Private markets through an outcome-oriented lens: Growth

This is the third of a four-part blog series which looks at private markets through an outcome-oriented lens. Understanding the sources of return, risk, and diversification for private assets, and how it fits into a traditional portfolio is the first step toward full public and private portfolio integration. While the second blog covered income, in this piece we discuss practical steps toward growth-enhancement through private markets. In a subsequent blog we will delve deeper into the practicalities of incorporating private markets into portfolios with another major investment outcome in mind: real return.

As we continue our discussion on the effectiveness of private markets to enhance portfolio outcomes, we’ll bring our focus to growth investments. It is key to define how we classify these investments, and most importantly how they can be combined to enhance risk-adjusted returns and complement traditional assets such as equities and fixed income. One common theme we see across client engagements, both in Asia and globally, is increased uncertainty about the path of economic growth given the aggressive monetary policy undertaken by Western central banks to control inflation, and subsequent downstream impact of those decisions. This is where private markets growth investments can be a useful tool to provide diversification from economic risk while still adding a meaningful long-term return premium to a portfolio.

The primary investment building block in the private market growth space is private equity, which most institutions, and a growing number of high-net worth investors, have gained considerable familiarity with over the last several years. The major categories in private equity would be buyout, venture capital, and growth capital investments, which have been mainstays since the early part of this millennium. However, as capital markets have evolved, the private growth space has expanded considerably, providing global investors with meaningful opportunities for risk-adjusted return enhancement.

As discussed in our recent piece, distressed debt is an area of strong interest, which has “equity-like” return potential with some of the unique features of debt investments such as strong capital structure positioning. Since access to these markets can be limited, this is where strong active manager capabilities can work to the benefit of investors. Another area of consideration is more opportunistic categories of real estate, such as the value add and opportunistic space. Like distressed credit, while there is an income component to asset class returns, most comes from capital appreciation. Therefore, we’ll also include this in the private growth sleeve.

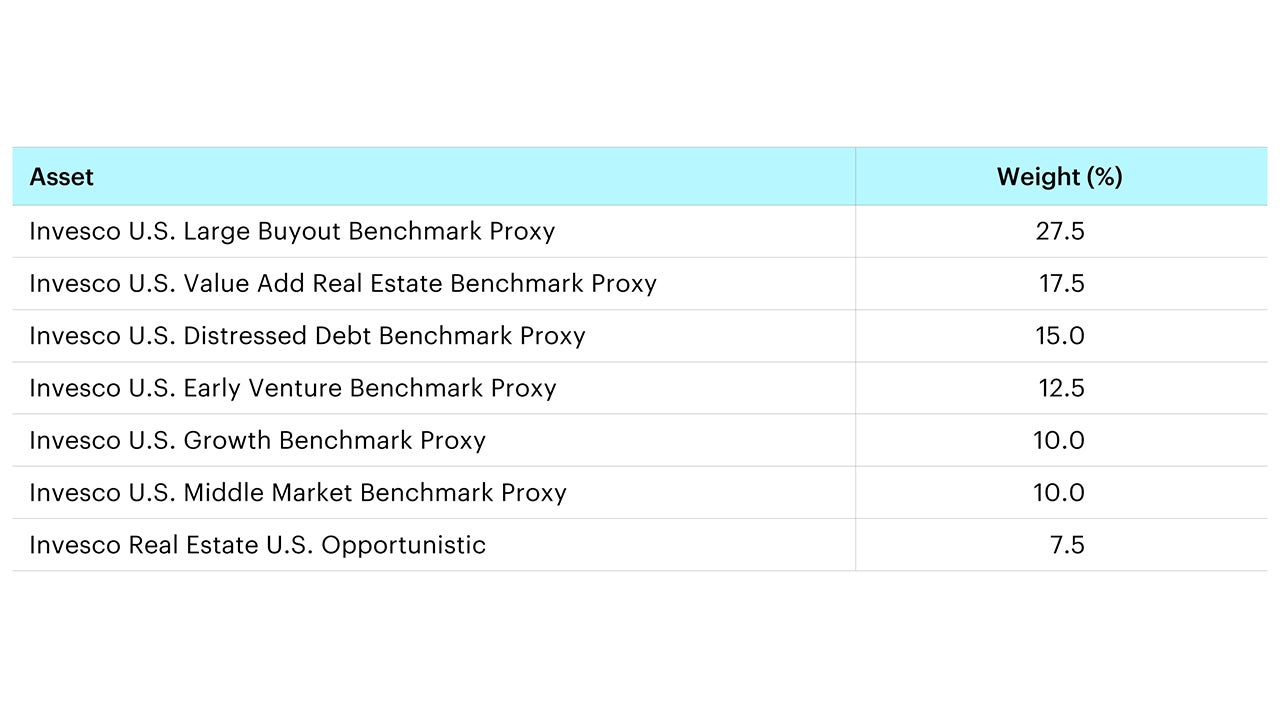

One key area of focus is portfolio construction within this space, and how to leverage long-term capital market assumptions and risk-modeling to design an optimal allocation which can be integrated into a portfolio of traditional assets. As with our prior pieces, we’ll leverage Invesco Vision to design a portfolio schematic, test its efficacy in a broader context, and examine how it expands the overall investor opportunity set. We’ll design a “private markets growth” sample portfolio utilizing asset classes discussed earlier: private equity (buyout and middle market), venture capital (early stage), growth capital investments, U.S. value add and opportunistic real estate, and distressed debt.

Source: Invesco, for illustrative purposes only.

One aspect that is evident is the divergence between expected return and risk among asset classes, which creates both challenges and opportunities for a portfolio constructionist. Developing asset class-level return expectations is essential to understanding the unique relationships between private markets growth asset classes. This is unique to private markets, as we’ve gone into detail for this series, as compared to traditional public assets. While this research is a considerable undertaking, the opportunities created through the ability to build diversified portfolios within the private markets growth space clearly outweigh the costs. There are meaningful diversification benefits to be harvested from effectively allocating to private markets. Working with partners who can help to guide investors through this process are essential.

As highlighted in prior write ups, we will leverage our long-term capital market assumptions, which span the public and private universe. Additionally, we adjust private markets by de-smoothing volatility, to provide a more “like for like” comparison across asset classes and make it more straightforward to integrate public and private asset classes together efficiently. As pointed out in our private markets income piece, and reinforced in our analysis or private growth assets, even after this volatility de-smoothing technique we still find risk-adjusted returns highly attractive.

While we wouldn’t advocate for a wholesale change in the portfolio construction approach due to the illiquid nature of private markets, we want to emphasize how even a somewhat small allocation (e.g., 10%) to private markets can make a meaningful impact on risk-adjusted returns. Below we’ve created a sample private markets growth portfolio along with weights and expected risk and return. We will then work to integrate this combined sleeve into a portfolio of traditional equities and fixed income.

Source: Invesco Vision, data as of 30 June 2023. Return estimates are based on the Q1 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

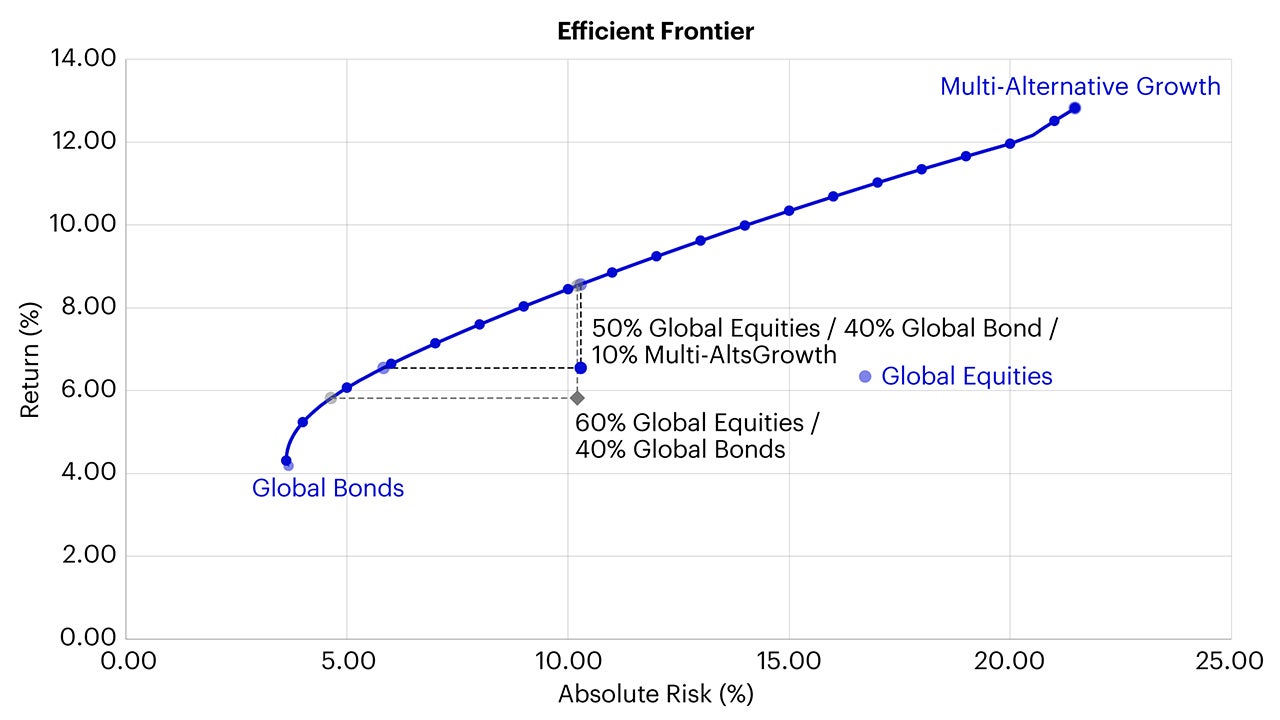

Looking at the Vision analysis, we combined the private markets growth building blocks with the aforementioned weighting schematic, titled “Private Markets Growth”, in an efficient frontier universe along with the MSCI All Country World Index (MSCI ACWI) and Barclays Global Aggregate Bond Index (USD-hedged) indices. We then created a sample portfolio with a 50%/40%/10% among equities, bonds, and private markets growth, respectively. Given the relatively high volatility of private markets growth assets, we have funded that allocation solely from the traditional equity sleeve. We review the following return/risk characteristics below:

Source: Invesco Vision, data as of 30 June 2023. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

As demonstrated above, integrating private markets growth into a traditional 60/40 portfolio provide measurable improvements, with increased return, diversification, and stable risk. Many investors associate asset classes such as private equity and venture capital as high volatility. While on a standalone basis they do maintain higher risk than traditional equities, once effectively combined with a broader private growth opportunity set, and incrementally implemented into a traditional balanced portfolio, they provide strong diversification and a long-term return premium opportunity. We also believe the portfolio should have ample liquidity given 90% exposure to public markets. We’d even argue for most investors that a higher allocation to private markets, consisting of growth, income, and real return building blocks, would still offer investor liquidity while effectively increasing strategic return opportunities. Ultimately the important piece is scaling an investor’s private markets exposure around their unique constraints, as there is no “one size fits all” approach.

Summary

In sum, growth can be greatly enhanced through private markets. While conceptually this notion is straightforward, important nuances arise when forecasting long-term private markets returns, understanding risk and the way it differs from public markets and how to adjust for this, as well as the method of building portfolios both within categories such as private credit and across public and private markets. Another point that is equally as important is having the appropriate private markets opportunity sourcing ecosystem (likely through global-scale active management partners) to find superior building blocks to effectuate asset class-based views. We believe this should incorporate a diverse array of assets, and access to primary, secondary, and co-investments. To effectively execute this process in its entirety, we believe investors need to either maintain these capabilities themselves or leverage partners that can provide them by adopting an outcome-focused, client-centered approach.