Asian investor interest in alternatives is growing

We spoke with Christopher Hamilton, Head of Client Solutions, Asia Pacific, on the themes he is seeing in the alternatives space and where he believes Asian investors may find opportunities.

Q: What are the trends you see emerging in the alternatives space?

A: From the lens of a multi-asset solutions provider spanning across public and private markets, one theme driving the importance of alternatives is volatility and subdued returns across traditional asset classes – specifically equities and fixed income. In our view, alternatives, particularly private markets exposure, can be used as a tool for investors to better meet portfolio outcomes specifically in light of the more challenging macroeconomic backdrop for traditional assets.

In terms of trends, we are starting to see investors looking at their alternatives exposure through a more granular lens. They are exploring how alternatives can be deployed together to enhance three core investment outcomes – growth, income, and diversification.

As the spectrum of possible outcomes in the alternatives space has grown exponentially over the last couple of decades, investors can look to have a deeper understanding of private markets beyond more traditional alternatives exposures such as core real estate, large cap private equity (PE), and venture capital (VC).

To effectively implement this, a firm grasp is needed of return drivers across all asset classes, particularly alternatives. This involves the creation of long-term capital market assumptions (LTCMAs) for private markets. It is commonplace to think about CMAs through the lens of traditional markets. However, in our view, having CMAs for alternatives is also an integral component of portfolio construction, as this enables investors to make a more neutral “like for like” comparison across asset class opportunities specifically in the areas of return, risk, and correlation assumptions. This then helps investors to avoid a structural bias in their investment process that may cause them to favor one asset class over another.

The basis of this is two-fold. First, sound, forward-looking CMAs across asset classes, and portfolio analytics allow us to view asset classes, both traditional and alternative, through a common factor and risk framework. Second, by rolling up these exposures we can make sure a total portfolio is aligned with its core objectives.

In the past, we’ve seen that investors tend to view alternatives in a silo, with less focus on portfolio integration and more focus on pure manager selection (which typically rewards strong past performance). In our opinion, a lack of forward-looking long-term return assumptions and analytics are the two main impediments to true portfolio integration.

Given the volatile macroeconomic environment, alternatives are increasingly being seen as an inflation mitigator and driver of real returns. On a high level, 60/40 portfolios have declined by roughly 17% over the last six months of 2022, which is historically poor.1 The inflationary environment has been a primary driver of this, so when thinking about alternatives exposure it can be worth looking at private asset themes that can balance a portfolio of equities and bonds – such as infrastructure equity and debt, aspects of private credit, commodities, and hedge fund-type solutions.

Q: How can investors ensure that alternative investing to complement their overall investment strategy so they can maintain a well-structured, diversified portfolio?

A: On a high level, the key benefit of alternatives is the flexibility and applicability of the asset class to meet growth, income, and diversification investment outcomes. Traditional asset classes on the other hand can usually only achieve one or two of those outcomes at any one time. For example, equities can provide growth, but often can suffer large drawdowns in unfavorable environments, so adding them to a balanced portfolio often may increase expected returns at the expense of increased risk. Alternatively, it is possible to effectively deploy certain private markets asset classes, such as infrastructure, in a way that may increase expected portfolio return, and concurrently reduce portfolio risk.

In our view, the trade-off when looking at alternatives exposure is devoting the appropriate time and research into understanding the asset class to determine how an effective alternatives implementation can benefit the broader portfolio.

The primary constraint impacting alternatives exposure, particularly private markets, is liquidity. This is usually a client-driven constraint and can greatly vary across client types – pensions, sovereign wealth funds, insurance companies, and financial intermediaries.

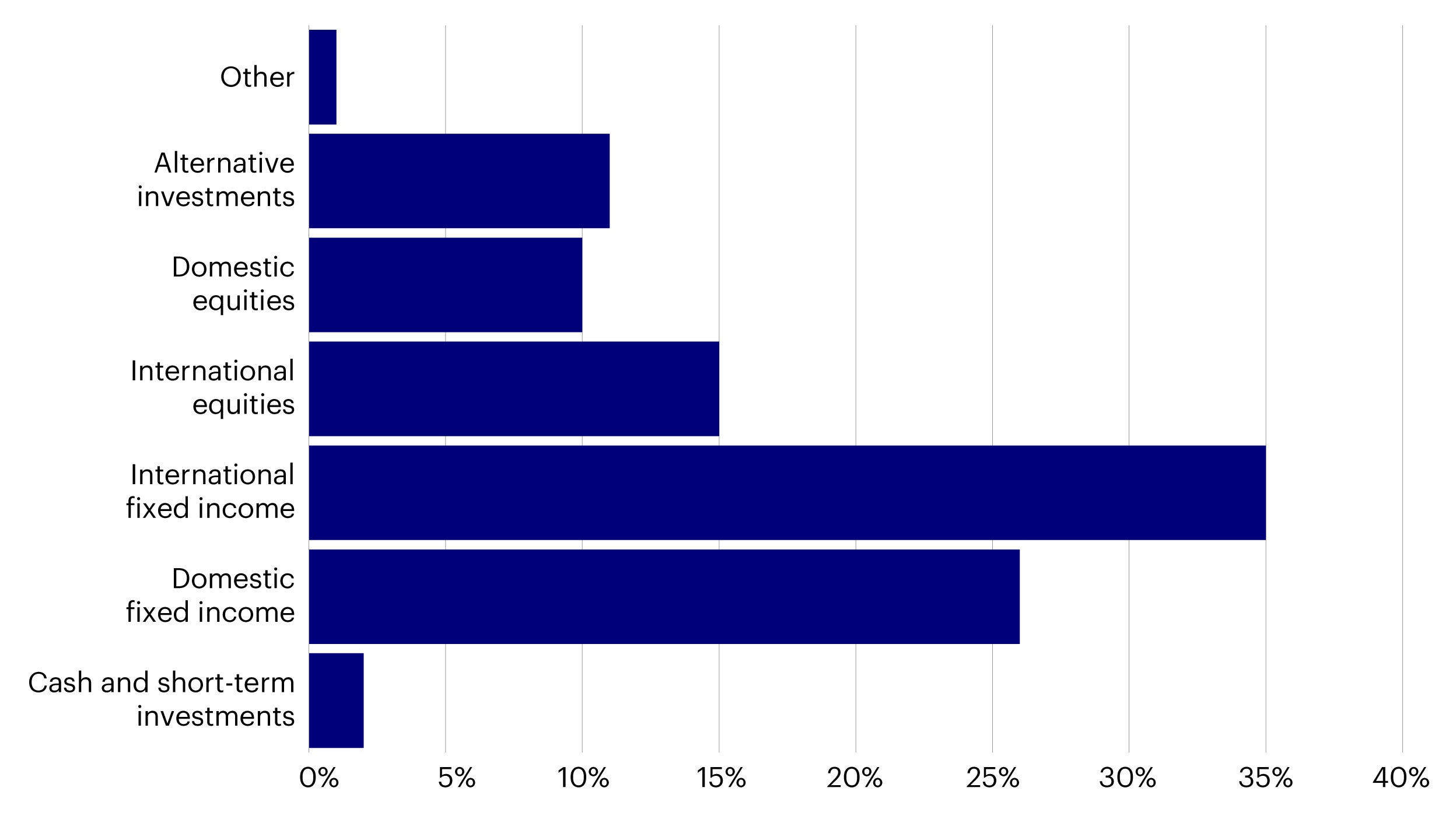

In general, we’ve found that Asian investors tend to value liquidity more than their North American counterparts, the reason being that Asian investors are comparatively underweight alternatives. In this current environment, we see this as an opportunity for Asian investors to take another look at their portfolios to begin implementing a more diversified alternatives framework. While exposure can vary, our experience has found that investors typically allocate anywhere from 10% to 40% in alternatives, inclusive of both liquid and illiquid structures.

Source: Greenwich Associates, 2019. Note: In APAC, International equities includes Asian equities, EM equities, and other international equities and International fixed income includes Asian fixed income, EM fixed income, and other international fixed income.

Q: How can investors factor ESG considerations into alternative investing? How compatible are ESG objectives with those of alternative investing?

A: I will say that ESG considerations come up in almost every client conversation regardless of whether we’re deploying traditional asset classes, alternatives, or some combination of the two.

A manager’s ESG process needs to be well thought out and explained, whether the strategy being deploying is positioning itself as “ESG” or not. As a firm, when we evaluate partners, a sound ESG strategy is something that we look for as part of the evaluation process.

In my view, any sound risk management framework, which is an integral component of the portfolio management process, needs to consider ESG factors (i.e., governance, climate risk, etc.) at some level.

Given what I’ve laid out, I believe there is a high level of compatibility between ESG, alternative investing, and portfolio construction. One challenge for Asia is lack of a common ESG framework. It is important for us as managers to therefore not take a “one size fits all approach” and instead understand the core concerns of each client.

As investors begin to view the concept of “return” through a broader lens, we’ll expect to continue to see ESG considerations grow among investors. In Asia, we’ve seen large institutions take the lead on ESG engagement, both on a broad basis and around specific topics such as decarbonization. We expect ESG to continue to gain momentum among a growing institutional investor base.

About Invesco Investment Solutions

Invesco Investment Solutions develops CMAs that provide long-term estimates for the behavior of major asset classes globally. The team is dedicated to designing outcome-oriented, multi-asset portfolios that meet the specific goals of investors.

As a team we have invested a significant amount of our research capacity to alternatives, both understanding the fundamental drivers of return across asset classes (i.e., long-term capital market assumptions and portfolio analytics) and developing partnerships with other alternatives specialists (internal and external) to enhance our investment solutions offerings.

Footnotes

-

1

Source: Bloomberg, July 2022.