Bitcoin and digital assets in 2025: Is the bull run just getting started?

Digital assets enjoyed strong performance in 2024. Following Republican victories in the US House, Senate, and Presidency, Bitcoin broke above the $100,000 mark, and the market capitalization of all cryptocurrencies now sits at $3.3 trillion USD,1 as of 31 December 2024. While US large-cap equities have risen 3.2% since the election, Bitcoin has risen 43.9% and ether has risen 39.7%.2 In 2025, we expect this momentum to continue as a series of positive headlines and legislative progress look likely.

Cryptocurrencies are disproportionately influenced by broader macro conditions and sentiment, in our view. We believe both are shifting to be more supportive for digital assets, including positive post-US election developments, friendlier investor attitudes towards cryptos, and a market backdrop that looks likely to be positive given central bank rate cuts and a more normal global growth environment. We highlight some stand-out factors below that suggest cryptocurrencies may continue to see positive performance in 2025:

The tide is turning in the US as crypto-friendly policymakers enter office.

President-Elect Donald Trump has signalled a slew of crypto-friendly policies, including his desire for a strategic bitcoin reserve and the installation of crypto-friendly policymakers at the Securities Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), the two key US regulators for the crypto space. However, the surge in digital assets support is broader-based than just the President: According to a pro-crypto industry group, 294 pro-crypto candidates from both parties were elected to the House and Senate in the 2024 election.

This will most likely mark a significant departure from the Biden administration’s approach, which has generally been hostile towards digital assets. For example, the SEC under Chair Gary Gensler pursued a number of cases against crypto enterprises without specifying the framework they were following, earning the unpopular description of a “regulation by enforcement” approach to policy. Biden himself has generally pushed back on crypto, opposing the FIT21 bill despite bipartisan support.

A key flashpoint is SAB 121, an SEC bulletin published in 2022 that imposed strict requirements for publicly traded institutions that custody digital assets on behalf of clients. This forced institutions that custody digital assets on behalf of clients to record it on their balance sheets, effectively shutting out most banks from participating in the digital assets ecosystem. This is because the act of recording the assets on their balance sheet would trigger regulatory capital requirements in the absence of bank custody solutions, many crypto investors have instead turned to a myriad of costly (and at times unreliable) solutions. Under new SEC leadership in 2025, industry participants expect that SAB 121 may be revised or revoked altogether, opening the door for more large institutions to provide custody solutions in the digital assets space.

As the US posture towards digital assets evolve, we anticipate that a larger cohort of investors will embrace digital assets and may help propel a bull market in cryptocurrencies.

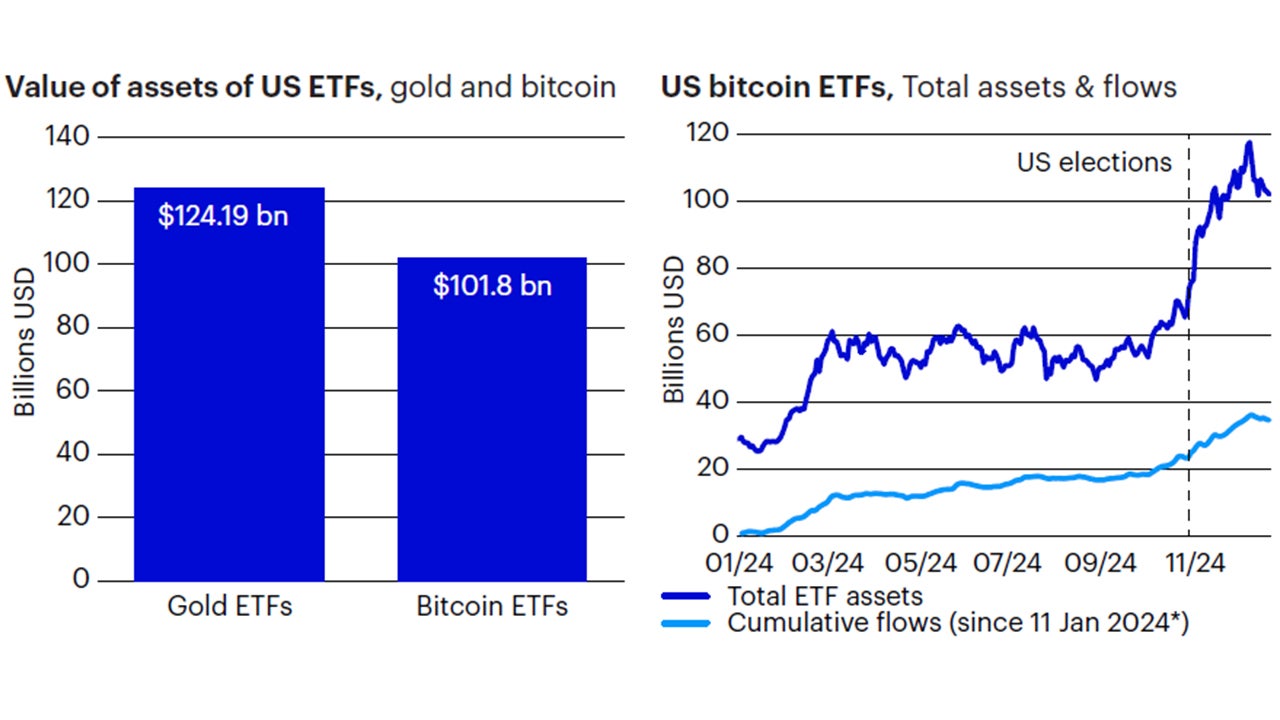

*On 11 Jan 2024, 11 spot bitcoin ETFs began trading in the US. Sources: Bloomberg L.P., Invesco, daily data as at 31 December 2024.

Investing in cryptocurrencies is getting easier.

2024 brought the launch of spot bitcoin ETFs in the US and Hong Kong, helping to propel $34.6 bn in net flows. 2025 may see additional countries permit spot ETFs to a broader set of investors, and additional cryptocurrencies may become more easily accessed through ETF products. As more products become available to a wider set of investors, we anticipate cryptocurrency prices will benefit.

Changing perception of Bitcoin.

As Bitcoin market cap grows, investor attitudes towards the largest cryptocurrency continue to evolve. The launch of spot Bitcoin ETFs in the US in January 2024 marked a key milestone as the world’s largest capital market provided an easy on-ramp for investors to gain exposure to Bitcoin (and later Ether). In the US, for example, investors have already allocated $34.5 billion to spot Bitcoin ETFs since 11 January 2024 making up $101.8 billion in assets as of the end of 2024. Compare this to gold ETFs, which have $124.2 billion in AUM.3

Favorable market backdrop.

Lower rates in the US, eurozone, UK, and other major economies suggests a risk-on year in global markets. Indeed, our outlook for 2025 favors more cyclically-oriented parts of the market including stocks and credit. This backdrop is likely to be supportive of cryptocurrencies, which tend to be influenced substantially by macro conditions.

Tokenization is building momentum.

Tokenization involves representing something on a blockchain in the form of a token, which enables a variety of benefits for information and asset custody management and exchange. We believe today’s financial system can realize a number of benefits through tokenization such as reduced counterparty risk, faster payment and settlement, and improved customizability in client investing experiences. Already, central bank digital currencies and asset tokenization pilot projects have been building momentum over the past five years, including tokenized money market funds, tokenized bonds, and tokenized private markets offerings. The UK government is planning to issue tokenized gilts for the first time within the next two years. In the euro zone, the European Central Bank is preparing to launch its digital euro, which is expected to facilitate tokenized use cases. As the adoption of this technology increases, we anticipate cryptocurrencies may also benefit.

Overall, we suspect that cryptocurrencies will continue to notch new highs in 2025, driven by improving regulatory clarity and friendlier policymakers. As in the past, bitcoin and other cryptocurrencies could benefit substantially on positive news flow (see, for example, crypto price behavior around Trump’s election win, the announcement of Trump’s SEC chair pick, and the authorization of spot bitcoin and ether ETFs in the US) helped by an anticipated pick-up in broad market risk appetite.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Cryptocurrencies are subject to fluctuations in the value of the cryptocurrency, which have been and may in the future be highly volatile. The price of a digital currency could drop precipitously (including to zero) for a variety of reasons, including, but not limited to, regulatory changes, a crisis of confidence, flaw or operational issue in a digital currency network or a change in user preference to competing cryptocurrencies. Cryptocurrencies trade on exchanges, which are largely unregulated and, therefore, are more exposed to fraud and failure than established, regulated exchanges for securities, derivatives, and other currencies. Currently, there is relatively limited use of cryptocurrency in the retail and commercial marketplace, which contributes to price volatility.

There are risks involved with investing in exchange traded funds (ETFs), including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements.

Footnotes

-

1

Source: Bloomberg L.P., and Macrobond, as of 31 December 2024.

-

2

Source: Bloomberg L.P., as of 31 December 2024.

-

3

Sources: Bloomberg L.P. and Invesco, as of 31 December 2024.