Alternative Opportunities - Q4 2024

In this quarterly outlook we cover the opportunities in the alternatives space, focusing on the five areas of private credit, private equity, real assets, hedge funds and commodities.

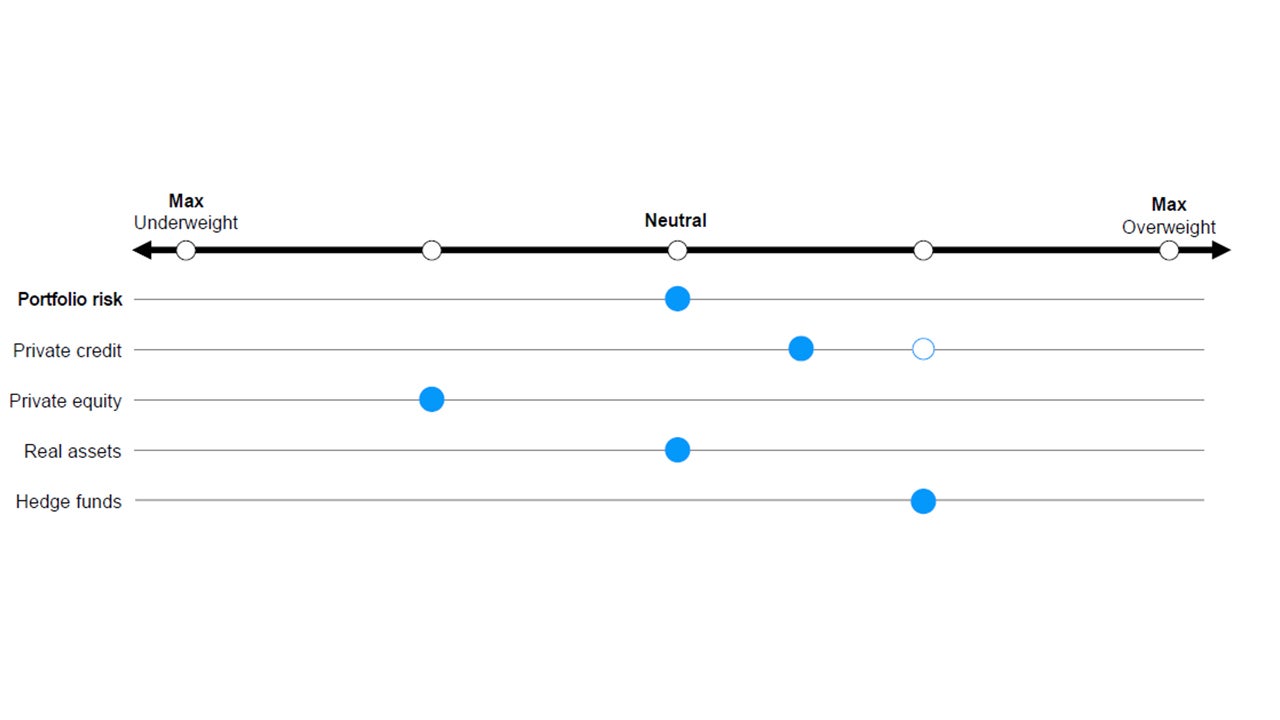

Portfolio risk: We remain neutral on how we’re allocating risk within our alternatives portfolio due to elevated downside growth risks, high equity valuations, and benign capital markets activity. In general, we’re more defensive, favoring private debt and hedged strategies versus private equity.

Private credit:

Private equity: PE exit activity appears to be improving this year from cycle lows on the backdrop of an improved financing environment with lower interest rates and less regulatory uncertainty. Deal activity is also anticipated to improve, given lower funding rates and a more robust lending environment. Growth strategies are still favored.

Real assets: Key to our outlook for 2025 is the fact that global interest rates have started to decline, increasing confidence in real estate markets and enabling a recovery in transaction volumes. Private market values have continued to fall while public market prices have started to recover, leading us to anticipate a recovery of private property values.

Hedge funds:

Source: Invesco Solutions, views as of Dec. 31, 2024.

In this quarterly outlook we cover the opportunities in the alternatives space, focusing on the five areas of private credit, private equity, real assets, hedge funds and commodities.

In this quarterly outlook we cover the opportunities in the alternatives space, focusing on the five areas of private credit, private equity, real assets, Hedge funds and commodities.

In this quarterly outlook we cover the opportunities in the alternatives space, focusing on the four areas of private credit, private equity, real assets and commodities.

Connect with us for in-depth presentation focused on your investment challenges and opportunities.