Evaluating liquid alternatives: Applications for asset allocation

Evaluating liquid alternative strategies

Main takeaways

1. Liquid alternatives are hedge fund strategies that attempt to capture alternative sources of alpha and are publicly available in both mutual funds and ETF vehicles.

2. We evaluate these assets using our investment process to determine their ability to improve traditional portfolios from both a risk-based and objective-oriented perspective.

3. Our conclusion is that a modest and selective allocation to liquid alternatives, in particular systematic trend and derivative income strategies, may enhance return or generate additional yield while reducing risk of traditional portfolios.

- A 5% allocation to a systematic trend strategy, with funding from the fixed income sleeve and combined with an overweight to equity, improved outcomes at the aggregate portfolio level across scenarios.

- Event-driven and market neutral strategies demonstrated variation in optimal allocations with lower equity weightings seeing the largest benefit.

What are liquid alternatives?

Hedge fund strategies that aim to generate alpha in a tradeable vehicle

Investors often search for uncorrelated returns to traditional assets to improve the risk profile of their portfolios, a category commonly referred to as alternatives. While alternatives are notably distinct from traditional assets, they come in many forms and are often quite different from each other within the category itself. For example, private credit, an illiquid alternative, looks and acts closer to traditional fixed income than a liquid managed futures exchange traded fund (ETF), a systematic trend liquid alternative, compares to private credit.

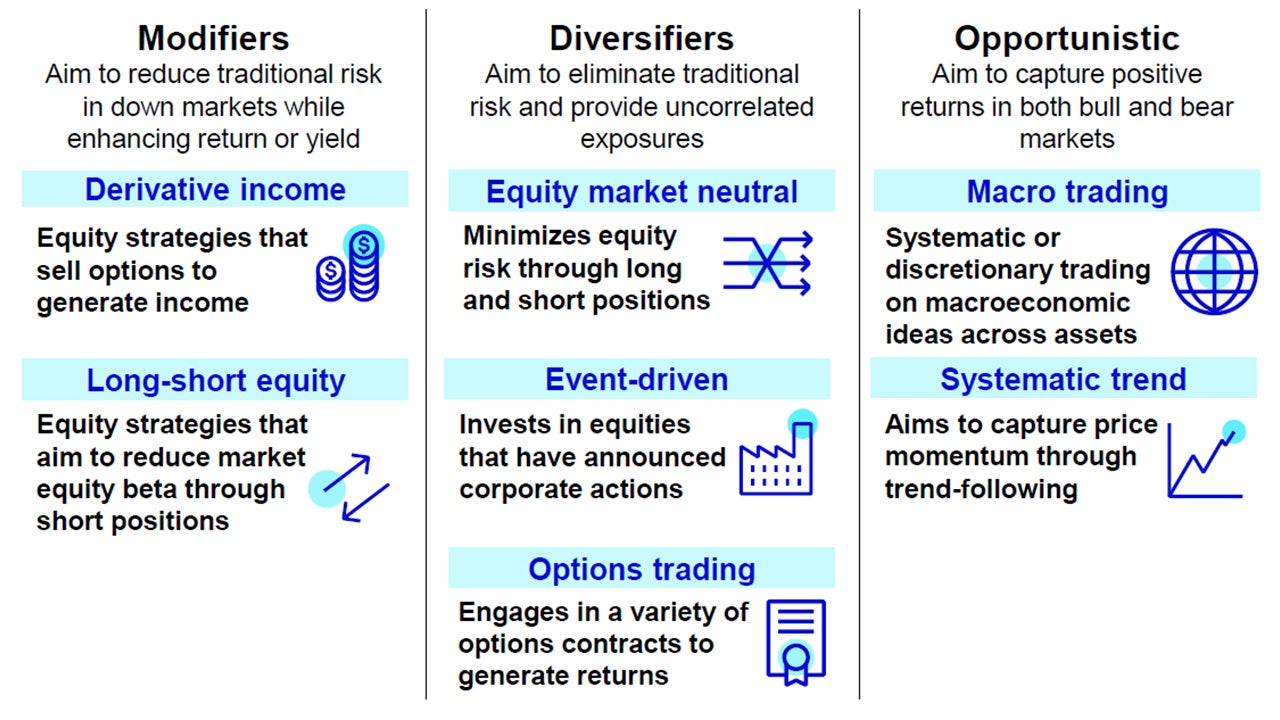

In their original form, liquid alternatives presented themselves as hedge funds and are now available in liquid vehicles like mutual funds and ETFs totaling $540 billion in assets under management (AUM) as of November 20241. This paper aims to review the diverse landscape of liquid alternatives and highlight how they may be implemented within a traditional portfolio. To do this, we utilize the framework presented by Morningstar to organize these assets as modifiers, diversifiers, and opportunistic; all of which play different roles in a portfolio.

Sources: Invesco Solutions, Morningstar.

How should they be benchmarked?

Liquid alternatives are not all the same and require unique benchmarks

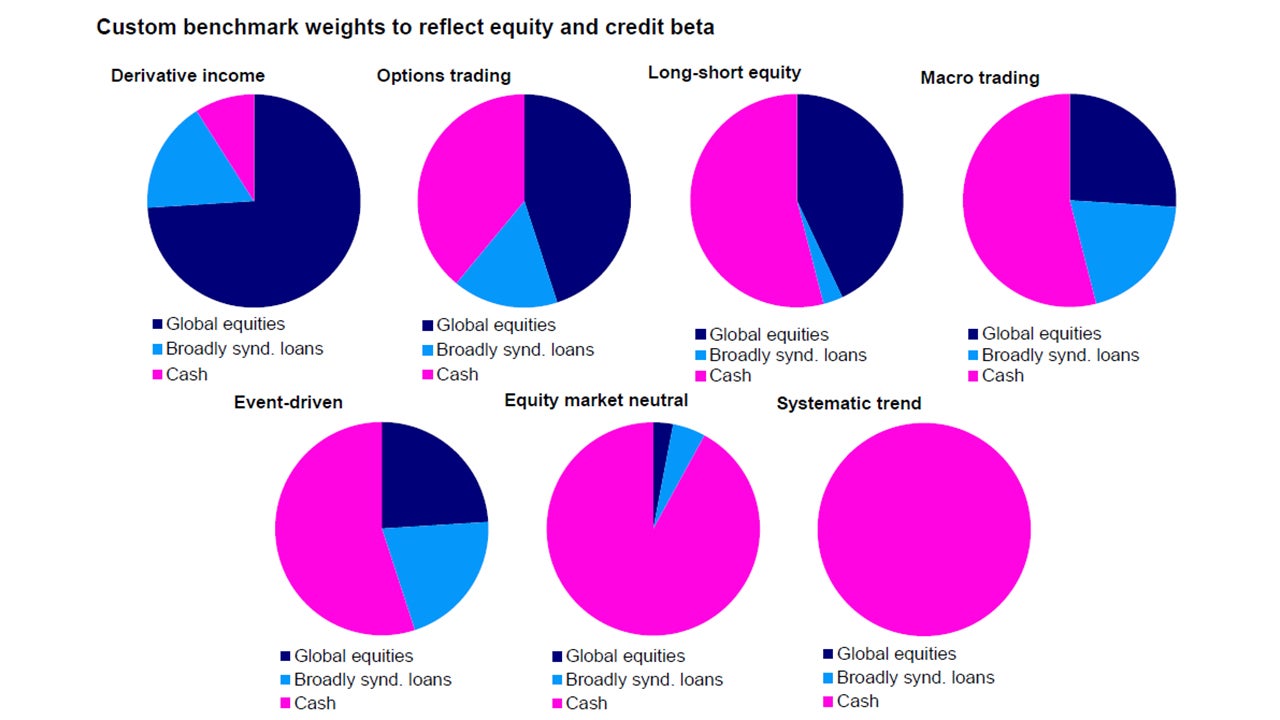

Since each liquid alternatives strategy has different characteristics and underlying investments, we needed to create unique benchmarks to properly analyze them.

We attempted to replicate these assets by minimizing the tracking error of a portfolio of three asset classes, equities, broadly syndicated loans, and cash. These assets were chosen due to their low correlations to each other and since they are common investments within the liquid alternatives categories themselves.

The resulting set of benchmarks contain variable weights of each of the three benchmark assets and provide reasonable expectations for the performance of each liquid alternatives categories. Derivative income, for example, has a benchmark with significant equity exposure, which is intuitive as the underlying investments are mostly equities, while equity market neutral has almost no equity exposure at all.

Sources: Invesco Solutions, as of Dec. 31, 2024. Liquid alts categories are represented by Morningstar categories.

How do they perform?

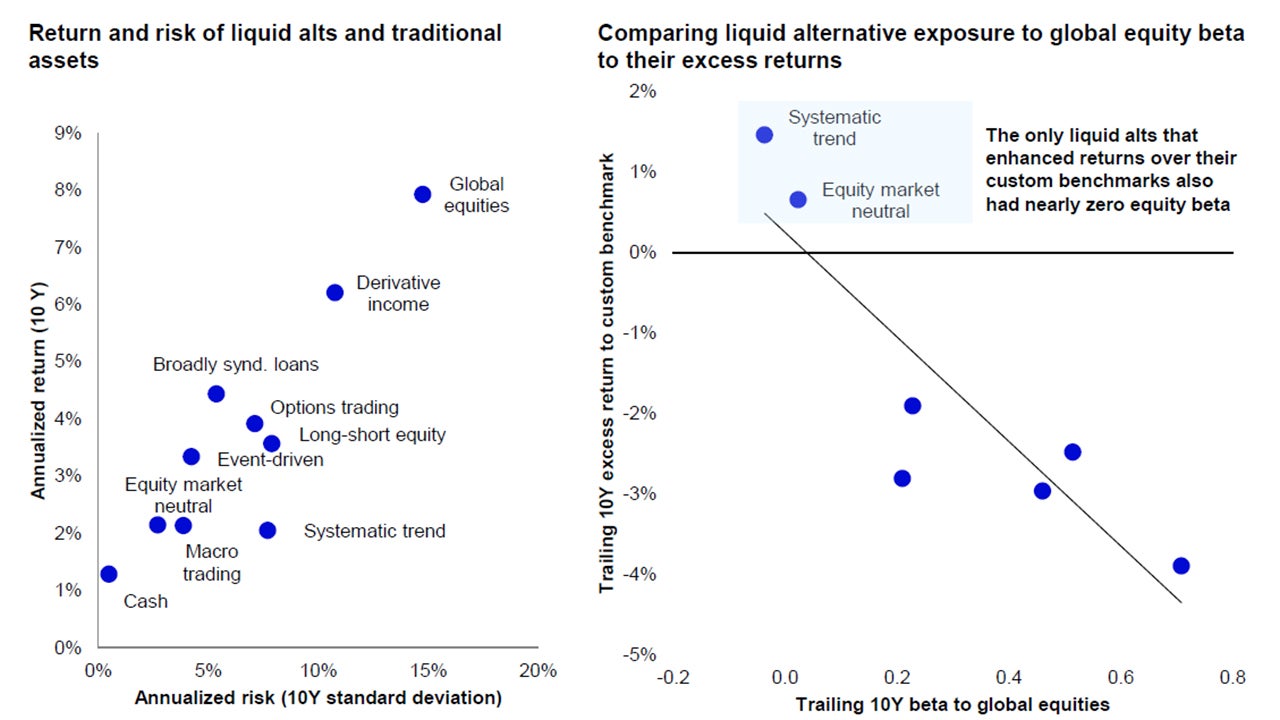

Systematic trend and market neutral have added alpha with near zero beta1

Since each liquid alternatives strategy has different characteristics and underlying investments, we needed to create unique benchmarks to properly analyze them.

We attempted to replicate these assets by minimizing the tracking error of a portfolio of three asset classes, equities, broadly syndicated loans, and cash. These assets were chosen due to their low correlations to each other and since they are common investments within the liquid alternatives categories themselves.

The resulting set of benchmarks contain variable weights of each of the three benchmark assets and provide reasonable expectations for the performance of each liquid alternatives categories. Derivative income, for example, has a benchmark with significant equity exposure, which is intuitive as the underlying investments are mostly equities, while equity market neutral has almost no equity exposure at all.

Sources: Invesco Solutions, Bloomberg, Morningstar Direct. Liquid alts categories represented by Morningstar categories; definitions are listed in the appendix. Global equities represented by the MSCI ACWI index, Broadly syndicated loans the Morningstar LSTA US Leveraged Loan Index and cash is the average yield on the 3-month U.S. T-bill Chart data uses the trailing 10 years ending Dec. 31, 2024. Past performance is not a guarantee of future results. An investment cannot be made directly into an index.1 Alpha is excess return; beta is equity beta.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Alternative strategies may include investments in private equity, private credit, private real estate and infrastructure, which may involve additional risks such as lack of liquidity and concentrated ownership. These types of investments may result in greater fluctuation in the value of a portfolio. Private Market investments are exposed to risk, which is the risk that a counterpart is unable to deal with counter party its obligations. Changes in interest rates, rental yields and general economic conditions may result in fluctuations in the value of any underlying strategies. These types of strategies may carry a significant risk of capital loss and other market risks.