The case for AAA-rated CLO notes

Collateralized Loan Obligations Notes (CLO Notes) are debt securities backed by an actively-managed portfolio of broadly syndicated bank loans primarily issued by BB and single-B rated borrowers (the CLO vehicle). The portfolio typically consists of 150-350 different issuers and loans (varies on region), with many diversification requirements in place to ensure the portfolio manager adheres to strict quality standards and investment guidelines. CLO notes are typically floating-rate and issued to take advantage of the difference between the spread earned on assets (i.e. loan spreads to Secured Overnight Financing Rate/Euribor) and the coupon paid on liabilities (i.e. CLO Note interest payments over SOFR/Euribor).

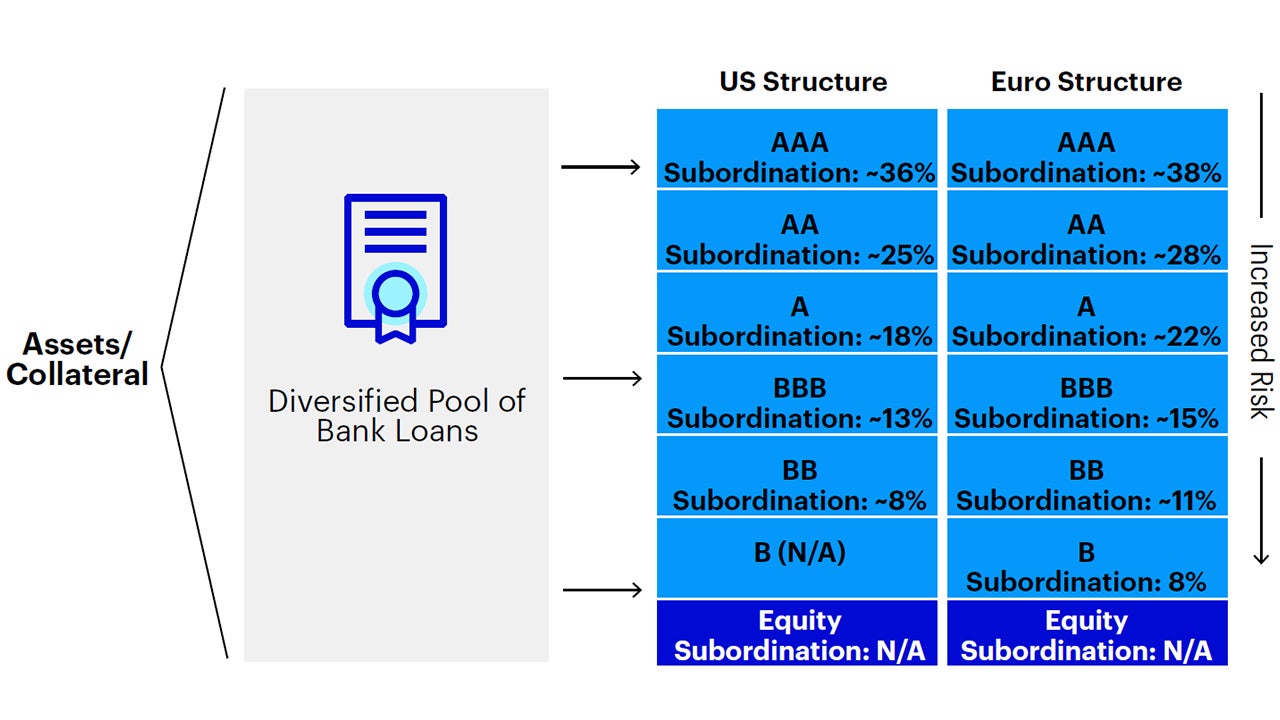

CLO Notes are offered in various tranches, each with its own rating depending on its priority in payment and claim on the portfolio. The senior-most tranches typically receive ratings of AAA then AA, while the junior tranches receive A, BBB, and BB, (potentially B) and finally the most subordinated tranche, the equity, is unrated but receives all excess interest and principal proceeds once the rated tranches have been paid. While very similar to the US structure, European CLOs follow a slightly different waterfall/subordination scheme and thus different spread levels.

Source: Invesco December 2024. For illustrative purposes only.

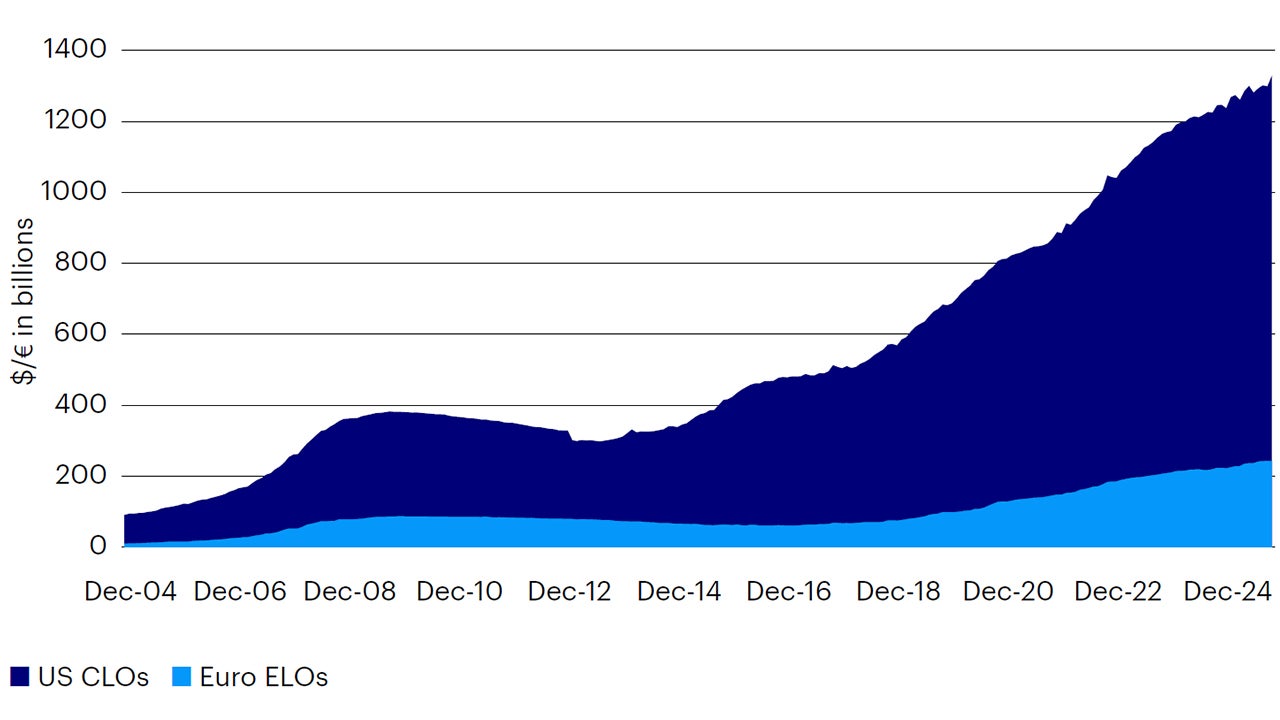

Although smaller than other debt or securitized markets, the Global CLO market has grown as global demand has increased, almost tripling in size over the last 10 years.

Source: BofA Global Research, Intex, as of December 31, 2024.

Key features

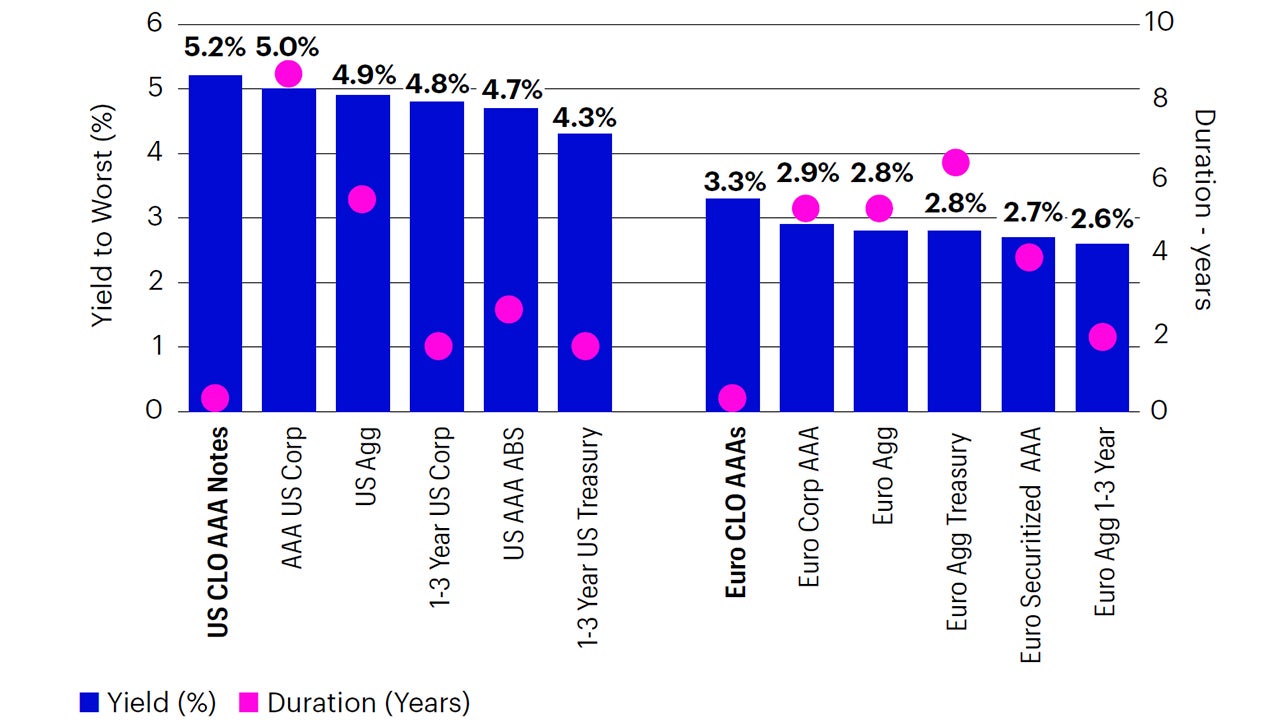

High income to risk

CLO Notes are structured with a “cashflow waterfall”, which provides the opportunity for relatively consistent monthly income and yields that are currently higher than other similarly rated fixed income. Furthermore, AAA-rated CLO notes have continued to offer relatively large spread pickup to comparable fixed-rate investments, leading to relatively higher yields.

Source: Yield represented by Yield to Worst (YTW). US CLO AAA Notes represented by J.P. Morgan CLOIE AAA Index, AAA US Corporates by Bloomberg U.S. Aaa Corporate Index, AAA US ABS by Bloomberg US Agg. ABS AAA Index, Bloomberg US Aggregate Bond Index by US Agg, 1-3 Yr Treasuries by U.S. Treasury: 1-3 Year Index and 1-3 year U.S. Corp by component of the US Agg index. Euro CLO AAA Notes represented by represented by J.P. Morgan Euro CLOIE Index. Euro Agg 1-3yr by Euro-Aggregate: 1-3 Year Index. Euro Securitized AAA by Bloomberg Euro-Aggregate: Securitized - AAA Index. Euro Agg by Bloomberg Euro-Aggregate Index. Euro Corp IG by Bloomberg Euro-Aggregate: Corporate Index. Euro Corp AAA by Bloomberg Euro-Aggregate Corporate Aaa Index and Euro Agg Treasury by Euro-Aggregate: Treasury Index. All Euro indices are hedged to Euro.

An investment cannot be made directly in an index. Past performance does not predict future returns. All data as of December 31, 2024

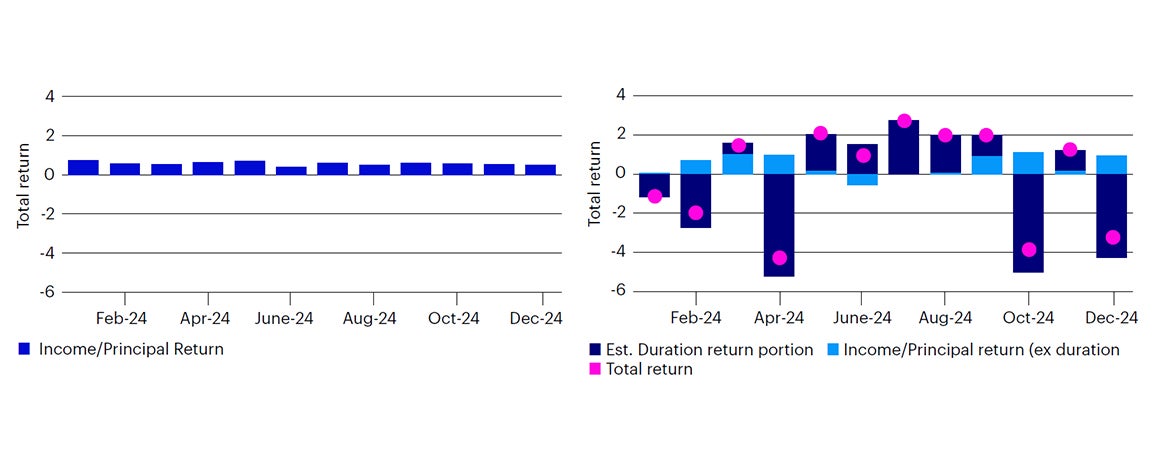

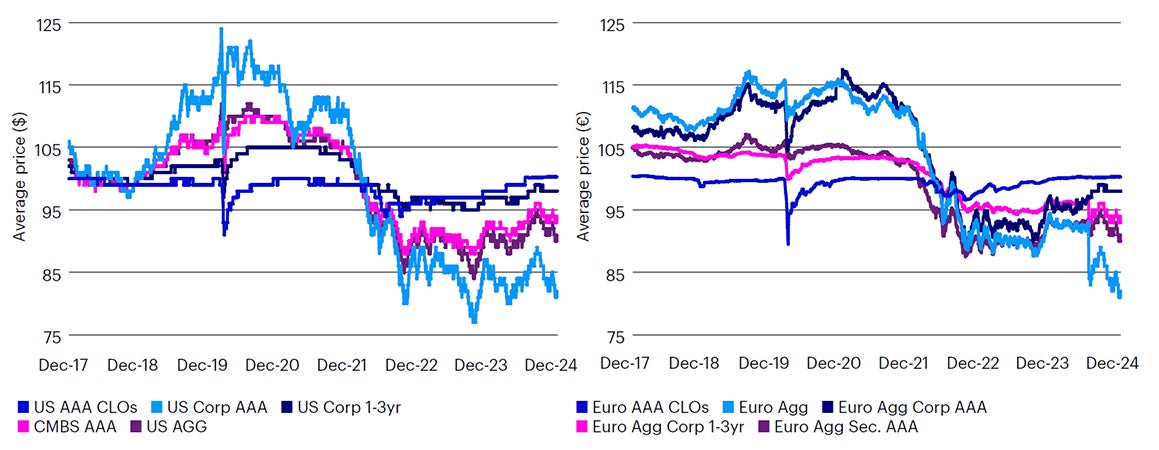

Floating rate feature - enabaling historically stable prices

CLO debt is typically floating-rate and tied to 3-month SOFR or Euribor (US vs Euro). The floating-rate feature of CLO debt helps protect investors against interest-rate volatility and duration risk, reducing price volatility compared to other asset classes, while also providing investors with a hedge against inflation with income potential increasing as interest rates rise.

Source: JPM CLOIE AAA Index & Bloomberg Aaa component of the U.S. Corporate Investment Grade index. data through December 31, 2024. An investment cannot be made in an index. Past performance is not a guarantee of future results. Estimated duration return based on modified duration as of prior month end and basis point change in yields of 10-year treasuries.

Source: JPM CLOIE AAA Index & Bloomberg Aaa component of the U.S. Corporate Investment Grade index. data through December 31, 2024. An investment cannot be made in an index. Past performance is not a guarantee of future results. Estimated duration return based on modified duration as of prior month end and basis point change in yields of 10-year treasuries.

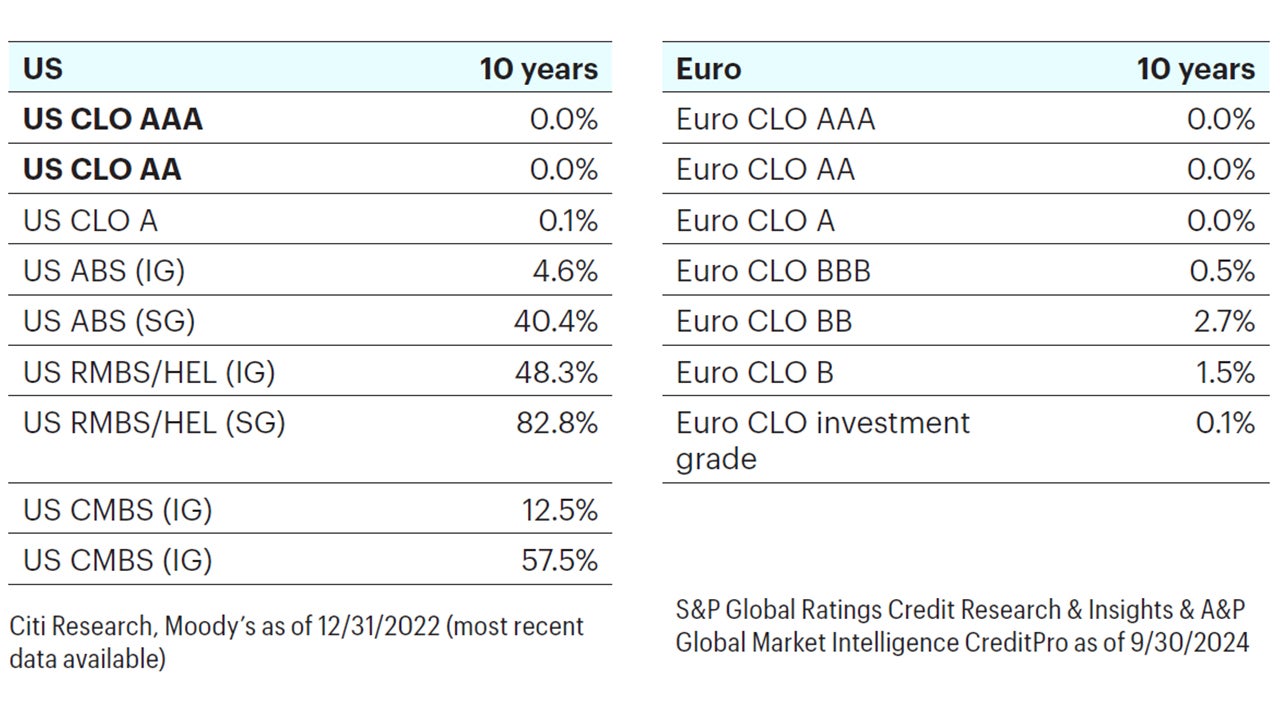

Structual advantages enabaling zero historical losses

The CLO structure incorporates various coverage tests and collateral quality tests that are measured regularly to “detect” warning signs of collateral quality erosion. If such tests are breached, the CLO structure 1) redirects cashflows to best cushion senior note holders; and 2) puts further restrictions on CLO managers’ reinvestment flexibilities. These features can create a rather counter-intuitive situation where AAA CLO notes become more attractive in periods of dislocation. With cash redirected away from equity distributions to amortize down the senior or AAA notes, the overall structure de-levers and the weighted average life of AAA notes can materially decline.

Of the US and Euro CLO tranches rated by Moody’s and S&P respectively in the 10 years ended 2022/2024 respectively, no AAA or AA tranches have ever experienced material principal impairment:

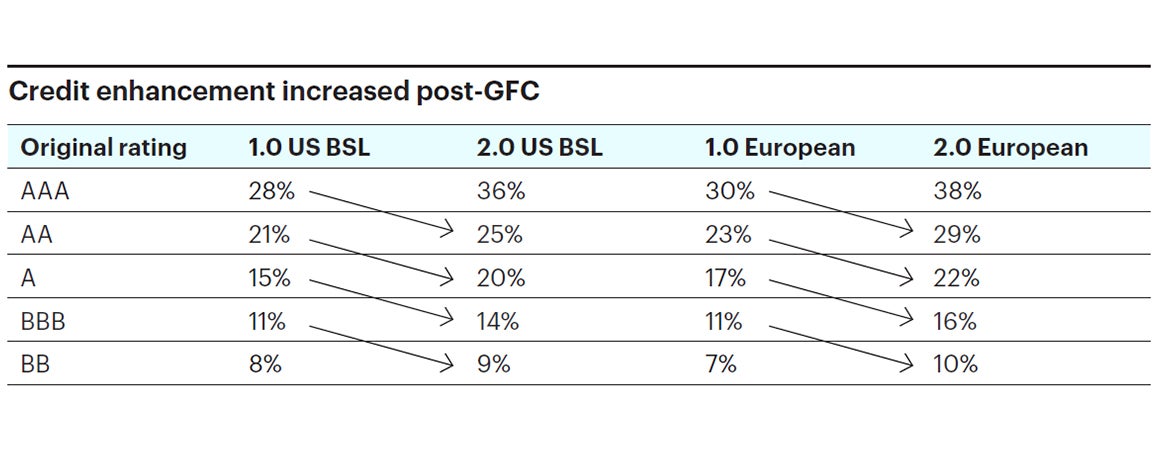

Despite lower default rates of CLOs versus comparable securitize products during the Great Financial Crisis of 2008-2009 (“GFC“), the structure of CLOs became more conservative primarily through increasing the par-subordination required to achieve a desired rating. For example, the par-subordination for a single-A rated CLO note today is very close to the par-subordination of AA-rated CLO notes pre-GFC. The par-subordination of a CLO note is the required par-loss before the CLO note experiences a principal impairment, as shown on the table below. Other changes which increased the security of post-GFC CLO notes include:

- Less structural leverage (more credit enhancement)

- Lower thresholds against defaults and losses which trigger amortization of the most senior tranche

- Shorter reinvestment periods (less chance for par erosion)

- Stricter diversification and collateral quality requirements on the underlying pool of assets

- Significant reduction in fixed-rate assets (i.e. bonds) and increased incentives to avoid assets with irregular cash-flows

Source: Pitchbook Data Inc, Intex, Barclays Research as of July 21, 2010, following the implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States.