Private markets through an outcome-oriented lens: An overview

This is the first of a four-part blog series on looking at private markets through an outcome-oriented lens. Understanding the sources of return, risk, and diversification for private assets, and how it fits into a traditional portfolio is the first step toward full public and private portfolio integration. In this blog we outline the importance of looking at “how” private markets might be integrated into a traditional portfolio. In subsequent blogs we will delve deeper into the practicalities of incorporating private markets into portfolios with each of the three major outcomes in mind: income, growth and real return.

As we continue to think through optimal pathways to diversify traditional “60/40” portfolios, our next multi-part conversation will focus on implementation of private markets using an outcome-driven framework. The conversation around private markets and its role in a portfolio is currently one of the most hotly debated topics in the industry. However, we believe the most important component of this discussion, and one that receives much less coverage, is not “if” private markets should be integrated into a traditional portfolio, but “how” this should occur. Many have painted a broad brush with respect to private markets and have in the process have oversimplified this very complicated topic. Our focus at Invesco Investment Solutions is to construct customized, outcome-oriented investment solutions for our investors. We believe this entails an “all of the above” approach to asset allocation and portfolio construction, spanning both public and private markets. While this requires necessary breadth and depth to implement the approach effectively, we think it ultimately increases the probability of investors achieving their core investment objectives, which is our key mission.

Over the ensuing weeks, we’ll unpack this issue in more detail, but I want to start the discussion by reframing the conversation around private markets toward focusing on the “how”. The key tenet of the conversation will revolve around positioning private markets to produce outcomes, as opposed to looking at pure asset classes. Using that framework, we’ll primarily think about private markets through a three-fold lens – growth, income, and real return. Leading with this approach, in our view, provides nuanced yet intuitive results for portfolio implementation. By un-anchoring ourselves from a pure asset class viewpoint, we can turn broad-based opportunities into precision tools which can be used to effectuate investor objectives in a practical manner. However, we will also detail the essential steps taken to understand and analyze the trade-off between return and risk at the asset-level, and how that formulates our views as to the appropriate asset allocation.

One key aspect of this analysis is the usage of forward-looking, long-term capital market assumptions (“CMAs”) across both public and private assets. We view private markets CMAs as a vitally important tool in driving portfolios toward desired outcomes. Understanding the sources of return, risk, and diversification for private assets, and how it fits into a traditional public portfolio is the first step in the multi-faceted process toward full public and private portfolio integration. Another aspect worth detailing is forecasting of asset volatility, which is arguably the most important component of this exercise. How do we think about forecasting volatility for public assets, which trade daily, versus private assets, which are “priced” between one to four times per year. This mismatch creates a “volatility gap”, which could potentially bias an investor toward one asset versus another. We address this by “de-smoothing” risk for private assets, to give investors a better lens into the true return-risk tradeoff in a neutral framework. However, what is important to note, is that even after this process, we still find the opportunities in private assets compelling.

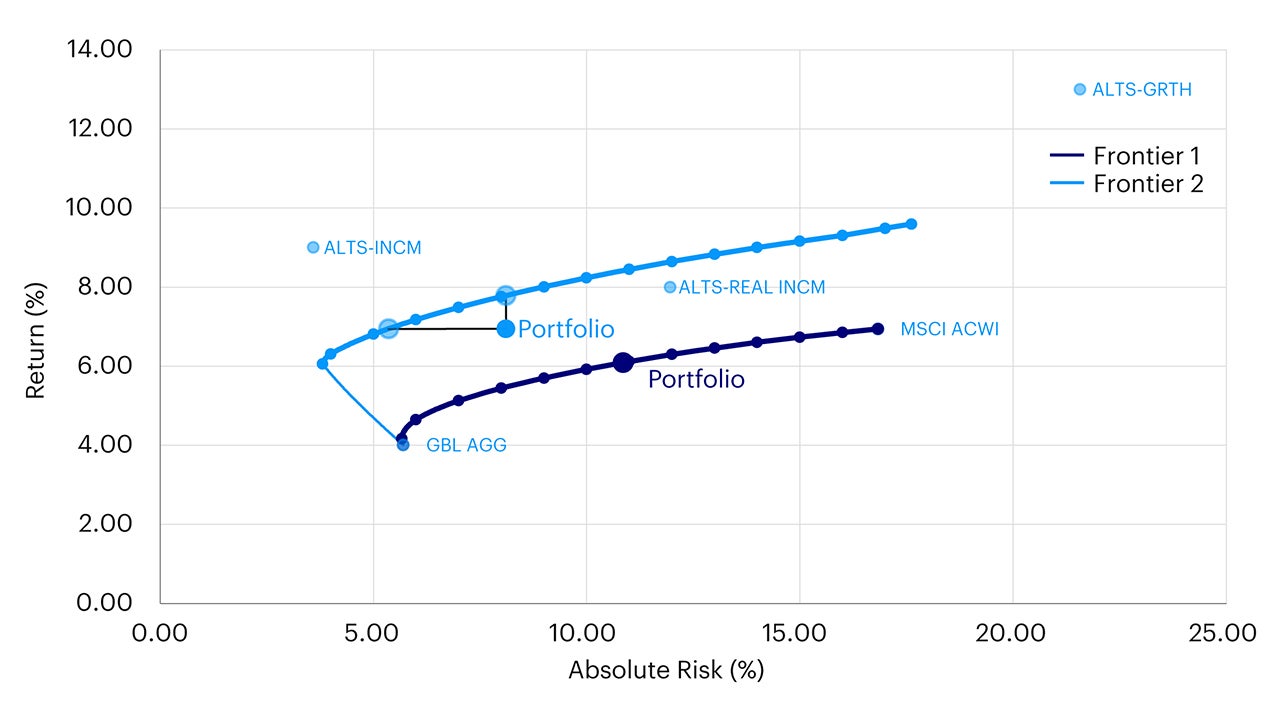

Below is a continuation of our analysis from our “Diversifying 60/40” conversation, where we use Invesco Vision as a decision-making tool in developing the spectrum of opportunities, and then align that with investor outcomes in a way that addresses unique goals, parameters, and constraints. We start this analysis with a high-level exercise – what sort of opportunity is created by simply allocating 30% of a traditional “60/40” portfolio into private markets, and how does it impact the shape of the efficient frontier?

Source: Invesco Vision, data as of 28 February 2023. Return estimates are based on the Q1 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

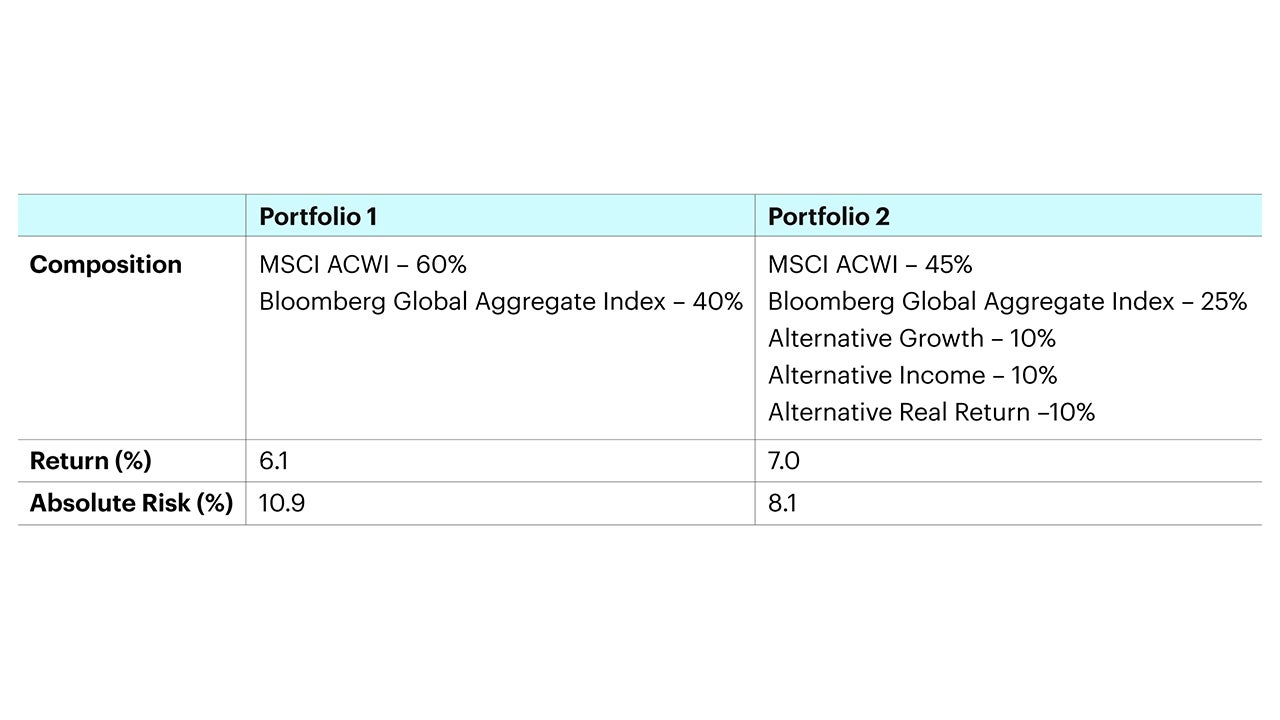

In the above analysis we’ve considered two investment universes – one with public assets, and the other with both public and private assets (private exposure capped at 40%), along with two sample portfolios. As you will see, the opportunity set greatly expands when private markets are integrated into the framework. Looking further at the two portfolios, we’ll highlight the expected return and risk associated with each.

Source: Invesco Vision, data as of 28 February 2023. For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

Considering this rather straightforward implementation exercise, the portfolio has improved return and risk characteristics. In our mind, this is what makes private markets such a useful tool in portfolio construction, the ability to improve growth, income, and diversification properties of a traditional portfolio. However, we know in practice implementation exercises are rarely this simple or straightforward. Therefore, it is so essential to consider the underlying exposure and determine what is the correct return/risk trade-off for investors, and how that aligns with their core outcomes. A client with a longer investment duration, such as a sovereign wealth fund or endowment, would likely want to achieve more growth exposure in their portfolio, whereas a pension would seek income to meet liability payments (and real return in the event liabilities were inflation-linked). This will meaningfully impact how we use private assets to achieve these investor objectives through a customized approach.

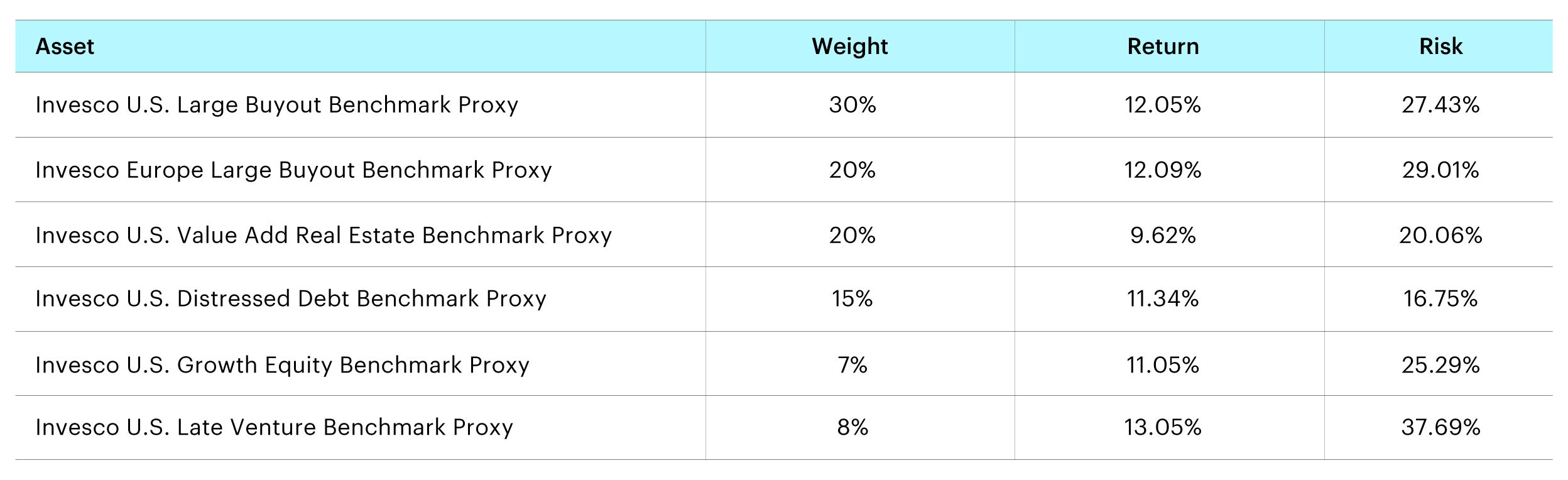

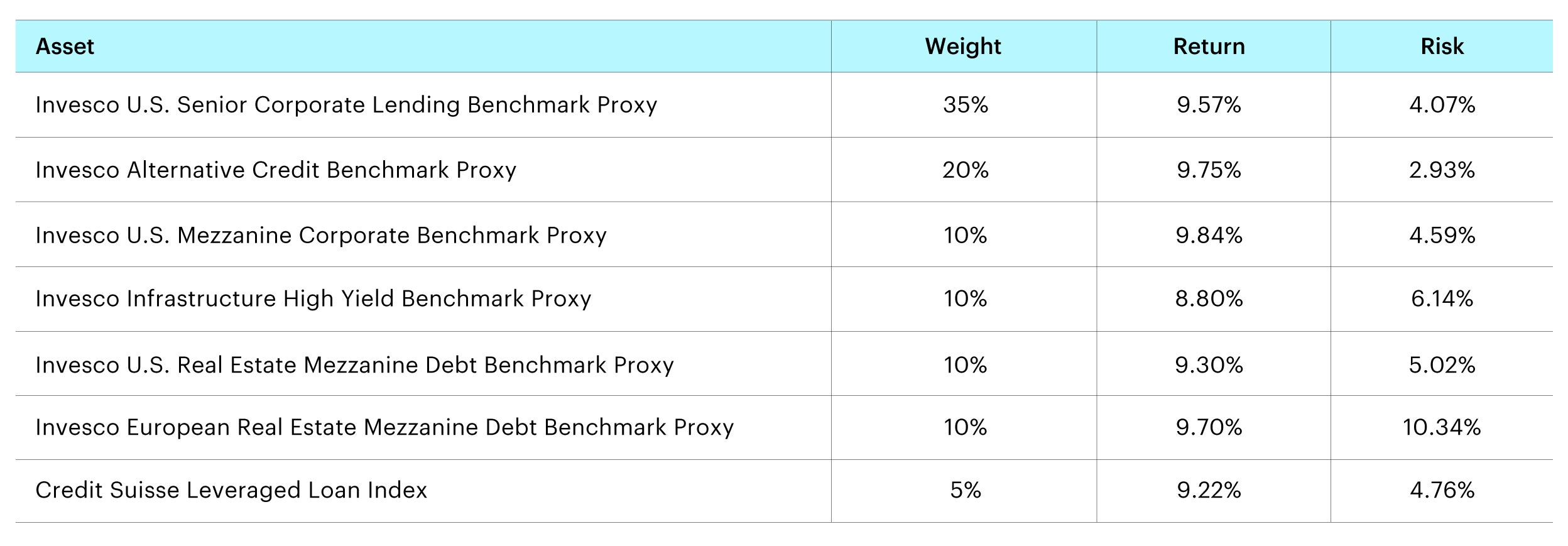

This is where the “how” discussion we alluded to at the outset becomes so integral, and this will serve as the springboard for the remaining pieces in this series, focusing on achieving growth, income, and real return in private markets. For each outcome, we will discuss how to take private assets and then apply them to this framework, creating three private markets “building blocks” which can be used as a guidepost for portfolio constructionists. Once distilled down into investment outcomes, versus thinking about it through the lens of dozens of sub asset classes, portfolio optimization becomes a much more straightforward and intuitive exercise.

Appendix

All data pulled from Invesco Vision as of 30 June 2023

All data pulled from Invesco Vision as of 30 June 2023