investment potential in Asia?

Choi: In this part of the cycle, sponsors are increasingly seeking flexible capital solutions and sources to meet their increasingly changing needs. We are observing a growing willingness to pursue unique restructurings / financings / partnerships which greatly benefits flexible capital providers such as ourselves. From a sourcing standpoint, this requires non-traditional channels and a willingness to dig through a much bigger haystack to find that proverbial needle. That’s where the number of “boots on the ground”, experience / track record, creativity and capital flexibility can offer clear competitive advantages.

5. What do you see looking ahead?

Grundy: The general perception is that Europe is ahead of the US in its value correction journey, which is unusual by historical standards. Average peak-to-trough valuation estimates across sectors tend to be in the minus 20-30% range, and Europe is far advanced along that path. That being said, we think it’s important not to try to be too precise in attempting to time the market and instead build in enough of a buffer in underwriting to accommodate that uncertainty. Overall, Europe appears far enough along now to begin thinking about making those judgments, and investors can help protect themselves through structure and pricing discipline.

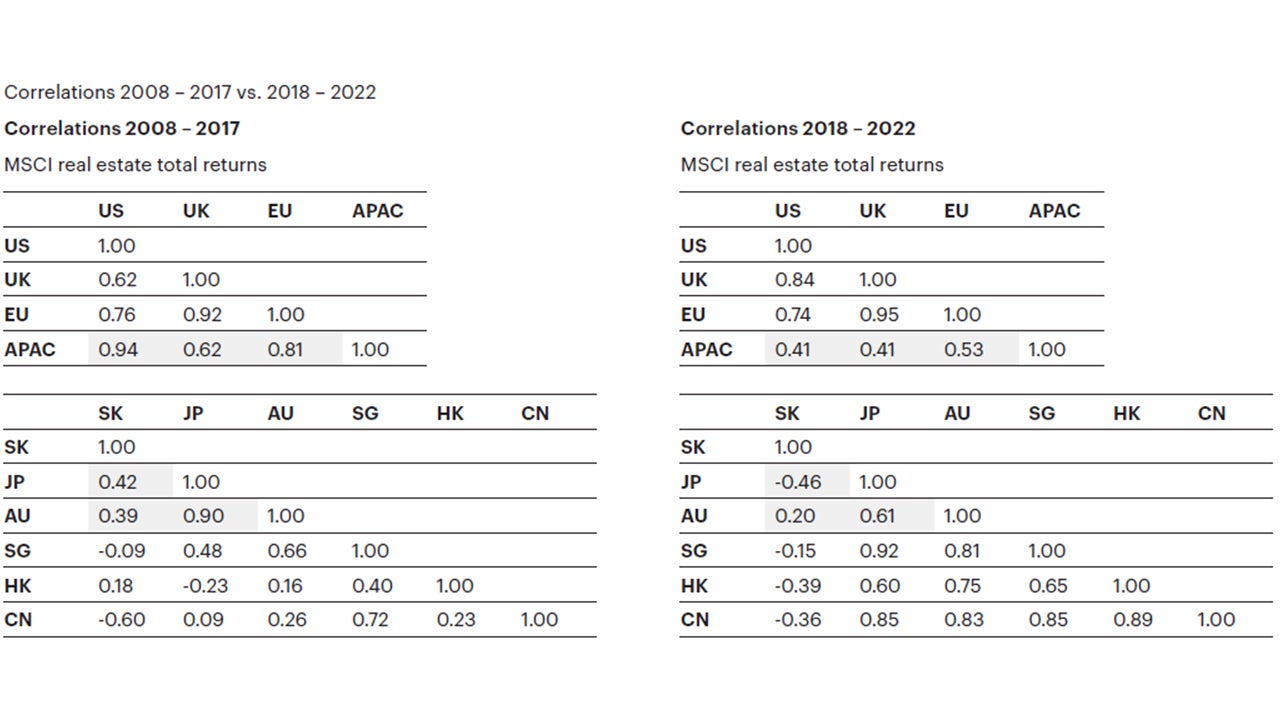

Choi: We are beginning to see increased interest and liquidity flow to Asia from global investors. (see Exhibit 2) Historically more correlated to the US, Asia has more recently shown to be a strong diversification region. This should continue to benefit real estate as an asset class.

Source: MSCI, Hines Research, Q4 2022.

Notes: Compares annual changes in total return Indices between a) US, UK, Europe and Asia Pacific and b) South Korea, Japan, Australia, Singapore, Hong Kong and China. Past performance is not a guarantee of future results.

6. What differentiates Invesco’s approach to real estate, especially in the current investment environment?

Grundy: It’s really about experience, depth of presence across local markets and breadth of strategies across the risk spectrum. Invesco Real Estate has been building real estate portfolios for more than 40 years and currently employs 586 professionals across 21 global offices in key markets around the world.

In Europe, it’s a great advantage to have fully-staffed local offices with investment professionals who have built their entire careers where we invest. In the current investment environment, the best opportunities are going to be off-market and negotiated between locals. It’s also valuable to have a platform that invests equity across strategies from core through to opportunistic, along with debt financing. The idea-sharing and real-time intelligence that springs from those different perspectives under one roof is powerful.

Choi: Likewise in Asia, we have the benefit of leveraging our global presence & scale (US$87.3bn AUM), local capabilities & track record, capital flexibility & partners and IQ compounding alongside our global, regional and country teams to differentiate ourselves from our peers. Our global platform, in addition to 7 regional Asia offices and c.100 “boots on the ground” in Asia are a true advantage in the real estate game.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested. Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer’s opinion and may not be realized.

Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Generally, real estate assets are illiquid in nature. Although certain kinds of investments are expected to generate current income, the return of capital and the realization of gains, if any, from an investment will often occur upon the partial or complete disposition of such investment.

Investing in real estate typically involves a moderate to high degree of risk. The possibility of partial or total loss of capital will exist.