Private markets for Asian investors: Challenges and opportunities

This is the first of a four-part blog series on integrating private markets into Asian investor portfolios, while accounting for FX risk. Subsequent blogs will analyze private income, growth and real return opportunities with a similar lens.

As we move into 2024, we’ll continue our discussion on integrating private markets into investor portfolios. One key nuance we’ll focus on this year is the impact of private markets specifically on Asian investor portfolios. Given the unique factors impacting Asian investors, particularly around foreign exchange risk, we’ll conduct a customized analysis to further understand how to effectively build resilient, outcome-oriented portfolios leveraging diversified investment building blocks. Our prior series leveraged analytics that were denominated in USD, which for many Asian investors is a reasonable and appropriate approach, but for others it is also important to consider the impact of decisions in local currency terms.

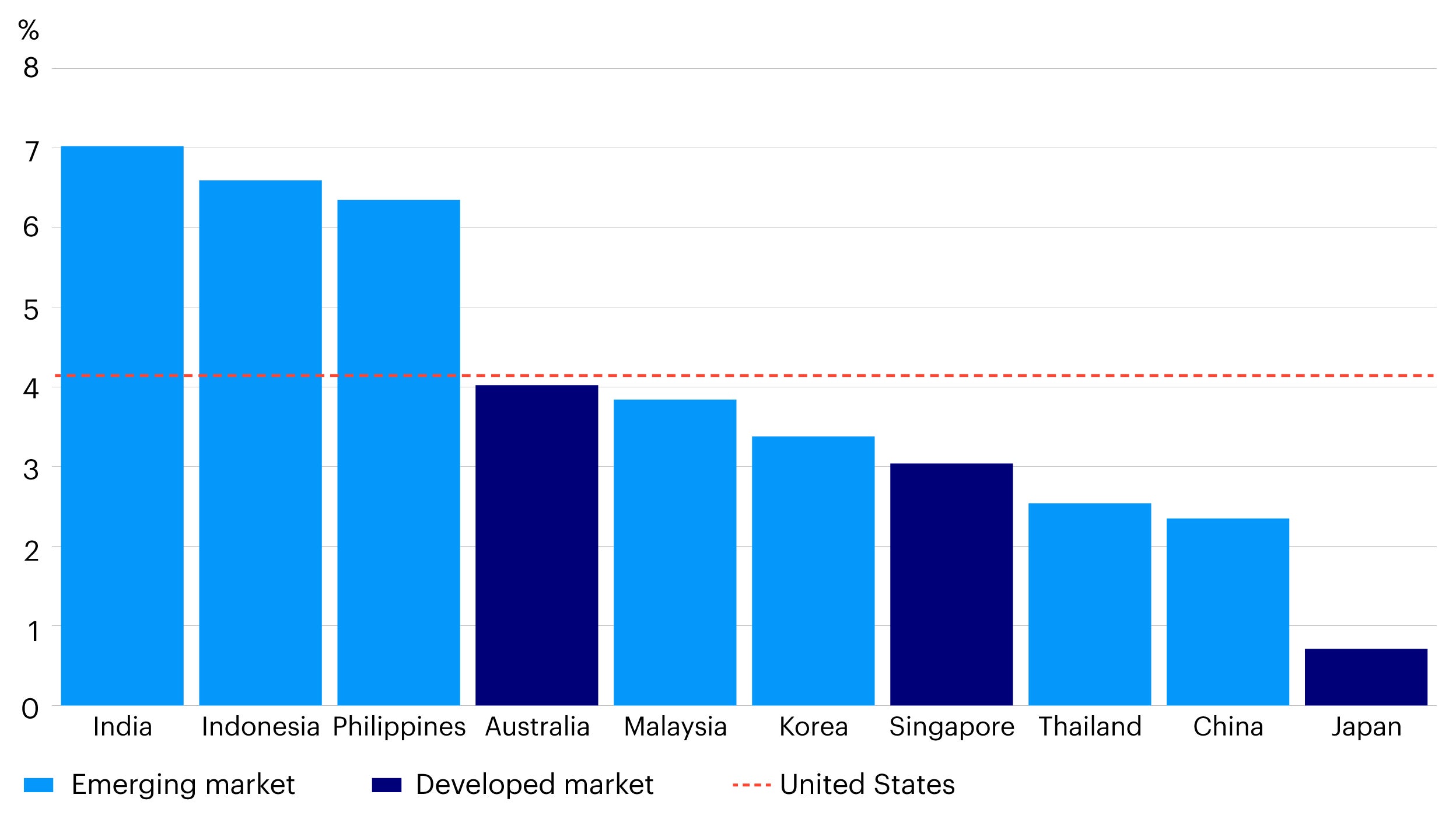

A key issue driving the importance of this analysis is the unprecedented shift in global monetary policy, specifically the US, and how the aftereffects of Covid-19 and accompanying stimulus policies continue to influence currency markets. Given aggressive tightening by the Federal Reserve, we find US rates higher than most Asian economies, even those classified as emerging markets. This creates a unique conundrum for many Asian investors, who are traditionally accustomed to having higher baseline interest rates than their US counterparts.

Source: Bloomberg, data as of 6 March 2024. Past performance does not guarantee future results.

Currently, US long-term government bond yields are at a higher level than Asia Pacific economies with the exceptions of India, Indonesia, and the Philippines. Why is this relevant? First, under the concept of interest rate parity (IRP), higher yielding currencies will experience natural depreciation over the intermediate to long-term. We reflect this in construction of long-term capital market assumptions, where interest rate parity demonstrates a long-term return drag on USD holdings. This datapoint is meant to highlight the challenge foreign investors have in building portfolios using USD assets but measuring performance in local currency terms.

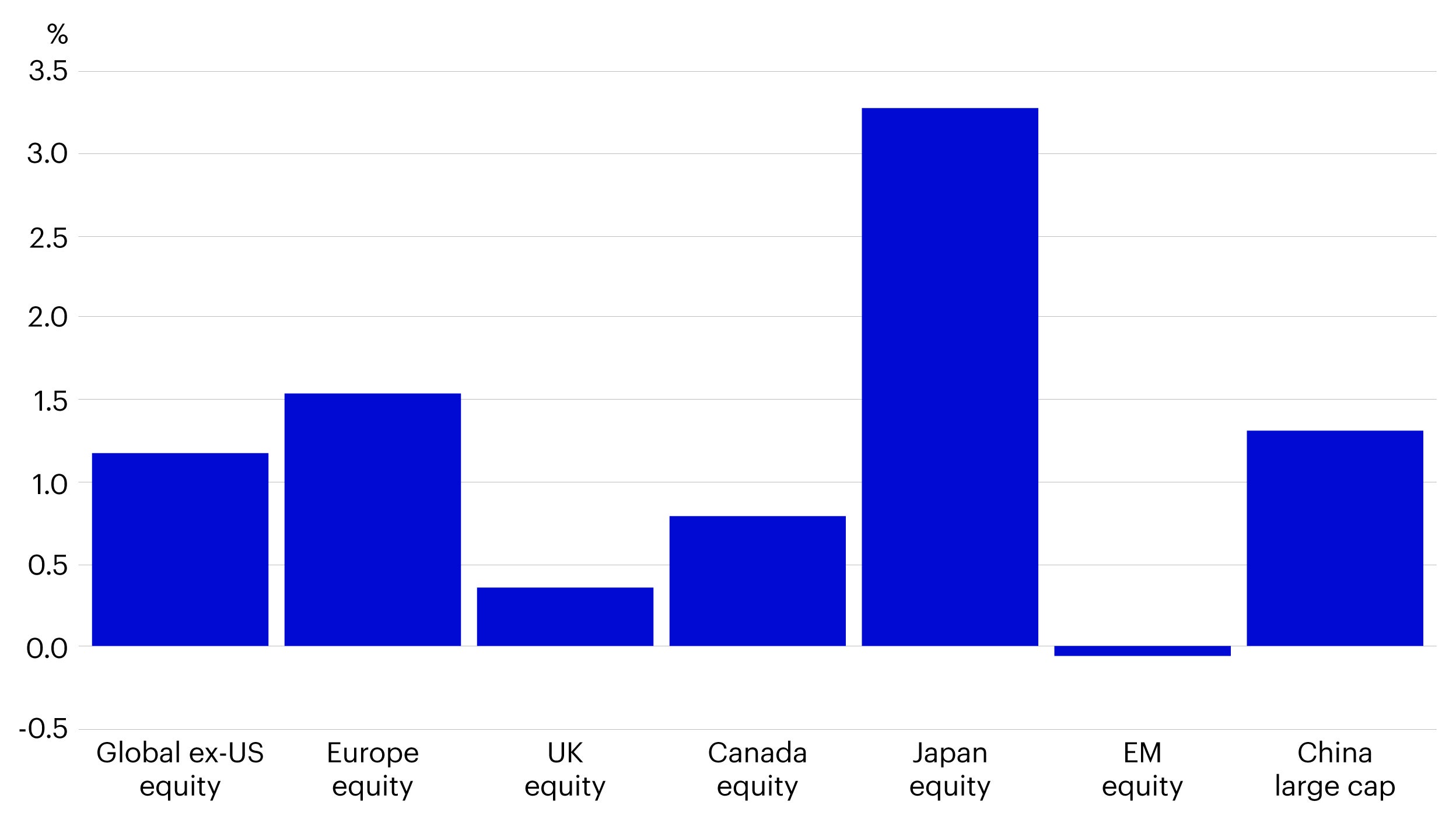

Source: Long-Term Capital Market Assumptions, data as of 31 December 2023. Past performance does not guarantee future results. Note: Proxies are as follows, Global equity - MSCI ACWI; Global ex-US equity - MSCI World ex U.S.; US large cap - S&P 500; US small cap – Russell 2000; Europe equity - MSCI Europe; UK equity -FTSE All-share; Canada equity - S&P/TSX Composite; Japan equity - MSCI Japan; EM equity - MSCI EM; China large cap - CSI 300.

Therefore, an Asian investor with lower baseline local yields could experience depreciation (and reduced returns) with US dollar-denominated positions. Additionally, investors typically choose to hedge their currency exposure and “lock in” this depreciation (particularly for fixed income holdings), in many cases incorporating a hedging cost that further reduces local currency returns.

These factors drive down local currency returns and usually make the achievement of investment outcomes more challenging for Asian investors. Essentially, higher yields in the US may not always mean higher yields for local Asian investors. This predicament necessitates a different approach to portfolio construction, and increased consideration of the use of private markets investments, which can serve as a key source of increased return, to offset these currency drags, but in many cases without meaningfully increasing portfolio volatility. As with prior pieces, we’ll utilize the Invesco Vision tool for portfolio analysis . For the sake of illustration, we’ve chosen to analyze a “global 60/40” portfolio in both US dollar and Korean won, albeit we could choose numerous regional currencies and have similar observations.

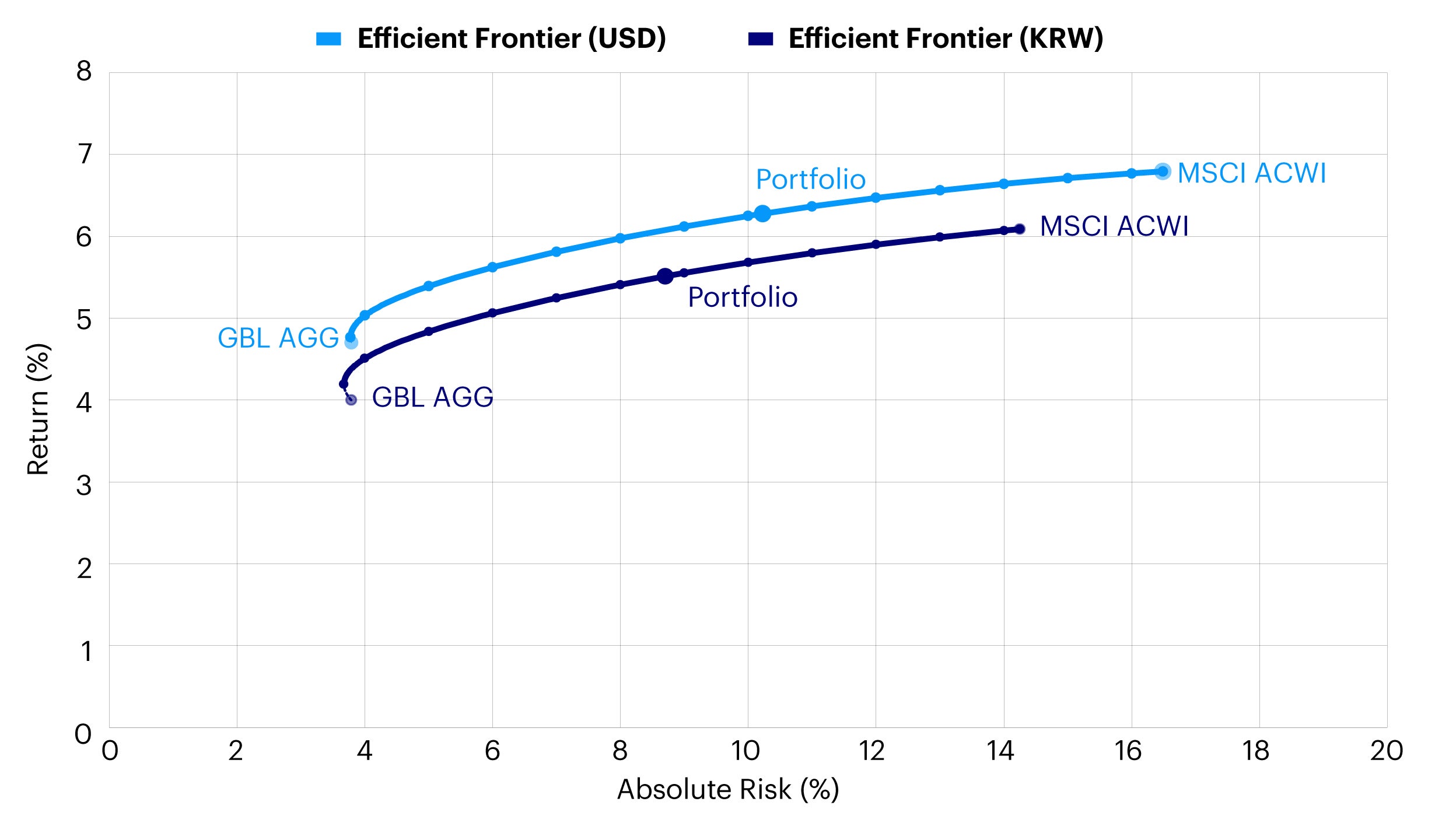

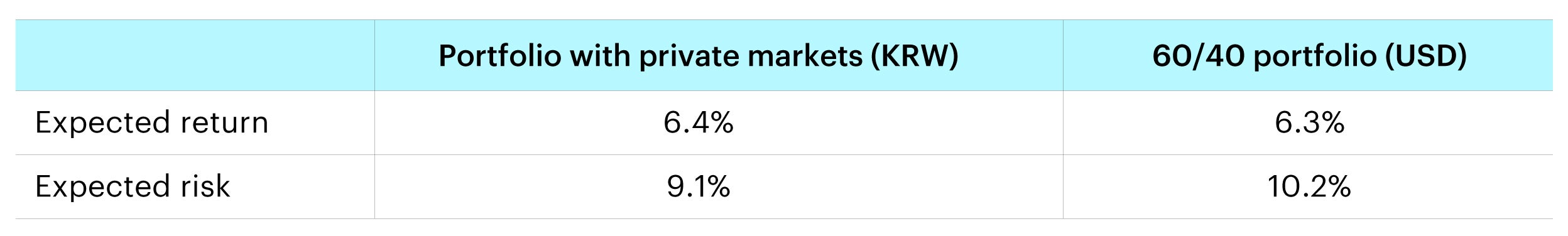

Source: Invesco Vision, data as of 29 February 2024. Return estimates are based on the 2024 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. Note: 60% global equity portfolio proxy is the MSCI All Country World Index. 40% global fixed income proxy is the Bloomberg Aggregate Bond Index.

For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

Leveraging the Vision output we see that the same strategic asset allocation, comprised of 60% global equities and 40% global bonds, has a reduced expected return of roughly 80 basis points simply by recomputing the expected returns in Korean Won and assuming interest rate parity. While it is important to consider the reduced risk from the local currency translation, even “up-risking” the portfolio to match the prior US dollar risk only increases the expected return to 5.7%. In practice, these returns would be even lower due to additional currency hedging costs (approximately 40 basis points on hedged assets).

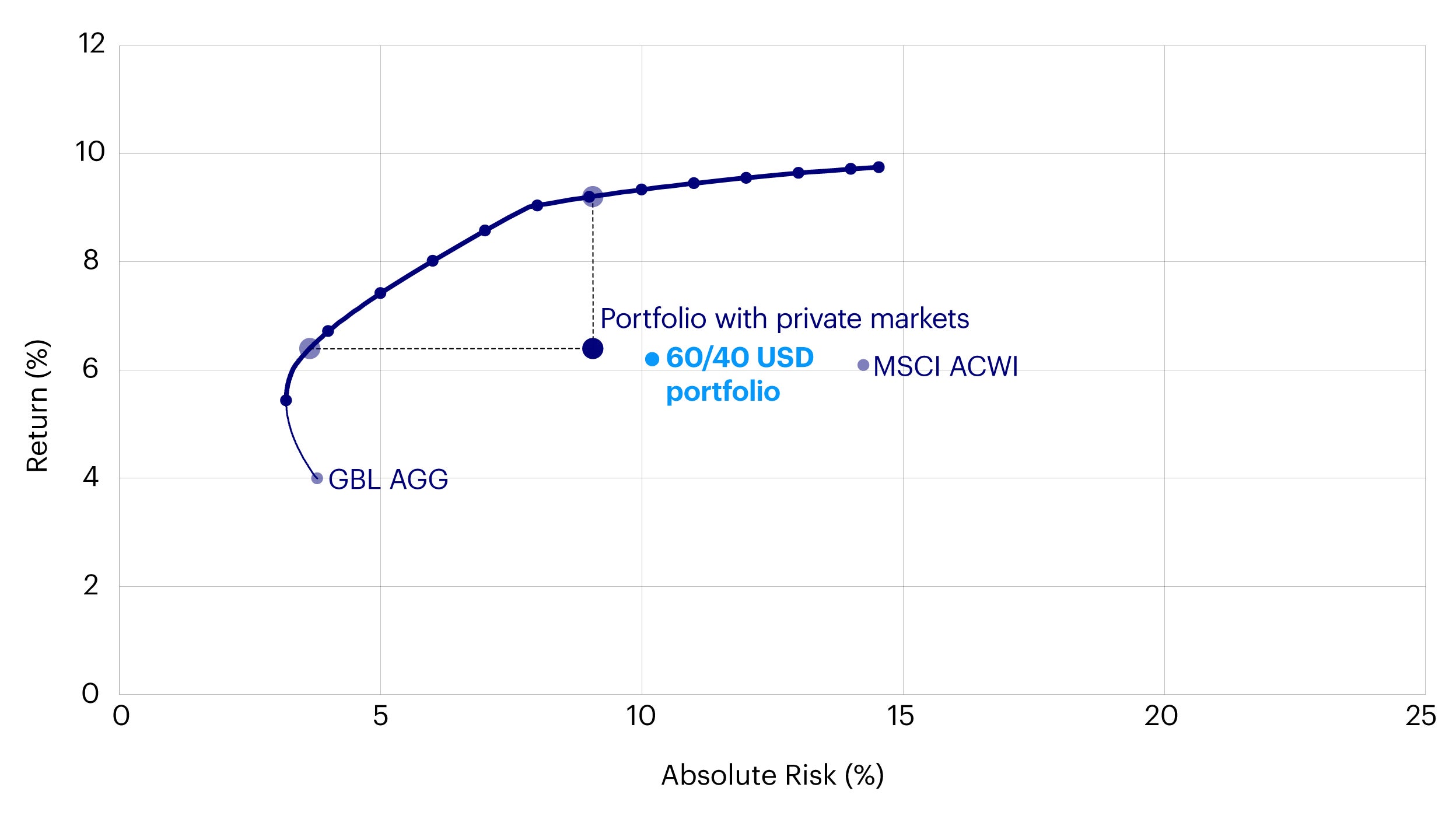

Not surprisingly, this is where private markets investments – encompassing growth, income, and real return building blocks, can increasingly become a significant component of the investment portfolios of Asian investors. The allure of private markets lies in their potential to offer higher returns compared to traditional public markets, alongside offering benefits such as portfolio diversification and lower volatility. However, the efficacy of these investments for Asian investors is intricately linked to various factors, specifically currency and the associated hedging costs, which can play a crucial role in determining net returns from these investments. By having a higher “starting point” from an expected returns perspective, the impact of currencies is less impactful than with a portfolio of purely public markets investments.

Source: Invesco Vision, data as of 29 February 2024. Return estimates are based on the 2024 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. Note: New portfolio allocation assumes 50% in global equities, 30% in global bonds, 10% in private markets growth and 10% private markets income.

For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

Adding 20% diversified private markets exposure to the Korean won-denominated portfolio increased expected return to 6.4%, closely aligned with the original US dollar-denominated public market portfolio expected return. This example shows us how private markets can help to offset the currency drag posed by the current interest rate environment. While in prior pieces we’ve advocated for private markets given the solid fundamental rationale regardless of currency, this is an added benefit for Asian investors. The objective of this piece was to lay out the initial challenge faced by many Asian investors and offers private markets as a vital solution in solving the issue of lower local currency expected returns. In subsequent pieces, we’ll dive into specific aspects of private markets implementation covering private credit, private equity, and real assets.

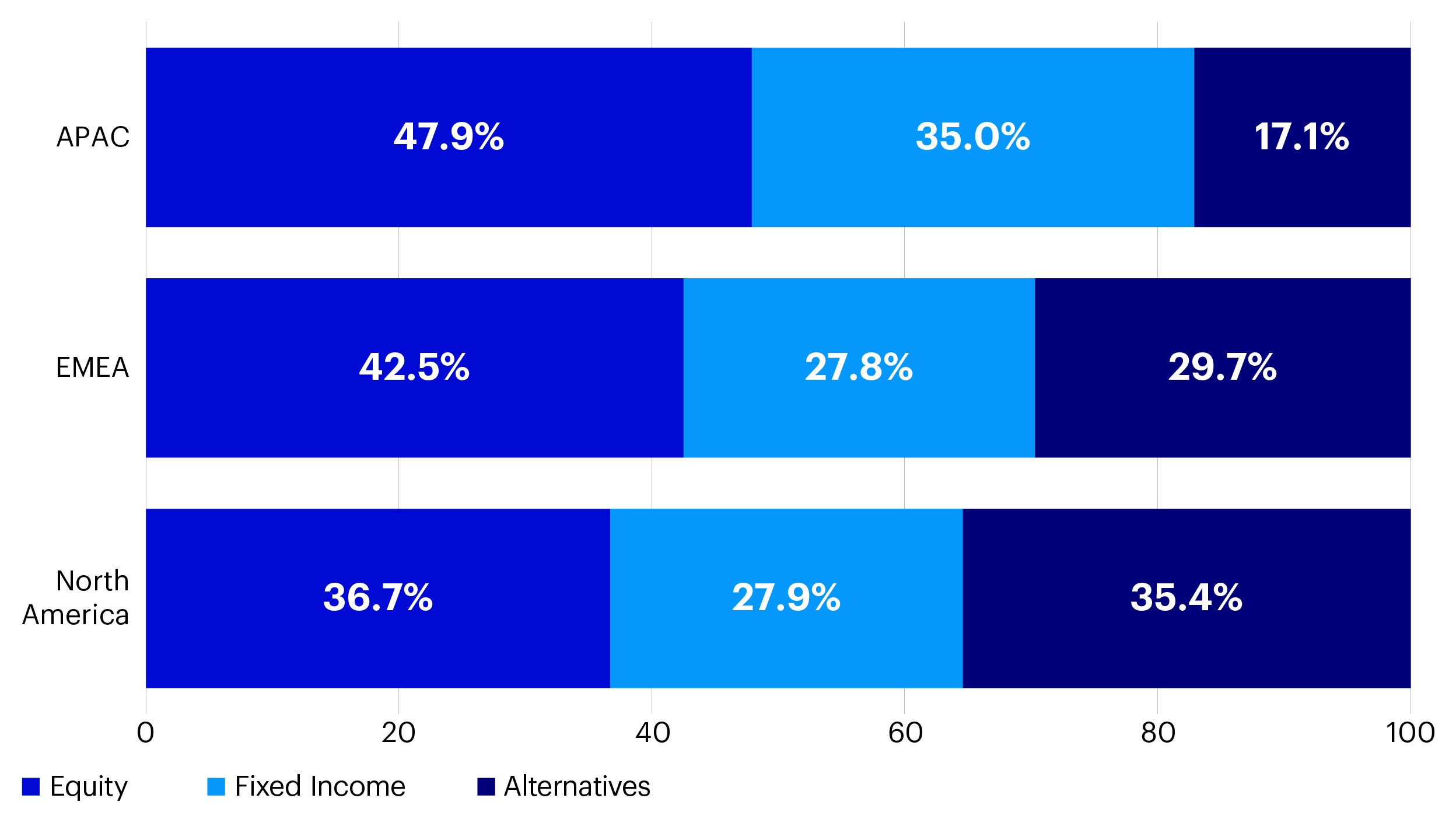

One current dilemma is the general underinvestment in private markets by Asian investors compared to global peers. APAC investors’ exposure to alternatives currently hovers at around 17%, compared to 35% for investors in North America (Figure 4). The current interest rate situation exacerbates this as more funds are likely invested in lower yielding local bonds or global holdings hedged back to local currency and are experiencing the “haircut” described above. However, one could argue this has also created a substantial opportunity for investors in Asia, as scaling up this exposure could help mitigate the aforementioned risks.

Source: Asset Owner 100 2023, Thinking Ahead Institute

In sum, Asian investors, in the face of increasing hedging costs and interest rate differentials, stand to benefit significantly from incorporating private market investments into their portfolios. As such, effectively integrating private and public market investments can provide a robust framework for achieving diversified growth and income objectives, positioning Asian investors well for the complexities of the global financial landscape.

Appendix

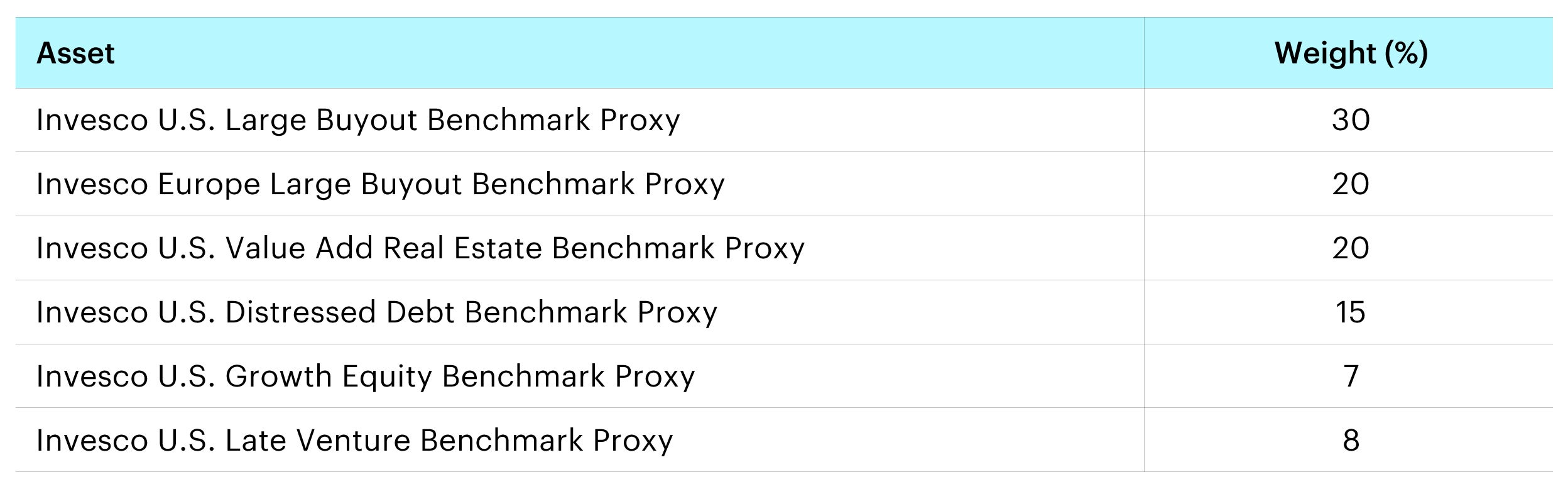

All data pulled from Invesco Vision as of 30 June 2023. For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

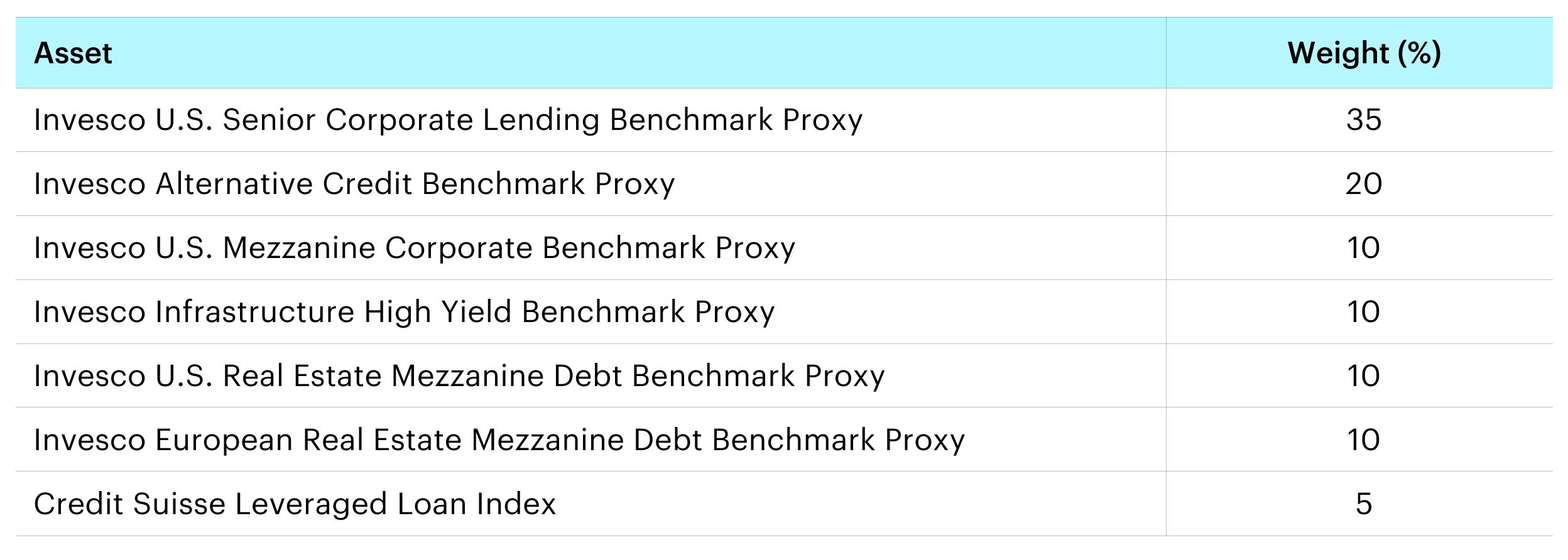

All data pulled from Invesco Vision as of 30 June 2023. For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Invesco Investment Solutions develops CMAs that provide long-term estimates for the behavior of major asset classes globally. The team is dedicated to designing outcome-oriented, multi-asset portfolios that meet the specific goals of investors. The assumptions, which are based on 5- and 10-year investment time horizons, are intended to guide these strategic asset class allocations. For each selected asset class, we develop assumptions for estimated return, estimated standard deviation of return (volatility), and estimated correlation with other asset classes. This information is not intended as a recommendation to invest in a specific asset class or strategy, or as a promise of future performance. Estimated returns are subject to uncertainty and errors and can be conditional on economic scenarios. In the event a particular scenario comes to pass, actual returns could be significantly higher or lower than these estimates.

Across a variety of alternative investment strategies, our objective is to capture the expected behavior of each strategy as represented by a broad proxy rather than a particular manager or fund. Granular data within private markets is difficult, and often impossible, to find. As such, we use objective, observable data from public proxies wherever possible as an input into our process; where data is not available, our alternatives specialists set forward-looking assumptions informed by their own experience.

Return assumptions vary by category. For Private equity, we use a building-block approach for US leveraged buyouts that captures earnings growth, valuation multiple expansion/contraction, fund leverage (and cost of financing), and fees to derive expected net returns. For other equity strategies such as venture capital, we compare historical returns to buyouts and then apply that difference to our forward-looking estimate for buyout returns on the assumption that return differences in the future will be consistent with the past.

Real Assets. For select real assets, namely Core US Real Estate and Core US Infrastructure, we utilize a building-block approach capturing rental income, maintenance CapEx, expected real income growth, expected inflation, expected valuation changes, leverage (and cost of financing), and fees to derive expected net returns. For other real assets, we utilize historical returns from NCREIF and Burgiss.

Private Credit. For most private credit proxies, we start with gross yields on underlying debt holdings and adjust for expected losses (based on historical averages), fund leverage (and cost of financing), and fees to derive expected net returns.

For a few private credit proxies, such as distressed debt, we utilize historical relationships to derive forward-looking assumptions as described above.

Approach to risk. A key principle of our risk methodology is to represent alternatives as a combination of both private and public exposures. This captures a distinct private element that is not correlated with traditional assets, while at the same time recognizing the underlying exposures themselves are often more public or traditional in nature. Taking private credit as an example, our methodology assumes exposure to a private debt factor as well as a public credit spread factor. The result is a private credit correlation with traditional assets that is greater than 0, but less than what would be suggested by public credit spread exposure alone. Because our Vision modeling platform extensively leverages the Barra framework, absolute risk for a number of alternative strategies is a byproduct of the Barra factor exposures. For alternative strategies not explicitly captured by Barra, we assume overall risk is consistent with history, with factors being mapped to the private and public factors that our alternatives specialists believe best represent the strategy.