Preparing for the next chapter in private credit

The current private credit environment is often described as a “Goldilocks” scenario, supported by high base rates, strong credit fundamentals, and a PE-backed borrower base that increasingly favors private credit over traditional bank financing. Special situations strategies also remain particularly well positioned in a “higher for longer” rate environment. However, the fast-changing US political landscape under the new administration introduces a fresh set of economic, political, and social variables, creating both challenges and significant opportunities for private credit investors.

Lending in a Trump 2.0 era

We remain encouraged by the strength of the US economy, the pro-business stance of the Trump Administration, and the overall health of the credit markets. For now, the US consumer remains strong, with household consumption reaching an all-time high of 68.2% of nominal GDP in Q4 2024.1 US economic growth remains well positioned, with GDP expanding by 2.3% and inflation holding around 3%. While some US macro indicators are positive, we remain very cautious about long-term risks, particularly those posed by structurally high fiscal deficits and the potential resurgence of inflation.

A Trump governance style, marked by rapid and often unpredictable policy shifts, has accelerated the potential for regulatory and economic changes beyond what has been seen at the start of any recent US administration. This shift, initially driven by a flurry of executive orders, has introduced heightened volatility, amplified by changes in key US political alliances. These shifts could reshape foreign policy, with direct and significant impacts on the broader credit markets.

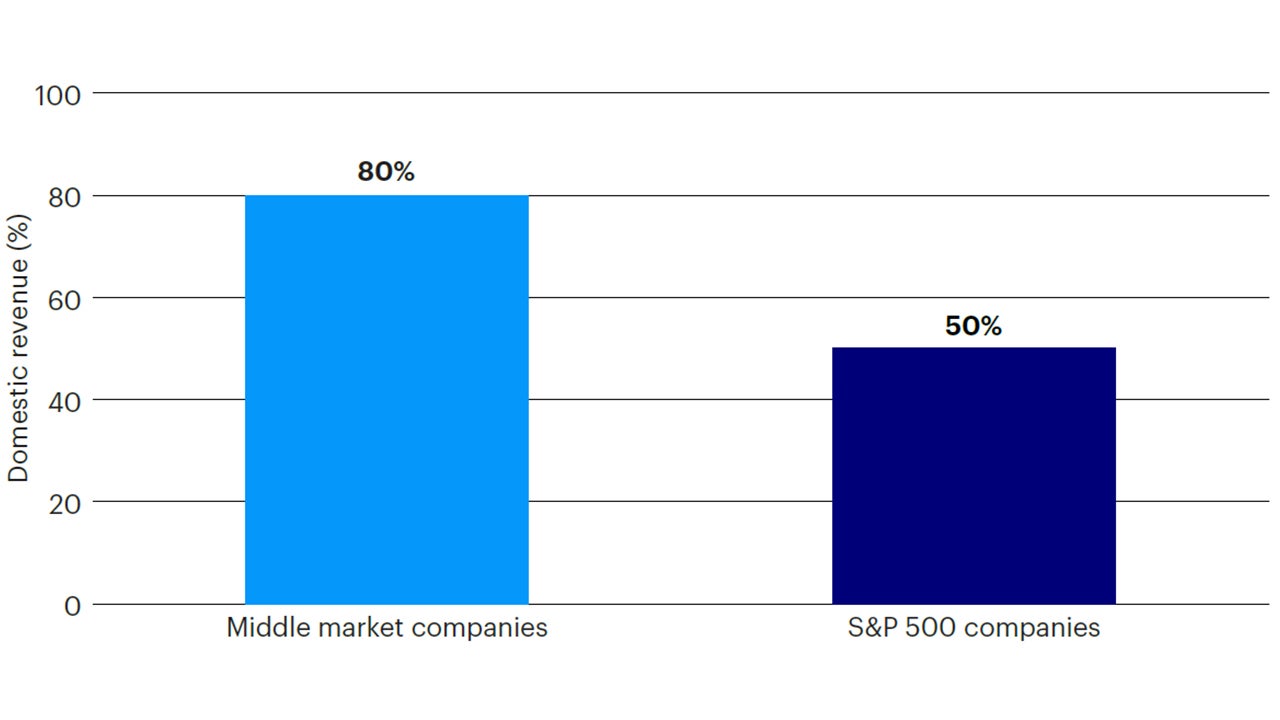

Additionally, the Administration’s use of tariffs as a strategic tool has already caused disruption, potentially impacting global trade flows, supply chain costs, and credit risk for those corporations reliant on international markets. While this evolving environment may pose challenges for some credit portfolios, private credit’s positioning relative to public markets has some noteworthy advantages.

Source: National Center for the Middle Market, as of December 31, 2024.

For example, private credit remains significantly less exposed to foreign sourced revenues as compared to the overall market. This favorable skew toward domestic-sourced revenues is particularly evident as we look within the core and lower end of the US middle market. More broadly, a volatile environment may create more situations where private credit plays a role in filing the gaps left by traditional bank lenders. We are already seeing more flexible pools of private capital step into this role and seek to fill the void through creative and bespoke capital solutions. Accordingly, we expect that more managers pursuing opportunistic and special situations strategies will look to this evolving landscape as a source of new potential deal flow and lean on their global investment platforms to navigate a shifting economic and political environment.

Supply and demand dynamics

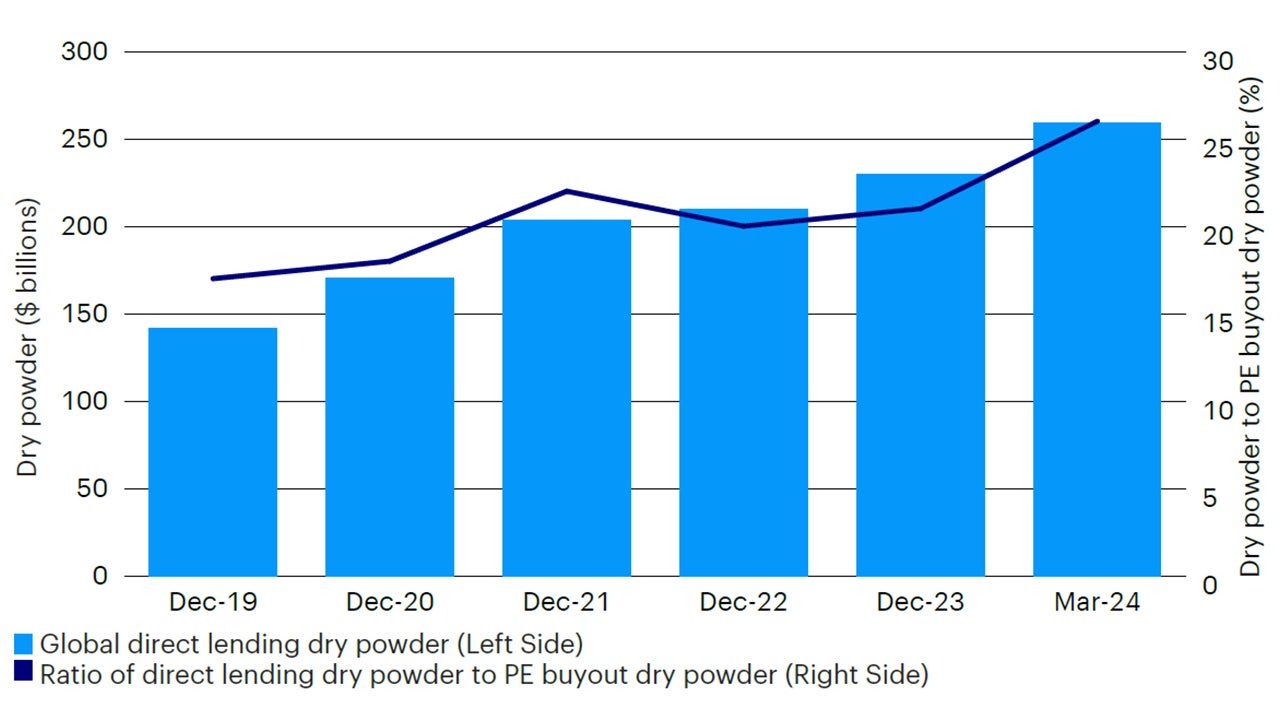

In addition to the fast-moving macro landscape, we are also seeing changes in the supply and demand drivers of this asset class. Private credit fundraising ended 2024 with ~$260bn in fresh capital, marking a 5% increase from the previous year.2 Investors remain attracted to private credit, particularly given the historic appeal of a double-digit return profile, which has held steady for the past eight quarters. While base rates and credit spreads have moderated from their peak, expectations of a “higher for longer” rate environment are now well entrenched, providing more sustainable tailwinds for private credit returns.

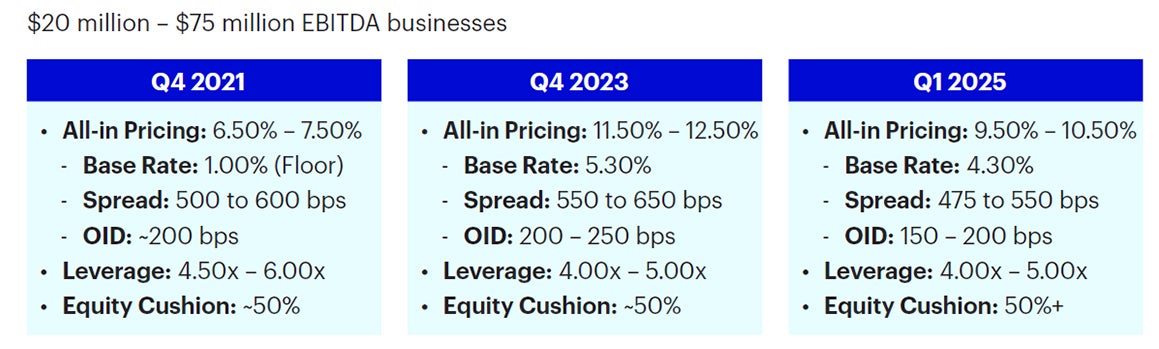

Source: Invesco Private Credit, as of February 2025.

When we compare risk/return drivers within the senior secured core middle market segment of direct lending, it becomes clear just how much this market has improved over the past few years. All-in returns remain 300+ basis points (bps) above historical norms, with transactions completed at lower leverage multiples and higher equity cushions. However, deal flow remains challenged, with recent deal flow activity well below its 2021 peak. A muted LBO environment, driven by a persistent valuation gap between buyer and seller, along with broader market uncertainty, continues to keep many PE deals on hold. This has created challenges for direct lenders, but structural tailwinds are emerging that could drive higher transaction volumes going forward.

Private equity (PE) portfolios are aging. According to Pitchbook, by the end of 2024, over 30% of PE-backed companies had been held by fund managers for at least five years — the highest percentage in nearly a decade.3 These extended hold periods are pressuring both IRRs and DPIs, making it harder for PE managers to market new follow-on funds. As a result, a large number of PE managers face growing pressure to build equity value in their portfolio, sell assets, and return capital to their LPs. On the buy side, we also see mounting pressure to deploy capital, with dry powder reserves for US PE managers now exceeding $1 trillion.4 With pressure growing for both PE buyers and sellers, transaction activity will inevitably increase, driving a new wave of financing opportunities for direct lenders.

Source: Preqin, as of 3/11/2024, excludes VC dry powder.

The scale dilemma

Scale in private credit allows managers to write larger checks, secure a greater share of a company’s balance sheet and potentially facilitate more transactions. While this can be beneficial, the rapid growth and concentration of AUM in this asset class also introduces new complexities and risks that warrant investor attention.

One of the most impactful shifts in direct lending has been the increasing concentration of AUM among the largest private credit firms. In 2024, five private credit funds each raised $10 billion or more, accounting for $89 billion combined —representing two-thirds of all direct lending fundraising and over 40% of total private credit fundraising that year.5

This concentration in growth is reshaping the market in several ways. Some direct lenders are now aggressively pursuing larger deals, many of which were previously financed through the broadly syndicated loan (BSL) market. In the first three quarters of 2024, 92% of all US LBOs were financed by direct lenders, compared to 80% in the previous year.6 However, crowding out the BSL market is not without risks. In past cycles, similar deployment pressures have led to weaker loan terms and looser documentation standards — trends that could resurface as capital deployment pressure continues to build.

Compounding these challenges is the rapid influx of new retail investors into the largest private credit funds, reshaping the overall market’s investor base and introducing a new set of potential risks. Many retail investors in these strategies have yet to experience a full market cycle, raising concerns about how they may react in periods of stress or shifting return expectations. Their exposure to semi-liquid private credit products could also have an outsized impact on the market if redemption pressures increase.

With capital deployment pressure building, fueled by increasingly larger fundraises, private credit managers with massive amounts of dry powder must balance the requirements of putting capital to work with maintaining disciplined underwriting and deal terms. In contrast, managers targeting smaller companies in the core middle market and investing out of more manageable fund sizes may be better positioned to deploy capital selectively.

Watching for smoke

While overall credit conditions remain solid, early signs of portfolio stress are emerging. Covenant defaults ticked up in Q4 2024 to 2.4%, though still well below the six-year average of 4.5%.7 Non-accrual rates in the middle market have also crept above 3% throughout 2024, signaling growing pressure on certain borrowers.8 However, one of the clearest indicators of mounting stress is the rising use of payment-in-kind (PIK) interest structures among direct lenders, reflecting liquidity constraints for borrowers navigating a prolonged high rate environment.

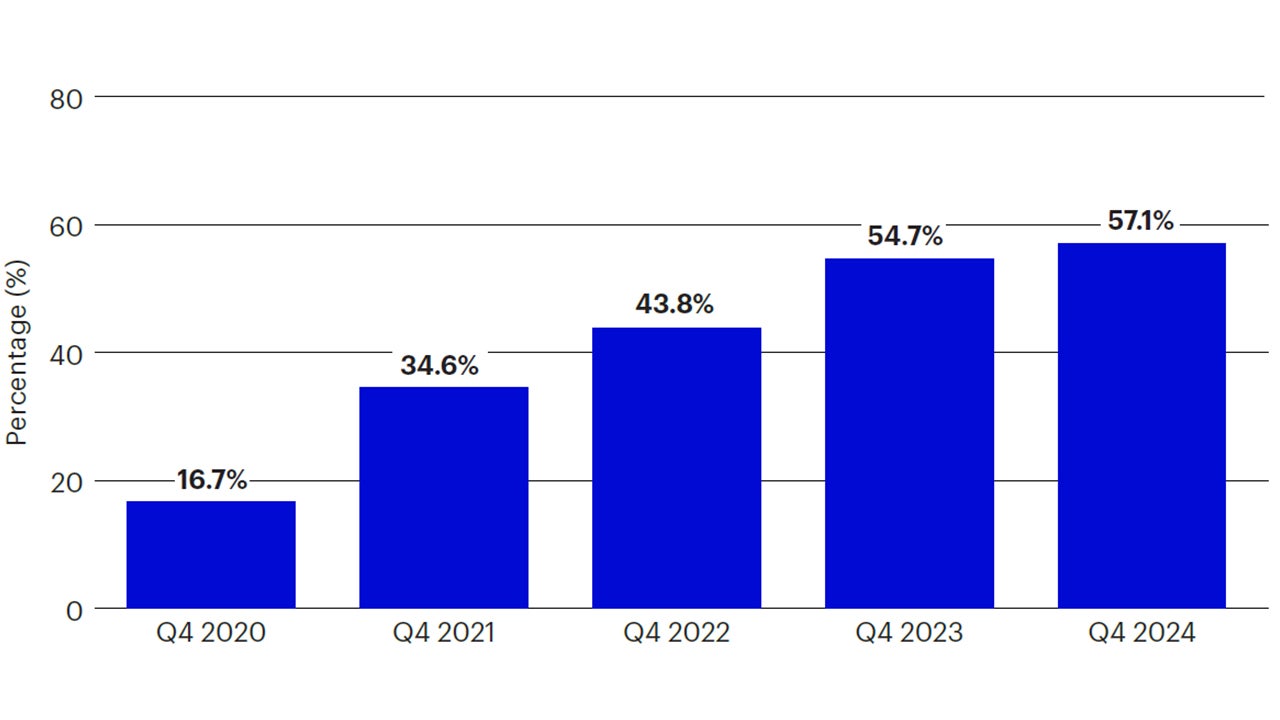

A recent analysis by Lincoln International found that 57% of all PE-backed investments in their middle market universe did not utilize a PIK at the inception of the LBO transaction but have since applied a PIK to the loan structure.9 This same cohort of PE-backed portfolio companies has experienced a significant decline in profitability, posting a -21% EBITDA CAGR since the initial investment date, alongside a near doubling of loan-to-value (LTV) ratios.10 Balance sheet strain is particularly acute in the consumer and health care sectors of the lower middle market, where LBO structures have proven more vulnerable.

Source: Lincoln Financial, as of December 31, 2024.

The increased reliance on PIK interest among direct lenders deserves close monitoring, as it may serve as an early warning sign of broader credit deterioration. However, lenders who maintain a disciplined approach — focusing on the most senior part of the capital structure and preserving strong loan documentation, including financial maintenance covenants, will be well-positioned to navigate market volatility. Additionally, lenders targeting sectors with stable cash flows and US companies with minimal exposure to foreign markets are well-positioned to outperform in this environment.

Reemergence of special situations

Several strategies within the special situations investment category are gaining momen-tum among distressed investors. Unlike past cycles, today’s opportunities often involve fundamentally strong companies led by experienced management teams in industries with solid near-term fundamentals. This shift is driven by a unique market environment — one marked by a period of rapid interest rate hikes and persistent cost inflation.

Vintage 2021 private equity — minimal equity value growth

| Entry 2021 | December 2024 | |

| LTM Adjusted EBITDA | $59.1 | $80.9 |

| EV Multiple | 12.7x | 11.4x |

| Enterprise Value | $748 | $919 |

| Average Leverage Multiple | 5.4x | 5.8x |

| Total Outstanding Debt | $321 | $466 |

| Total Equity Value | $428 | $453 |

| Implied MOIC | 1.0x | 1.1x |

|---|

Source: Lincoln Financial, as of December 31, 2024.

A look at vintage 2021 middle-market buyouts (see table on previous page) shows that, to date, PE managers have generated little equity value in portfolio companies of this vintage, posting an average MOIC of only 1.1x. As PE struggles to generate returns for their LPs, special situations investors have stepped in with creative solutions, working alongside PE managers and other lenders to recapitalize balance sheets, unlock growth, and seek to generate attractive risk-adjusted returns for their own investors.

Capital solutions

PE managers have several tools to enhance investor outcomes, including NAV loans, continuation vehicles, and capital solutions. Capital solutions are particularly well-suited for PE-owned companies in maturing funds that have generated little equity value and are running out of time to deliver returns. Rather than servicing costly cash-pay debt, PE managers can use capital solution providers to redirect the cash flows of portfolio companies toward growth initiatives, effectively reviving their initial investment thesis. Unlike distressed investments, these companies are financially sound, with strong operations and solid strategic positioning.

While each capital solution is uniquely structured, the common goal is to replace expensive cash-pay debt with a PIK instrument, improving liquidity and extending the investment horizon. Although PIK structures can signal stress in direct lending portfolios, capital solution investors are well compensated for these structures. These deals typically involve senior secured debt with equity warrants or preferred equity with similar upside participation. Notably, most capital solution transactions maintain manageable debt levels, with LTVs generally in the 50 – 60% range.

In the smaller end of the capital solution market, where fewer participants are active, investor protections play a key role. Governance rights for capital solution investors include:

- Veto authority over M&A activity and significant CapEx spending.

- Restrictions on incremental debt issuance at all levels of the capital structure.

- The ability to replace the Board and force a sale if the PE manager fails to exit the company within a predefined period.

Additionally, these transactions are often structured with a minimum MOIC return threshold, designed to ensure downside protection for investors.

Liability management exercises

Like capital solutions, liability management exercises (LMEs) present growing opportunities for special situations investors, driven by sustained high interest rates that have exposed over-levered balance sheets. While both LMEs and capital solutions are PE manager-led transactions, they differ in key ways. Capital solutions typically involve healthy companies with significant equity value, redirecting cash flow toward growth. LMEs, however, are used when distressed companies need additional liquidity and require a full balance sheet restructuring.

LMEs exploit weak credit documentation to improve collateral positions and/or economics for participants. Historically, these transactions have led to volatile outcomes, as some creditors use aggressive tactics to gain priority over others. However, the stigma around LMEs has diminished as PE managers adopt more inclusive structures, and creditors increasingly use cooperation agreements to ensure better outcomes for all parties involved.

Source: Pitchbook LCD, as of December 31, 2024.

As noted in the figure above, distressed exchanges/LMEs have grown significantly, now accounting for nearly 70% of defaults.11 The prevalence of loose covenants and borrower-friendly terms from the low interest rate era has created a white space for the most experienced special situations investors to collaborate with borrowers in these transactions. This trend is likely to persist as long as legacy credit agreements remain in place, interest rates remain elevated, and PE managers continue to pursue these types of transactions.

Conclusion: The opportunity ahead

As private credit enters its next phase, a disciplined and selective approach will be key to navigating an evolving market. Within direct lending, a conservative strategy focused on less crowded segments — such as the core middle market — offers attractive risk-adjusted opportunities. For investors seeking higher returns, opportunistic and special situations strategies are particularly well-positioned in an uncertain market where volatility creates compelling entry points.

Success in these specialized areas depends on deep sector expertise, active engagement with stakeholders, and strong structuring and negotiating capabilities. The ability to adapt to shifting market conditions while maintaining underwriting discipline will be critical. In today’s dynamic private credit landscape, managers with flexible mandates and specialized teams are best equipped to capitalize on emerging opportunities and seek to deliver strong risk-adjusted returns for their investors.

Investment risks

Many senior loans are illiquid, meaning that the investors may not be able to sell them quickly at a fair price and/or that the redemptions may be delayed due to illiquidity of the senior loans. The market for illiquid securities is more volatile than the market for liquid securities. The market for senior loans could be disrupted in the event of an economic downturn or a substantial increase or decrease in interest rates. Senior loans, like most other debt obligations, are subject to the risk of default. The market for senior loans remains less developed in Europe than in the U.S. Accordingly, and despite the development of this market in Europe, the European Senior Loans secondary market is usually not considered as liquid as in the U.S. The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Footnotes

-

1

U.S. Bureau of Economic Analysis via Federal Reserve Economic Data as of Q4 2024. https://fred.stlouisfed.org/series/DPCERE1Q156NBEA/

-

2

Invesco Solutions, Preqin, Pitchbook LCD, data as of Sept. 30, 2024.

-

3

Pitchbook as of December 31, 2024. https://pitchbook.com/news/articles/aging-buyout-portfolios-reach-decade-high

-

4

Preqin as of 3/11/2024, excludes VC dry powder

-

5

Pitchbook as of December 31, 2024. https://pitchbook.com/news/articles/aging-buyout-portfolios-reach-decade-high

-

6

Preqin, PitchBook Data, Inc as of December 30, 2024. https://www.chicagoatlantic.com/private-credit-markets-2024-in-review-outlook-for-2025/

-

7

LSEG as of September 30, 2024.

-

8

Lincoln International as of Q4 2024. “Q4 2024 Lincoln Senior Debt Index” https://www.lincolninternational.com/publications/research-indices/q4-2024-lincoln-senior-debt-index/

-

9

Lincoln International as of February 13, 2025. “Q1 2025 Private Market Webinar: U.S. Edition”

-

10

Lincoln International as of February 13, 2025. “Q1 2025 Private Market Webinar: U.S. Edition”

-

11

Pitchbook LCD as of December 31, 2024.