Climate change impacts enhance the case for real assets

In the recent paper, “How to make climate-aware adjustments to Capital market Assumptions”, we noted the challenges long-term investors face with respect to climate change. Regardless of the level of intervention, we are confident that costs will be imposed on corporations, governments, and broader economies to prevent or delay climate change. It is our view that this will impact portfolio returns, and necessarily the attractiveness of certain asset classes.

The climate-aware adjustments in the paper were constructed using our Long-Term Capital Market Assumptions, which we use to forecast long-term asset class returns. Leveraging multiple resources, such as studies taken from the “Network for Greening the Financial System” and security level data from data analytics provider Planetrics, we made multiple modifications to our asset class forecasts to account for climate change – with a particular focus on inflation risk.

We expect a higher level of inflation going forward as a result of climate change impacts, particularly given the influence this is likely to have on energy prices and overall demand. We are predicting a 1% increase in global inflation annually over a 10-year period. This puts overall inflation at around 3%, up from 2% before making these climate adjustments. This increase is significant and could impact the way investors think about asset allocation. While much of the current conversation revolves around the near-term path of inflation, the long-term landing point of inflation can change investor preferences over a full market cycle and potentially longer.

One area of interest, which we believe now has an increasingly strategic place in portfolios, is real assets. The inflation mitigation potential of real assets, particularly in an environment where longer-term inflation is expected to be considerably higher than it was in the last decade, can be deployed to meet more challenging investor outcomes of securing real returns and maintaining purchasing power.

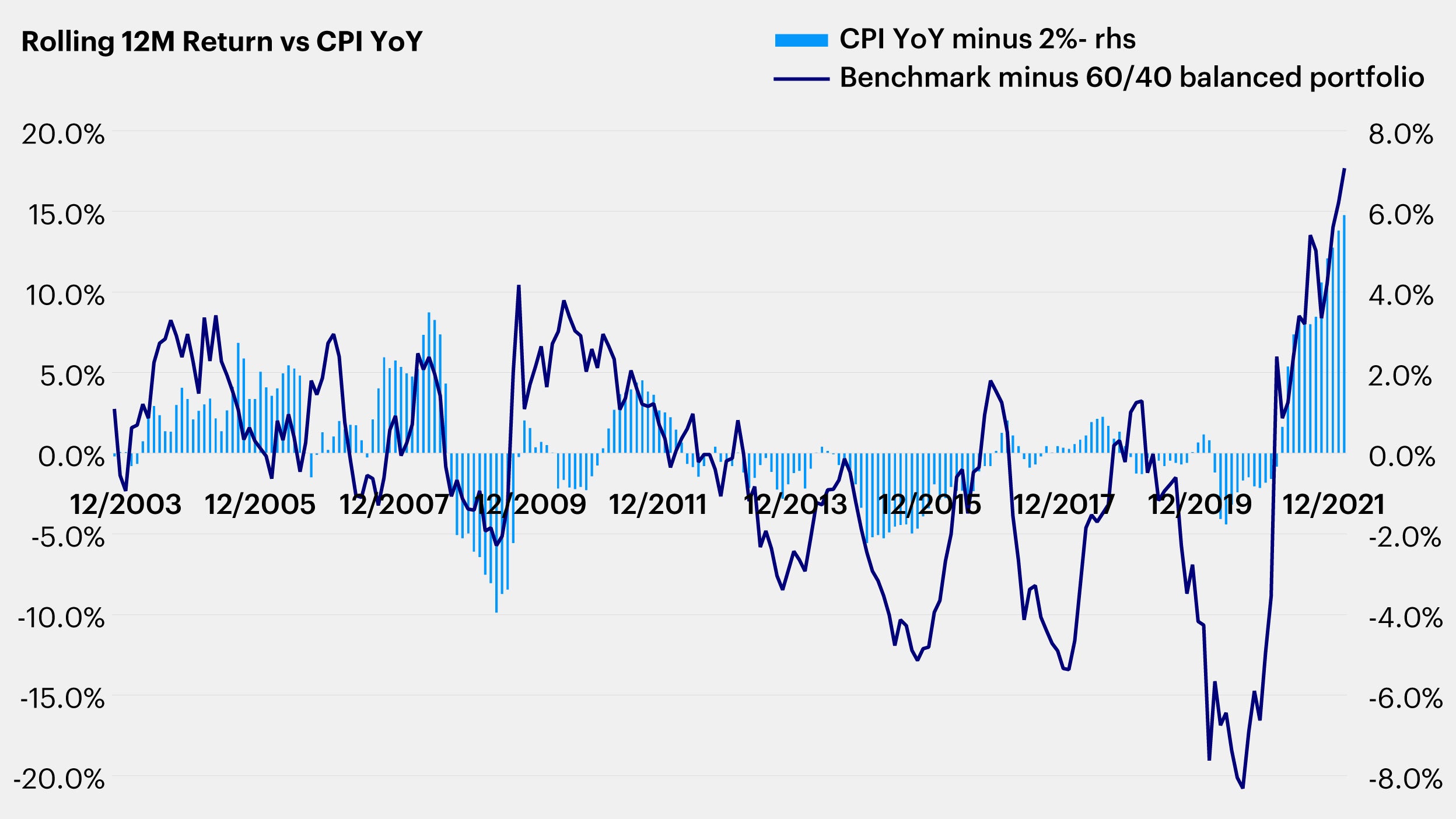

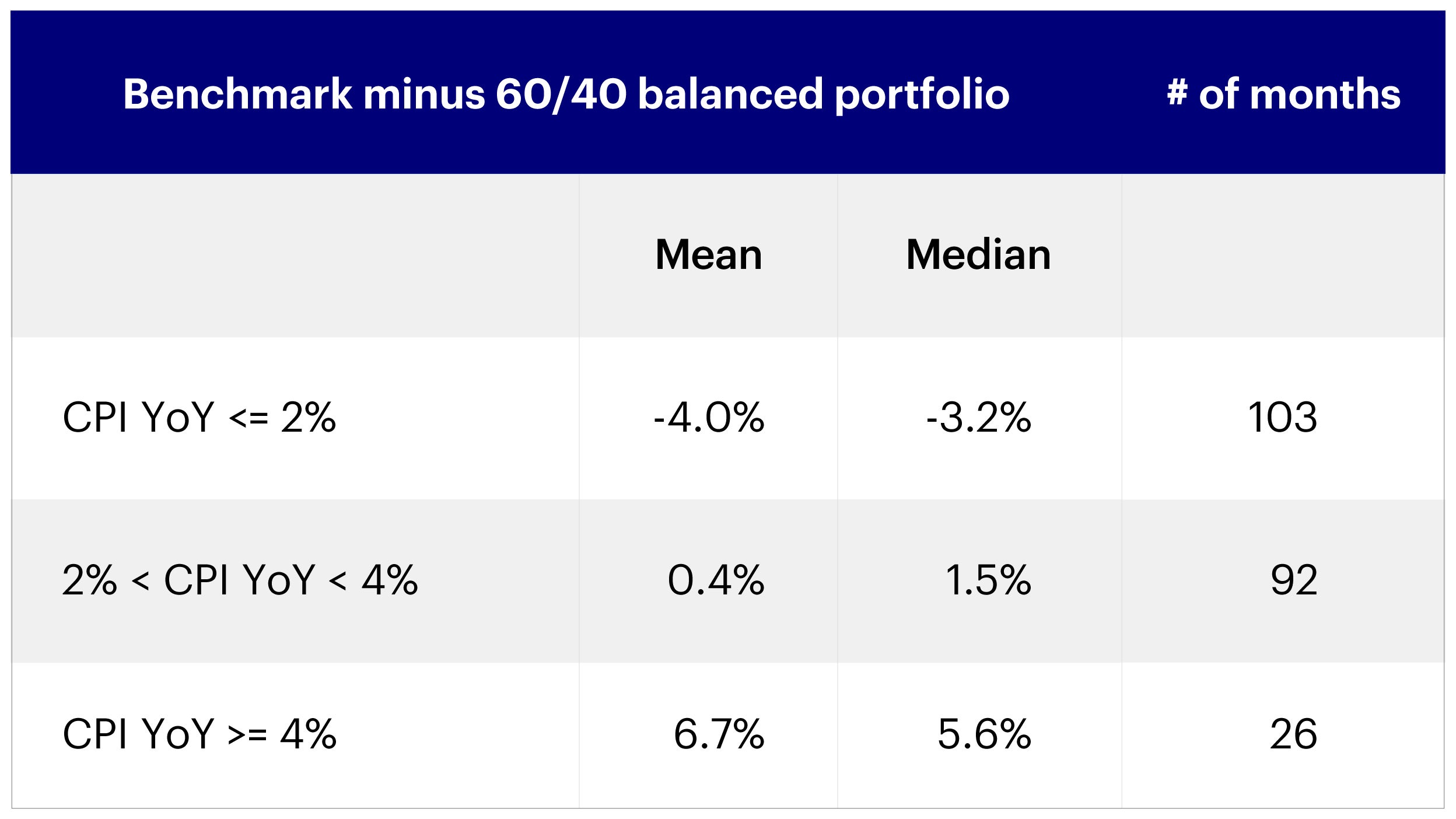

Based on historical analysis, we’ve found that a diversified real asset portfolio with an equally weighted mix of TIPs (Treasury Inflation-Protected Securities), listed infrastructure, real estate securities, and commodities outperformed a traditional 60/40 portfolio when inflation remained above 2% (Figure 1). Given our long-term view of inflation risk arising from our climate-adjusted CMAs, we view real assets as an essential component of investor portfolios.

*Benchmark comprises of 20% FTSE EPRA/NAREIT Developed Index, 13.3% Dow Jones Brookfield Global Infrastructure Index, 16.7% Bloomberg Cmdty Index, 16.7% Morningstar MLP Composite Total Return Index, and 33.3% BAML US Inflation-Linked Treasury (1-5 Y) Index; 60/40 balanced portfolio comprises of 60% MSCI ACWI + 40% US Agg.

Source: Invesco, as of Dec 31, 2021. Simulated past performance is not a guide to future returns. It is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities or investment advisory services and does not constitute a recommendation of the suitability of any investment strategy or investment advice. Real assets carry certain risks and challenges and may not be suitable for all investors. Not for further distribution.

*Benchmark comprises of 20% FTSE EPRA/NAREIT Developed Index, 13.3% Dow Jones Brookfield Global Infrastructure Index, 16.7% Bloomberg Cmdty Index, 16.7% Morningstar MLP Composite Total Return Index, and 33.3% BAML US Inflation-Linked Treasury (1-5 Y) Index; 60/40 balanced portfolio comprises of 60% MSCI ACWI + 40% US Agg.

Source: Invesco, as of Dec 31, 2021. Simulated past performance is not a guide to future returns. An investment cannot be made directly into an index. It is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities or investment advisory services and does not constitute a recommendation of the suitability of any investment strategy or investment advice. Real assets carry certain risks and challenges and may not be suitable for all investors. Not for further distribution.

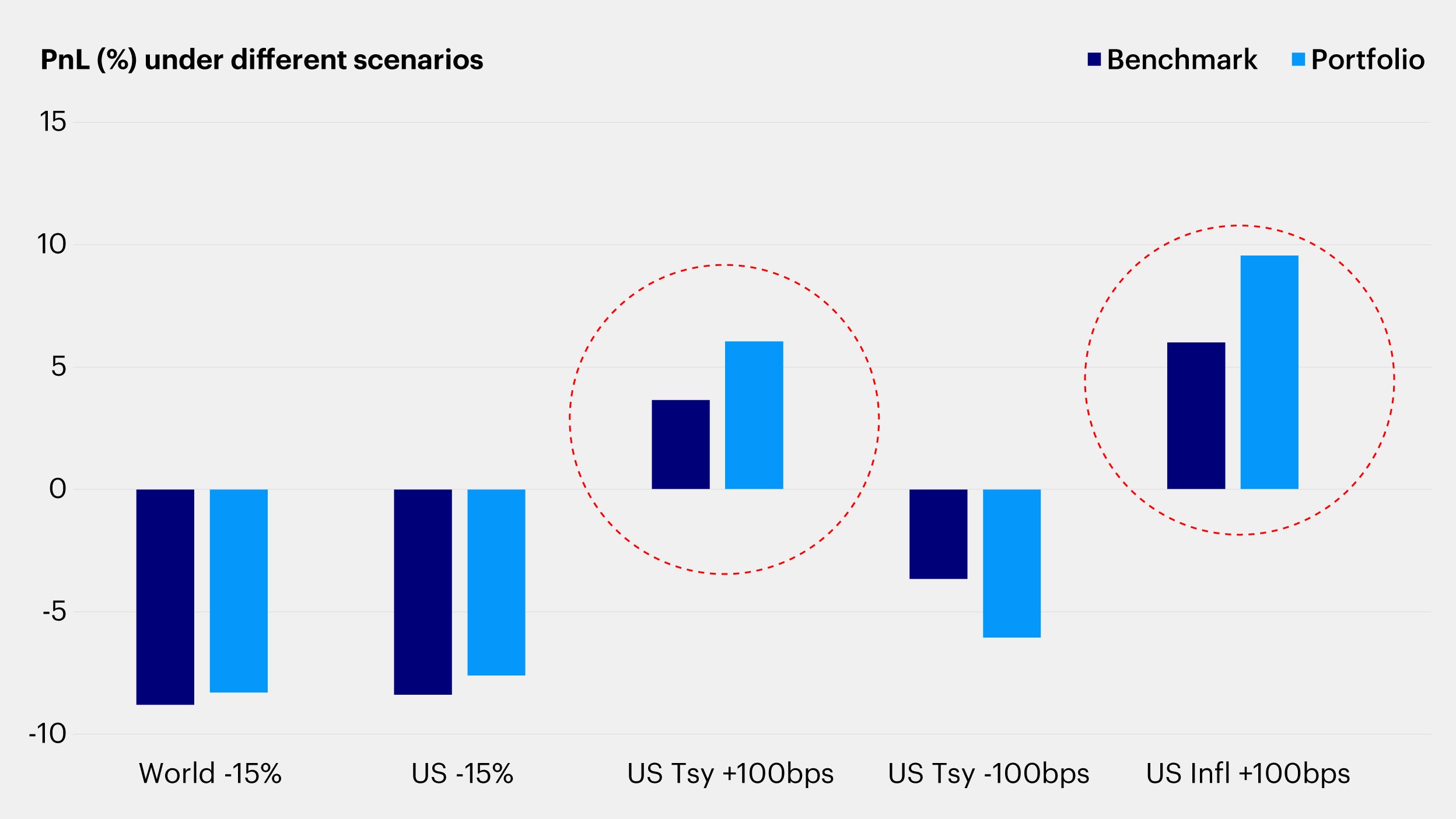

We have also considered additional stress testing using our Invesco Vision platform. Using factor-based analytics, we found that a portfolio of diversified real assets tends to have both defensive properties in a market downturn and diversification advantages in rising rate or rising inflation scenarios.

Source: Invesco, for illustrative purposes only. Risk is based on the BarraOne Mac Risk Model. Forward-looking CMAs used in this analysis as of 31 Mar 2022. All CMAs are subject to change given market fluctuations. Past performance is not a guarantee of future results. Currency in USD. There is no guarantee expected returns can be achieved.

We think impacts from climate change will have meaningful effect on the Asia Pacific region, with inflation expectations rising across both developed and developing economies. Our expectation is that regional inflation could be 1 to 2% higher going forward, potentially impacting investor asset allocation profiles and demand for real return generating assets. Given much of the inflation increase would be driven by commodity input prices, Asian economies that rely heavily on imports of these products could be more exposed to inflation than those that are more self-sufficient.

In sum, we believe climate change and the subsequent impact it is having and will continue to have on corporations, governments, and overall economies is dramatically changing the investment decision-making landscape. As part of this shift, the relevance of real assets in diversified portfolios can help investors drive key investment outcomes, particularly the achievement of real returns.