Global commercial real estate update: State of play heading into Q4 2024

In most years, the fourth quarter has seen a significantly higher volume of global real estate transactions than the prior three quarters. We head into Q4 2024 expecting values to start to recover after 24 months of correction. Unlike most years, the recent increase in interest rates in many markets will keep the pace of transaction subdued through year-end, in our view. We have growing confidence that transaction activity is likely to re-accelerate in early 2025, and that the start of a new real estate value cycle is close at hand.

With slowing inflation, and the initial easing of interest rates in some European markets expected to be followed elsewhere, we believe that we’re at the start of a new real estate value cycle. Looking ahead for the next couple of years, the macro environment will likely be one of ongoing short-term volatility in interest rates, in our view. We expect interest rates to fall from current levels but settle/normalize at higher levels than seen over the prior decade. Global gross domestic product (GDP)1 growth is likely to be lower than the prior decade and also we expect greater divergence between markets.

The new real estate value cycle is expected to experience less benefit from cap rate compression compared to previous recoveries. As a result, achieving the best real estate returns, relative to the respective local market, will require a focus on property income growth and reliance on secular demand drivers that can mitigate an easing of the economic cycle. It also elevates the need to seek differentiated performance through market selection, because of the large historical gap between top- and bottom-performing markets.

1. Macro environment: Focus on income growth

We expect three macro factors to be key in shaping returns:

Capital markets: Limited cap rate2 compression to support return growth.

Over the past couple of decades, declining interest rates have led to declining commercial real estate (CRE) cap rates and helped drive value growth. Going forward, we expect declining interest rates to exert less influence on CRE cap rates.

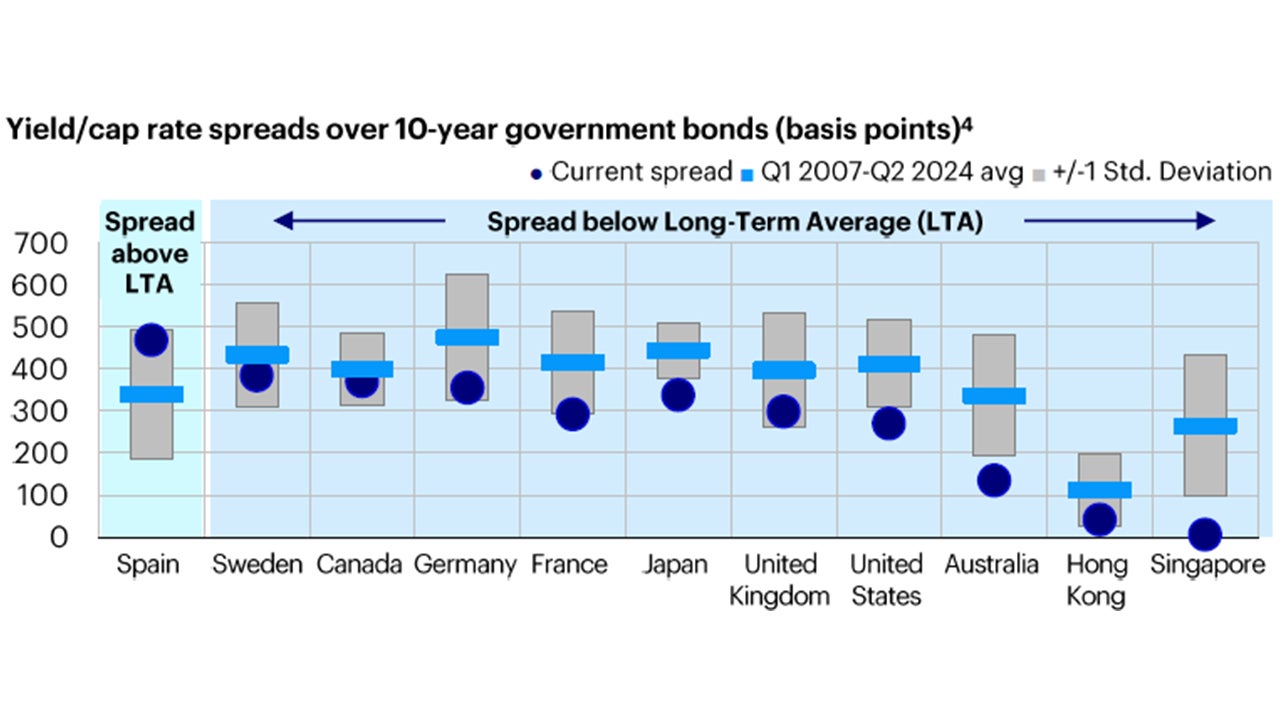

Monetary policy loosening and global interest rate declines were essential to boosting liquidity during the past two decades. This resulted in real estate cap rates in almost all of the key global real estate markets maintaining a significant spread above the local 10-year government rate (see chart below). Equally important is that, for most markets, current cap rate spreads are either within one standard deviation3 of the long-term range, or very close to that range, indicating that current pricing is not out of line with the historical levels.

Note: current spread is calculated as the spread between the Q1 2024 cap rate and the August 13, 2024. 10-yr government bond rate. Countries are ordered from left to right by current spread value after sorting by relative distance from LTA.

LTA is the average since Q1 2007. Spreads at LTA are within +/-25 basis points of LTA.

Source: Invesco Real Estate using data from Real Capital Analytics and Macrobond as of August 2024. Past performance is not a guarantee of future results.

While current real estate pricing is in line with historic ranges in most markets, it’s at the tighter end of that range. As a result, we expect cap rate compression will likely play a lesser role for real estate value growth, certainly until spreads move closer to the long-term average. Long-term government bond yields have moved out significantly over the past two years, but real estate cap rates have been slower to react because transaction evidence takes time to come through. The result is that the spread between real estate cap rates and interest rates has either been thin relative to history or inverted, driving CRE cap rates higher to restore an appropriate risk premium. Globally, it seems unlikely that longer term interest rates would return to the low levels that once prevailed in post-Global Financial Crisis years. As a result, we believe real estate cap rate compression will likely play a muted role in the recovery of CRE values over the next few years.

Economic conditions: Limited market-level real estate returns.

With cap rates likely to contribute little to real estate value growth, investors need to turn attention to income to drive returns. With the global GDP growth expected to be lower in the coming years than in the past couple of decades, real estate income growth is likely to be relatively lower. This means that property income will need more than cyclical drivers to accelerate growth. Stronger growth will likely either need to come from secular demand drivers, such as shifting demographics and advancing technologies, or from active management of individual properties to drive improvements and operating efficiencies in order to increase income.

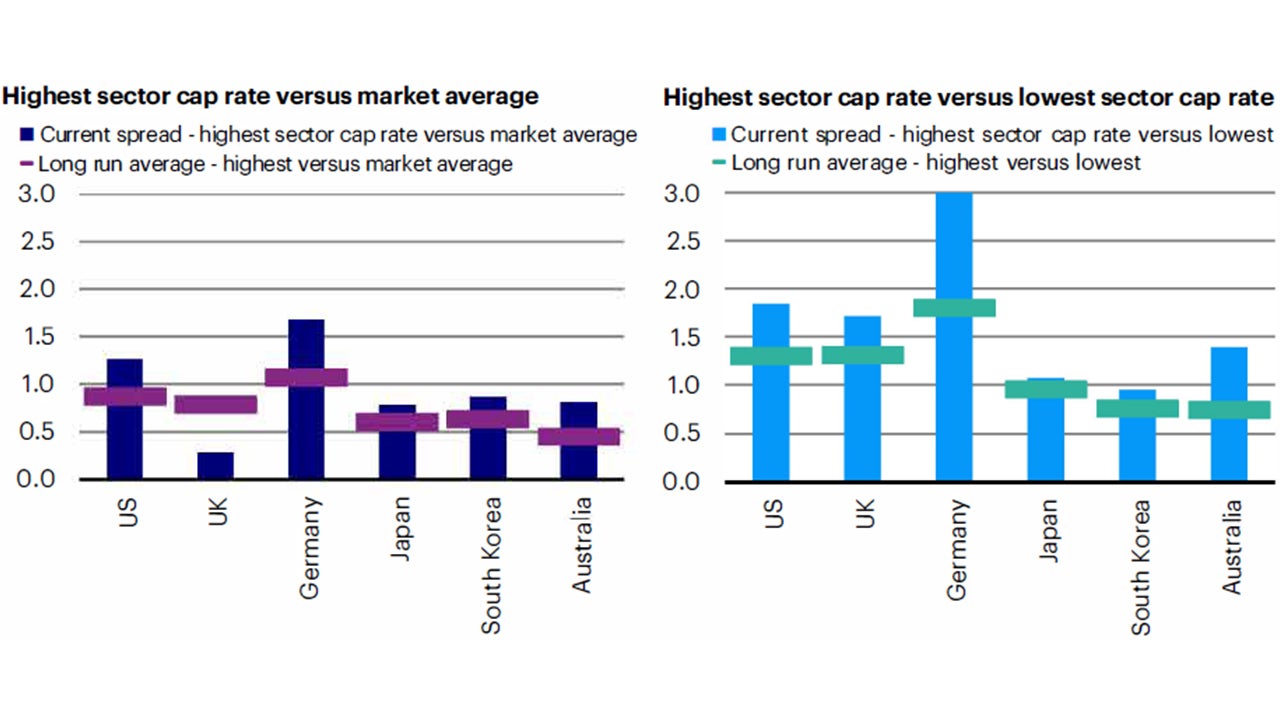

Sector pricing: Differences have rarely been wider.

Over longer periods of time we see fluctuations in the relative risk premia between real estate sectors, both globally and within individual markets. A key driver of these variations is changes in the outlook for income growth between the sectors. Those with a more positive growth outlook will likely trade more tightly than other sectors, all else being equal. The relative spread between sectors, however, varies significantly by market. The chart shows the current cap rate spread of the highest priced sector over both the market average and the tightest priced sector. It also compares these metrics to the long-run averages for each of these spreads. The key driver in these sentiment changes is the sector differences in expected growth and liquidity. A large element of this may be priced into the market already (more so than the past two decades), making the search for property income growth more challenging.

Source: Invesco Real Estate, utilizing data from MSCI RCA as of August 2024. Sectors represented are office, industrial, retail, and residential, plus MSCI RCA's calculated market average cap rate for the period. Long run averages calculated from Q1 2008 when available for all markets.

2. Property income: Attractive growth available by differentiating

Differences between the characteristics of individual property sectors and geographic markets are key to finding stronger relative income growth opportunities.

By property sector

Our outlook for property sector income growth is based on each sector’s exposure to long-term secular demand drivers, sensitivity to the economic cycle, and exposure to new supply within its local market. The chart below summarizes the key trends and how they vary by region.

These drivers are playing through differently in each market. Some local sectors may deliver stronger property income growth over the next one-to-two years, while others over a longer time horizon. The key differentiating factors between these shorter- versus longer-term outlooks is the relative near-term picture of supply relative to demand, and the strength of the structural factors that will drive ongoing demand.

By geography

Income growth within local real estate markets reflects a number of specific factors, such as political and geopolitical considerations. Also, tenant demand for each property type is driven by unique factors, which can vary considerably by location. For example:

- Proximity to the nearest port and local consumer density for industrial demand

- Relative mix between home and in-office working for office demand

- Student-age population growth for student housing demand

It’s also influenced by common factors, demographic growth being the most dominant.

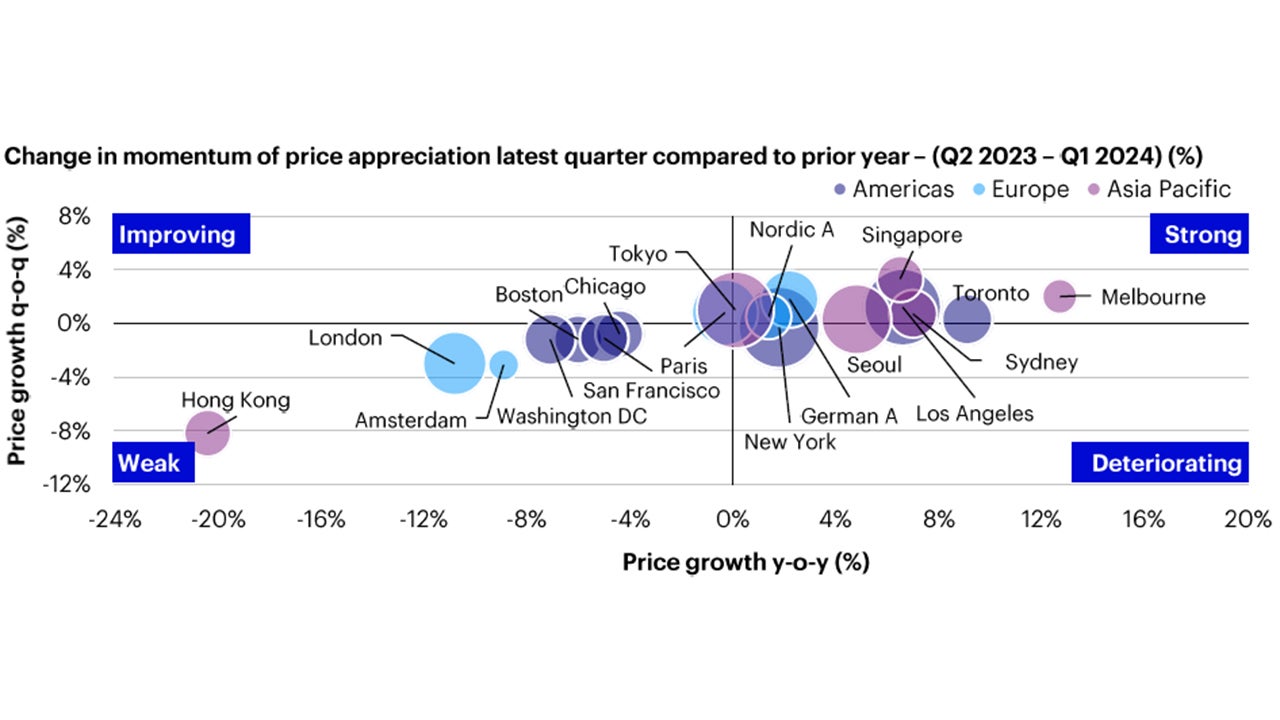

The investment implications of demographic shifts reflect both macro and localized trends. We see considerable variation between different countries, and also within countries. These are key drivers of income growth and real estate returns, which highlights the need for local knowledge and analysis for specific real estate assets and investment decisions.

Source: Invesco Real Estate based on data from Real Capital Analytics as of March 2024. Note: Change in Real Capital Analytics Commercial Property Price Index (based on industrial, office and retail properties valued at USD$10 million or more). Size of bubble determined by the volume of transactions Q2 2023-Q1 2024).

3. Why differentiation matters

Relative performance across real estate portfolios is driven by thematic differences in portfolio concentrations. Key themes include sector, market, and location exposures, and asset characteristics.

Sector

Sector-level themes tend to reflect long-term secular drivers that boost demand over-and-above normal cyclical growth. For example, relative performance over the past decade has been largely defined by whether a portfolio held an overweight or underweight exposure to the burgeoning industrial sector. Secular trends go through roughly four performance stages.

- Emergence: Tenant demand undergoes outsized growth and returns surge.

- Recognition: Investors pay up to gain exposure to the growth trend and developers accelerate construction activity to meet higher levels of demand.

- Deceleration: The tenant demand trend starts to moderate, but market pricing hasn’t adjusted to moderated growth.

- Normalization: The secular driver has run its course and related real estate demand reverts to a normalized long-term growth rate.

When we assess where the secular demand drivers are for industrial (or any other sector) along these four stages, we can’t assume that the coming decade will be like the last one. These trends are dynamic, and we will update our views as we anticipate shifts.

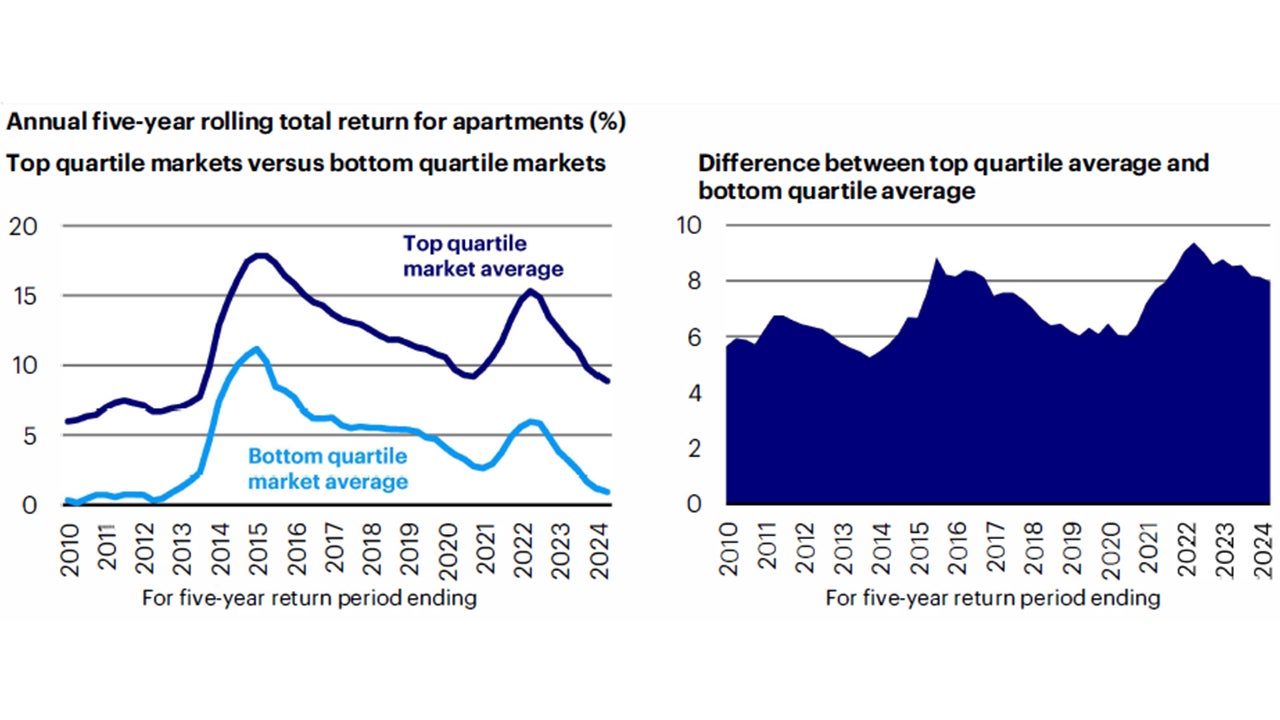

Market

There can be marked differences in market-level performance within single sectors within individual countries. Consider US apartment markets. The difference between five-year rolling returns for top-quartile performing markets versus bottom-quartile has consistently ranged from 5% to more than 8%. (See chart below) Individual markets move in and out of the top-quartile and bottom-quartile positions due to the ebb and flow of market prices, changes in supply levels, operating expenses, or capital expenditures, as well macro-economic drivers and local migration patterns. While the market composition in the top and bottom positions can change over time, the consistent performance gap between the best and worst markets within a property type is a big reason why market differentiation matters.

Sources: Invesco Real Estate, utilizing data from NCREIF as of July 2024. Past performance is not a guarantee of future results.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer’s opinion and may not be realised.

These materials may contain statements that are not purely historical in nature but are “forward-looking statements.” These include, among other things, projections, forecasts, estimates of income, yield or return or future performance targets. These forward-looking statements are based upon certain assumptions, some of which are described herein. Actual events are difficult to predict and may substantially differ from those assumed. All forward-looking statements included herein are based on information available on the date hereof and Invesco assumes no duty to update any forward-looking statement. Accordingly, there can be no assurance that estimated returns or projections can be realized, that forward-looking statements will materialize or that actual returns or results will not be materially lower than those presented. The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Generally, real estate assets are illiquid in nature. Although certain kinds of investments are expected to generate current income, the return of capital and the realization of gains, if any, from an investment will often occur upon the partial or complete disposition of such investment.

Investing in real estate typically involves a moderate to high degree of risk. The possibility of partial or total loss of capital will exist.

Defined Terms and Notes

-

1

Gross domestic product (GDP) is a broad indicator of a region’s economic activity, measuring the monetary value of all the finished goods and services produced in that region over a specified period of time.

-

2

Capitalization rates (cap rates) is the quotient of a property’s net operating income divided by the property’s estimate value.

-

3

Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean.

-

4

Basis point (bps) is a unit that is equal to one one-hundredth of a percent.