Private markets through an outcome-oriented lens: Real return

This is the fourth of a four-part blog series which looks at private markets through an outcome-oriented lens. Understanding the sources of return, risk, and diversification for private assets, and how it fits into a traditional portfolio is the first step toward full public and private portfolio integration. While the second and third blogs covered income and growth, in this piece we discuss practical steps toward real return-enhancement through private markets.

In our final piece in this series on enhancing portfolios outcomes through private markets, we focus on real return-generating investments. Real returns, typically expressed through an allocation to real assets, have gained increased focus from investors as they seek inflation protection and diversification amidst a more uncertain macroeconomic backdrop. Our objective in this analysis is to think about ways in which we can meaningfully improve a traditional portfolio through the implementation of private real assets – primarily centered around real estate and infrastructure.

We examine potential portfolio constructs by taking a wide view across equity and debt investments and look at opportunity across the risk spectrum – for example, considering real estate exposure across the core, value add, and opportunistic spaces. Casting a wide net and continually refining the exposure we believe will allow us to construct a diversified set of building blocks that improves a traditional asset allocation.

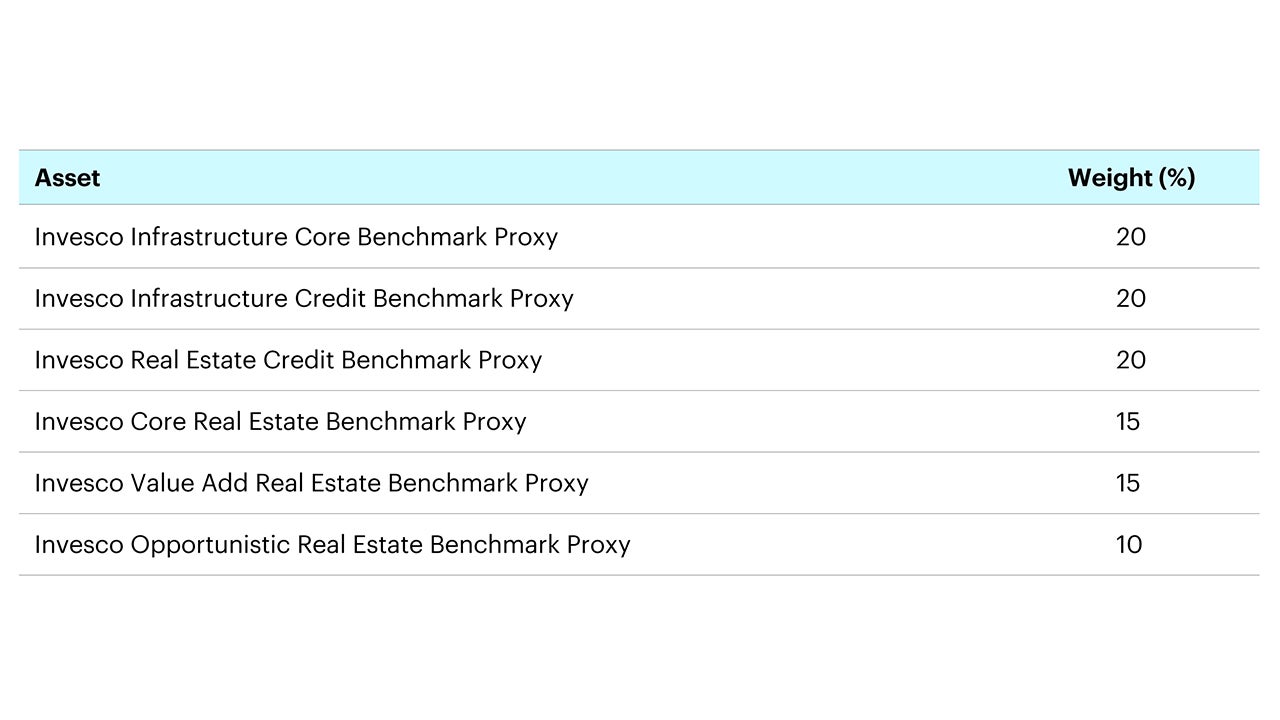

Given our broad-based remit for this exercise, we’ll continue to leverage the Invesco Vision tool, which will guide us in examining the trade-offs between private assets and help us consider how to most effectively incorporate these investments in the context of a public assets portfolio (i.e., 60/40 portfolio). Our initial portfolio workspace will consider the following assets and weights.

Source: Invesco, for illustrative purposes only.

The above asset class mix is split with 60% allocated to “equity” investments (i.e., asset ownership) in infrastructure and real estate, and 40% allocated to “debt” investments, in line with a traditional 60/40 portfolio. This will allow us to appropriately examine the return and risk potential and examine the efficacy of the real return portfolio allocation. Within real estate, given the wide risk spectrum of opportunities, we have constructed a balanced mix of core, value add, and opportunistic building blocks in addition to debt exposure. Thinking through infrastructure, our blocks include core and debt. This mix allows us to achieve income, growth, and diversification objectives. Additionally, the real return nature of these assets, which often have cash flows with direct or indirect relationships with inflation, can improve the overall prospects of a traditional portfolio. It is this real return characteristic that drives considerable investor interest in these assets. When thinking about the primary outcomes in private markets, that is why we believe growth, income, and real return must be targeted when building an optimal portfolio allocation.

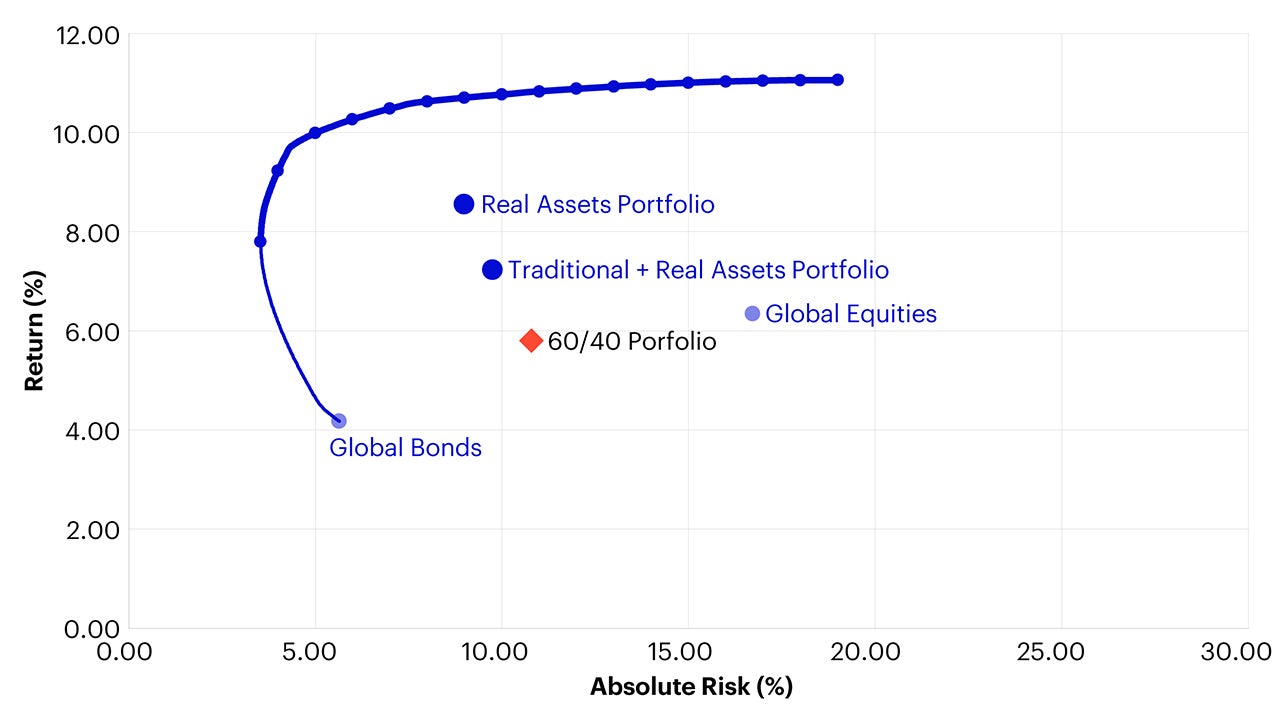

Source: Invesco Vision, data as of 31 December 2023. Return estimates are based on the Q1 2024 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

Looking at the efficient frontier framework above, it’s quite evident that diversified real assets have an attractive return/risk profile, particularly compared to traditional assets such as equities and fixed income. When adding the real assets portfolio to a traditional “60/40” portfolio, we can both increase expected return and reduce portfolio risk. Leveraging our long-term capital market assumptions, and Invesco Vision, this exercise becomes much more flexible and scalable.

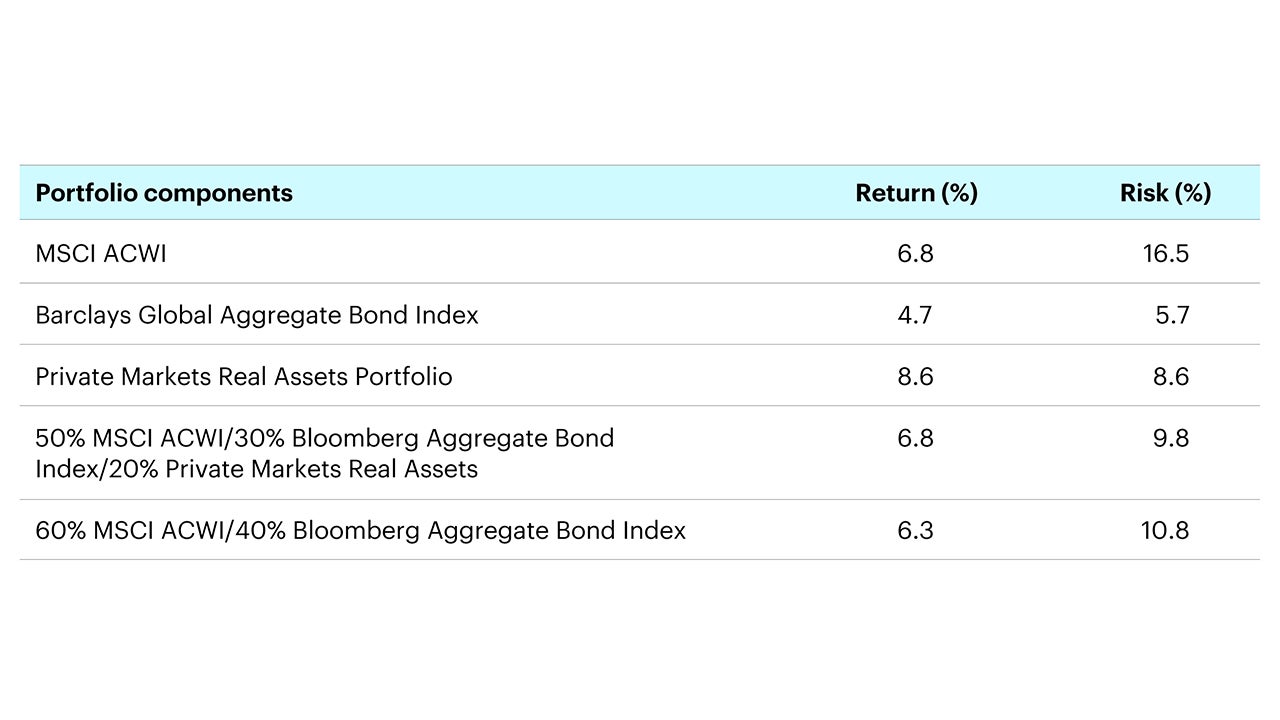

We review the following return/risk characteristics by combining private markets real assets building blocks along with the MSCI All Country World Index (MSCI ACWI) and Barclays Global Aggregate Bond Index (USD-hedged) indices. We then created a sample portfolio with a 50%/30%/20% among equities, bonds, and private markets real assets, respectively. As seen in the analysis, a portfolio of real assets harvests a meaningful return premium over public assets, particularly on a risk-adjusted basis. We view this as a highly attractive value proposition, particularly for strategic asset allocators.

Source: Invesco Vision, data as of 31 December 2023. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. An investment cannot be made directly in an index.

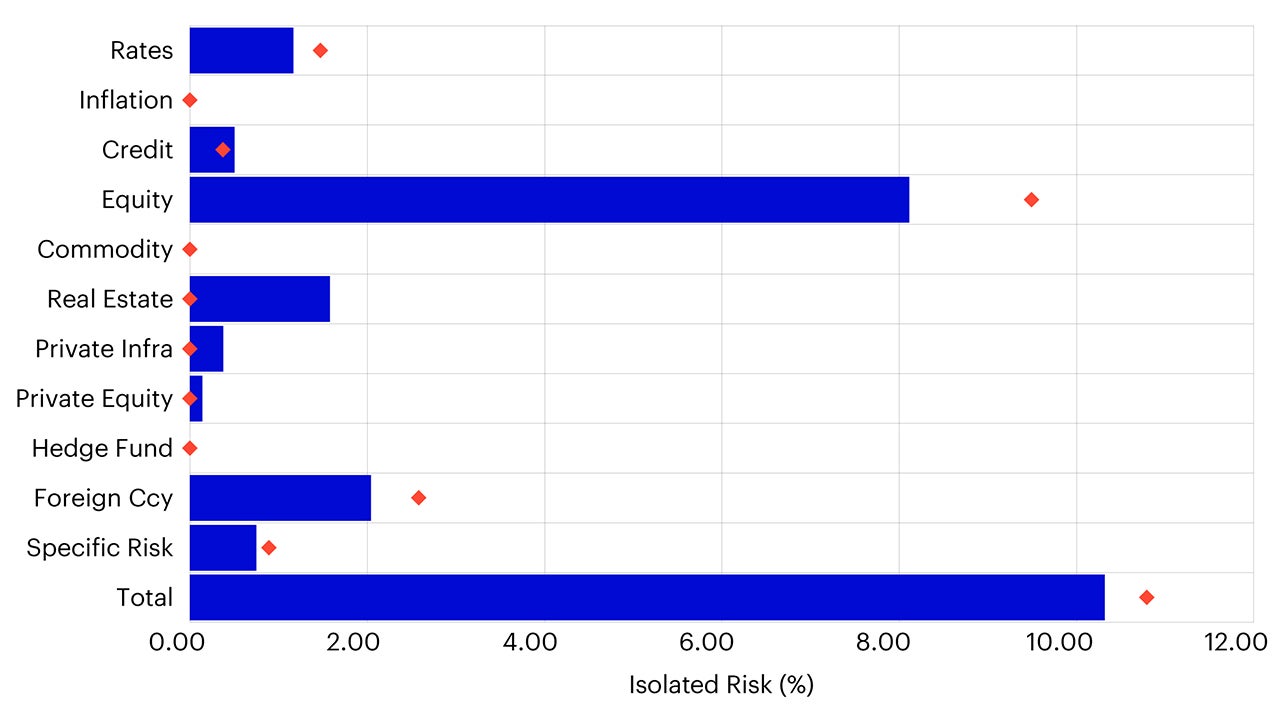

We also like to consider the underlying portfolio exposure through a factor lens, as it allows us to further examine portfolio allocations and understand the core risk drivers in a portfolio. This also serves as a check for diversification, and if a private markets allocation diversifies a traditional portfolio away from three traditional portfolio factors – equity, rates, and currency. As we will see below, the traditional + real assets portfolio does reduce the reliance on the equity and rates factors, with increased exposure to real estate and infrastructure factors. The overall takeaway is that while the Traditional + Real Assets Portfolio does have improved return and risk characteristics, its core factor exposure is much more diversified, and can provide stability for strategic investors willing to allocate to private real assets.

Source: Invesco Vision, data as of 31 December 2023. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

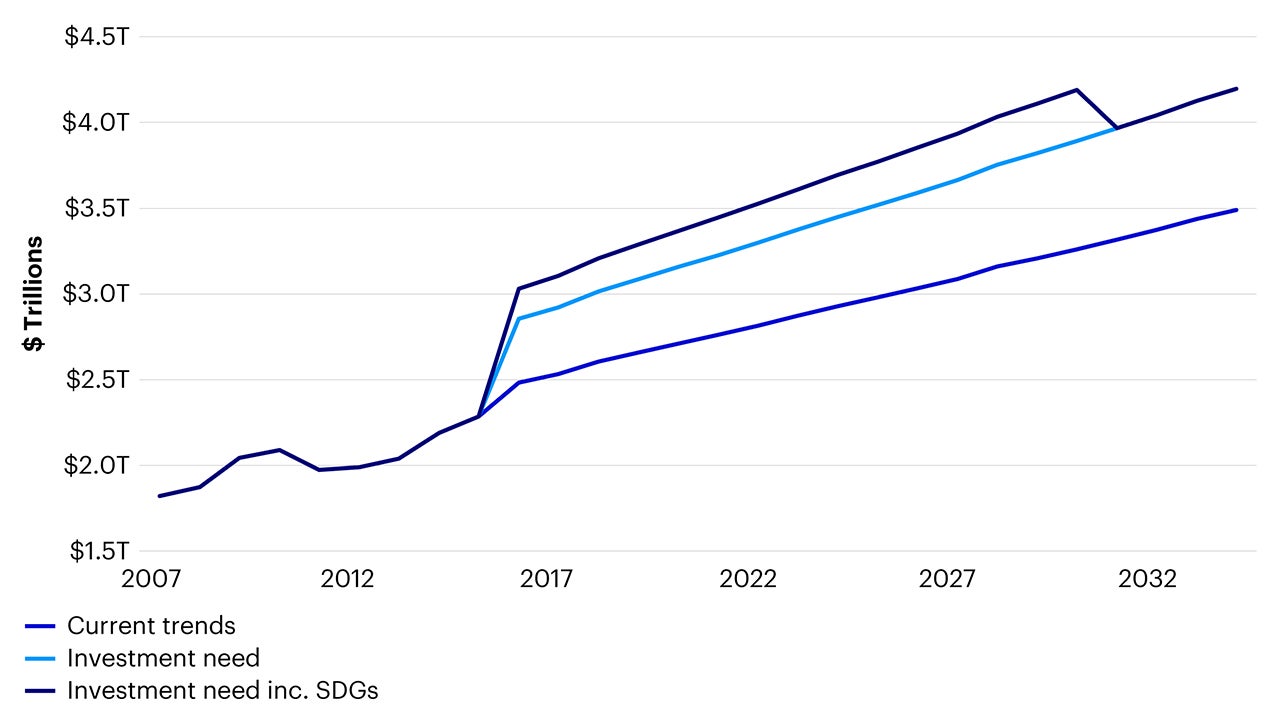

It’s apparent through this exercise that implementing real assets exposure can have clear portfolio-level benefits, the key being an emphasis on diversified exposure across asset classes and investment styles. Thinking about the macro backdrop, while inflation concerns have dissipated in the short-term, there is still a long-term concern about upside inflation risk due to climate transition impacts (link to climate CMAs document), and potential underinvestment in traditional sources of energy. Additionally, there are investment opportunities that we expect will arise from the climate transition, such as physical infrastructure buildout.

Source: Invesco Solutions, Pitchbook, Preqin, Global Infrastructure Hub, as of Oct. 31, 2023. Note: SDGs refer to Sustainable Development Goals.

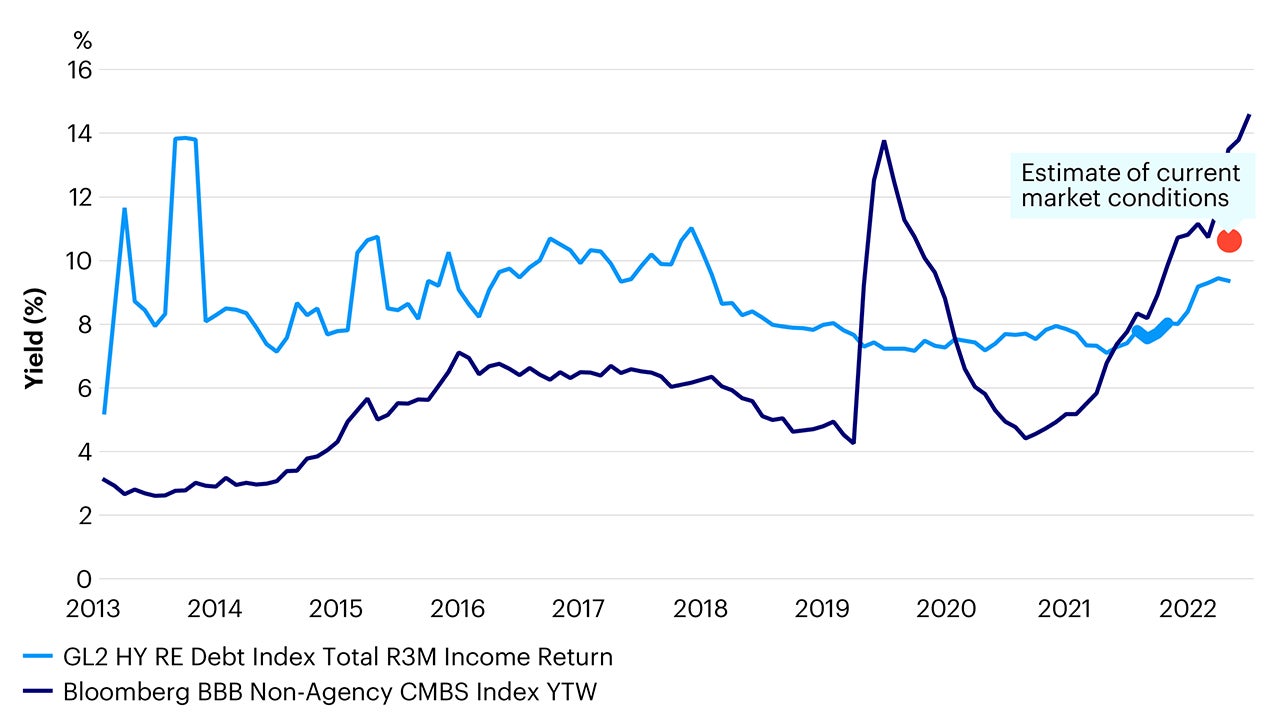

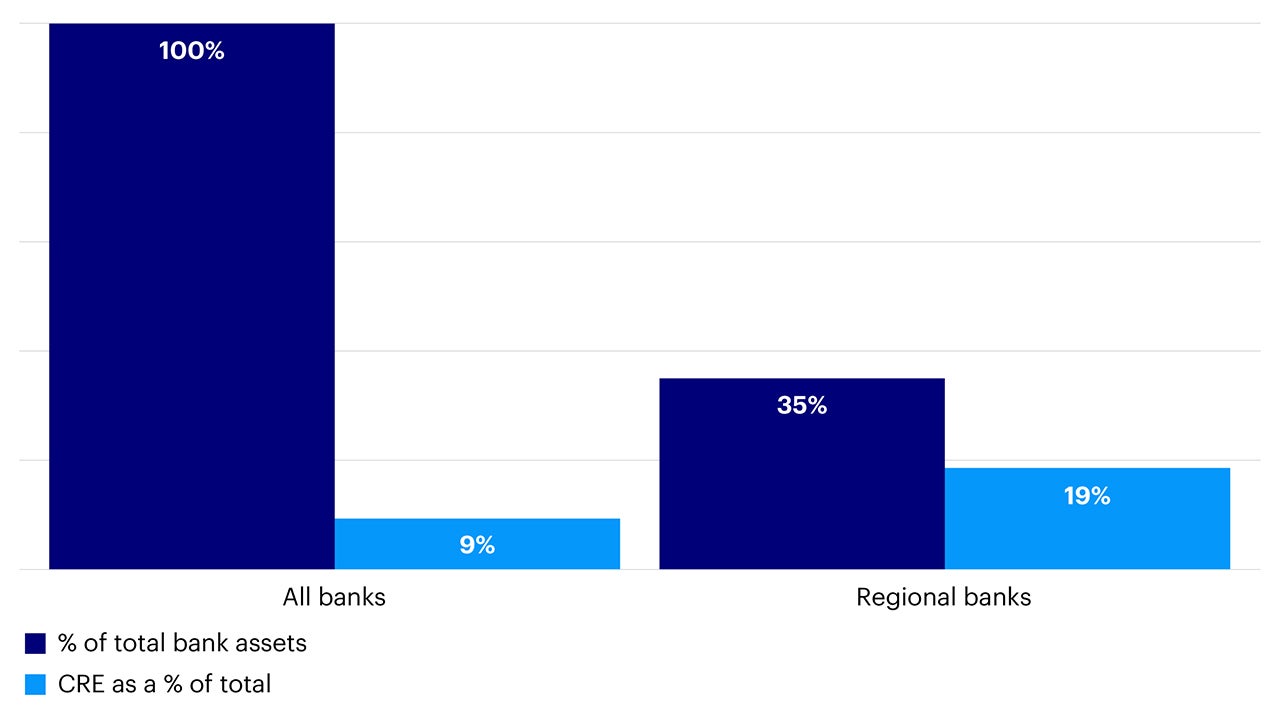

Thinking about real estate, we see increasingly attractive opportunities in the debt space, as banking retrenchment and increasing short-term rates have led to meaningful opportunities for private capital to provide loans to high quality commercial borrowers. The confluence of these factors has led to increased focus on real assets and taking an “all of the above” approach to portfolio construction, allowing for flexibility and diversification to improve traditional portfolios.

Source: Invesco Solutions; Gilberto-Levy, FDIC, Bloomberg L.P., as of June 30, 2023. Note: CMBS YTW refers to commercial mortgage-backed securities yield to worst. Past performance does not guarantee future results.

Source: Invesco Solutions; Gilberto-Levy, FDIC, Bloomberg L.P., as of June 30, 2023. Note: CRE refers to commercial real estate.

Summary

In sum, private assets can be used to greatly enhance the real return properties of a traditional portfolio. By looking at a diversified mix of real estate and infrastructure, investors can harvest the current investment opportunity set to capture long-term secular trends and position portfolios for potential headwinds. However, it’s key for investors to take an “all of the above” approach in this space and engage partners who can help to achieve scale to appropriately meet their investment outcomes.