The basics of alternative investments - Part 4: How to incorporate alternatives into your portfolio

I hope you are enjoying your summer and my summer blog series covering the basics about alternative investments (with an emphasis on those alternatives available as mutual funds). In this, the fourth installment in the series, I will focus on how investors can incorporate alternatives into their portfolios.

How to Incorporate Alternatives Into Your Portfolio

I recommend that investors follow the below multi-step process when incorporating alternatives into their portfolio:

- Define your investment objectives - As I wrote in the first post in this series, similar to stocks and bonds, alternatives investments are simply tools investors use in an effort to achieve their investment goals. To this end, it is important for investors to define their investments objectives so they can evaluate whether or not different types of alternatives have the potential to help them achieve those objectives.

- Identify those alternatives that are consistent with your objectives - Given the myriad alternatives available, one of the major challenges for investors is figuring out which alternatives to use given their investment objectives. To help investors navigate this challenge, Invesco has created the below investment framework that organizes the liquid-alternatives universe around common objectives.

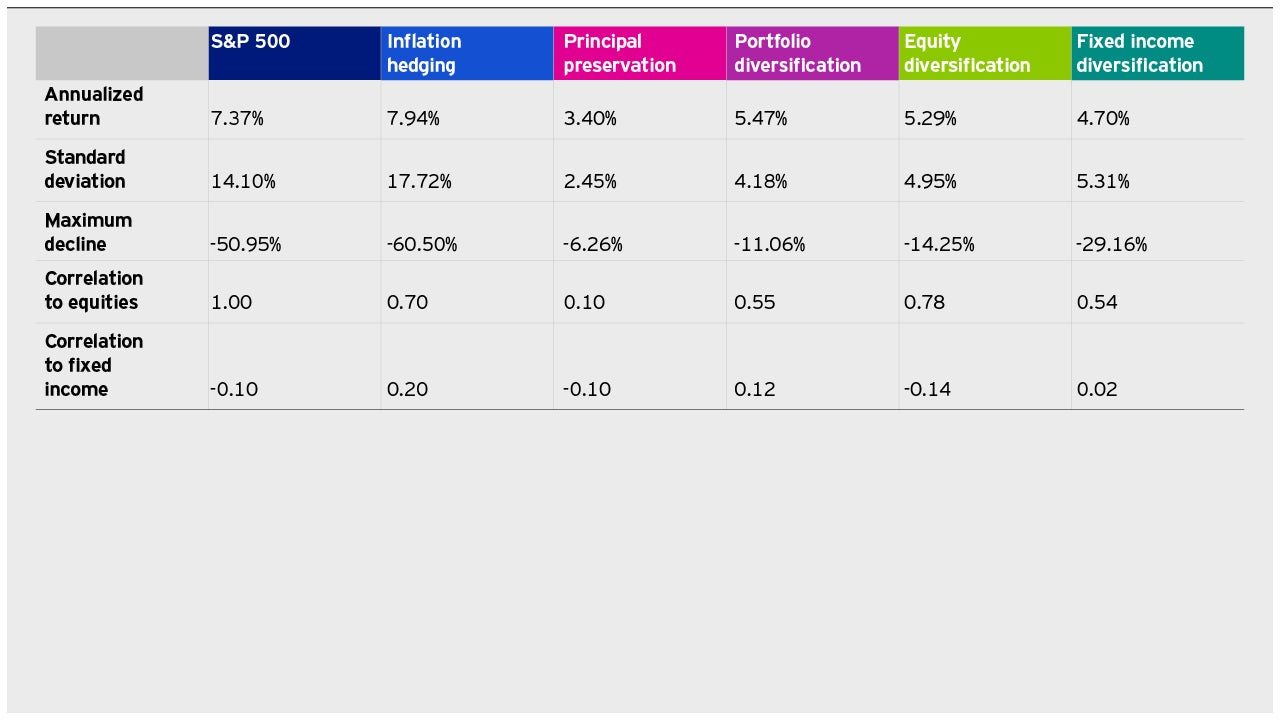

The table1 below summarizes the historical performance characteristics of the various categories comprising the above framework.

Research-specific funds – Once investors have decided which strategies they want to incorporate, they need to select the specific funds in which they will invest. Importantly, an investor should only invest in a fund after they understand the unique characteristics of the strategy and manager, such as expected return and risk, what constitutes a favorable/unfavorable environment, expected performance during different periods of the market cycle, and key drivers of return. To assist their research, investors can find a wealth of information on the internet via the websites of the various fund providers and fund-research sites such as Morningstar.

As part of the research process, an investor should consider if he or she prefers a single-manager fund or a multi-manager fund. The advantage of single-manager funds is that the investor can be targeted in his/her approach as single-manager funds usually have very well-defined investment approaches. The disadvantage of single-manager funds is that the investor is taking on manager risk (i.e. the risk of selecting an underperforming manager). To help mitigate manager risk, the investor can invest across multiple managers or in a multi-manager fund, thus limiting his/her exposure to any specific manager.

The advantage of multi-manager funds is that they allocate across multiple managers (and often across multiple strategies), and as such funds provide a “one-stop shop” solution to the issue of mitigating manager risk. The disadvantage of multi-manager funds is that the allocation across managers and strategies typically fluctuates over time, thus limiting an investor’s ability to be targeted in his/her exposure to a particular strategy.

Decide how much to invest in alternatives – There is no one correct answer as to how much to invest in alternatives. In my experience, investors typically allocate between 5% and 30% of their portfolio to alternatives. Many of the investment firms I work with recommend an allocation of between 10% and 20% to alternatives. The percentage an investor allocates to alternatives is typically driven by his/her risk tolerance and comfort in using alternatives. I believe that if an investor decides to allocate to alternatives, he/she should allocate a sufficient amount so that it can have an impact on the portfolio. If the allocation is too small, the impact on the portfolio will be negligible, thus defeating the purpose of adding alternatives.

How to fund the investment in alternatives - I am a big believer that asset allocation is as much an art as a science. Furthermore, each investor has his/her own unique investment objectives that will drive his/her asset allocation decisions. As a result, there is no one-size-fits-all answer to the question of how to fund an allocation to alternatives.

That said, I suggest that investors allocate based on the return and risk characteristics of the alternative. If the alternative has predominantly equity-like return and risk characteristics, they should fund the investment as they would an equity investment. Similarly, if the alternative has predominantly fixed-income like characteristics, they should fund the investment as they would a fixed-income investment.

1Source: StyleADVISOR.September 2001 – March 2018 Past performance is not a guarantee of future results. Investments cannot be made directly into an index. Maximum decline refers to the largest percentage drop in performance. Equities are represented by the S&P 500 Index. Fixed Income is represented by the Barclays U.S. Aggregate Bond Index. Inflation-hedging is represented by 75% FTSE NAREIT US Real Estate Index Series, All Equity REITs and 25% Bloomberg Commodity Index. The 75%/25% split reflects Invesco’s belief that investors tend to invest in strategies with which they are more familiar. Principal preservation is represented by the BarclayHedge Equity Market Neutral Index. Portfolio diversification is represented by 60% BarclayHedge Global Macro Index and 40% BarclayHedge Multi-Strategy Index. Multistrategy is underweighted in this example due to its potential overlap with global macro. Equity diversification is represented by the BarclayHedge Long/Short Index. Fixed income diversification is represented equal allocations to BarclayHedge Fixed Income Arbitrage Index and S&P/LSTA US Leveraged Loan Index.