Opportunities in real estate

As part of Invesco’s recent China Investment Forum, Max Swango, Managing Director, Global Head of Client Portfolio Management, shared his thoughts on how demand in the real estate industry has evolved in recent years and the drivers of real estate performance going forward, particularly as it relates to the APAC region. Below are some excerpts from this insightful session.

Q: Why are institutional investors interested in real estate?

A: Institutional investors look to real estate as it offers strong total returns over the long term. For example, core real estate has typically returned high single digits and you can add to that if you take more risk in your portfolios. It also provides diversification from the other asset classes, as investors look to diversify away from the volatility in the public markets. The stable income component is another key draw. Historically, this asset class has served as a hedge against inflation, making it a desirable investment option in the current macro environment.

Q: When is a good time to invest in real estate?

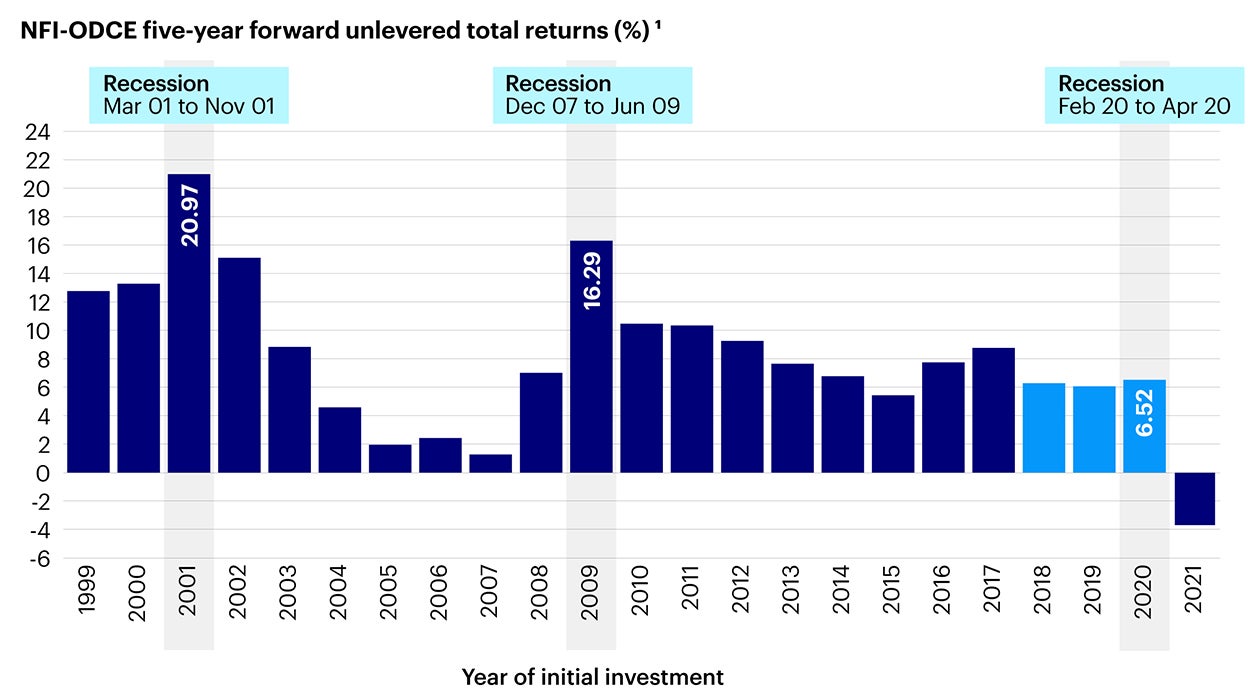

A: While timing the market precisely is challenging, historical trends show that real estate, like other asset classes, goes through cycles every eight to twelve years. Investing after a downturn can offer attractive returns, with opportunities typically arising when values are depressed. As values have adjusted downwards over the last six to eight quarters, 2024-2025 appears to be an interesting time to consider real estate investments.

1Based on data from NCREIF-ODCE, all property types, investment returns calculated from Q1 following the calendar year of investment. 2018 data reflects annualized returns for acquisitions in 2018 (1Q-2019 to 4Q-2023); 2019 data reflects annualized returns for acquisitions in 2019 (1Q-2020 to 4Q-2023); 2020 data reflects annualized returns for acquisitions in 2020 (1Q-2021 to 4Q-2023); 2021 data reflects annualized returns for acquisitions in 2021 (1Q-2022 to 4Q-2023). Source: Invesco Real Estate using data from NCREIF as of March 31, 2024.

Q: What are the key drivers of real estate performance going forward?

A: Real estate performance is driven by real estate fundamentals and capital markets. Fundamentals include metrics such as occupancy rates, rent growth, net operating income, and earnings growth. While every market and sector is different, generally, real estate fundamentals are healthy – occupancy rates are basically in-line with long term averages and earnings growth is good. On the other hand, capital markets, interest rates and investor sentiment, play a crucial role in shaping real estate valuations and investment opportunities. As interest rates rise, required capitalization rates for real estate increase, negatively affecting property valuations. And the opposite is typically true - as interest rates fall, cap rates follow, and values increase.

Q: Which opportunities exist right now in real estate credit investment?

A: Real estate credit historically has provided attractive returns with lower volatility and low correlations to other asset classes. With banks seeking to reduce their exposure to real estate, there's a current increased opportunity for non-bank lenders to capitalize on the reduced competition. Strategies may include providing loans for new acquisitions, recapitalizing existing loans, or acquiring loan portfolios from financial institutions.

Q: What are some risks associated with real estate credit investment?

A: While real estate credit investment can offer attractive returns, market fluctuations may impact the value of underlying properties and affect loan performance. Falling interest rates could create an environment where equity real estate outperforms debt. Mezzanine lending carries risks, as investors are exposed to the higher portion of the capital stack, where losses can occur in downturns.

Q: Can you provide an example of an existing compelling real estate credit investment strategy?

A: One compelling investment strategy involves providing financing to help fund new property acquisitions. A lender can make a loan representing 65% of a property's acquisition cost – which is likely 20% +/- below what values were a couple of years ago with the borrower providing equity representing 35% of the cost of the property. The lender can finance up to 50% of the cost, keeping the 50-65% of cost piece of the capital stack. Today, returns on that remaining piece are in the low double digits – insulated from value declines by the 35% equity investment made by the buyer/borrower.

Q: What are the current trends and opportunities in specific regions such as Asia?

A: In Asia, each market presents unique opportunities and challenges. Japan is considered a safe haven with attractive spreads between cap rates and borrowing rates. Australia benefits from strong population growth, driving demand for real estate. Korea offers domestic opportunities, especially in logistics and senior housing due to an aging population. Meanwhile, China is experiencing a correction after decades of rapid growth, presenting both challenges and potential medium to long term opportunities for investors.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.