Considerations for investing in global real estate

Many investors are familiar with the appeal of holding real estate. With a generally low correlation to other asset classes1, it can serve as an instant diversifier in a mixed-asset portfolio. Historically, real estate has delivered strong relative performance across multiple cycles compared to other asset classes, and its characteristic stable income, underpinned by long-term leases, makes it a compelling alternative to traditional fixed-income instruments. Investors continue to allocate to alternative investments. Despite interest rate hikes and decelerating deal flows cooling the real estate market in H1 2023, real estate fundraising momentum remained steady through Q2 2023. Value-add strategies are currently the most popular amongst investors, looking to take advantage of market dislocation2.

Real estate investors around the world have tended to be domestically focused, but many are now investing across global real estate markets. Large institutional investors and sovereign wealth funds have been at the forefront of the shift to global real estate investment, driven by the generally stable income component and the potential for diversification benefits, risk reduction, and return enhancement. Likewise, a lack of domestic investment opportunities has played a role in investors’ increasing appetite for an international portfolio as a way to broaden their opportunity set (Figure 1).

Assessing the global real estate market and the different means of gaining exposure through listed, unlisted, equity, and debt vehicles can be a daunting task. Investors must assess various factors before making an allocation, including the impact of currency fluctuations and foreign tax laws. They must also assess their own internal capabilities for evaluating such an allocation.

Figure 1: Why real estate?

Investors have different motivations for considering global real estate

Key considerations

Source: Invesco Real Estate as of October 2023.

A note on current market conditions as of Q4 2023

While the purpose of this note is to summarise the longer-term strategic considerations for investing in global real estate, some reference does need to be made to the more immediate market conditions in which we currently operate.

Investment Context and Outlook

At the time of writing, global inflationary pressures have started to abate. Financial markets have shifted from questioning how high key interest rates need to go, and are now debating how long they will remain elevated. The US success, at least to date, in starting to curb inflation without driving unemployment higher is supporting consensus expectations of a ‘soft landing’, although current risks remain weighted to the downside due largely to credit tightening. Current market expectations for the Eurozone overall are similarly for a period of low but positive GDP growth. Meanwhile economic growth expectations in AsiaPac remain higher than the other regions, though at lower levels than historically seen.

After a 1.1% total return in 2022, the MSCI GPFI (natural weight in US$) declined 3.6% in H1 2023, with performance weakest in North America. In contrast, developed market listed real estate saw a 1.0% total return in H1 2023 (FTSE EPRA Nareit Developed index in US$). With price discovery still ongoing in direct markets and limited liquidity, quarterly variations likely reflect timing differences rather than the relative outlook for each region. Further pressure on fundamentals and pricing will widen the window to capture value and/or stressed opportunities.

Global Real Estate Market Outlook

From prior expectations of interest rates rapidly reducing from peak levels, financial markets are now shifting to the realisation that rates will need to remain elevated for longer. Consensus is for a ‘soft landing’ in the US and Eurozone. The focus for real estate is around the longer-term interest rate outlook, particularly regarding the impact on exit cap rates 5-10 years out. While nearer term rate expectations have been volatile, longer-term interest rates have shifted upwards as financial markets price in higher-for-longer rates, essentially reducing yield curve inversion by raising the long end rather than reducing the short end.

Global GDP growth has slowed significantly in 2023 and is expected to remain low, albeit positive, for most major markets in 2024, though with risks to the downside. For real estate, while the combination of weak growth and cautious sentiment is likely to dampen some occupational demand, occupier fundamentals should remain healthy for markets without excess supply. We note however that we are seeing clear fundamental weakness in markets with excess supply. While asset values continue to reprice, banks are focused on existing loan books and so offer limited new liquidity, thereby impacting the volume of real estate transactions in all key markets.

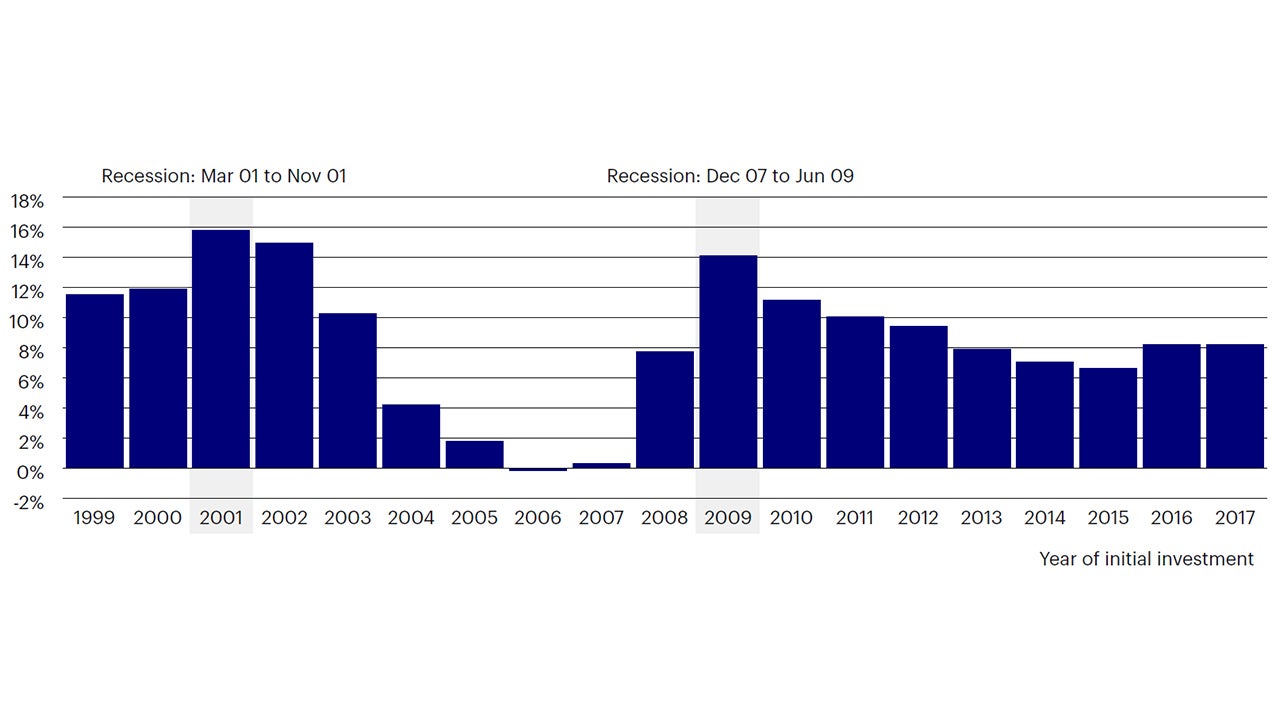

Taking advantage of cyclicality

At the time of writing, real estate liquidity remains constrained. Combined with valuation corrections, this is presenting opportunities to secure assets which meet our long-term investment convictions. Real estate investors historically benefited from outsized returns after market corrections. Figure 2 below shows the US NCREIF Property Index at different times by year of first investment, and a similar pattern is evident when looking at five-year forward look returns in the other regions.

Based on data from NCREIF NPI, all property types, investment returns calculated from Q1 following calendar year of investment. Source: Invesco Real Estate using data from NCREIF as of April 2023

Investment options in global real estate

Real estate as an asset class can be invested in through both equity and debt positions, and through listed or unlisted vehicles. In recent years, the potential paths to invest in real estate have become more varied; while global public real estate markets have long been accessible to investors, more recent industry fund launches now offer access to global unlisted real estate. Prior to that, unlisted real estate was accessible primarily through closed-end, higher-return strategies or through management-intensive direct ownership. This enhancement to the composition of available investment vehicles in the industry is providing investors with greater opportunities for diversification by adding unlisted global real estate to their portfolios.

It is noteworthy that while listed and unlisted real estate tend to have similar characteristics in the long term, they have varying characteristics in the short term, driven in large part by the liquidity component of each. Listed real estate offers daily liquidity, but this comes with higher volatility, whereas unlisted real estate generally offers only periodic liquidity, which underscores generally greater stability under normal market conditions (Figure 3). This is beginning to change. Increasingly, a range of unlisted vehicles is evolving that provides greater liquidity than the traditional closed-end and open-ended funds, often through a blend of direct and listed real estate.

In addition to choosing an investment vehicle, various real estate strategies exist across the risk-return spectrum that may warrant consideration depending on an investor’s goals and risk tolerance. The options include core, core plus, value-add and opportunistic approaches.

Core assets are generally stable, cash-flow producing assets with stable occupancy, while opportunistic assets represent the riskiest real estate approach, wherein investors look to achieve higher returns by tackling assets with structural or financial obstacles.

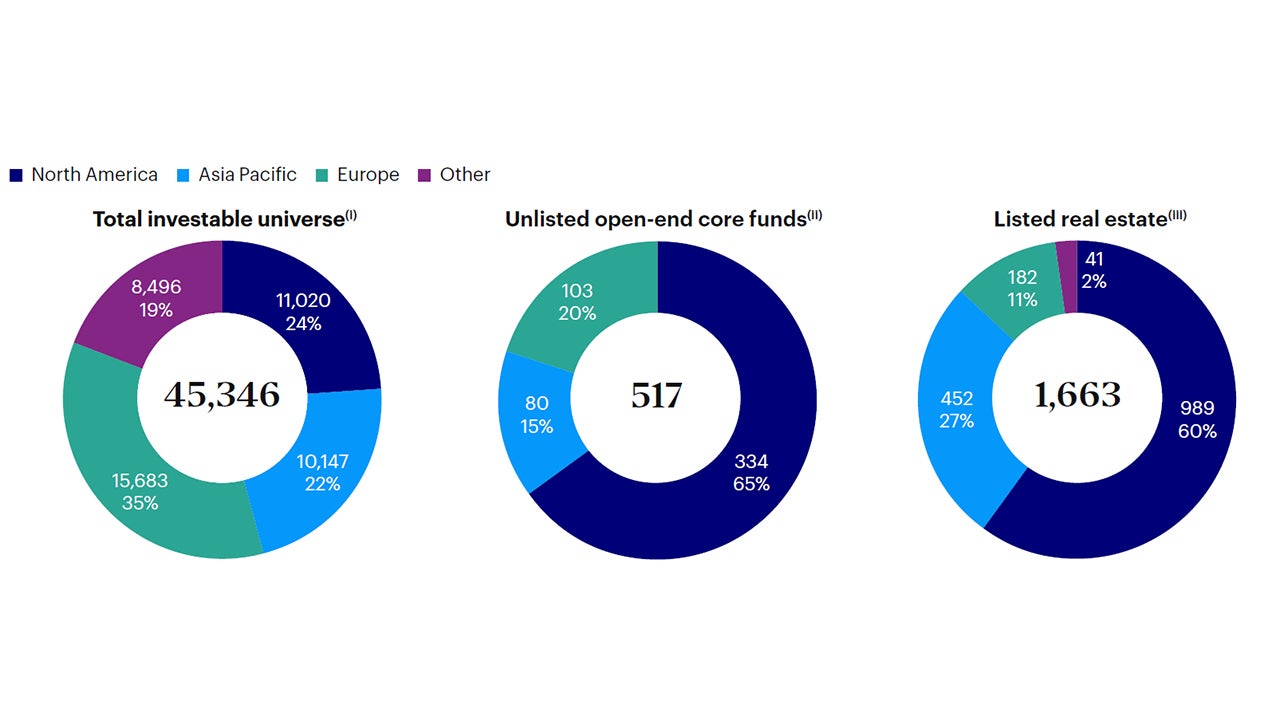

While it is likely that an institutional investor may pursue a combination of real estate approaches to achieve their performance objectives, in this paper our focus is on equity positions largely within private real estate, as unlisted real estate represents the largest share of the estimated global investable universe, while listed indices represent less than 5% of the universe based on their market capitalisation (Figure 4).

Global interest in real estate has continued to increase in recent years as investors seek yield amidst the ultra-low interest rate environment. Even though government bond yields have started to show modest increases, it seems likely that interest rates will remain moderate over the long term.

Figure 3: Comparison of listed and unlisted real estate

| Listed (Public) Real Estate | Unlisted (Private) Real Estate | |

| Return | Broadly similar returns over the long term (see Figure 5) | |

| Risk (Volatility) | More volatile | Less volatile |

| Liquidity | Very liquid | Less liquid |

| Diversification benefit | Moderate but not as large as private real estate | Substantial over the long term |

| Investment horizon | Flexible | Generally longer term |

| Availability of information | Readily available, real-time transaction based | Improving but less readily available, mainly appraisalbased |

| Timeliness of information | Daily | Quarterly (or monthly in selected countries) |

Sources: Invesco Real Estate, Bloomberg L.P. and FTSE International Limited (FTSE) © 2023.

Sources: Invesco Real Estate based on data from PWC market size report, MSCI Global Quarterly Property Fund Index, and FTSE EPRA/NAREIT Global Real Estate Index as of March 2023.

Depth and liquidity issues

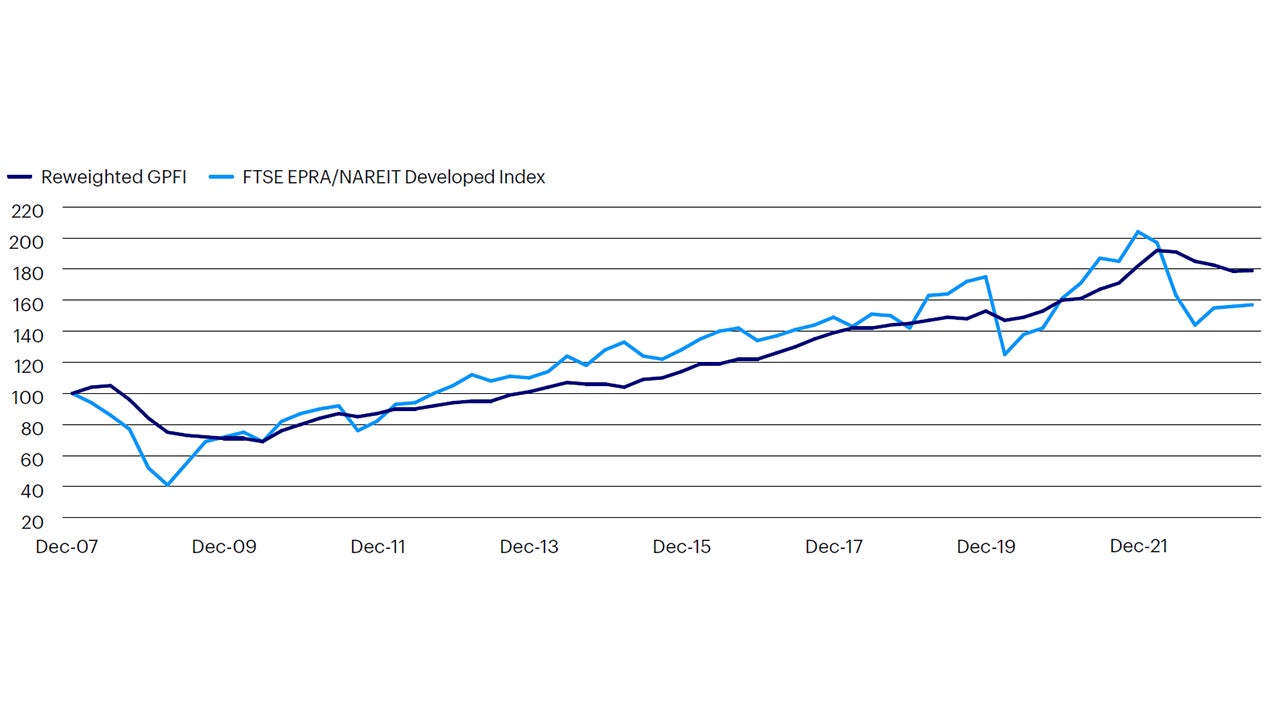

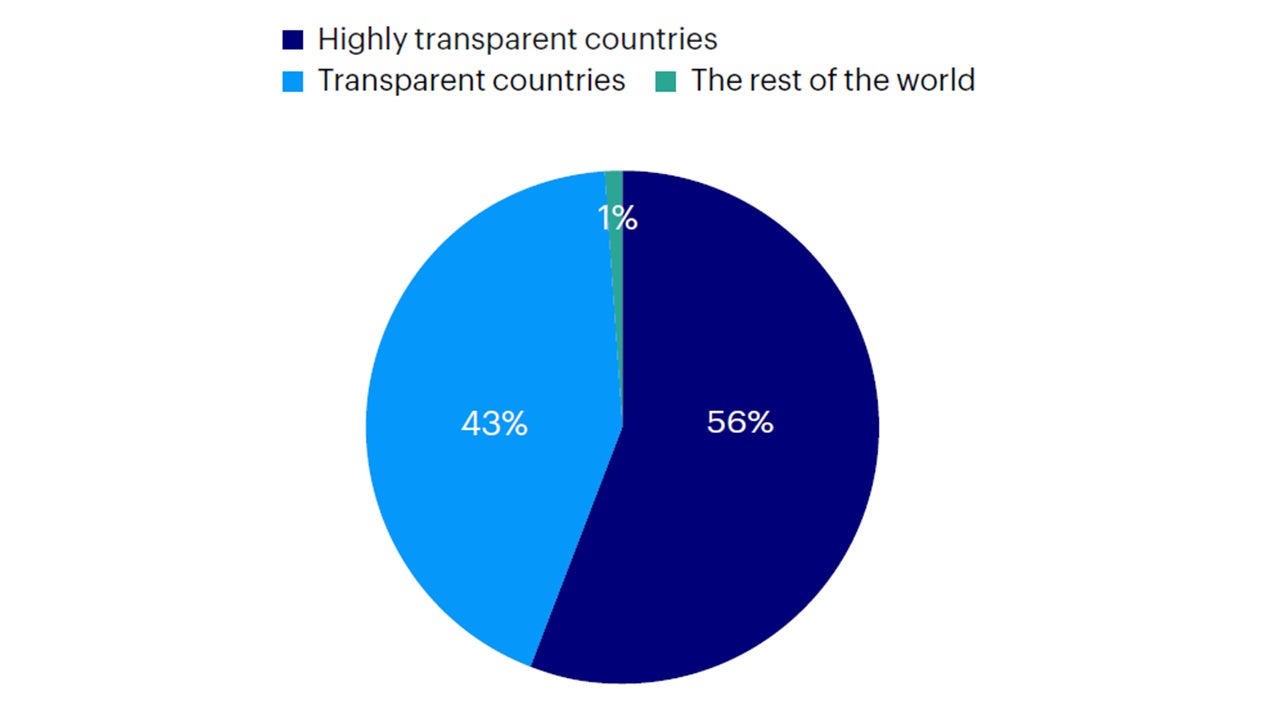

While listed and unlisted real estate assets perform somewhat similarly, they bring different qualities to a portfolio (Figure 5). Unlisted assets are less volatile, while listed real estate offers greater liquidity. Going global can open additional investment opportunities to access quality real estate investments. The majority of all commercial property transactions, as reported by Real Capital Analytics, take place in 34 Transparent and Highly Transparent markets (Figure 6). As such, it is not surprising that many investors around the world are looking abroad to source real estate deal flow.

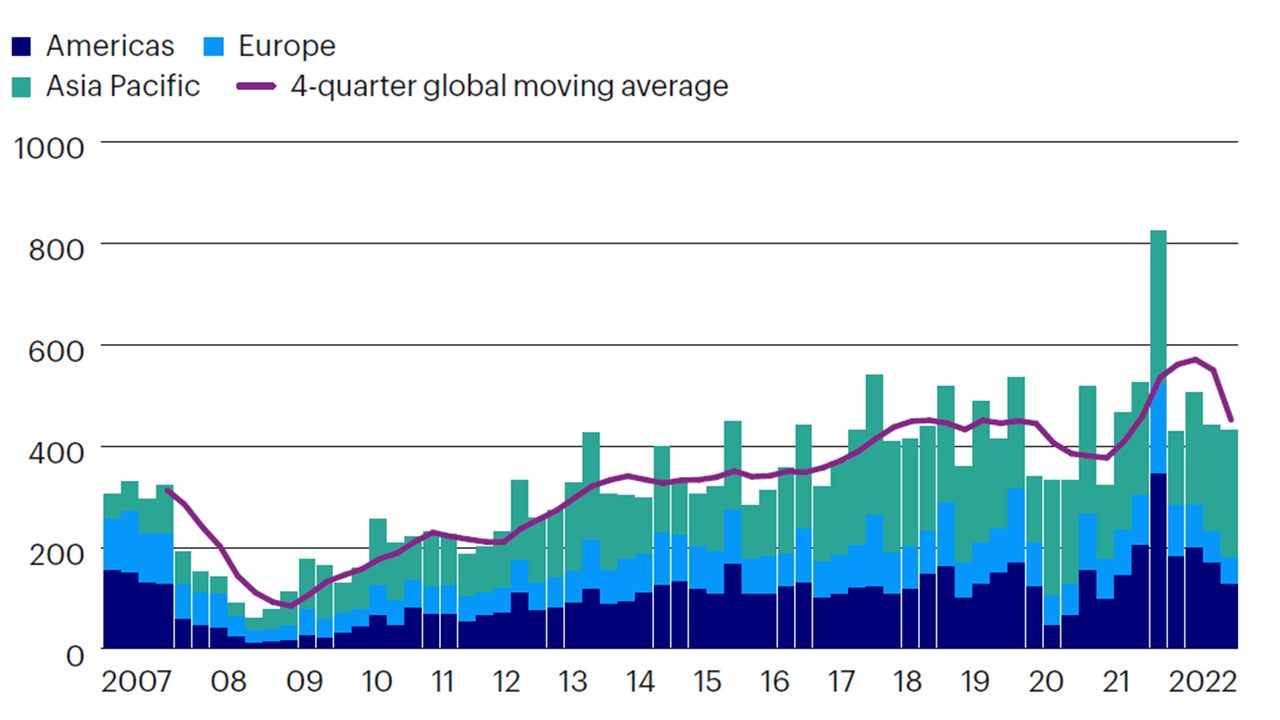

This elevated external focus has spurred growth in transaction volumes globally. According to Real Capital Analytics, global quarterly transaction volumes have ranged from US$129 billion to US$822 billion since 2010 (Figure 7). In 2021, property transactions totaled US$2.1 trillion, an increase of 40.7% year over year. Property transactions subsequently fell in 2022 to US$1.8 trillion, a 15.6% decrease year over year.3

Figure 5: Listed and unlisted real estate performance

Unlisted global real estate performance 2007-2023 Q2, December 2007=100

Note: All returns shown in USD.

Source: Invesco Real Estate based on data from MSCI Global Quarterly Property Fund Index and Macrobond as of June 30, 2023. “Reweighted GPFI” refers to the MSCI Global Quarterly Property Fund Index (GPFI) reweighted to 25% Asia Pacific, 25% Europe and 50% North America. Past performance is not a guide to future returns.

Source: Invesco Real Estate using data from JLL Transparency Index 2022 and Real Capital Analytics as of October 2023.

Figure 7: All property transaction volume 2007-22

US$ billions, quarterly

The figure relates to direct transactions involving all property types including land. Source: Invesco Real Estate based on data from Real Capital Analytics as of December 2022.

Diversification

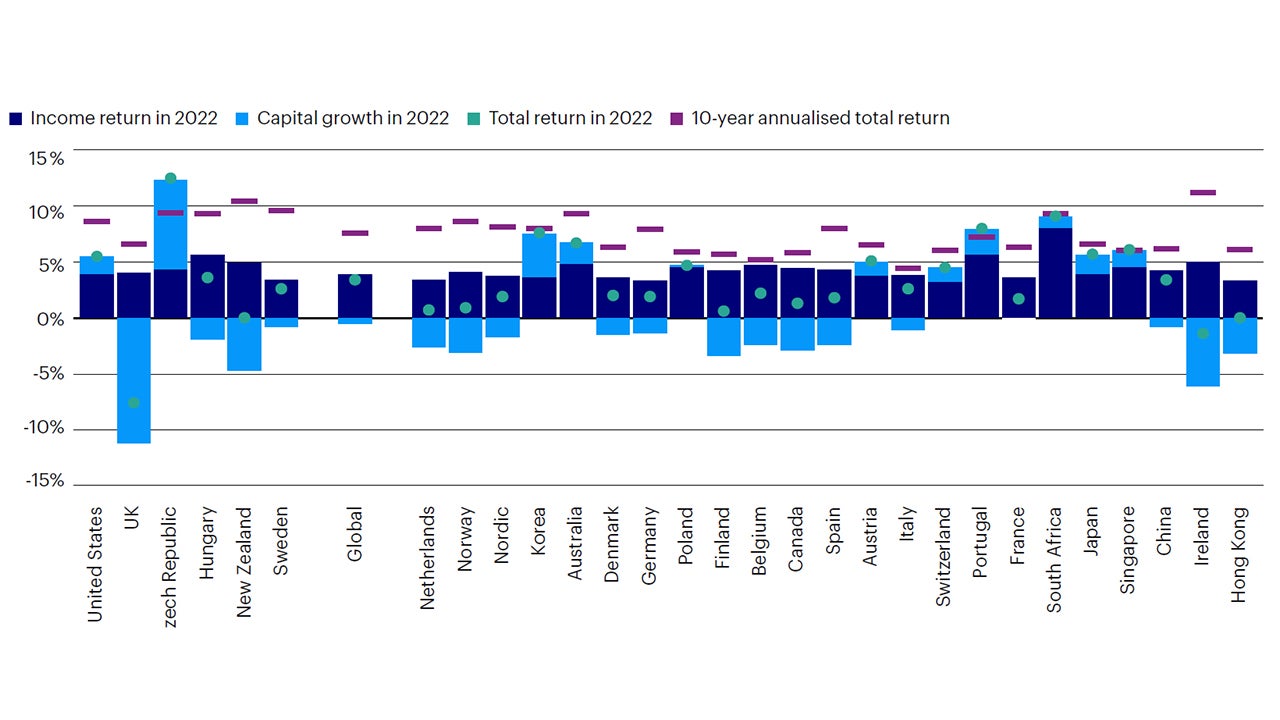

Investors’ appetite for real estate is spurred in part by the asset class’s generally stable income component. Across the globe, income returns as a share of private real estate total returns are generally quite high (Figure 8). Except for a few high-growth markets such as Hong Kong, annualised total returns are driven primarily by income.

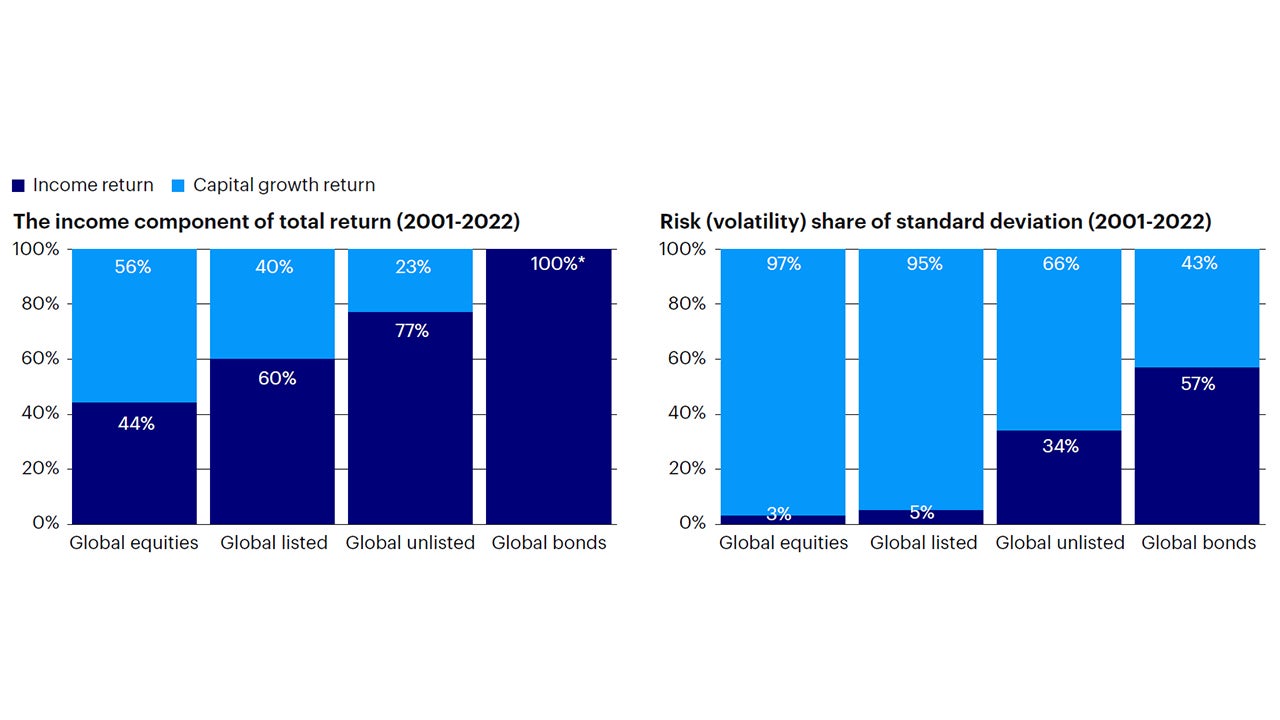

Furthermore, when considered as part of a mixed-asset portfolio, the income return from real estate, both public and private, becomes even more compelling. Over the period 2001-22, global equities derived 44% of their total return from income, with 56% from capital appreciation. That 56% from appreciation was responsible for 97% of equities’ total return volatility (Figure 9). By comparison, for real estate globally, income contributed a greater share of total return (60% for listed and 77% for unlisted real estate) and was only modestly responsible for the volatility of returns (Figure 9). This suggests that a portfolio that adds global real estate may diminish risk through lower volatility.

Sources: Invesco Real Estate using data from MSCI as of May 2023. Past performance is not a guarantee of future results.

Source: Invesco Real Estate based on data from MSCI, Bloomberg L.P. and Macrobond as of May 2023. * Global bonds over the period delivered a -18% capital growth return.