China rental housing: Capturing the growing opportunities

The rise of China’s rental housing market

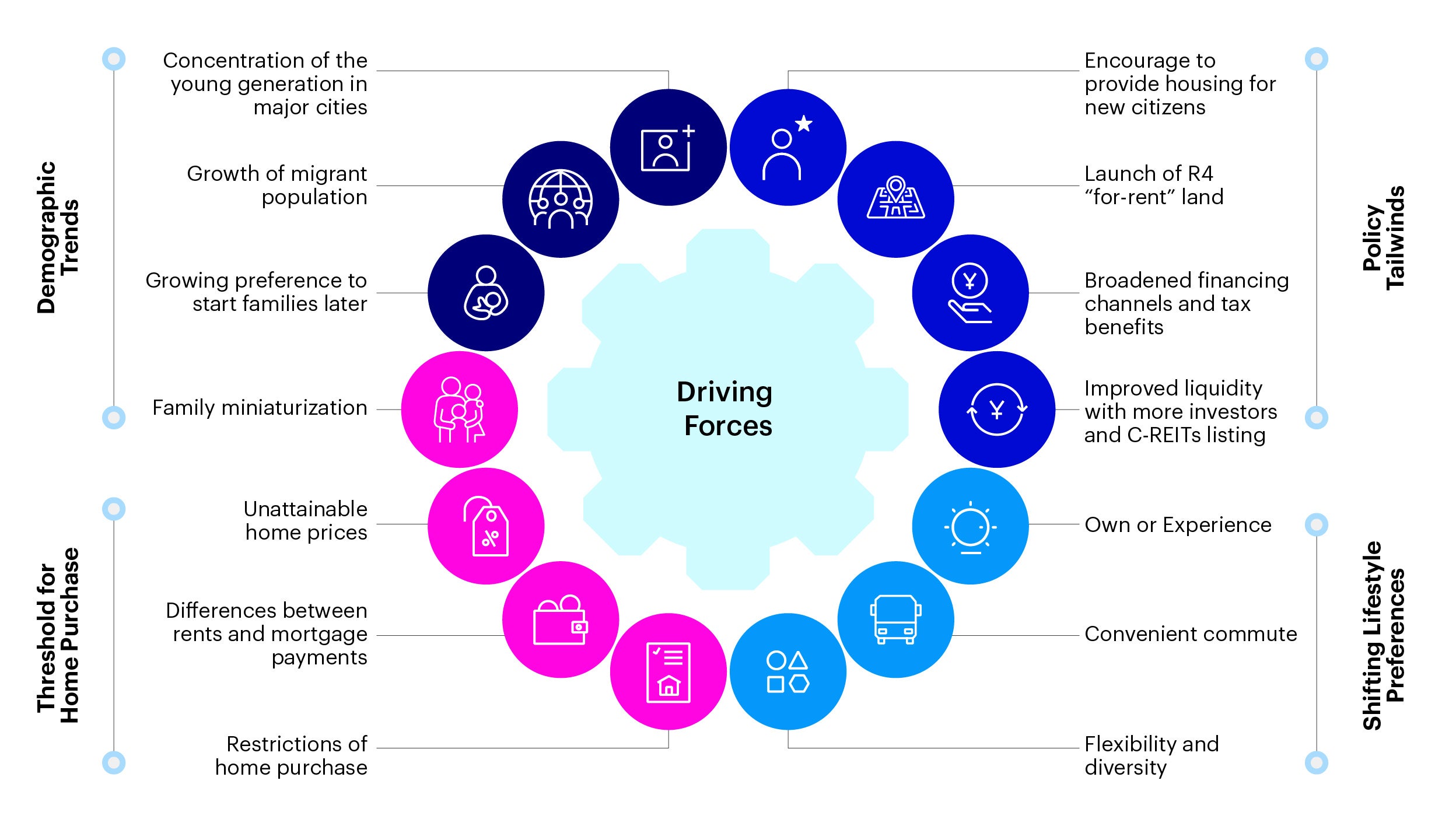

The rental housing market in China has transformed significantly over the past few decades. Historically, homeownership was seen as a symbol of financial stability and success. However, in recent years there has been an attitude shift among the younger generation, who prioritize mobility, cash flow preservation, and quality of life over the long-term commitment of owning properties. Several factors are driving this change including the property market downturn, high cost of real estate in major Chinese cities, the desire for career mobility, and a broader redefinition of wealth and success.

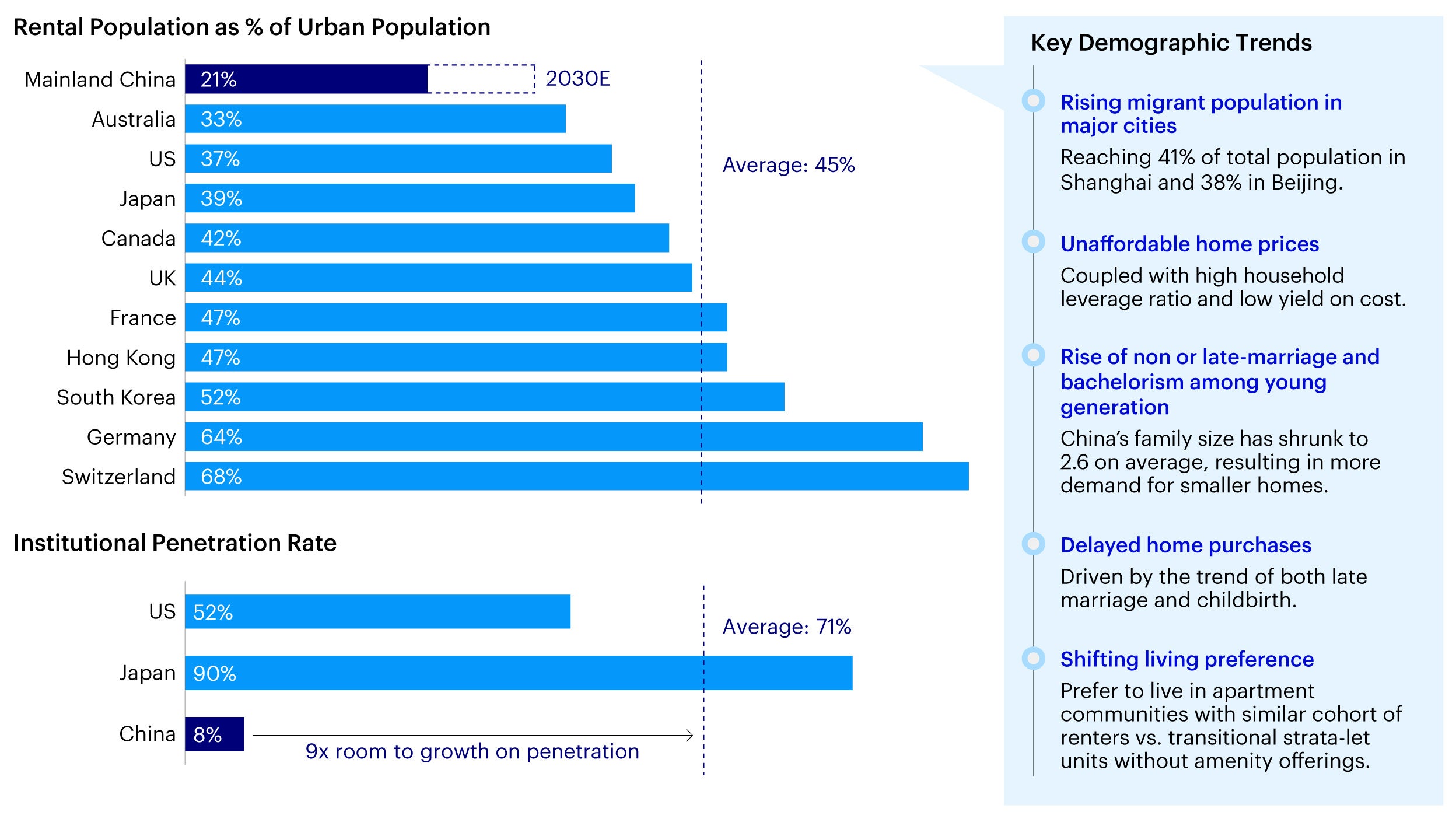

In 2020, China’s rental population reached nearly 200 million, with about 47.3% of residents in top-tier cities like Beijing, Shanghai, Guangzhou, and Shenzhen opting to rent rather than buy.1 This trend has continued in recent years, supported by government policies aimed at promoting a balanced housing market, ensuring equal rights for renters and homeowners, and stabilizing urban housing conditions.

Source: JLL Research, September 2023.

Current market conditions and latest policy developments

The Chinese property market has been experiencing a downcycle in recent years. Since early 2024, the government has introduced various stimulus measures. However, liquidity-focused initiatives aimed at encouraging household borrowing have largely been ineffective due to low confidence in future income and economic uncertainties.

With further policy support on both supply and demand sides, there are emerging signs of property market stabilization. Consequently, some end-user demand for home purchases may return in the medium term, potentially weakening the leasing demand. However, due to affordability concerns, mobility preferences, and a focus on cash flow preservation, a vast proportion of the younger generation is expected to remain cautious to purchase homes. As of February 2025, occupancies for institutionally managed rental housing in Beijing and Shanghai remained around 90%2, indicating solid demand for professionally managed rental housing.

From a liquidity standpoint, favorable policies continue to drive institutional investors’ interest in this sector. Over the past few years, the rental housing market has seen a rise in en-bloc transactions and enhanced liquidity, involving both domestic and foreign participants, with strategies ranging from core to value-add. In July 2024, market-oriented rental housing was newly included as an eligible asset for C-REITs, further diversifying exit strategies for rental housing assets in China. In 2024, rental housing REIT price index witnessed an increase of 31% and it is the only sector with compressing cap rates that we have observed.3 These policies have supported the sector’s growth by enhancing institutional investor interest and providing more exit options.

Opportunities in the China rental housing market

Despite macroeconomic headwinds and China’s economic slowdown, rental housing is also viewed as the most anti-cyclical and defensive asset class, providing outperforming return profile with a low vacancy rate and steady rental growth.

Source: CRIC, CREIS, CBRE Research, JLL Research, National Bureau of Statistics of China, Chinese Academy of Social Sciences.

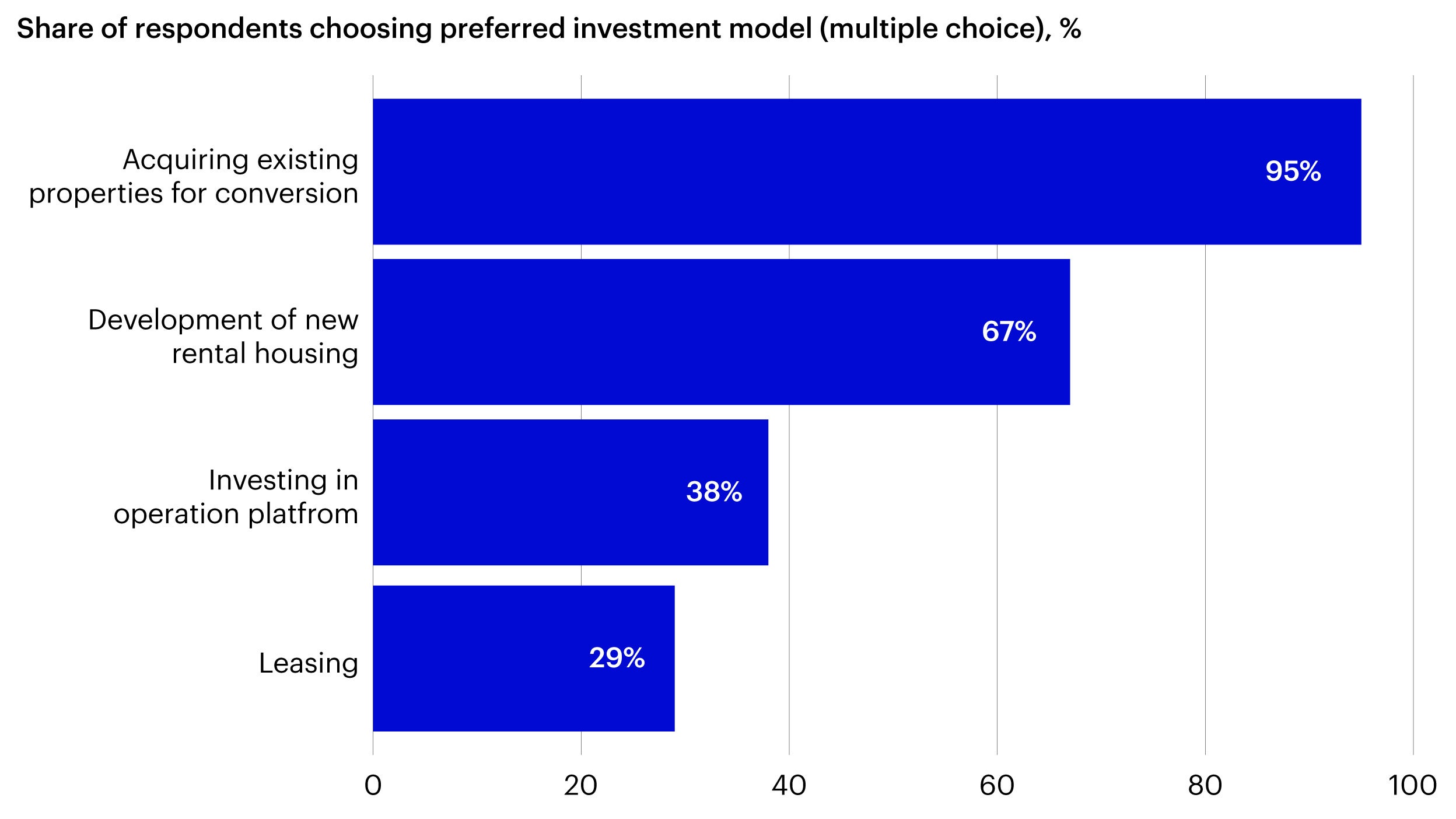

These market trends have led institutional investors to invest either directly into Chinese rental projects or partner with Chinese developers and operators to access this growing sector. Some investors have also established their own brands and operating platforms whilst making these asset-heavy investments.4

Source: JLL China Rental Housing Investment Sentiments Survey 2023.

As China’s rental housing market expands with more market participants, it is crucial to enhance market access channels and operational expertise to differentiate from homogeneous product offerings. We outline several investment approaches to unlock rental housing opportunities under the current market conditions in China.

1. Creation of purpose-built assets

Experienced operators can create purpose-built rental assets through forward purchases. This involves designing customized products at the greenfield stage with strong credit developers, typically sourced off-market by providing exit solutions for non-residential portions to those developers. This strategy ensures that the assets are tailored to meet specific local market demands with high-quality deliverable standards.

2. Repositioning of underperforming assets

While purpose-built products are preferred by investors, these are challenging to execute due to the lack of pricing transparency, knowledge of product specifications, and the need for advanced engagement with developers. Consequently, a conversion strategy is also attractive for rental housing investors to reposition and redevelop underperforming office spaces or budget hotels to unlock potential asset value. These deals, though smaller, can offer attractive returns due to discounted acquisition prices and thus capture market pricing inefficiencies.5

3. Consolidation of stabilized assets

The consolidation of core or core-plus portfolio opportunities is another key focus for investors accessing this sector. Private equity real estate funds that invested in the last cycle are now seeking liquidity, presenting opportunities for investors to consolidate their assets under management and integrate some new operator managers. By leveraging renovation and operation capabilities, companies can aim to enhance operational efficiency and the improve return profiles of their investments.

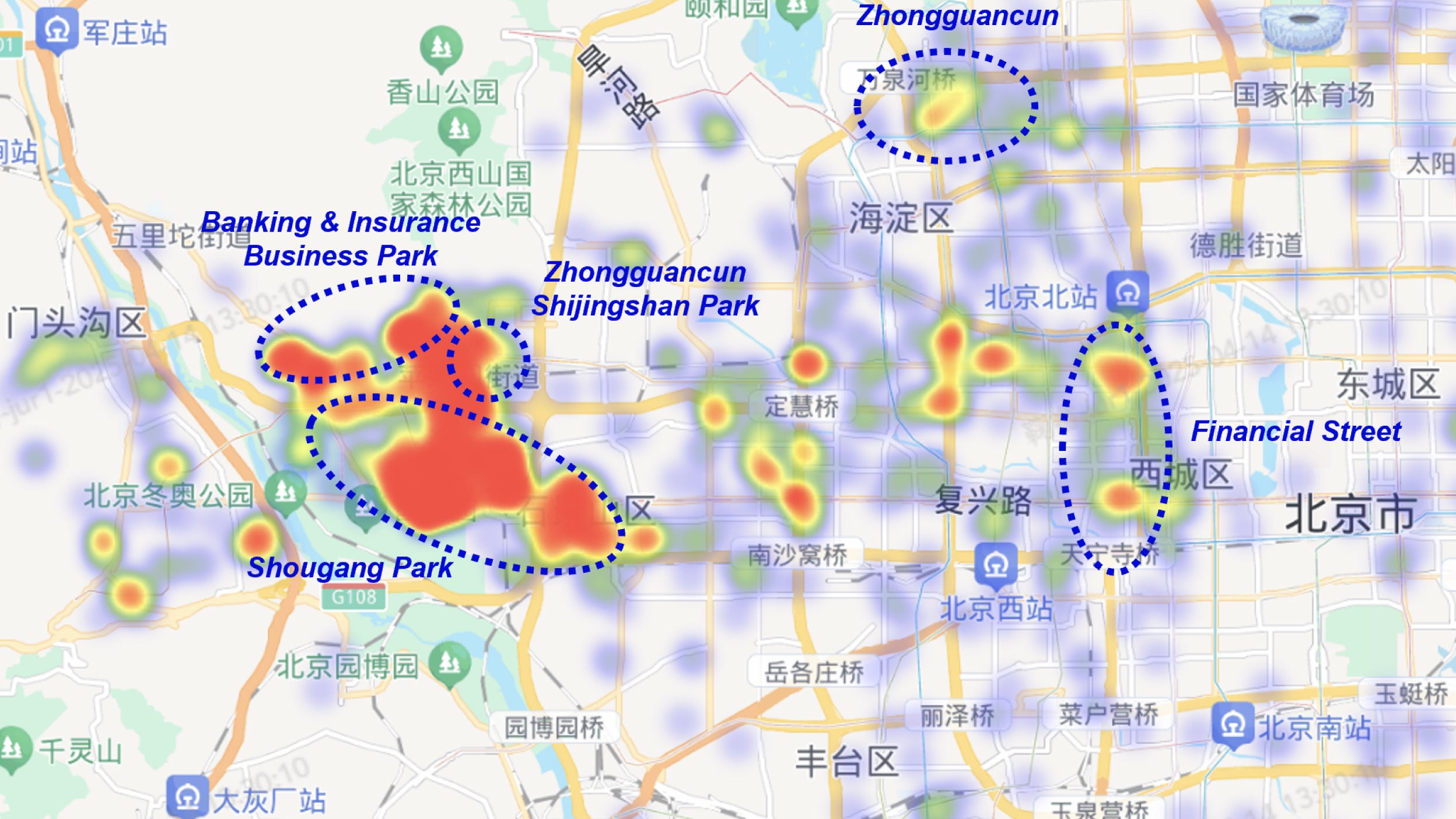

4. Use of technology and big data to enhancing product offerings and operational efficiency

Technology plays a crucial role for rental housing investors engaging in project underwriting, product design, and day-to-day management. During the acquisition stage, extensive databases and tools, combined with investment expertise, ensure precise and efficient project evaluations. In terms of product design, newer rental housing projects feature comprehensive smart home systems, including central control panels for home appliances such as smart lighting, intelligent door locks, smart air conditioning, and remote-control systems. Daily management is enhanced by advanced operation systems, which include automated lease and utility bill management, real-time monitoring of equipment energy consumption, and AI integration for streamlined operations.

Case Study: Invesco and Ziroom joint venture

In late February, Invesco Real Estate announced a joint venture with apartment management platform Ziroom called Izara Holdings to invest in and operate rental housing in China. This collaboration aims to fill a market void by providing modern and affordable rental accommodation in primary cities like Shanghai and Beijing by combining Invesco’s investment expertise with Ziroom’s operational capabilities6 The joint venture is set to launch with an approximately 1,500-room development in Beijing, to be completed in 2027.7 Market analysis using proprietary database was conducted to have a comprehensive understanding of the market landscape and competition, in order to formulate the most optimal pricing strategy and product positioning.

Source: Invesco, for illustrative purposes only. Note: Photographs are included for illustrative purposes only and are used with permission, do not constitute investment advice or a recommendation. There can be no assurance that stated objectives will be realized. Past performance is not a guide to future results.

Source: Ziroom Inc., analysis by IRE team as of February 2025, for illustrative purposes only. Note: Data represents each potential customer in Beijing who searched for apartment located within 3km radius of Beijing project using Ziroom app and website. Photographs are included for illustrative purposes only and are used with permission, do not constitute investment advice or a recommendation. There can be no assurance that stated objectives will be realized. Past performance is not a guide to future results.

Conclusion

China’s rental housing market presents significant long term opportunities for investors, driven by supportive government policies, changing lifestyle preferences, and technological adoption. The joint venture between Invesco and Ziroom is one example of the potential for strategic collaborations to enhance market efficiency and provide high-quality rental housing solutions. As China’s rental market continues to evolve, it offers promising prospects for sustainable growth and potentially attractive investment returns.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer’s opinion and may not be realised. Past performance does not predict future returns.

Footnotes

-

1

2024 report on rental housing development in major cities of China, November 2024, China Academy of Urban Planning and Design (CAUPD).

-

2

Source: CREIS, March 2025.

-

3

WIND and China Credit Trust as of Dec 31, 2024.

-

4

2023 China Rental Housing Market, December 2023, https://www.joneslanglasalle.com.cn/en/trends-and-insights/research/2023-china-rental-housing-market-gathering-momentum-moving-toward-brightness.

-

5

China Insights: On the Ground Investment Views, Invesco, November 2024.

-

6

Invesco Sets Up China Rental Housing JV With Ziroom, February 2025, https://www.mingtiandi.com/real-estate/finance/invesco-sets-up-izara-china-rental-housing-jv-with-ziroom/

-

7

Ibid.